You may complete Form It 201X Tax instantly by using our online PDF tool. We at FormsPal are devoted to giving you the best possible experience with our tool by consistently adding new capabilities and improvements. With all of these improvements, using our tool gets better than ever before! To start your journey, consider these simple steps:

Step 1: First, access the tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: With the help of this handy PDF file editor, it is possible to accomplish more than just fill in forms. Edit away and make your forms appear high-quality with custom textual content added, or optimize the file's original content to perfection - all that comes with an ability to insert just about any images and sign the file off.

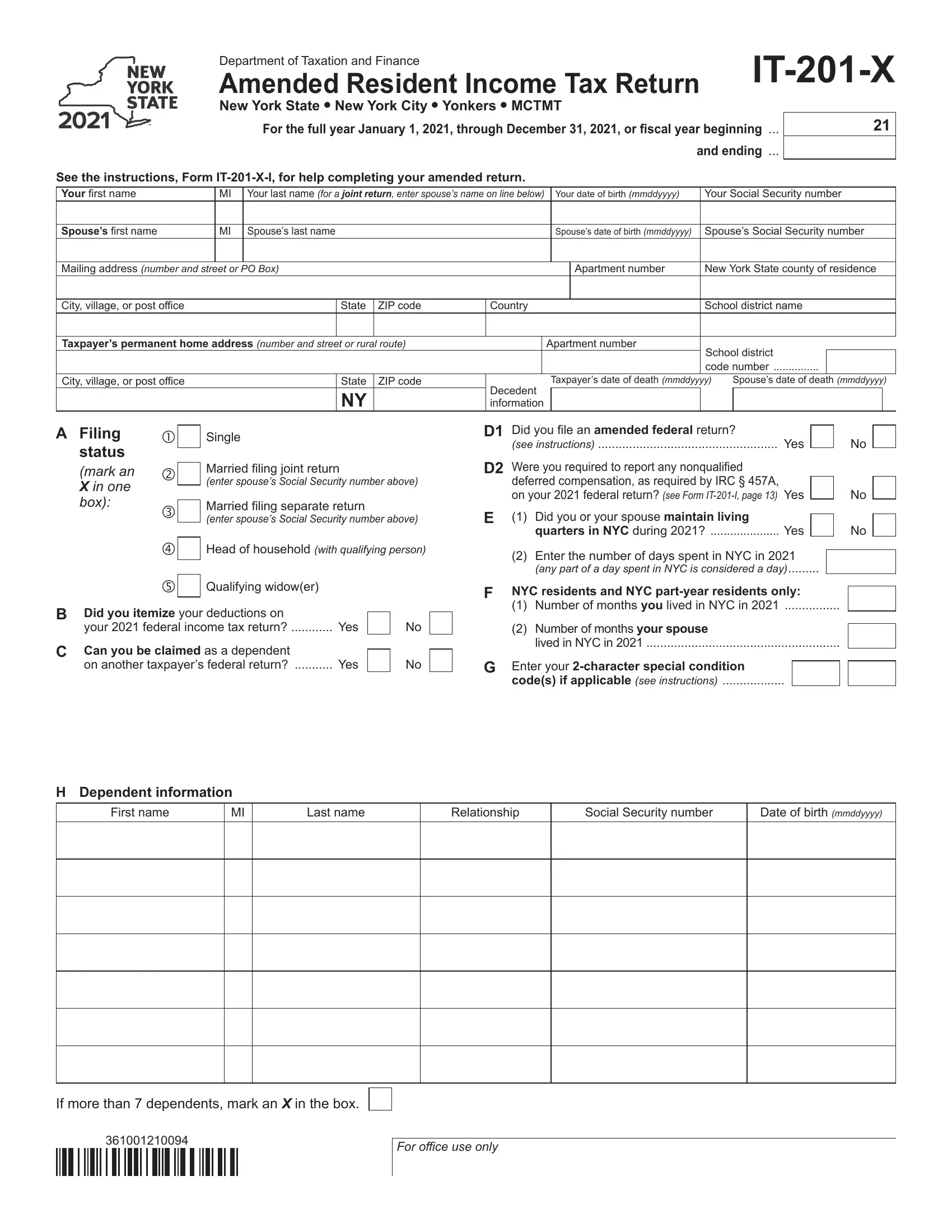

This PDF requires specific information to be filled in, thus ensure that you take some time to type in exactly what is required:

1. Start completing the Form It 201X Tax with a selection of necessary blanks. Consider all the required information and ensure there is nothing forgotten!

