Making use of the online tool for PDF editing by FormsPal, you can fill in or edit lincoln financial beneficiary change right here. Our tool is consistently developing to deliver the very best user experience attainable, and that is because of our commitment to continual development and listening closely to feedback from customers. By taking a few simple steps, it is possible to start your PDF editing:

Step 1: First of all, open the tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: As soon as you open the online editor, you'll notice the document ready to be filled out. Besides filling in various blank fields, you might also do other things with the file, namely writing custom text, changing the original textual content, inserting graphics, affixing your signature to the document, and more.

This document will require you to enter some specific information; in order to ensure consistency, make sure you take into account the guidelines hereunder:

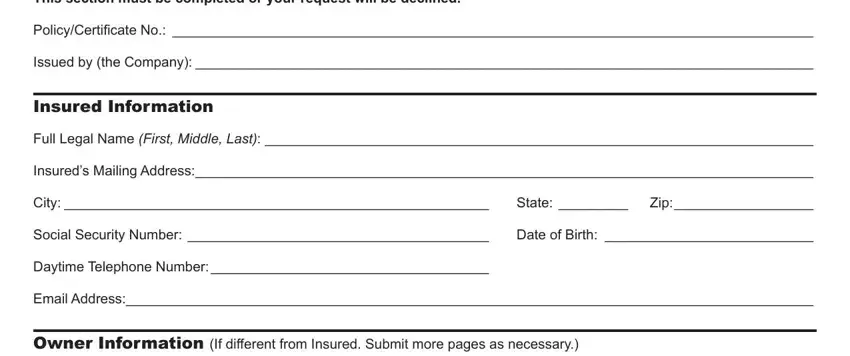

1. The lincoln financial beneficiary change requires certain details to be inserted. Make sure the subsequent blank fields are finalized:

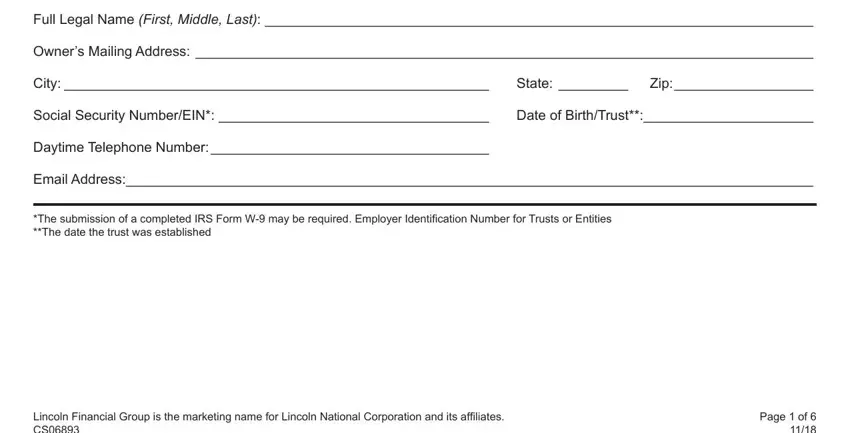

2. Soon after filling out the last step, go on to the next step and complete all required details in all these blank fields - Full Legal Name First Middle Last , Owners Mailing Address , City State , Zip , Social Security NumberEIN Date of, Daytime Telephone Number , Email Address , The submission of a completed IRS, Lincoln Financial Group is the, and Page of .

