Handling PDF forms online is actually super easy using our PDF editor. You can fill out Mutal here effortlessly. To have our editor on the forefront of efficiency, we aim to implement user-driven capabilities and enhancements on a regular basis. We're at all times looking for suggestions - help us with reshaping PDF editing. By taking a few basic steps, you'll be able to begin your PDF journey:

Step 1: Press the "Get Form" button in the top section of this webpage to open our PDF tool.

Step 2: When you start the file editor, you will notice the document made ready to be completed. Besides filling in various blank fields, you could also do many other things with the file, namely writing your own text, editing the initial text, adding images, signing the document, and much more.

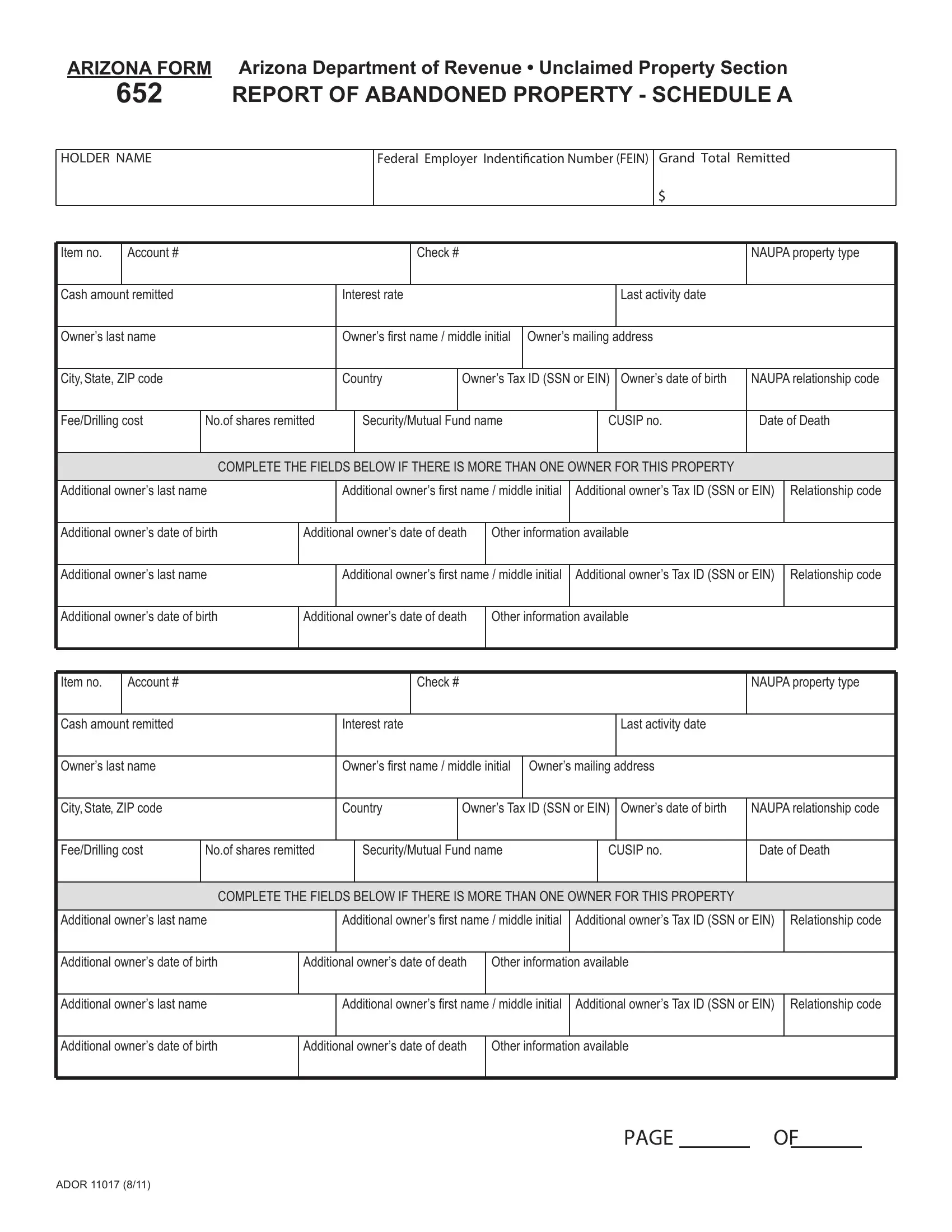

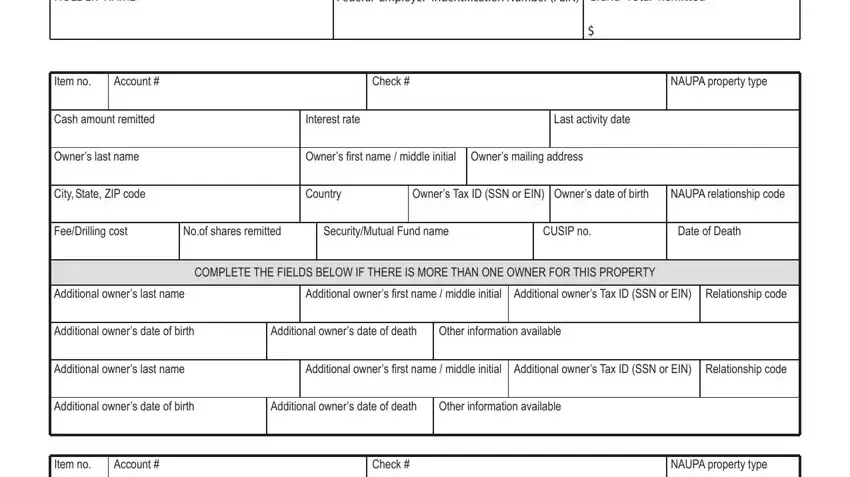

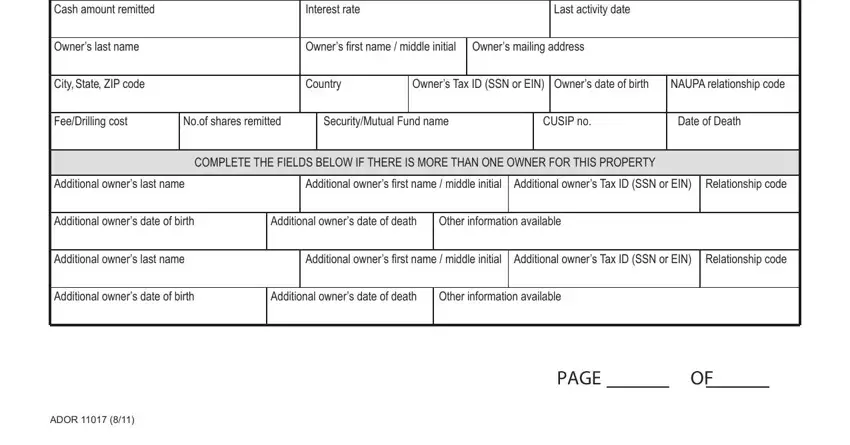

So as to finalize this PDF form, make sure you type in the required details in every single blank field:

1. Whenever submitting the Mutal, make certain to incorporate all essential blank fields within the associated form section. It will help hasten the process, enabling your information to be handled without delay and properly.

2. The third step is to fill in the following blanks: dettimer tnuoma hsaC, etar tseretnI, etad ytivitca tsaL, eman tsal srenwO, srenwO, fi rst name middle initial Owners, ytiC, State, edoc PIZ , yrtnuoC, htrib fo etad srenwO NIE ro NSS DI, edoc pihsnoitaler APUAN, FeeDrilling cost, Noof shares remitted, and SecurityMutual Fund name.

It is possible to make an error when filling in the FeeDrilling cost, therefore you'll want to go through it again before you'll submit it.

Step 3: Just after rereading your completed blanks, hit "Done" and you're good to go! After creating a7-day free trial account at FormsPal, you'll be able to download Mutal or email it immediately. The document will also be readily accessible from your personal account menu with your each and every modification. FormsPal guarantees secure document completion devoid of personal data record-keeping or any sort of sharing. Feel at ease knowing that your details are safe with us!