asic 388 can be filled out online easily. Just use FormsPal PDF editing tool to finish the job fast. Our editor is consistently developing to present the best user experience achievable, and that is thanks to our commitment to continuous improvement and listening closely to testimonials. Here's what you'll want to do to get started:

Step 1: Click the "Get Form" button above. It is going to open our editor so you can start filling out your form.

Step 2: This editor lets you modify nearly all PDF documents in many different ways. Improve it by writing any text, correct existing content, and include a signature - all when it's needed!

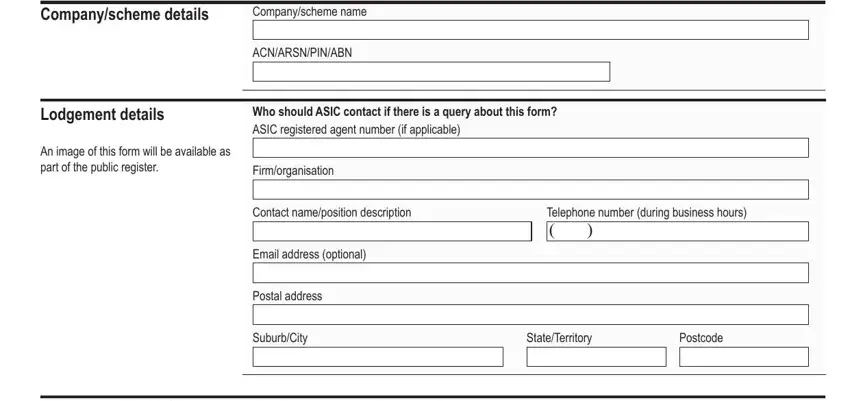

When it comes to blanks of this particular PDF, here's what you should do:

