Once you open the online tool for PDF editing by FormsPal, you are able to fill out or edit bir 0605 form download right here and now. To keep our editor on the forefront of convenience, we work to put into action user-oriented capabilities and enhancements regularly. We're routinely looking for feedback - help us with revampimg how we work with PDF forms. To get the process started, go through these easy steps:

Step 1: Press the "Get Form" button above on this webpage to get into our tool.

Step 2: Using this online PDF file editor, you're able to do more than merely fill out forms. Express yourself and make your forms appear faultless with customized text incorporated, or modify the file's original content to perfection - all that comes along with an ability to insert your own photos and sign the document off.

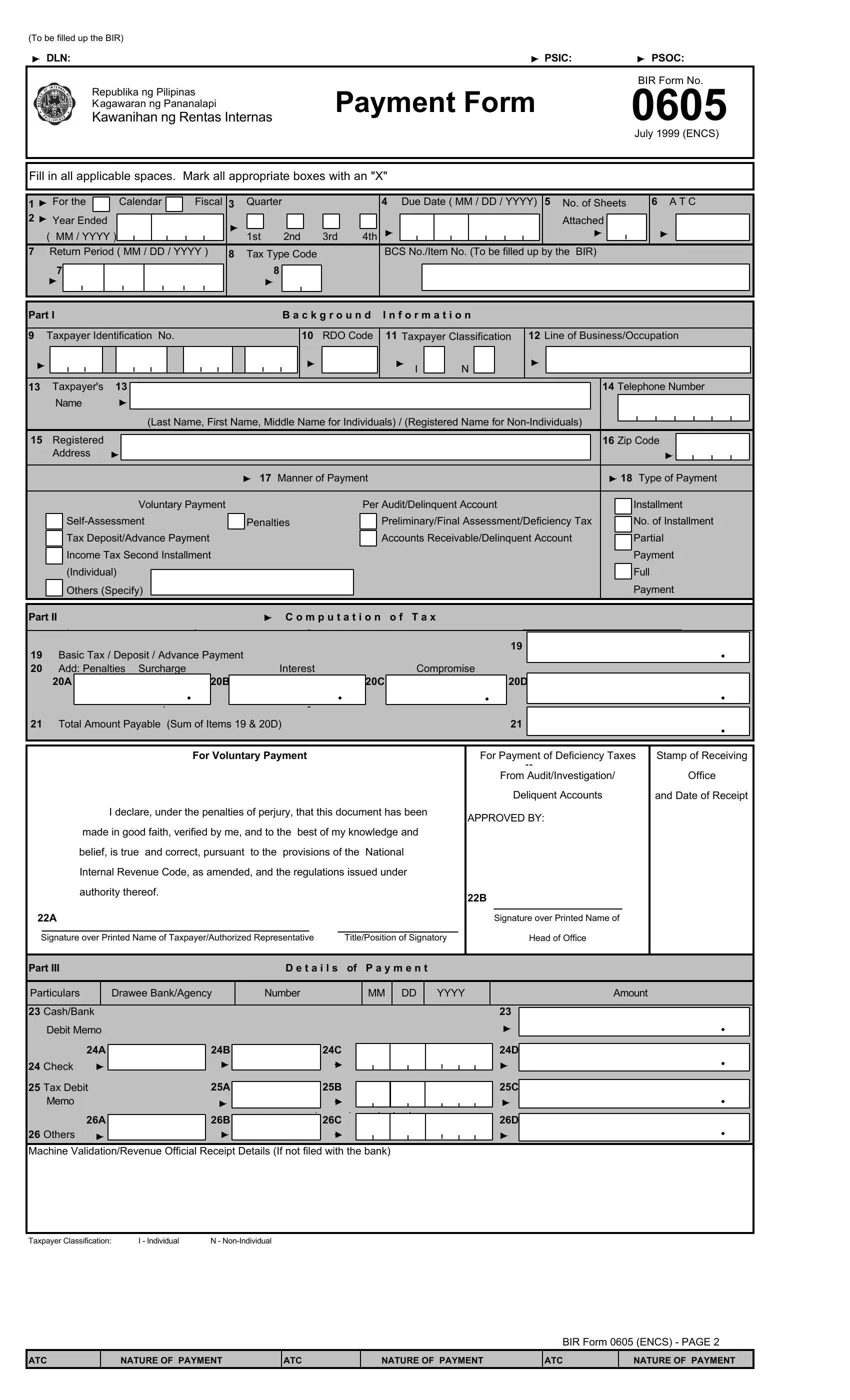

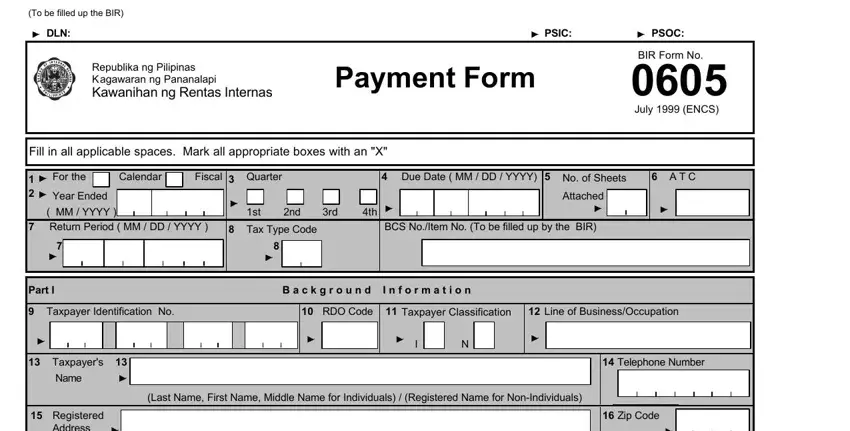

This form requires specific details; in order to guarantee correctness, remember to take note of the next tips:

1. Fill out the bir 0605 form download with a number of major fields. Note all the important information and be sure absolutely nothing is omitted!

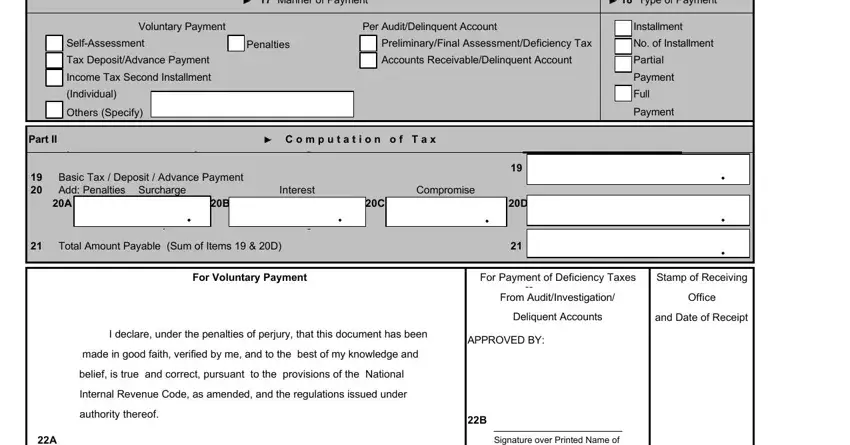

