Only a few tasks can be easier than creating documents working with the PDF editor. There is not much for you to do to change the equitable 403b rollover form form - simply follow these steps in the following order:

Step 1: The first step should be to choose the orange "Get Form Now" button.

Step 2: After you've entered the equitable 403b rollover form edit page, you'll discover all actions you may use regarding your file in the upper menu.

The next parts are what you are going to prepare to have the finished PDF form.

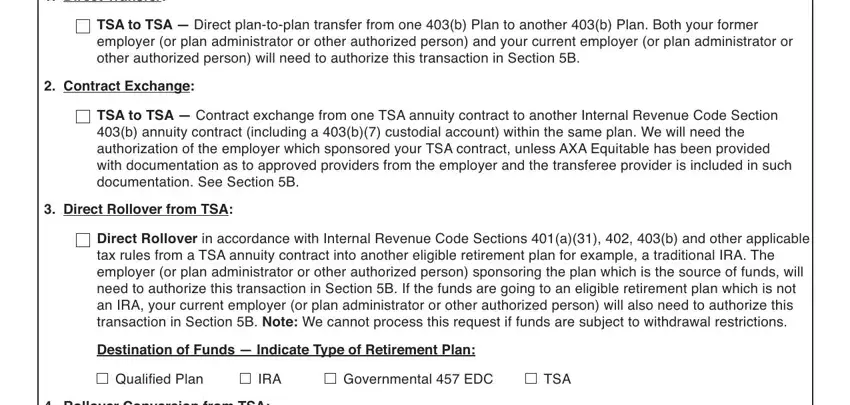

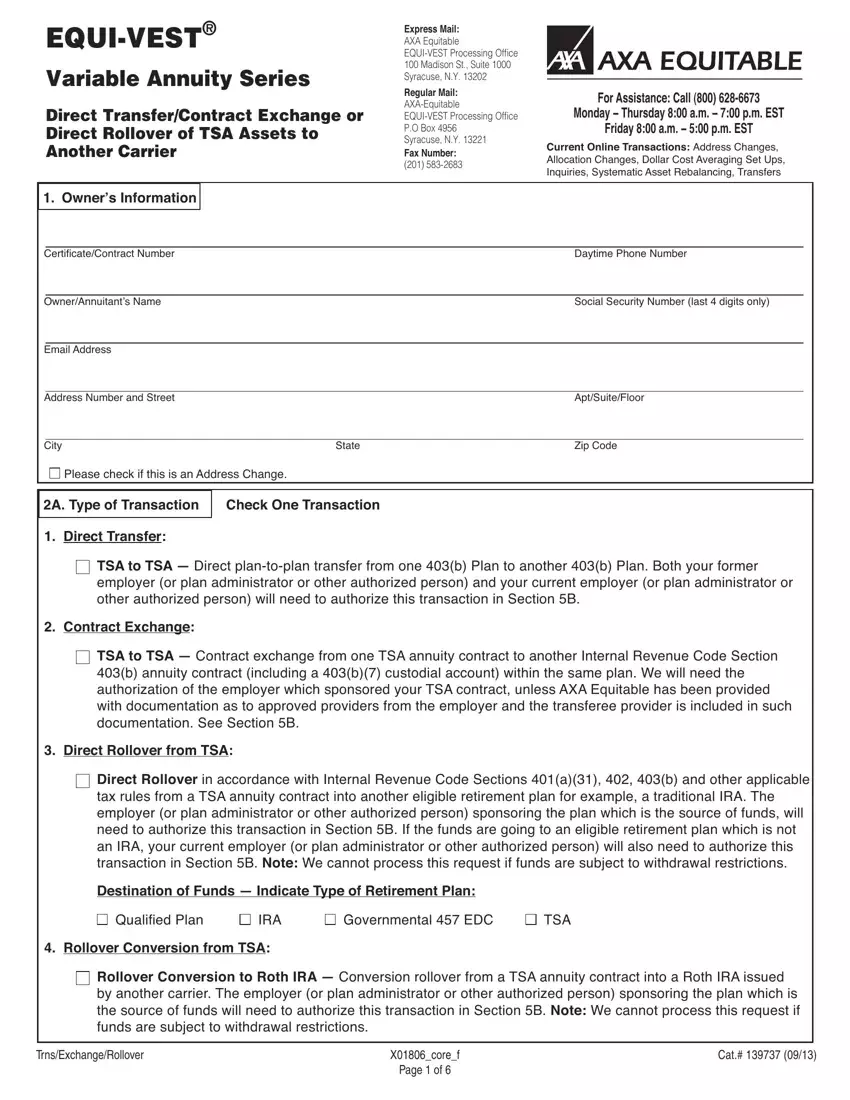

