IdentificationNumber can be completed online easily. Just make use of FormsPal PDF editor to do the job right away. Our editor is constantly evolving to grant the very best user experience achievable, and that is thanks to our dedication to continual enhancement and listening closely to testimonials. Here's what you would have to do to get started:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" above on this webpage.

Step 2: The tool provides you with the ability to work with PDF forms in a range of ways. Transform it by including customized text, correct existing content, and add a signature - all at your fingertips!

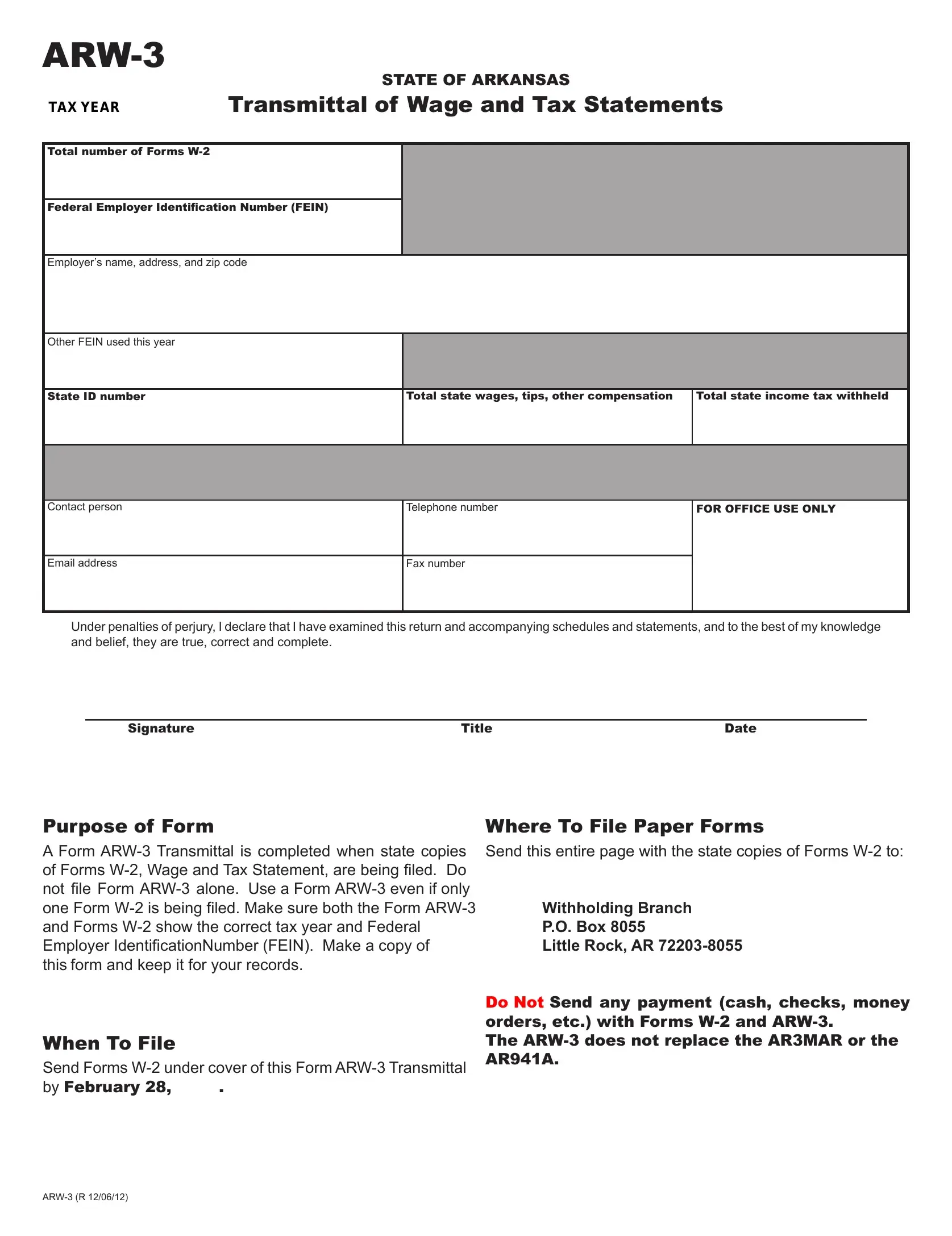

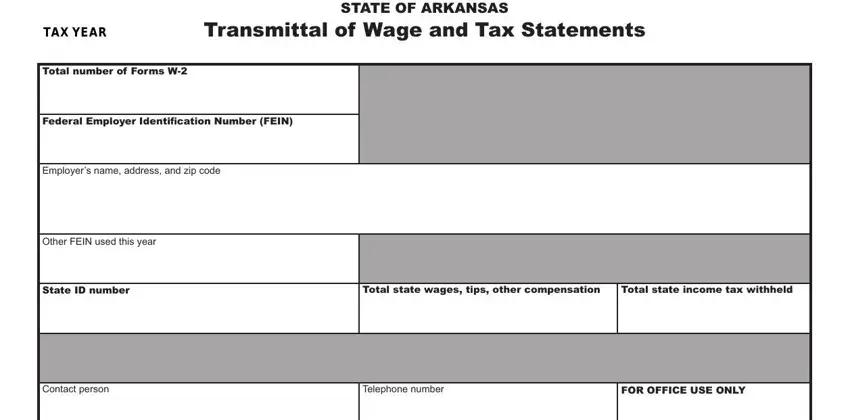

When it comes to fields of this particular PDF, this is what you should do:

1. The IdentificationNumber will require certain details to be entered. Ensure that the subsequent blanks are finalized:

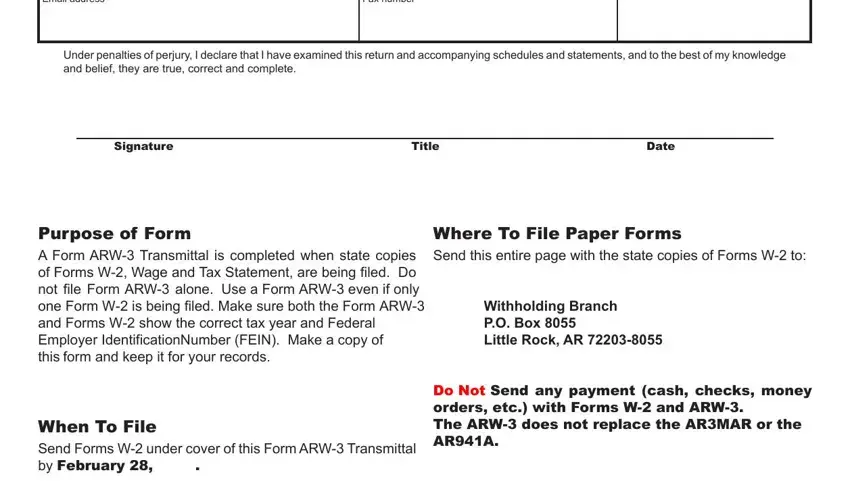

2. After filling in the last step, go on to the next step and fill out the necessary details in all these fields - Email address, Fax number, Under penalties of perjury I, Signature, Title, Date, Purpose of Form A Form ARW, When To File Send Forms W under, Where To File Paper Forms Send, Withholding Branch PO Box Little, and Do Not Send any payment cash.

It is easy to make errors while filling in the Title, thus you'll want to take another look prior to deciding to submit it.

Step 3: Immediately after proofreading the filled out blanks, press "Done" and you're all set! Create a free trial subscription at FormsPal and gain instant access to IdentificationNumber - accessible in your personal account. Here at FormsPal.com, we do our utmost to be certain that all your information is maintained secure.