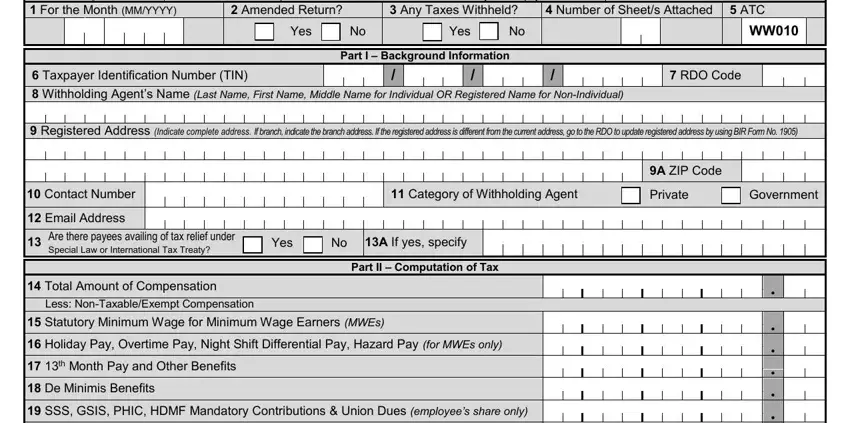

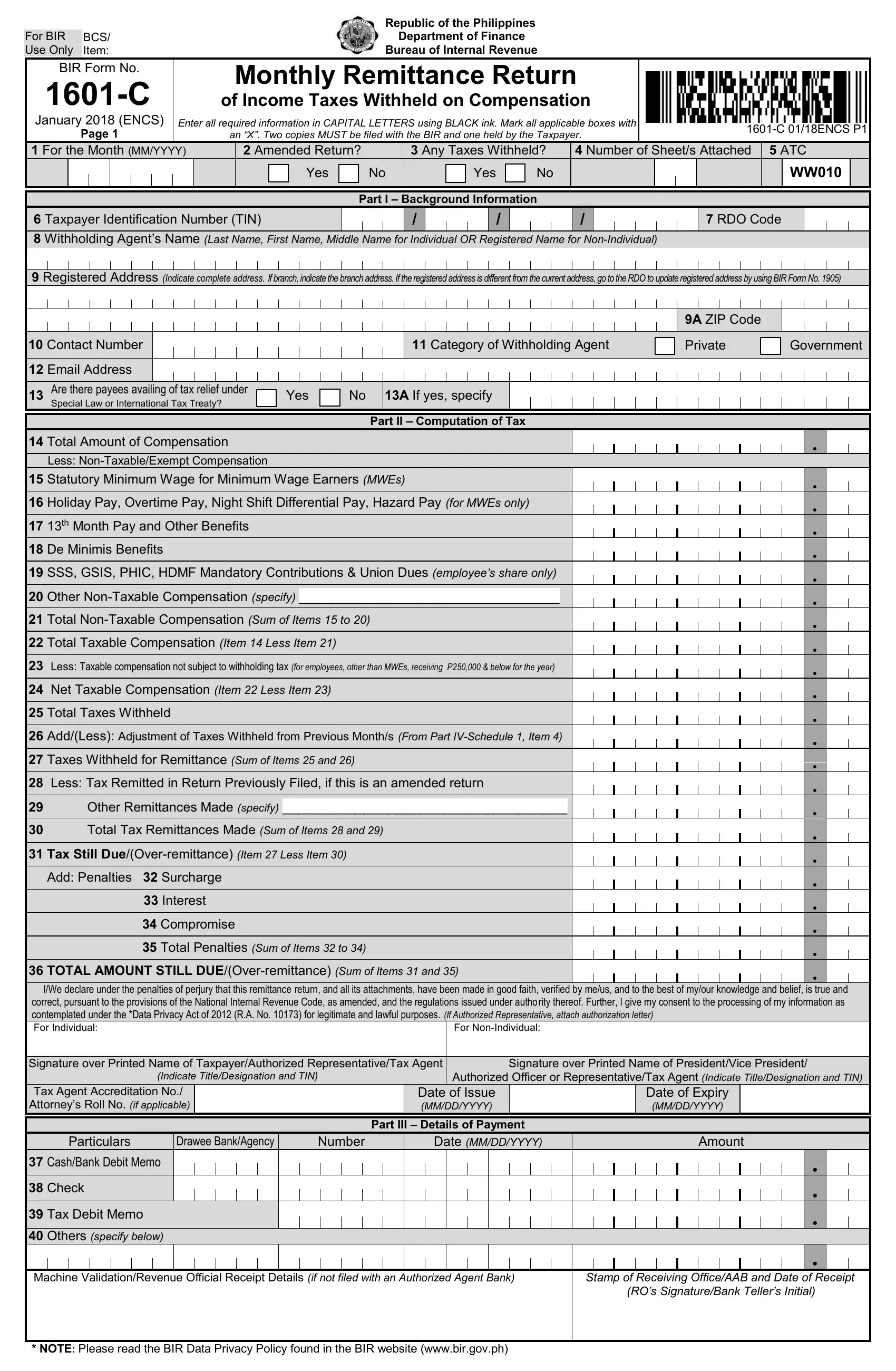

Who Shall File

This monthly remittance return shall be filed in triplicate by every withholding agent (WA)/payor required to deduct and withhold taxes on compensation paid to employees.

If the person required to withhold and pay/remit the tax is a corporation, the return shall be made in the name of the corporation and shall be signed and verified by the president, vice-president, or any authorized officer.

If the Government of the Philippines or any of its agencies, political subdivisions or instrumentalities, or a government-owned or controlled corporation, is the withholding agent/payor, the return shall be accomplished and signed by the officer or employee having control of disbursement of income payments or other officer or employee appropriately designated for the purpose.

With respect to a fiduciary, the return shall be made in the name of the individual, estate or trust for which such fiduciary acts and shall be signed and verified by such fiduciary. In case of two or more joint fiduciaries, the return shall be signed and verified by one of such fiduciaries.

