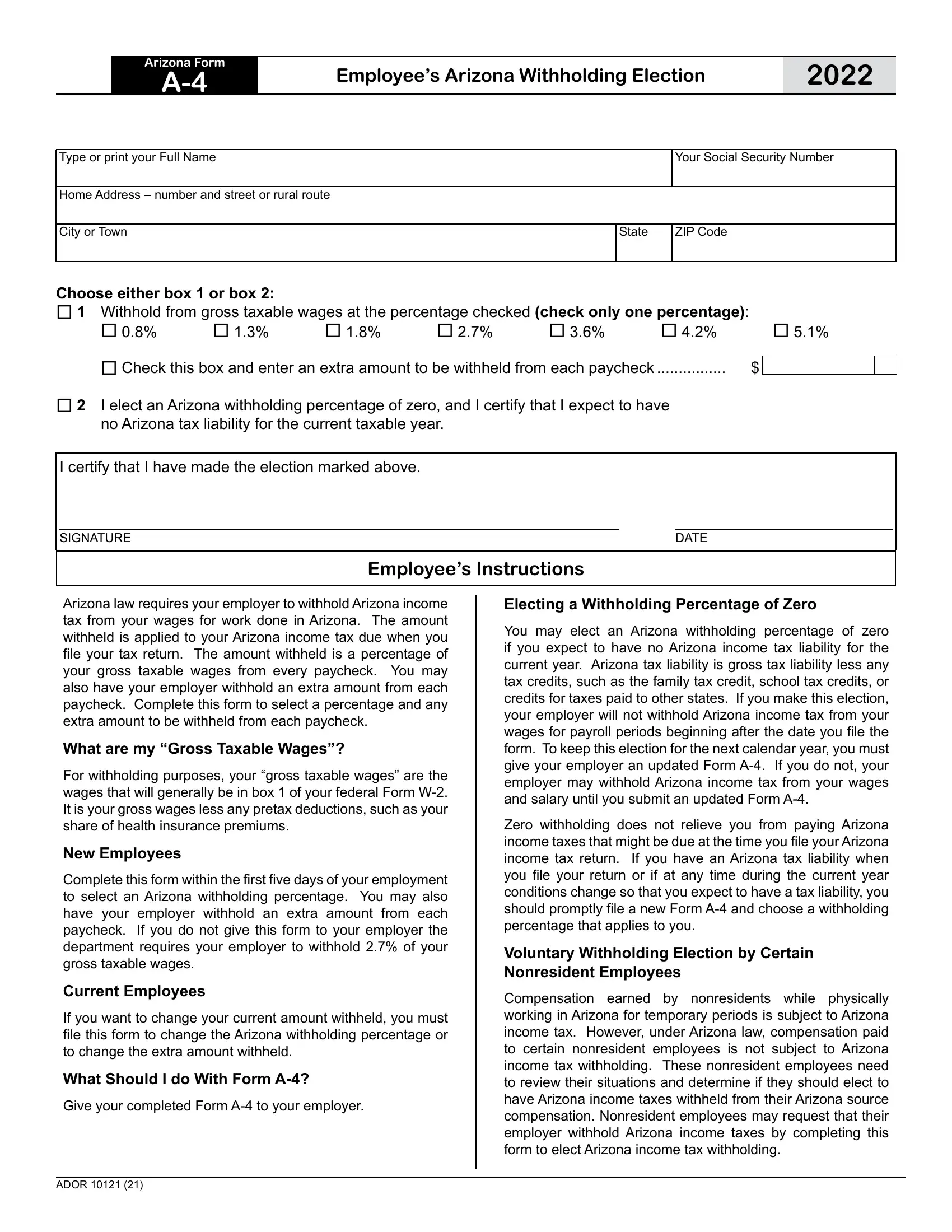

If you desire to fill out arizona form a 4 2021, you won't need to download any kind of programs - just try our PDF editor. We at FormsPal are dedicated to making sure you have the perfect experience with our editor by continuously presenting new functions and enhancements. Our editor has become even more helpful as the result of the latest updates! Now, editing PDF files is simpler and faster than ever before. To begin your journey, consider these simple steps:

Step 1: Open the PDF doc in our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: After you start the online editor, you'll see the document prepared to be completed. Apart from filling in various blank fields, you may also do various other actions with the PDF, namely adding custom words, changing the original text, inserting illustrations or photos, putting your signature on the form, and much more.

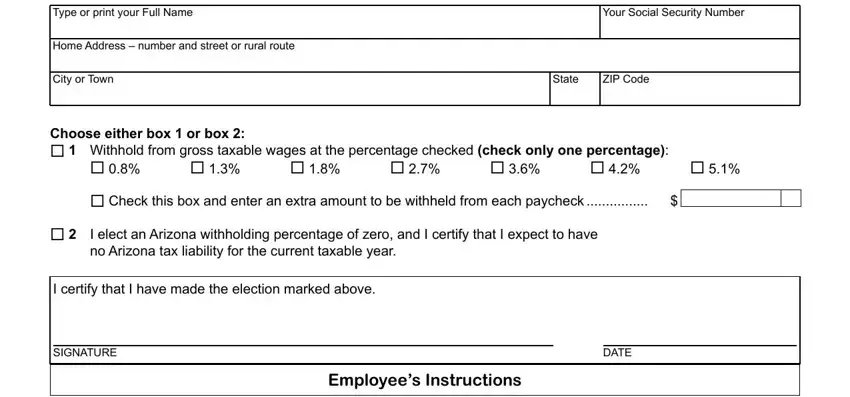

This PDF doc will require specific details; in order to ensure accuracy, remember to take note of the guidelines below:

1. While completing the arizona form a 4 2021, be certain to complete all of the necessary blanks within its relevant area. It will help facilitate the process, enabling your details to be processed without delay and correctly.

Step 3: Check everything you have entered into the blank fields and click the "Done" button. Join FormsPal right now and instantly get access to arizona form a 4 2021, ready for downloading. All changes made by you are saved , meaning you can edit the form at a later time if needed. FormsPal offers safe document editor without personal information recording or sharing. Be assured that your information is safe here!