Through the online PDF editor by FormsPal, you'll be able to fill in or alter az a1 wp form here and now. FormsPal team is relentlessly working to enhance the editor and enable it to be much faster for people with its cutting-edge features. Take your experience to a higher level with continuously developing and fantastic opportunities available today! Starting is easy! All you have to do is adhere to these easy steps below:

Step 1: Hit the "Get Form" button at the top of this page to access our tool.

Step 2: The tool enables you to modify your PDF form in a range of ways. Modify it by writing personalized text, correct original content, and add a signature - all possible within minutes!

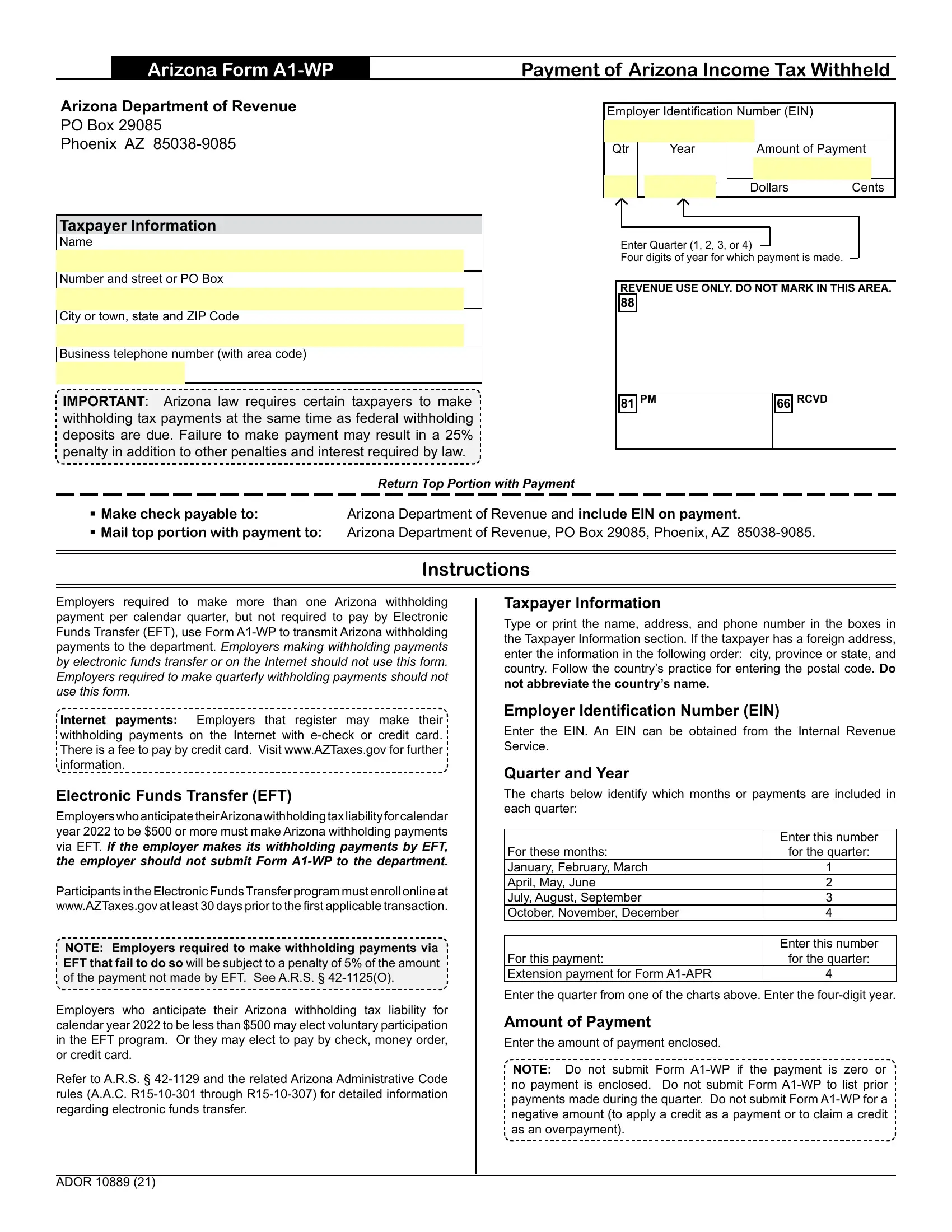

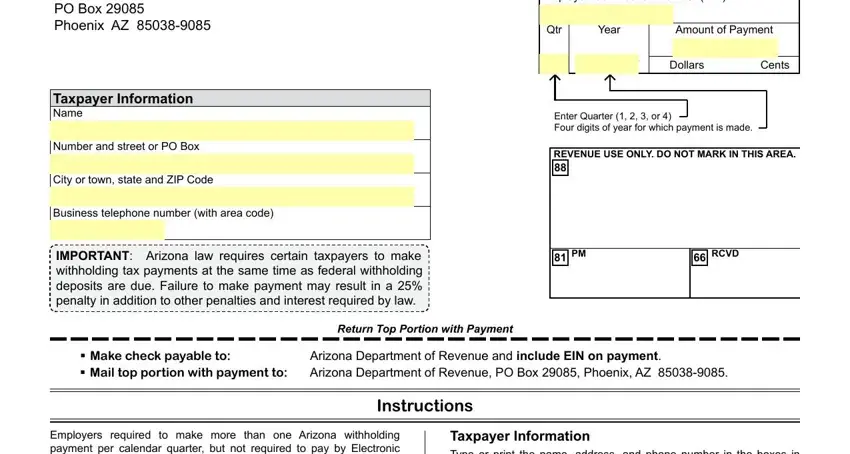

If you want to finalize this PDF form, ensure that you enter the required information in every single field:

1. Firstly, once filling in the az a1 wp form, start with the page containing subsequent fields:

Step 3: Confirm that your information is correct and just click "Done" to complete the project. Grab the az a1 wp form after you join for a free trial. Instantly access the form within your FormsPal account, with any edits and changes being conveniently synced! FormsPal guarantees protected document tools devoid of data recording or any type of sharing. Rest assured that your information is in good hands here!