arizona 290 form can be filled out without any problem. Just open FormsPal PDF editor to get it done in a timely fashion. The editor is constantly improved by our team, getting awesome functions and becoming greater. It just takes a couple of easy steps:

Step 1: First, access the editor by clicking the "Get Form Button" in the top section of this page.

Step 2: This tool enables you to modify nearly all PDF documents in various ways. Transform it by writing any text, correct what's originally in the file, and add a signature - all readily available!

It will be easy to fill out the document with this helpful guide! This is what you need to do:

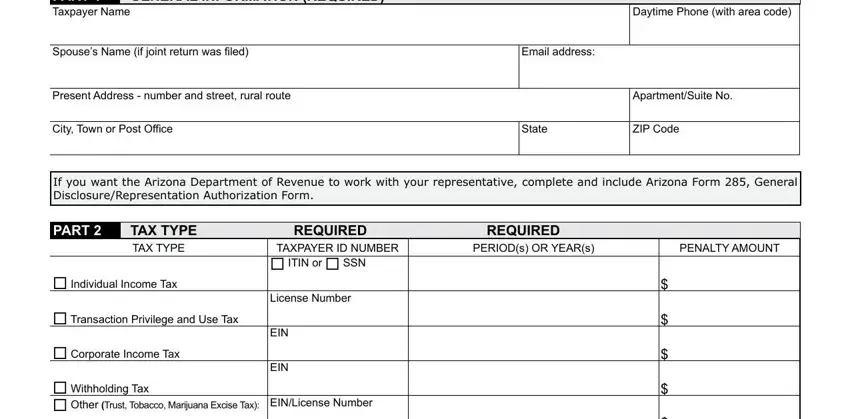

1. Whenever submitting the arizona 290 form, make sure to complete all of the necessary blank fields in its corresponding section. It will help to hasten the process, which allows your details to be processed quickly and accurately.

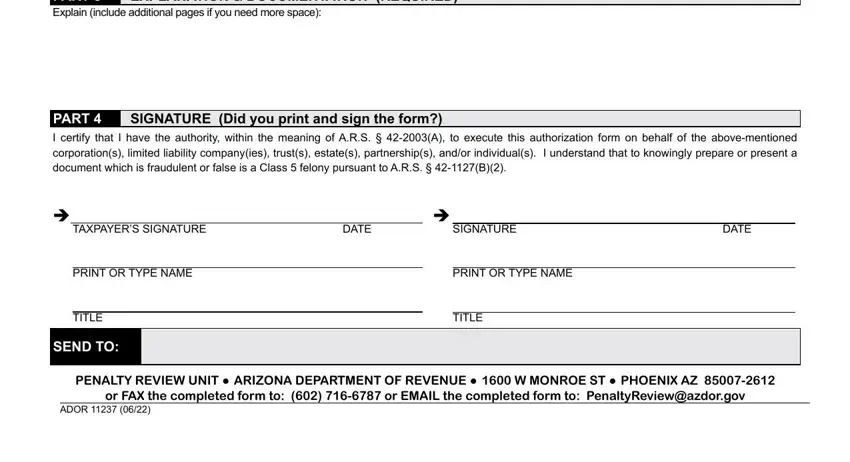

2. Once your current task is complete, take the next step – fill out all of these fields - PART Explain include additional, EXPLANATION DOCUMENTATION REQUIRED, PART, SIGNATURE Did you print and sign, I certify that I have the, TAXPAYERS SIGNATURE, DATE, SIGNATURE, DATE, PRINT OR TYPE NAME, TITLE, SEND TO, PRINT OR TYPE NAME, TITLE, and PENALTY REVIEW UNIT ARIZONA with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be extremely mindful while filling out EXPLANATION DOCUMENTATION REQUIRED and DATE, since this is the part in which a lot of people make mistakes.

Step 3: Once you have looked over the details in the blanks, click "Done" to complete your form. After getting afree trial account at FormsPal, you will be able to download arizona 290 form or email it at once. The document will also be available from your personal account with your each and every modification. FormsPal ensures your information confidentiality via a secure method that in no way saves or distributes any type of private information used in the PDF. Be assured knowing your files are kept protected when you use our service!