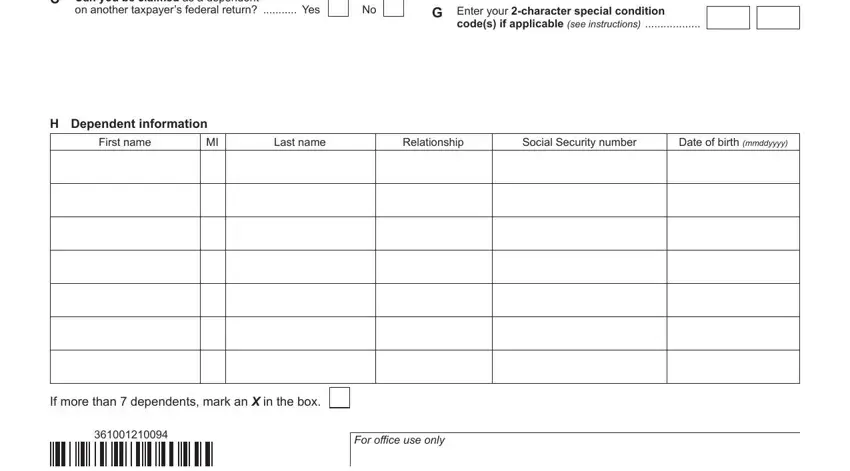

2. When this section is completed, go to type in the applicable details in all these: B Did you itemize your deductions, on another taxpayers federal, F NYC residents and NYC partyear, codes if applicable see, H Dependent information, First name, Last name, Relationship, Social Security number, Date of birth mmddyyyy, If more than dependents mark an X, and For office use only.

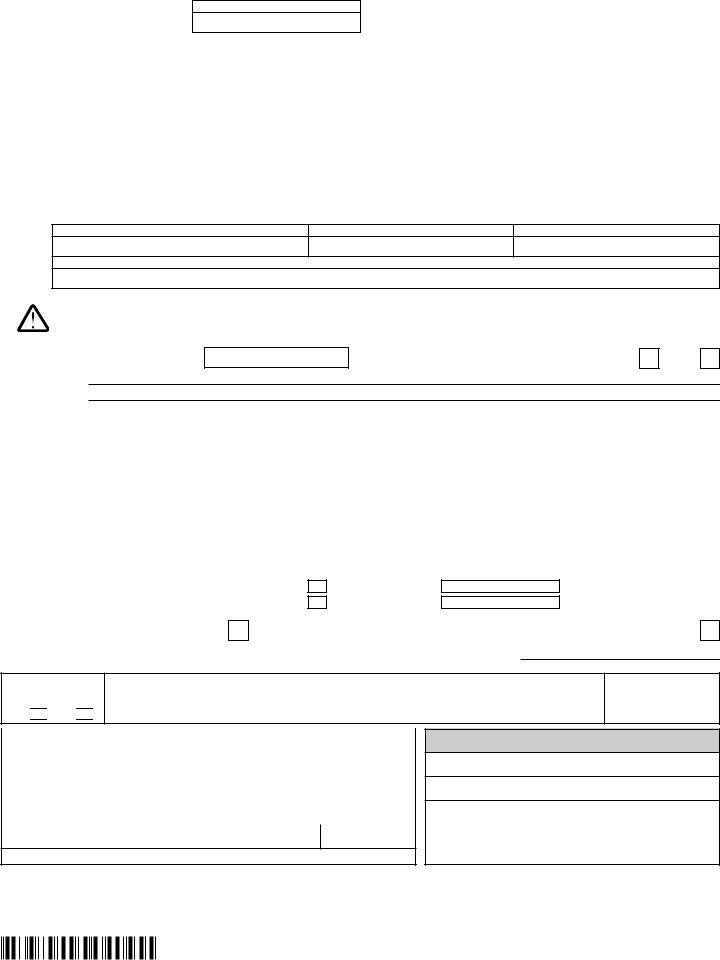

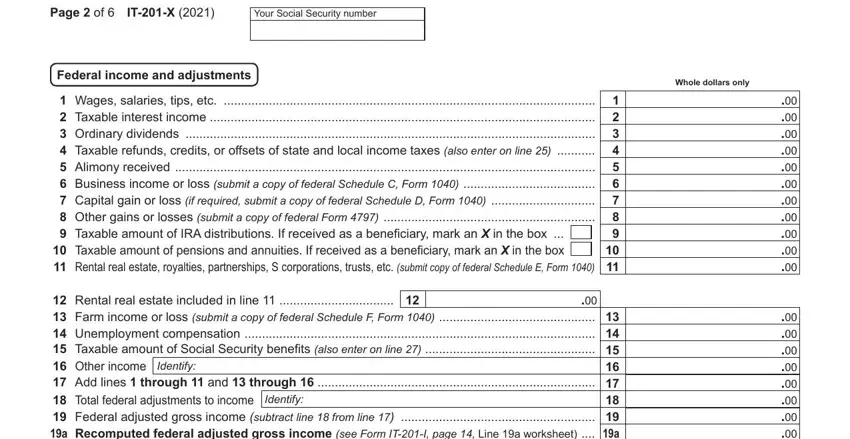

3. Completing Page of, ITX, Your Social Security number, Federal income and adjustments, Whole dollars only, Wages salaries tips etc, Rental real estate included in, Identify, and Identify is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be extremely attentive when filling in Your Social Security number and Whole dollars only, since this is where a lot of people make mistakes.