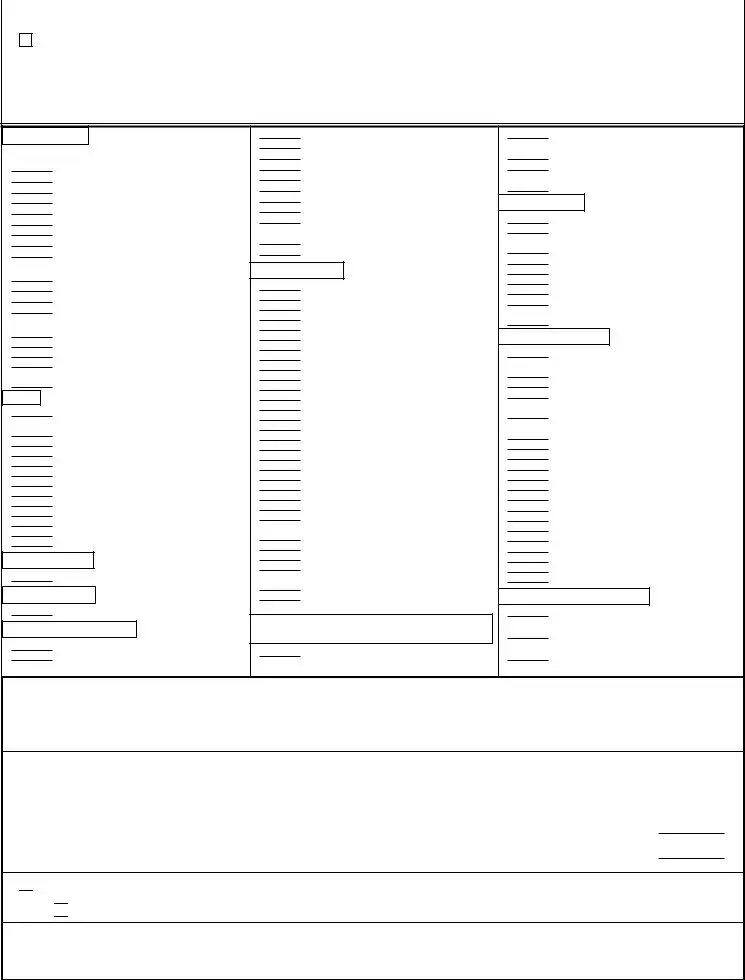

Enter the appropriate information in Direct Transfer, TSA to TSA BHHBFFIJIJGKF, BBLBBB LBLMKG, Contract Exchange, TSA to TSA NFOPQR, IJIJSBGT LFBBOUVAWBR BBRBRFBFBR, Direct Rollover from TSA, Direct RolloverPQRIXJXUIYUIJBB, NFOBFNBUPQGO BBLBBBFFU LMKGPFFB, Destination of Funds Indicate, RMSA, and Rollover Conversion from TSA part.

The program will ask you to write certain essential details to instantly fill in the section Rollover Conversion from TSA, Rollover Conversion to Roth IRA, GOBBLBBB FFLMKGNoteTBWF FZG, TrnsExchangeRollover, Xcoref Page of, and Cat.