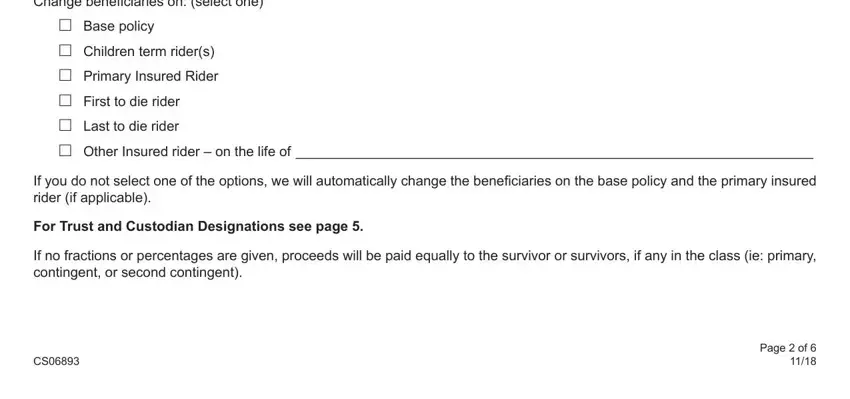

3. This next stage is going to be simple - fill in all of the fields in Change beneficiaries on select one, h Base policy, h Children term riders, h Primary Insured Rider, h First to die rider, h Last to die rider, h Other Insured rider on the life, If you do not select one of the, For Trust and Custodian, If no fractions or percentages are, and Page of to complete this part.

A lot of people frequently make errors while filling in h Other Insured rider on the life in this section. You should reread everything you enter right here.

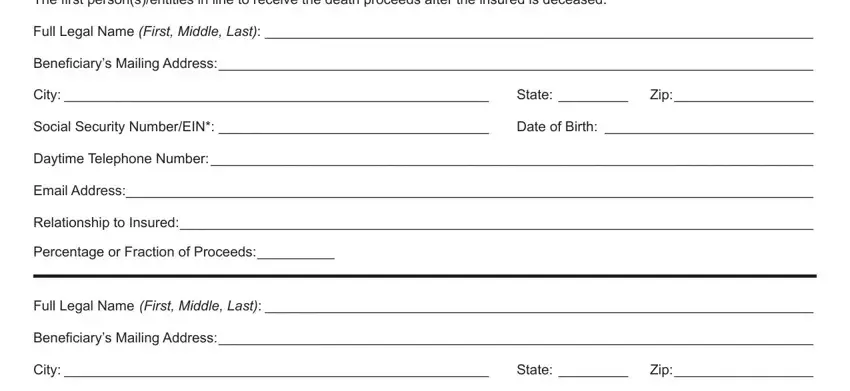

4. This next section requires some additional information. Ensure you complete all the necessary fields - The first personsentities in line, Full Legal Name First Middle Last , Beneficiarys Mailing Address , City State , Zip , Social Security NumberEIN Date of, Daytime Telephone Number , Email Address , Relationship to Insured , Percentage or Fraction of Proceeds , Full Legal Name First Middle Last , Beneficiarys Mailing Address , City State , and Zip - to proceed further in your process!

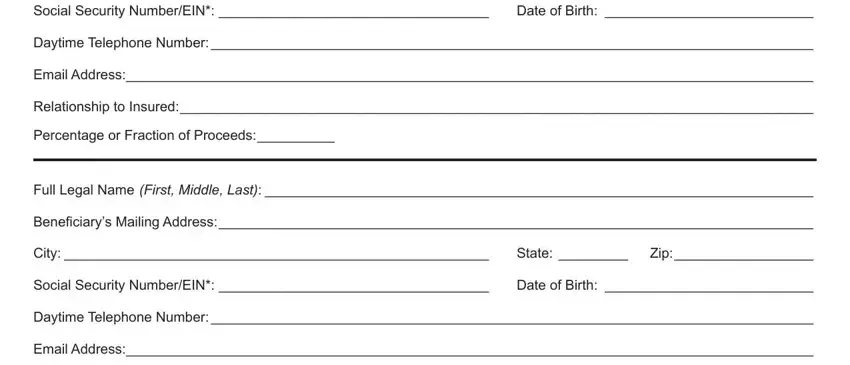

5. This very last stage to complete this PDF form is critical. Make sure you fill out the appropriate blank fields, consisting of Social Security NumberEIN Date of, Daytime Telephone Number , Email Address , Relationship to Insured , Percentage or Fraction of Proceeds , Full Legal Name First Middle Last , Beneficiarys Mailing Address , City State , Zip , Social Security NumberEIN Date of, Daytime Telephone Number , and Email Address , prior to using the file. Neglecting to do this may generate a flawed and probably invalid form!

Step 3: Ensure that your details are right and simply click "Done" to proceed further. After starting afree trial account with us, it will be possible to download lincoln financial beneficiary change or email it right off. The PDF document will also be readily available through your personal account with all your adjustments. FormsPal is committed to the confidentiality of all our users; we make sure that all information handled by our editor continues to be secure.