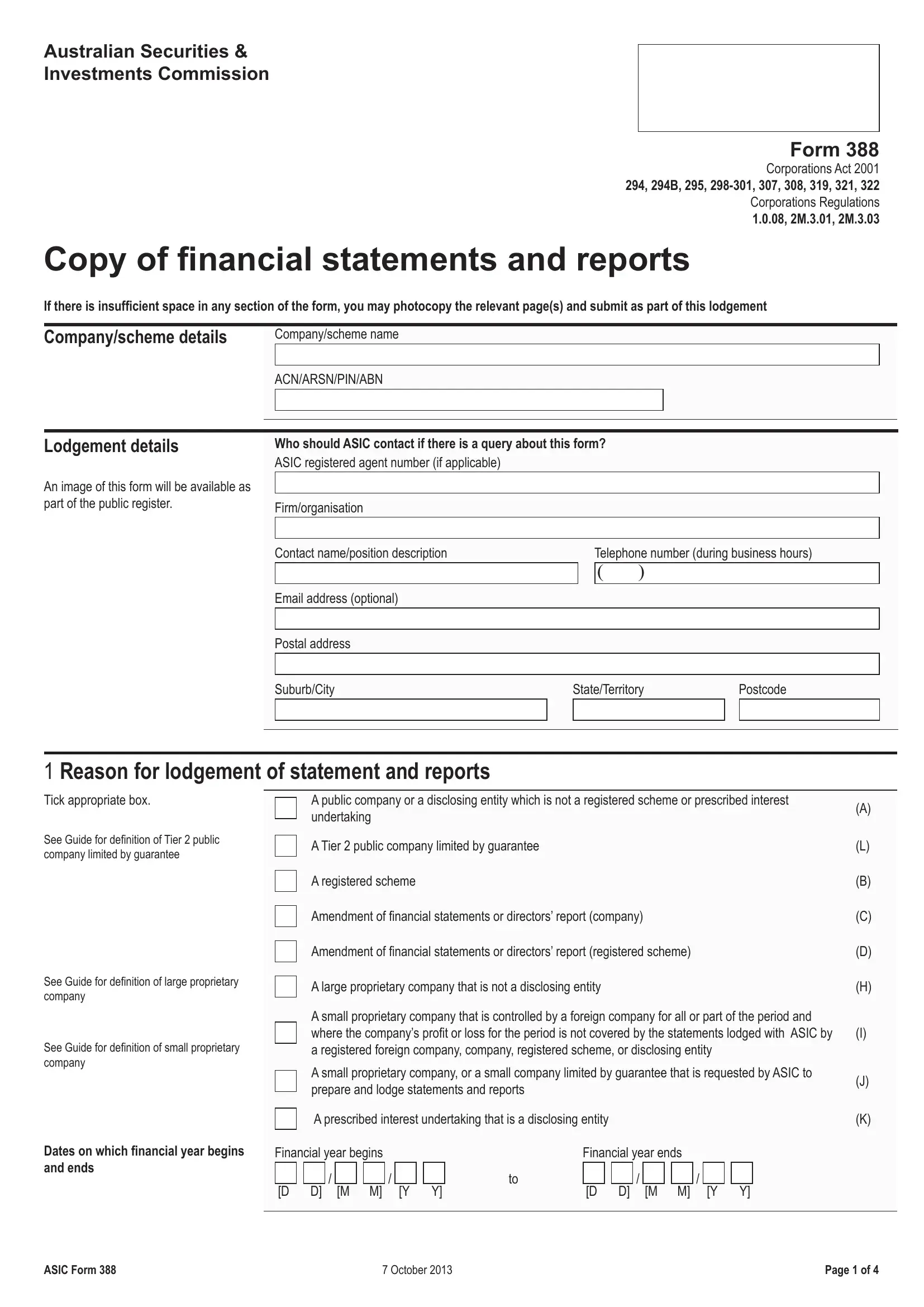

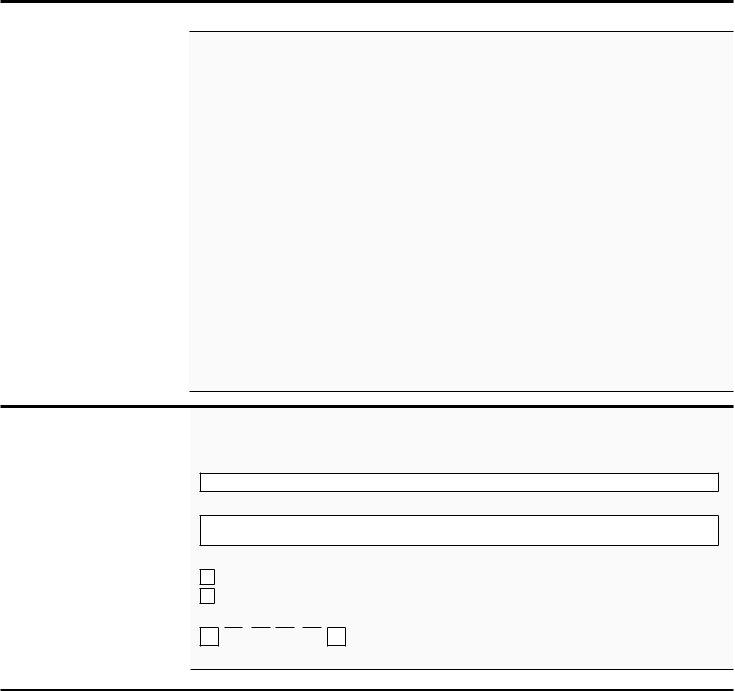

1. To begin with, when filling in the asic 388, start with the page that includes the next fields:

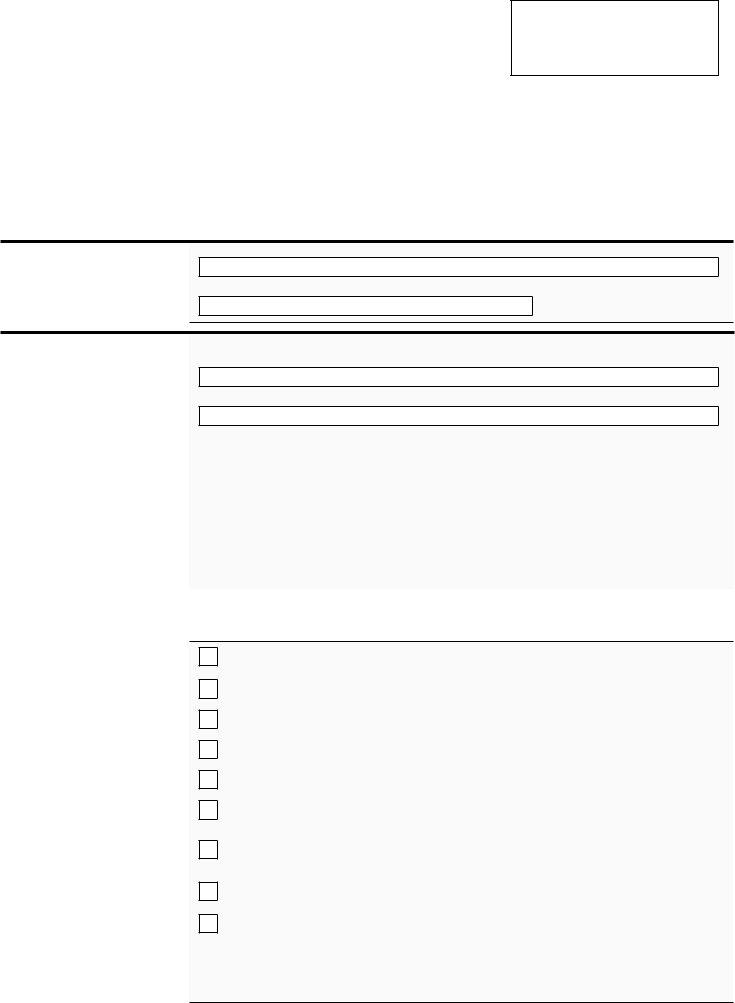

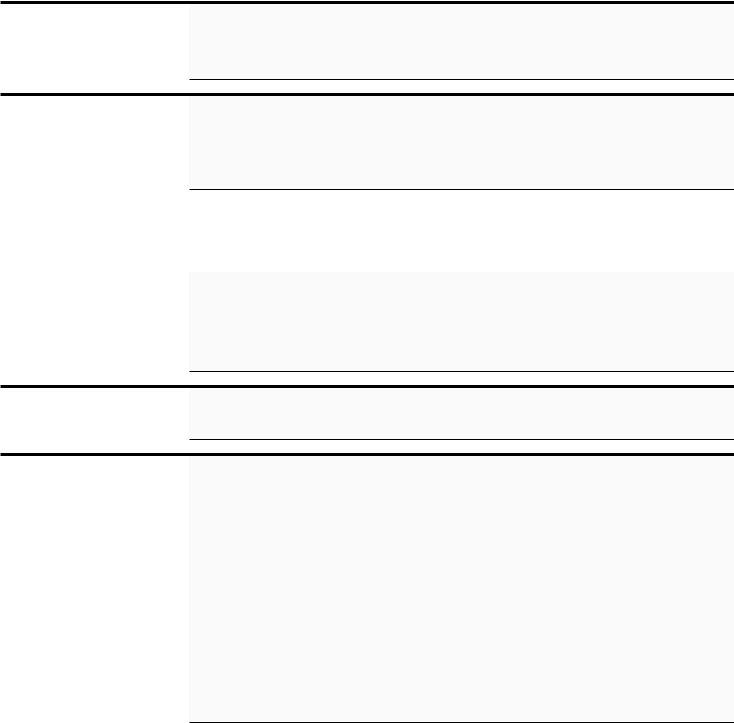

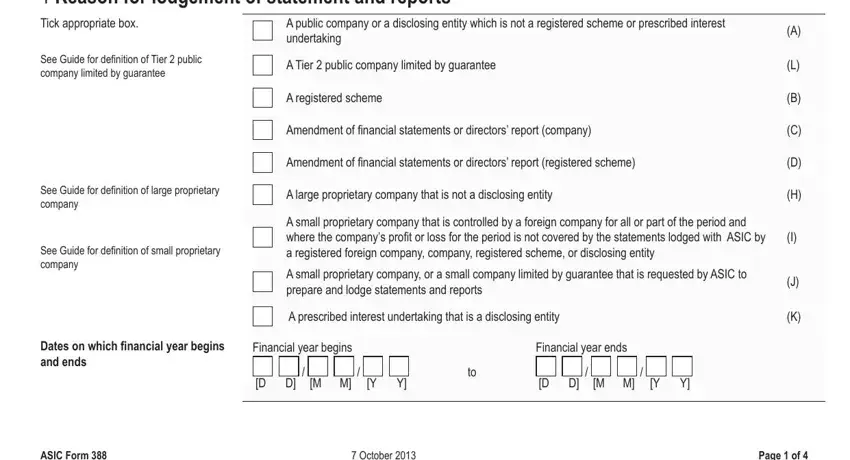

2. After the previous part is completed, you're ready to include the required particulars in Reason for lodgement of statement, A public company or a disclosing, See Guide for deinition of Tier , A Tier public company limited by, A registered scheme, See Guide for deinition of large, See Guide for deinition of small, Dates on which inancial year, Amendment of inancial statements, Amendment of inancial statements, A large proprietary company that, A small proprietary company that, A small proprietary company or a, A prescribed interest undertaking, and Financial year begins so that you can move forward to the third stage.