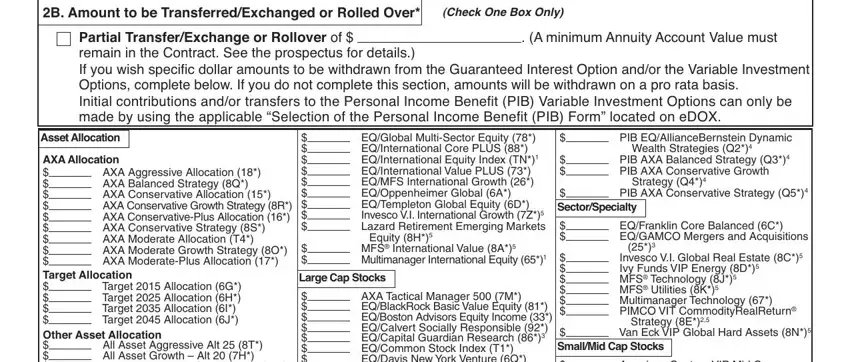

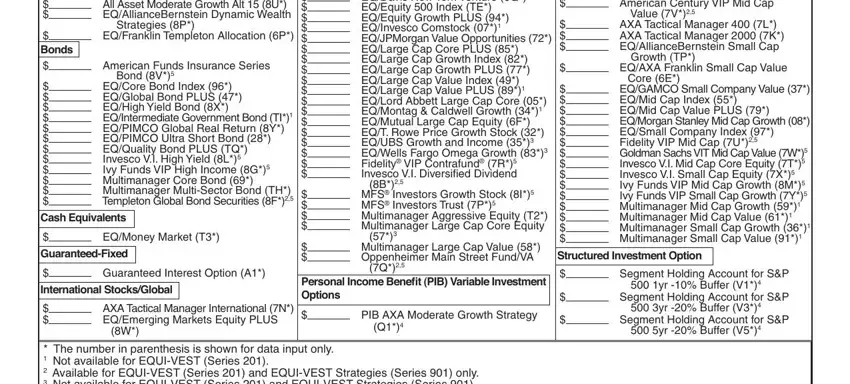

The B Amount to be, Check One Box Only, Partial TransferExchange or, GBBFG PFBFPBPR BUBGPFBUBG, AXA Aggressive Allocation AXA, Target Allocation G Target, Asset Allocation, AXA Allocation Target, All Asset Aggressive Alt T All, Large Cap Stocks, EQGlobal MultiSector Equity, Invesco VI International Growth Z, MFS International Value A, AXA Tactical Manager M, and PIB EQAllianceBernstein Dynamic section will be the place to insert the rights and responsibilities of both sides.

Fill out the template by reading all these areas: AXA Allocation Target, All Asset Aggressive Alt T All, Strategies P, EQFranklin Templeton Allocation P, American Funds Insurance Series, Bond V, EQCore Bond Index EQGlobal Bond, EQIntermediate Government Bond TI, EQPIMCO Global Real Return Y, Bonds, Cash Equivalents, EQMoney Market T, GuaranteedFixed, Guaranteed Interest Option A, and International StocksGlobal.

Step 3: Choose the Done button to save your file. So now it is offered for upload to your gadget.

Step 4: Generate copies of the document - it can help you avoid future challenges. And don't worry - we are not meant to share or check the information you have.

