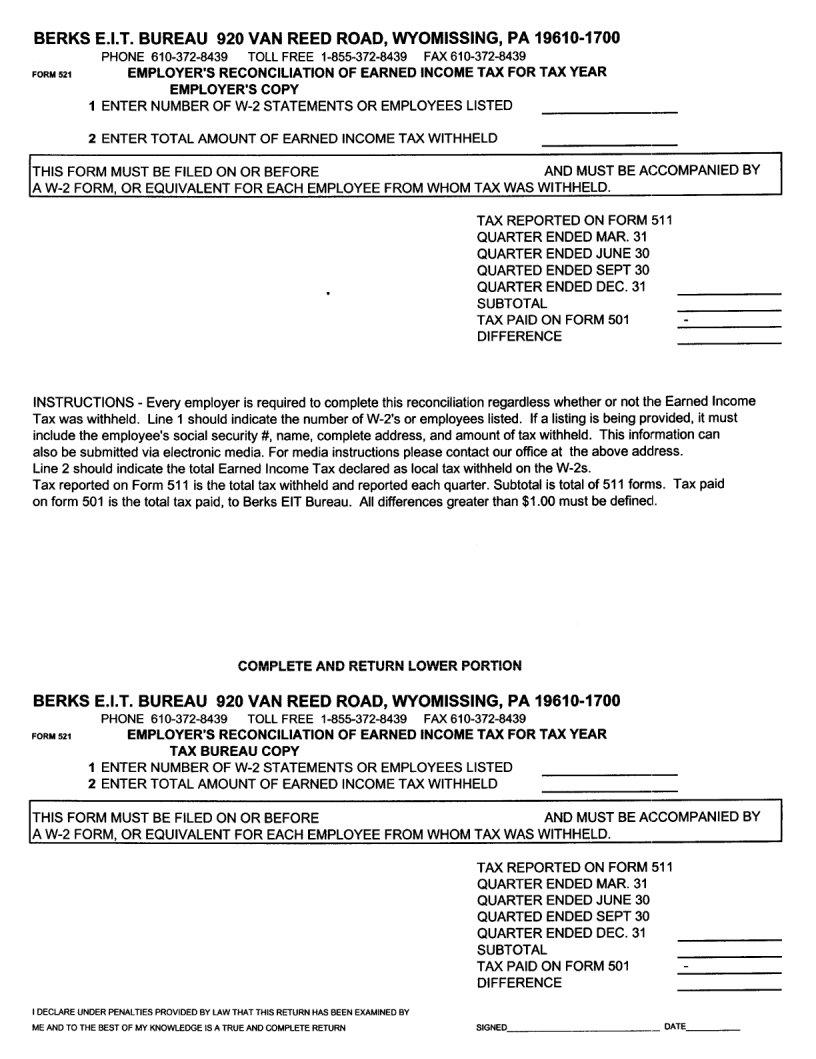

In the landscape of local taxation, residents are often required to navigate through an array of forms and declarations, each significant in its own ambit. One such pivotal document is the Berks Tax Form, which serves as a cornerstone for individuals residing within this jurisdiction to comply with their tax obligations. This form encompasses various aspects of local tax regulations, including but not limited to, income declaration, property tax assessments, and eligibility for certain tax credits and exemptions. It is designed to simplify the process of tax filing for residents, ensuring that they meet their legal responsibilities while potentially benefiting from deductions and rebates that the local legislation offers. Understanding the intricacies of the Berks Tax Form is essential not only for fulfilling civic duties but also for grasping the potential financial advantages it may unveil for compliant taxpayers.

| Question | Answer |

|---|---|

| Form Name | Berks Tax Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | berks county local tax form, eit, berks eit form 511, berk eit bureau |