Page 3

8. Please list the type of musical genre you primarily work in (check only one):

Popular, or

Symphonic/Concert Music (works for orchestra, chamber ensemble, chorus, wind ensemble, concert band, solo instrumental, electro-acoustic forces, etc.).

9.WARRANTIES AND REPRESENTATIONS

A.I represent that there are no existing assignments or licenses, direct or indirect, of non-dramatic performing rights in or to the musical work listed in #8 above, except to or with the publisher(s) of this work. If there are assignments or licenses other than with publishers, I have attached copies of such assignments or licenses.

B.I have read the ASCAP Articles of Association, Compendium of Rules and Regulations, and Second Amended Final Judgement entered in U.S. vs ASCAP (“AFJ2”), and agree to be bound by them, as now in effect, and as they may be amended, and I agree to execute agreements in such form and for such periods as the Board of Directors shall have required and shall hereafter require for all members.

C.I represent that I meet the eligibility requirements for membership as set forth herein. I understand that ASCAP reserves the right to request substantiation of eligibility at any time.

D.I warrant and represent that all of the information furnished in this application is true. I acknowledge that any agreement entered into between ASCAP and me will be in reliance upon the representations contained in this application, and that my membership will be subject to termination if the information contained in this application is not complete and accurate.

Optional: Writer Digital Home Recording (“DART”) Royalties Election

Under the Audio Home Recording Act of 1992, royalties are paid by manufacturers and importers of digital audio recording equipment and recording media (e.g., blank tapes or discs). The royalties are shared by writers, publishers, recording artists and record companies. ASCAP can act on behalf of those members who specifically designate ASCAP to represent them in digital audio royalty matters under the Act. SEE DART FACT SHEET ON BACK FOR MORE INFORMATION BEFORE MAKING YOUR DECISION. IF YOU ARE UNDECIDED, YOU MAY LEAVE THIS SECTION BLANK.

YES, I grant the American Society of Composers, Authors and Publishers (“ASCAP”) the exclusive right to collect and distribute digital audio royalty payments as provided in Public Law No. 102-563 (the Audio Home Recording Act of 1992), as such law may be amended and payments for home recording of my copyrighted musical works outside of the United States, with respect to all of the musical works described in the ASCAP Membership Agreement.

NO, I do not wish ASCAP to represent me regarding home recording rights.

Undecided

PLEASE SIGN YOUR LEGAL NAME HERE:

Sign Here |

Date |

|

|

Signature of parent or guardian if applicant is under 18 |

Date |

REMINDER: YOU MUST MAIL THE FOLLOWING FOUR (4) FORMS TOGETHER TO:

Membership Application Enclosed, ASCAP, One Lincoln Plaza, New York, NY 10023

❍ASCAP Writer Application (this form)

❍ASCAP Membership Agreement

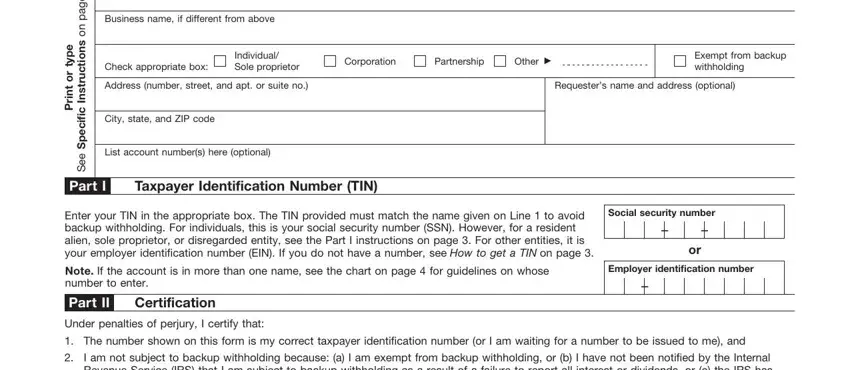

❍W-9 Form or other applicable tax form. (See instructions.)

❍Application Processing Fee Form. (See instructions.)

ALL FOUR (4) FORMS MUST BE COMPLETED AND SIGNED OR YOUR APPLICATION WILL BE RETURNED TO YOU.

For ASCAP office use only: Card type/check #_____________________________ Transaction Code:__________________________________ Date:__________________________