, ,

, , ,

,  ,

,  ,,[.(;%&">,3;(+,,,,,,,,,

,,[.(;%&">,3;(+,,,,,,,,, ,,PQ7,,,,,,,,,,,

,,PQ7,,,,,,,,,,, ,,\*R"#+/"+$(;,=MS,A1!,,,,,,,,

,,\*R"#+/"+$(;,=MS,A1!,,,,,,,, ,,O:7

,,O:7 ,

,

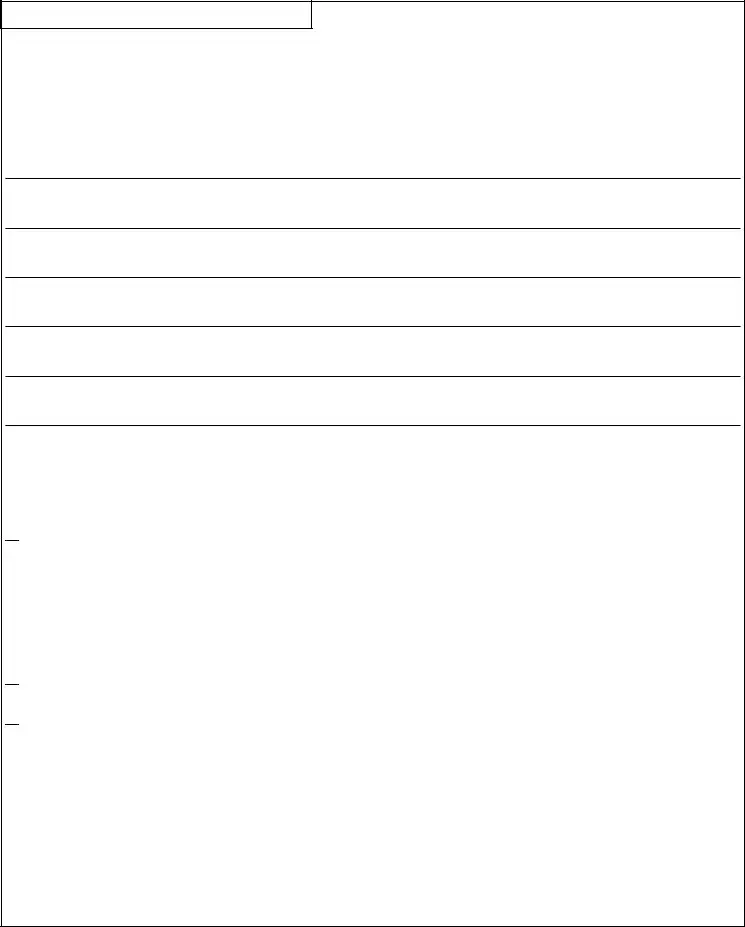

,!4"'E,4"#",%F,2*.,9";"'$">,(,$*$(;,$#(+9F"#)"N'4(+?",*#,#*;;*R"#,(+>,(#",.+(0;",$*,;*'($",2*.#,'*+$#('$G

,!4"'E,4"#",%F,2*.,9";"'$">,(,$*$(;,$#(+9F"#)"N'4(+?",*#,#*;;*R"#,(+>,(#",.+(0;",$*,;*'($",2*.#,'*+$#('$G

, O4",$#(+9F"##">)"N'4(+?">,O:7,F.+>9,6%;;,0",(BB;%">,$*,(+,P+$"#+(;,Q"R"+.",!*>",:"'$%*+,=IJ<0@,(++.%$2,'*+$#('$,(9, B#*R%>">,%+,O#"(9G,Q"?G,:"'G,=IJ<0@HXI,6%$4,$4",(BB#*R(;,*F,$4","/B;*2"#G

, O4",$#(+9F"##">)"N'4(+?">,O:7,F.+>9,6%;;,0",(BB;%">,$*,(+,P+$"#+(;,Q"R"+.",!*>",:"'$%*+,=IJ<0@,(++.%$2,'*+$#('$,(9, B#*R%>">,%+,O#"(9G,Q"?G,:"'G,=IJ<0@HXI,6%$4,$4",(BB#*R(;,*F,$4","/B;*2"#G

, O4%9,>%#"'$,#*;;*R"#,6%;;,0",(BB;%">,$*,(+,";%?%0;",#"$%#"/"+$,B;(+,6%$4%+,$4",/"(+%+?,*F,P+$"#+(;,Q"R"+.",!*>",:"'$%*+, =IY<'@<l@<K@,(+>,$4",B;(+,(''"B$9,$4%9,E%+>,*F,#*;;*R"#G

, O4%9,>%#"'$,#*;;*R"#,6%;;,0",(BB;%">,$*,(+,";%?%0;",#"$%#"/"+$,B;(+,6%$4%+,$4",/"(+%+?,*F,P+$"#+(;,Q"R"+.",!*>",:"'$%*+, =IY<'@<l@<K@,(+>,$4",B;(+,(''"B$9,$4%9,E%+>,*F,#*;;*R"#G

, O4%9,'*+R"#9%*+,#*;;*R"#,6%;;,0",(BB;%">,$*,(,Q*$4,PQ7,6%$4,/2,+"6,'(##%"#G,P,.+>"#9$(+>,$4($,7V7,AW.%$(0;",6%;;,&;",C*#/, XIccHQ,(+>,/2,+"6,'(##%"#,6%;;,&;",C*#/,M=clG