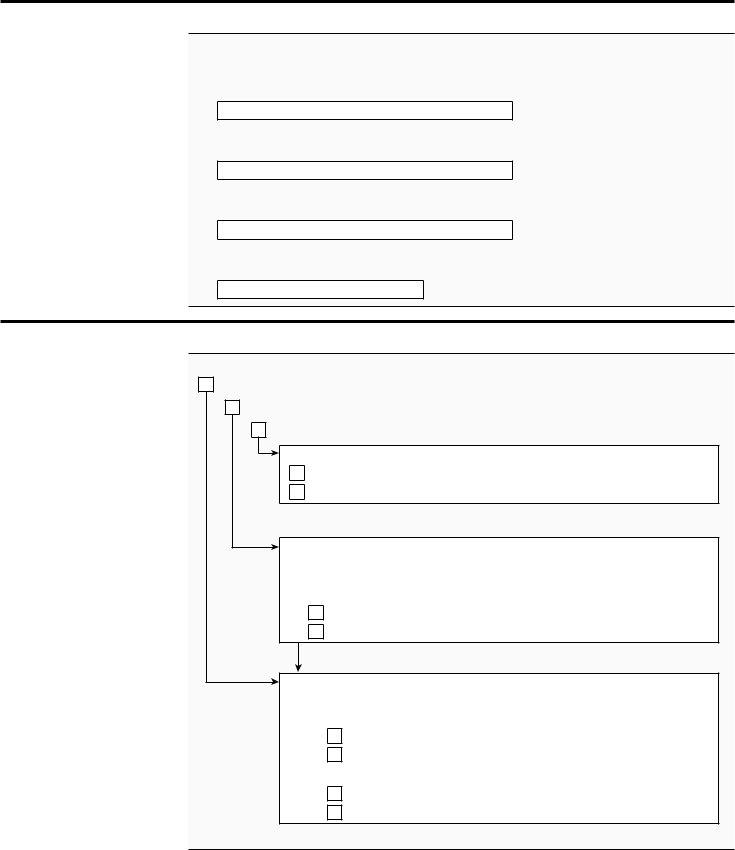

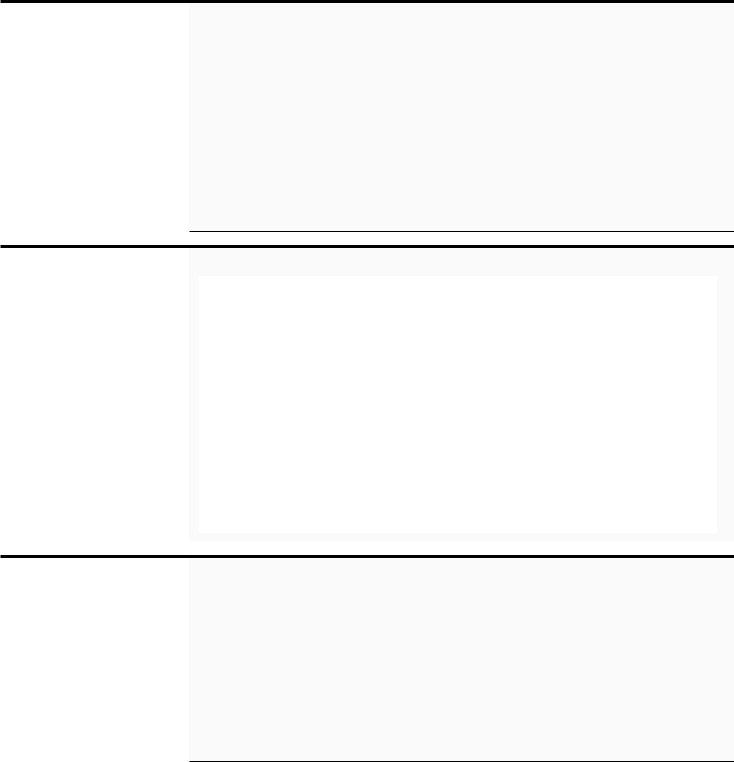

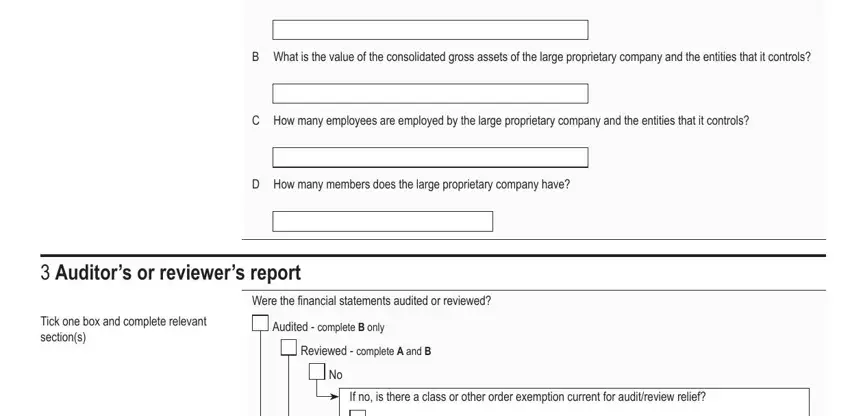

3. Within this step, take a look at B What is the value of the, C How many employees are employed, D How many members does the large, Auditors or reviewers report, Tick one box and complete relevant, Were the inancial statements, Audited complete B only, Reviewed complete A and B, and If no is there a class or other. All these need to be filled out with greatest focus on detail.

People generally make some errors when filling in B What is the value of the in this section. Be sure to reread everything you type in here.

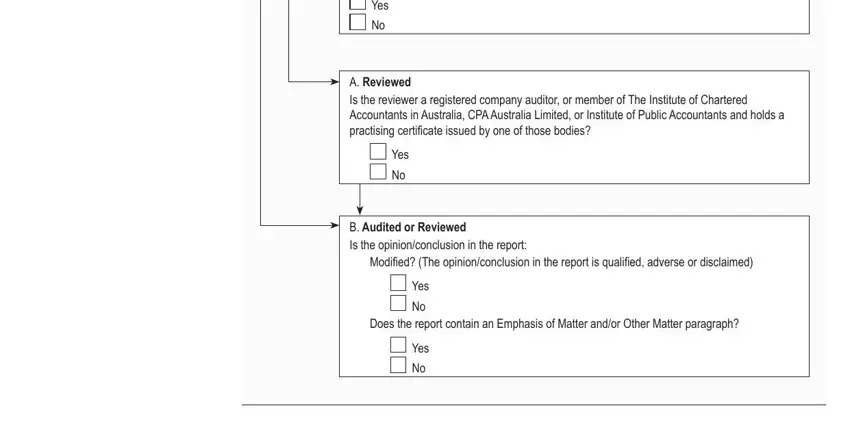

4. This fourth subsection arrives with the next few fields to fill out: Yes, A Reviewed Is the reviewer a, Yes, B Audited or Reviewed Is the, Modiied The opinionconclusion in, Yes, Does the report contain an, and Yes.