Authorized Representative and Accredited Tax Agent filing, in behalf of the taxpayer, shall also use this return to pay/remit the creditable taxes withheld.

In the case of hazardous employment, the employer in the private sector shall attach to BIR Form No. 1601-C, for return periods March, June, September and December a copy of the list submitted to the Department of Labor & Employment Regional/Provincial Offices–Operations Division/Unit. The list shall show the names of the Minimum Wage Earners who received the hazard pay, period of employment, amount of hazard pay per month and justification for payment of hazard pay as certified by said DOLE/allied agency that the hazard pay is justifiable. In the same manner, for the aforementioned return periods, employer in the public sector shall attach a copy of Department of Budget and Management (DBM) circular/s or equivalent, as to who are allowed to receive hazard pay.

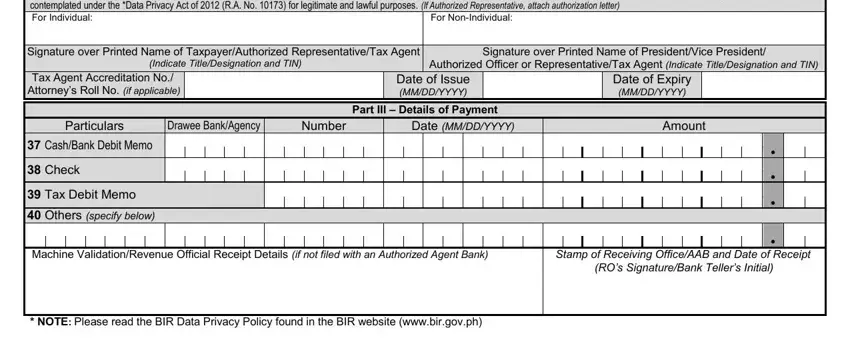

When and Where to File and Pay/Remit

The return shall be filed and the tax paid/remitted on or before the tenth (10th) day of the month following the month in which withholding was made except for taxes withheld for December which shall be filed and paid/remitted on or before January 15 of the succeeding year.

