Whenever you intend to fill out W-2, there's no need to install any sort of software - just use our online tool. Our tool is continually evolving to deliver the very best user experience achievable, and that is because of our dedication to constant enhancement and listening closely to user comments. This is what you'd need to do to begin:

Step 1: Click the "Get Form" button above on this page to get into our PDF editor.

Step 2: After you open the tool, you'll notice the document all set to be filled out. In addition to filling in different blank fields, you might also perform many other things with the form, including putting on custom words, modifying the original text, inserting illustrations or photos, placing your signature to the form, and more.

Be mindful when filling in this form. Ensure all mandatory blank fields are filled in accurately.

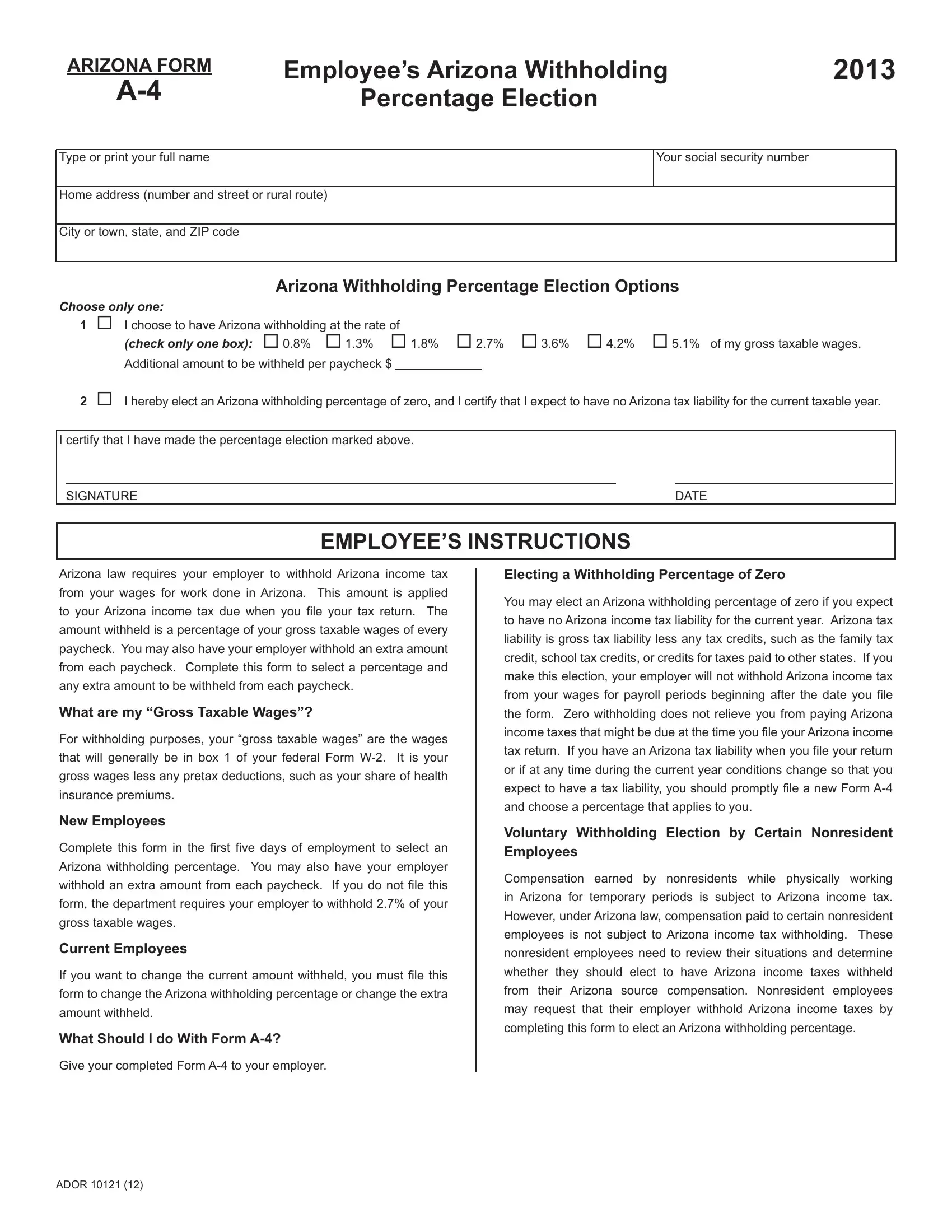

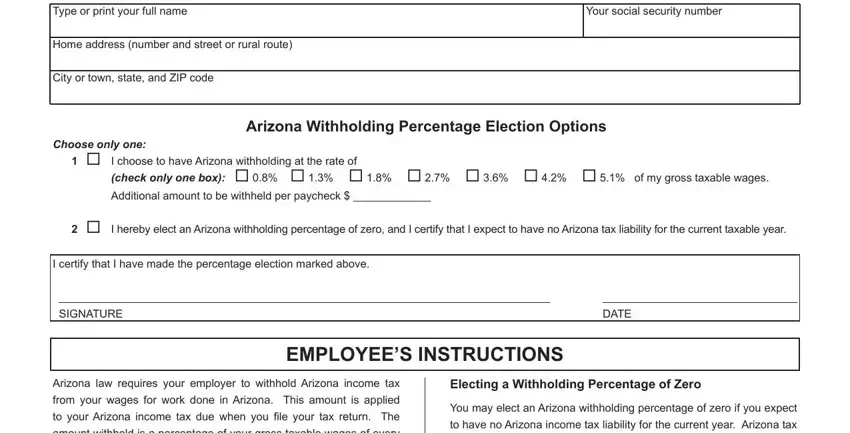

1. To begin with, while filling in the W-2, begin with the part that contains the next blank fields:

Step 3: When you have looked again at the details provided, click "Done" to complete your FormsPal process. Right after setting up a7-day free trial account with us, it will be possible to download W-2 or email it directly. The document will also be easily accessible in your personal cabinet with your every modification. We do not sell or share the details you enter while completing forms at our website.