Have you ever had a dispute with a vendor or merchant while conducting a transaction? Most likely, you have. And if you haven't yet, you will. It's an unfortunate reality of doing business. Thankfully, there are ways to handle these situations and minimize the headache they can cause. In this blog post, we'll discuss one such way: the BDO Transaction Dispute Form. We'll outline what it is, how to use it, and why it may be beneficial for your business. So, if you're facing a dispute with a vendor and need some guidance on how to proceed, read on!

| Question | Answer |

|---|---|

| Form Name | Bdo Transaction Dispute Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | how to file dispute in bdo credit card, bdo dispute, bdo transaction dispute, bdo credit card dispute form |

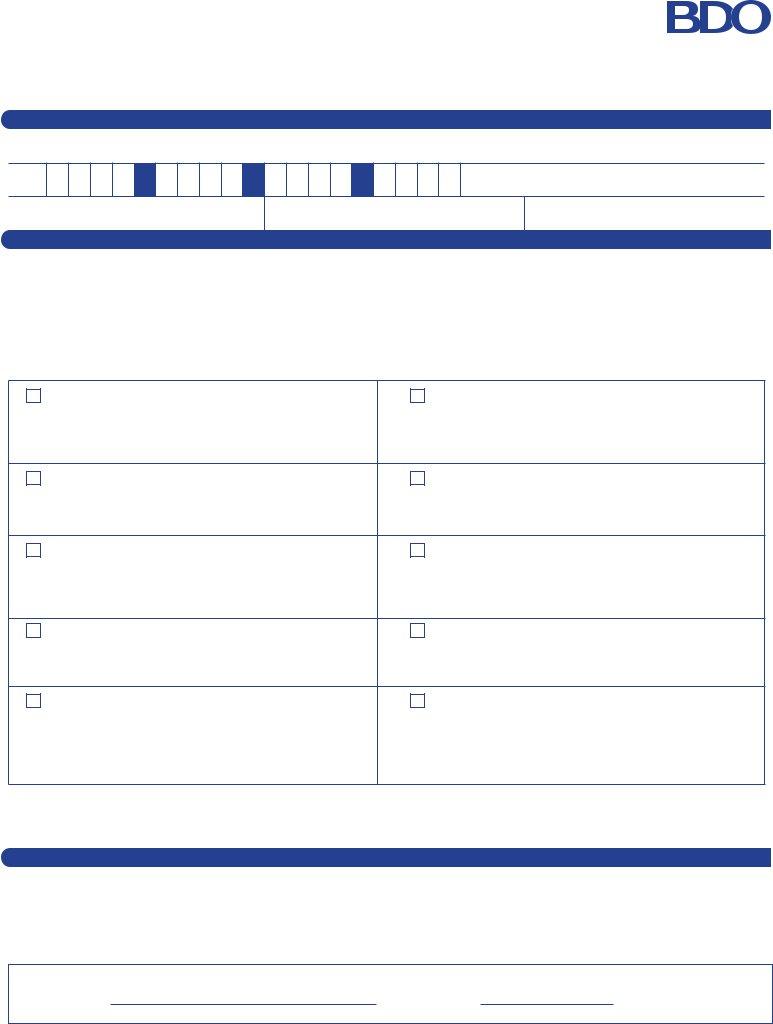

CARDHOLDER TRANSACTION DISPUTE FORM

Instructions:

In order for us to investigate your dispute:

1.The CUSTOMER INFORMATION and TRANSACTION DISPUTE DETAILS should be complete and legibly filled out.

2.Please check one category which best describes your dispute and enclose all supporting documents.

3.Please complete one form for each disputed transaction if dispute types are dierent in nature.

4.Your duly filled out signed form must reach us through fax or email within 60 days from posting date.

Send to:

Fax No.:

Email Address: callcenter@bdo.com.ph

CUSTOMER INFORMATION

Customer Name (Last, First, M.I.)

Card No.

Email Address

Tel. No.

Mobile No.

Fax No.

TRANSACTION DISPUTE DETAILS

TRANSACTION DATE |

POST DATE |

MERCHANT NAME |

TRANSACTION AMOUNT |

TRANSACTION AMOUNT |

|

(Php) |

(Foreign) |

||||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNAUTHORIZED TRANSACTION |

CANCELLED MEMBERSHIP / SUBSCRIPTION |

I did not authorize or participate in the transaction(s) |

I have cancelled the subscription / membership / policy |

indicated above or authorize anyone to engage in the |

(encircle one) on ___/___/___ (dd/mm/yy) yet the charge |

transaction(s) and my card was in my possession at the time |

was billed to my credit card. Enclose is a proof of my |

of purchase. |

cancellation with the merchant. |

DUPLICATE BILLING |

INCORRECT AMOUNT |

I have been billed more than once for the same transaction. I |

I made a transaction amounting to _________. However, I |

authorized only one charge with this merchant for the |

was charged for ___________. I am disputing the di |

amount of _____________on ____/____/____ (dd/mm/yy). |

of ____________. Enclosed is the copy of the sales slip. |

PAID BY OTHER MEANS |

UNDISPENSED CASH ADVANCE |

I used another form of payment for this transaction(s) (cash, |

I attempted to withdraw cash thru (name of |

check, or other credit card). Enclosed is a copy of the proof |

bank)___________ ATM located at _______________ (Area, |

of payment. |

City) on ___/___/___ (dd/mm/yy), however no cash was |

|

dispensed. Enclosed is a copy of the ATM Slip. |

REFUND / CREDIT NOT PROCESSED |

|

I ordered the merchandise on ___/___/___ (mm/dd/yy) with |

I have not received my refund from the merchant. Enclosed is |

|

|

an expected delivery date on ___/___/___ (dd/mm/yy). |

a copy of my credit voucher. |

|

|

Enclosed is a copy of my order form. |

|

DEFECTIVE / RETURNED / NOT AS DESCRIBED MERCHANDISE |

OTHERS |

The item that I purchased did not conform to what was |

Please provide a complete description of the dispute along |

|

|

agreed with the merchant or was defective. I returned the |

with your attempted resolution with the merchant. Enclose |

|

|

item(s) last ___/___/___ (dd/mm/yy). Enclosed is the proof |

any documentation that supports your claim. |

|

|

of return/credit voucher and documentation that supports |

|

my claim. |

|

Important Reminder:

In case you are disputing an airline ticket transaction, please be informed that related travel booking may be placed on hold or cancelled while investigation is ongoing. Please contact your airline directly.

TERMS AND CONDITIONS

1.Only transactions reported within 60 days from its posting date will be accommodated. A temporary credit will be applied within 5 days upon receipt of the signed transaction dispute form and additional supporting documentation, as applicable.

2.All transactions reported beyond 60 days from the posting date will no longer be accommodated and will be considered true, accurate and binding upon you.

3.You will be advised of the final disposition via a letter, SMS or call out within 90 calendar days from receipt of the transaction dispute form.

4.If the transaction is proven to be valid, it will be billed back to you inclusive of related finance charges.

I hereby a

Signature Over Printed Name |

Date |