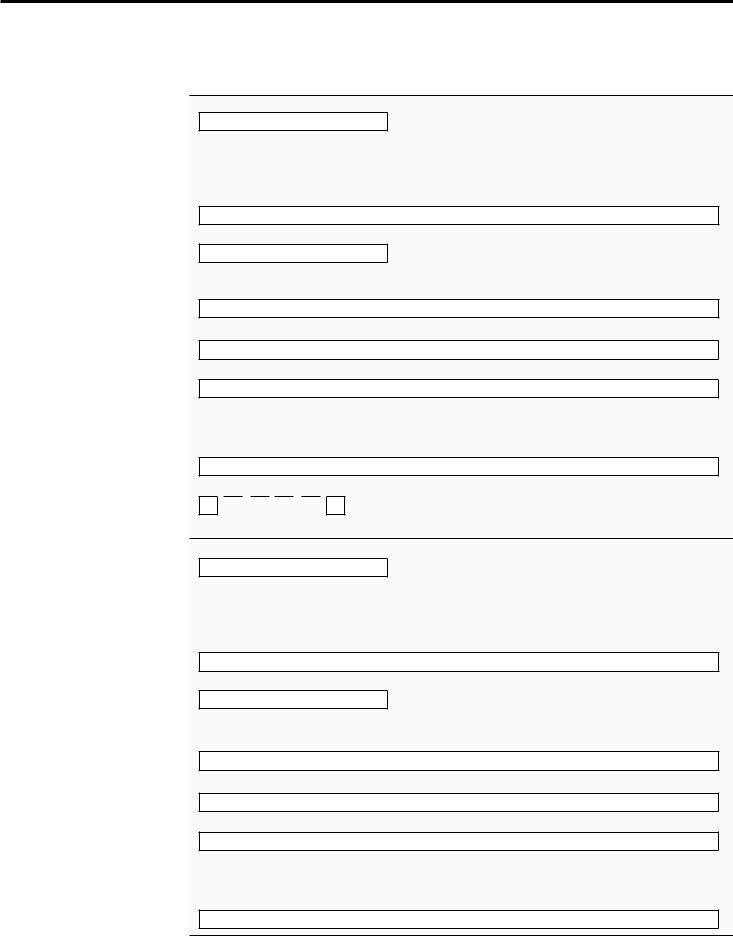

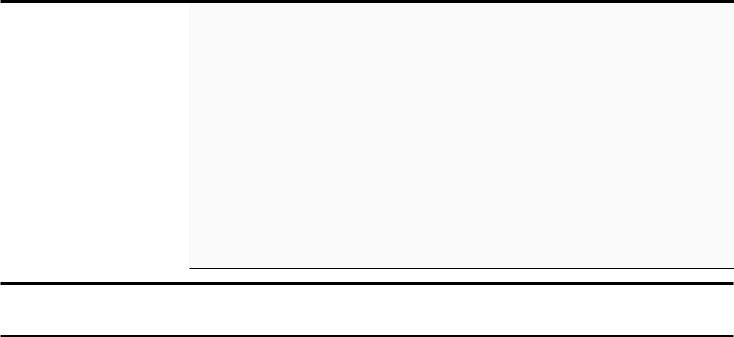

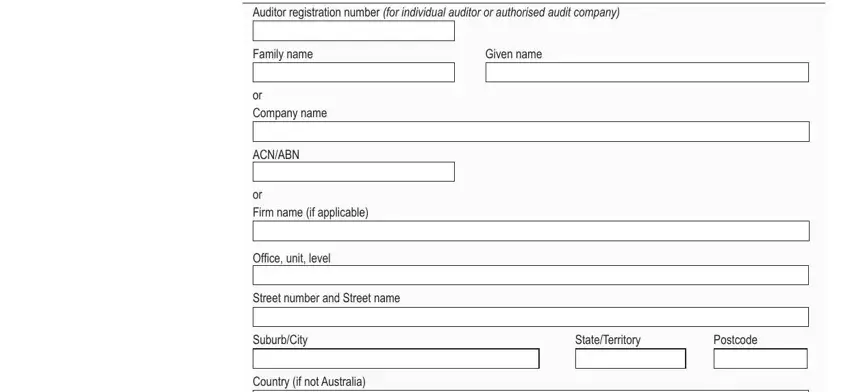

5. This form must be concluded by filling out this segment. Here one can find a detailed listing of blank fields that need correct information for your form usage to be faultless: Auditor registration number for, Family name, Given name, or Company name, ACNABN, or Firm name if applicable, Ofice unit level, Street number and Street name, SuburbCity, StateTerritory, Postcode, and Country if not Australia.

Step 3: You should make sure your details are accurate and click "Done" to conclude the task. Join FormsPal now and easily access asic 388, prepared for downloading. All alterations made by you are preserved , making it possible to customize the document at a later point when necessary. FormsPal is committed to the confidentiality of all our users; we make sure that all information put into our tool is kept secure.