You'll be able to fill in equitable lump form easily with our online PDF editor. Our expert team is continuously endeavoring to develop the tool and insure that it is even faster for users with its extensive features. Enjoy an ever-evolving experience today! In case you are looking to get going, here is what it requires:

Step 1: Click on the "Get Form" button at the top of this webpage to open our editor.

Step 2: After you access the file editor, there'll be the form made ready to be filled out. Aside from filling out various fields, you could also perform other sorts of things with the PDF, such as putting on any text, editing the original textual content, adding illustrations or photos, signing the form, and much more.

This form will need you to type in specific details; in order to guarantee accuracy, be sure to take note of the recommendations below:

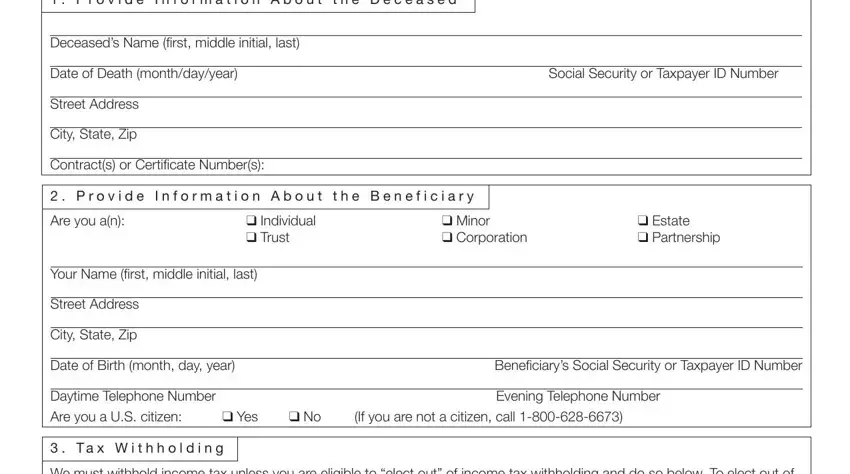

1. You will want to fill out the equitable lump form accurately, hence be mindful when filling in the parts including these specific blank fields:

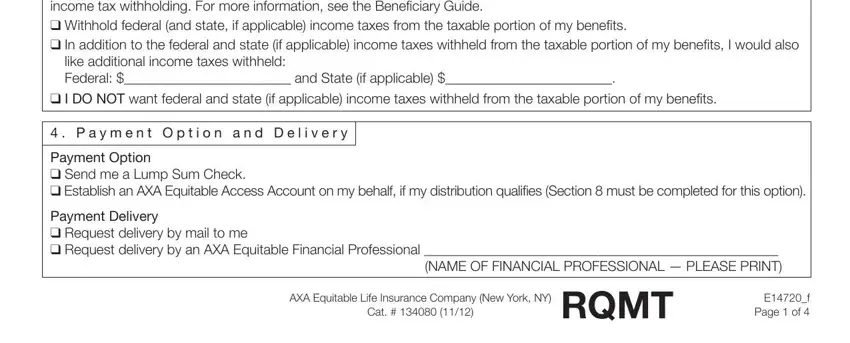

2. Right after the first part is done, go to enter the applicable details in all these - We must withhold income tax unless, like additional income taxes, I DO NOT want federal and state, P a y m e n t O p t i o n a n d, Payment Option Send me a Lump Sum, Payment Delivery Request delivery, AXA Equitable Life Insurance, Cat , RQMT, and Ef Page of .