2. The next step is to submit all of the following fields: Manner of Payment, Type of Payment, Voluntary Payment, Per AuditDelinquent Account, Installment, SelfAssessment, Penalties, PreliminaryFinal, No of Installment, Tax DepositAdvance Payment, Income Tax Second Installment, Individual, Others Specify, Accounts ReceivableDelinquent, and Partial.

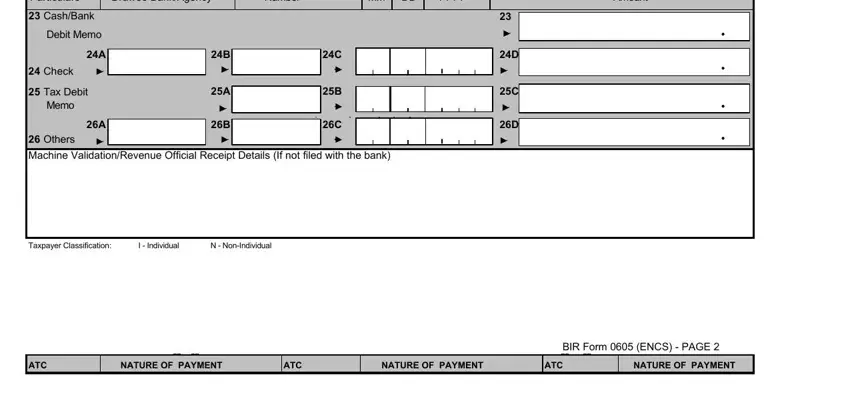

3. The following step is focused on Particulars, Drawee BankAgency, Number, MM DD, YYYY, Amount, CashBank, Debit Memo, Check, Tax Debit, Memo, Others, Machine ValidationRevenue Official, Taxpayer Classification, and I Individual - fill in every one of these fields.

As to Tax Debit and Taxpayer Classification, make sure you do everything properly in this current part. Both of these could be the most significant fields in the file.

Step 3: Prior to moving forward, make sure that all blanks are filled in the correct way. When you believe it's all fine, click “Done." Make a 7-day free trial option at FormsPal and get direct access to bir 0605 form download - download or modify inside your personal cabinet. FormsPal provides secure document completion with no personal data recording or distributing. Feel at ease knowing that your information is safe with us!