, O4%9,'*+R"#9%*+,#*;;*R"#,6%;;,0",(BB;%">,$*,(,Q*$4,PQ7,6%$4,/2,+"6,'(##%"#G,P,.+>"#9$(+>,$4($,7V7,AW.%$(0;",6%;;,&;",C*#/, XIccHQ,(+>,/2,+"6,'(##%"#,6%;;,&;",C*#/,M=clG

, 9.#R%R%+?,9B*.9",0"+"&'%(#2,*F,>"'"(9">,7++.%$(+$U,*#

, 9.#R%R%+?,9B*.9",0"+"&'%(#2,*F,>"'"(9">,7++.%$(+$U,*#

, 9B*.9",*#,F*#/"#,9B*.9",#"'"%R%+?,>%9$#%0.$%*+,.+>"#,(,[.(;%&">,1*/"9$%',Q";($%*+9,5#>"#,*F,ii[1Q5G88,

, 9B*.9",*#,F*#/"#,9B*.9",#"'"%R%+?,>%9$#%0.$%*+,.+>"#,(,[.(;%&">,1*/"9$%',Q";($%*+9,5#>"#,*F,ii[1Q5G88,

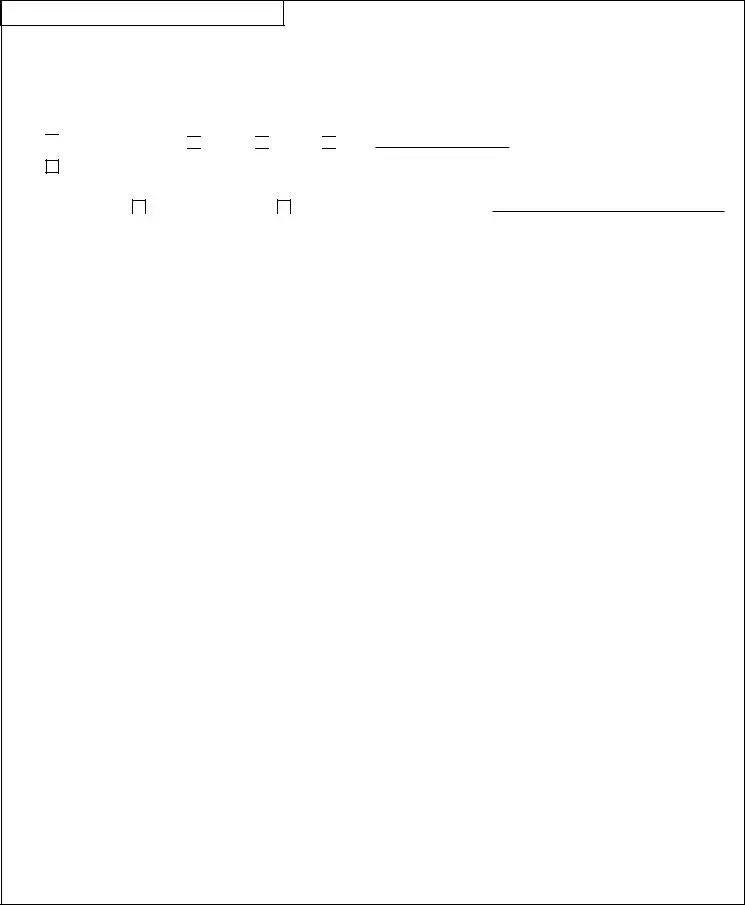

, P,6%94,$*,";"'$,*.$,*F,6%$44*;>%+?G,]+>"#,B"+(;$2,*F,B"#Z.#2U,P,'"#$%F2,$4($,$4",F*;;*6%+?,O(NB(2"#,P>"+$%&'($%*+,

, P,6%94,$*,";"'$,*.$,*F,6%$44*;>%+?G,]+>"#,B"+(;$2,*F,B"#Z.#2U,P,'"#$%F2,$4($,$4",F*;;*6%+?,O(NB(2"#,P>"+$%&'($%*+,

, :G:G-,

, :G:G-,

,

,

, 5$4"#

, 5$4"#