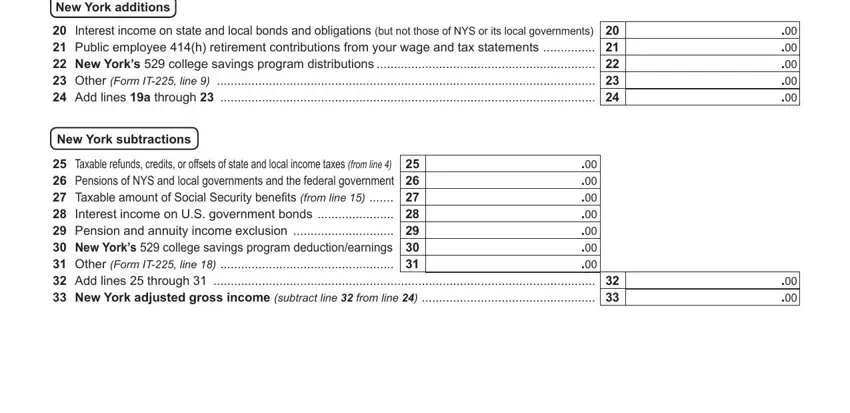

4. This next section requires some additional information. Ensure you complete all the necessary fields - New York additions Interest, New York subtractions, and Taxable refunds credits or - to proceed further in your process!

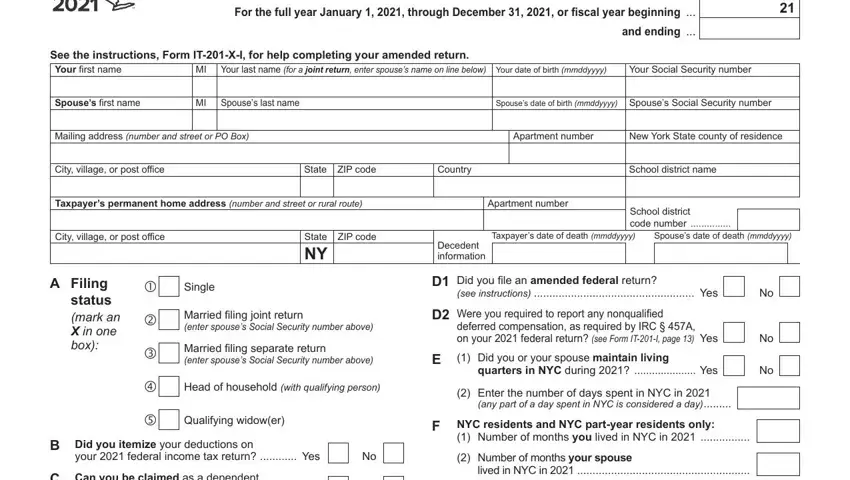

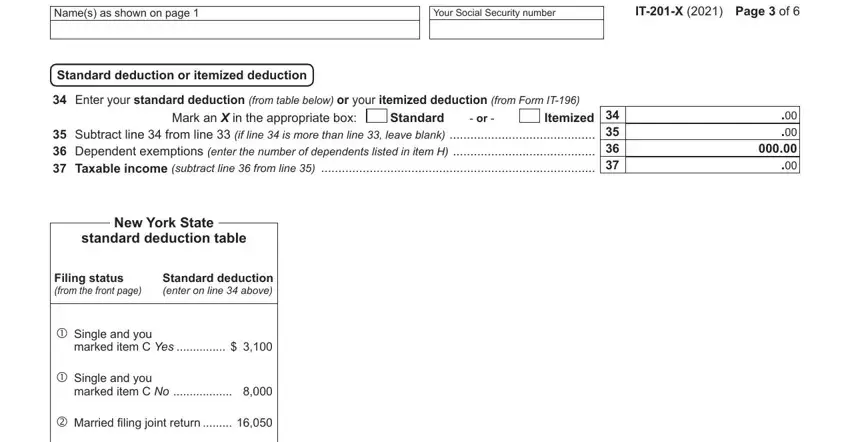

5. Since you approach the finalization of the file, you will find a few extra requirements that must be fulfilled. Notably, Names as shown on page, Your Social Security number, ITX Page of, Standard deduction or itemized, Standard, Enter your standard deduction, Mark an X in the appropriate box, New York State, standard deduction table, Filing status from the front page, Standard deduction enter on line, Single and you marked item C Yes, Single and you marked item C No, and Married filing joint return must be filled out.

Step 3: Make sure your information is accurate and then click "Done" to complete the project. Get hold of the Form It 201X Tax when you register at FormsPal for a 7-day free trial. Quickly view the pdf form in your FormsPal account, together with any edits and changes being all saved! FormsPal is dedicated to the personal privacy of all our users; we make certain that all information processed by our system remains secure.