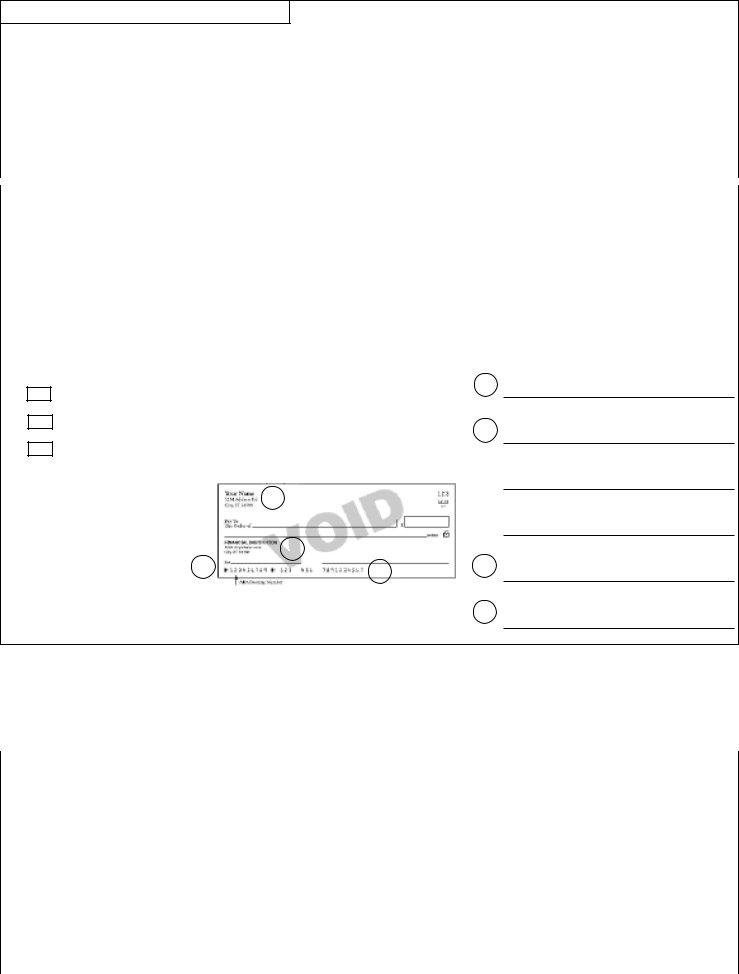

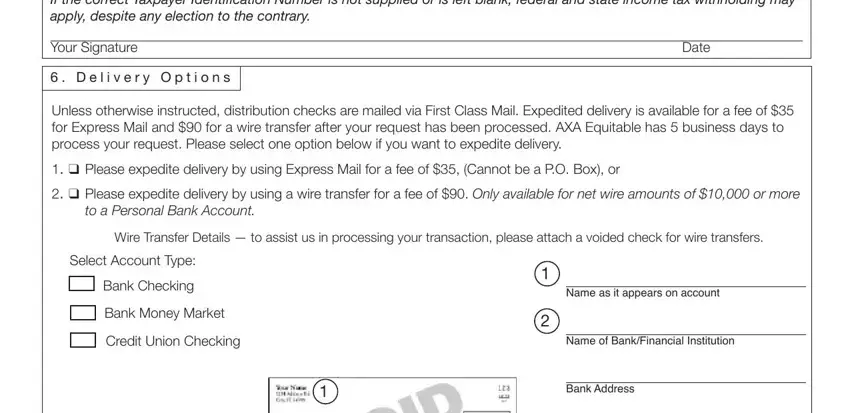

3. Completing Under penalties of perjury I, Your Signature, D e l i v e r y O p t i o n s, Date, Unless otherwise instructed, to a Personal Bank Account, Wire Transfer Details to assist, Select Account Type, Bank Checking, Bank Money Market, Credit Union Checking, Name as it appears on account, Name of BankFinancial Institution, and Bank Address is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

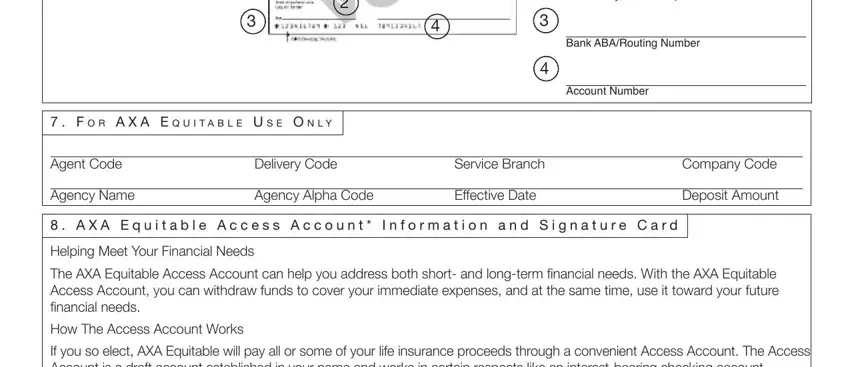

4. This next section requires some additional information. Ensure you complete all the necessary fields - Bank City State Zip Code, Bank ABARouting Number, Account Number, F o r A x A E q u i t a b l e u, Agent Code, Agency Name, Delivery Code, Service Branch, Agency Alpha Code, Effective Date, Company Code, Deposit Amount, A x A E q u i t a b l e A c c e, and Helping Meet Your Financial Needs - to proceed further in your process!

In terms of A x A E q u i t a b l e A c c e and Helping Meet Your Financial Needs, make certain you review things in this section. The two of these are thought to be the key ones in this page.

5. Last of all, the following final section is what you will need to wrap up prior to submitting the document. The blank fields you're looking at are the next: Please complete the information, Print Your Name FirstMILast, Contract Number, Your Mailing Address, Social Security or Other Taxpayer, Daytime Telephone Number, Your Signature as it should appear, Date, Securities products and services, and global AXA Group AXA Advisors.

Step 3: Before addressing the next stage, check that all blanks have been filled in as intended. The moment you establish that it is fine, click “Done." After starting a7-day free trial account here, it will be possible to download equitable lump form or email it immediately. The document will also be readily available in your personal account menu with your each edit. FormsPal guarantees your data privacy with a secure system that never records or shares any type of private data provided. You can relax knowing your docs are kept confidential every time you work with our service!