Provided, however, that with respect to non-large and large taxpayers who shall file through the Electronic Filing and Payment System (eFPS), the deadline for electronically filing the return and paying/remitting the taxes due thereon shall be in accordance with the provisions of existing applicable revenue issuances.

The return shall be filed and the tax paid/remitted with the Authorized Agent Bank (AAB) of the Revenue District Office (RDO) having jurisdiction over the withholding agent's place of business/office. In places where there are no Authorized Agent Banks, the return shall be filed and

the tax paid/remitted with the Revenue Collection Officer (RCO) of the RDO having jurisdiction over the WA’s place of business/office, who will issue an Electronic Revenue Official Receipt (eROR)

therefor.

When the return is filed with an AAB, taxpayer must accomplish and submit BIR-prescribed

deposit slip, which the bank teller shall machine validate as evidence that payment/remittance was received by the AAB. The AAB receiving the tax return shall stamp mark the word “Received” on the

return and also machine validate the return as proof of filing and payment/remittance of the tax by the

taxpayer. The machine validation shall reflect the date of payment/remittance, amount paid/remitted and transactions code, the name of the bank, branch code, teller’s code and teller’s initial. Bank debit

memo number and date should be indicated in the return for taxpayers paying/remitting under the bank debit system.

Payment/Remittance may also be made thru the epayment channels of AABs thru either their online facility, credit/debit/prepaid cards, and mobile payments.

A taxpayer may file a separate return for the head office and for each branch or place of business/office or a consolidated return for the head office and all the branches/offices. In the case of large taxpayers only one consolidated return is required.

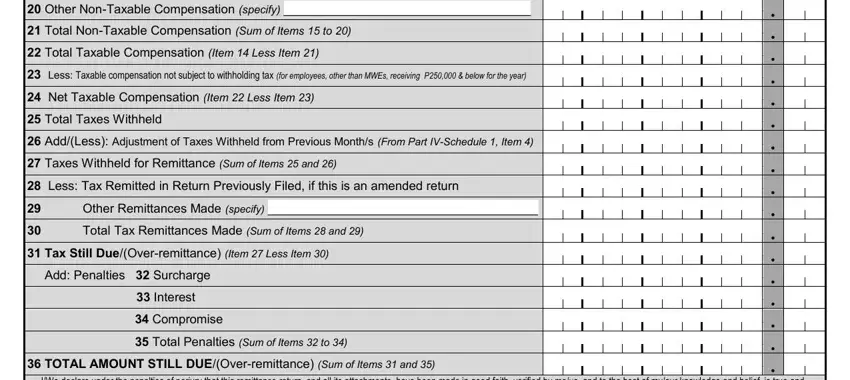

Penalties

There shall be imposed and collected as part of the tax:

1.A surcharge of twenty-five percent (25%) for the following violations:

a.Failure to file any return and pay the amount of tax or installment due on or before the due date;

b.Filing a return with a person or office other than those with whom it is required to be filed, unless otherwise authorized by the Commissioner;

c.Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed on or before the due date;

d.Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment.

2.A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made before the discovery of the falsity or fraud, for each of the following violations:

a.Willful neglect to file the return within the period prescribed by the Code or by rules and regulations; or

b.A false or fraudulent return is willfully made.

3.Interest at the rate of double the legal interest rate for loans or forbearance of any money in the absence of an express stipulation as set by the Bangko Sentral ng Pilipinas from the date prescribed for payment until the amount is fully remitted: Provided, That in no case shall the deficiency and the delinquency interest prescribed under Section 249 Subsections

(B)and (C) of the National Internal Revenue Code, as amended, be imposed simultaneously.

4.Compromise penalty as provided under applicable rules and regulations.

Violation of Withholding Tax Provisions

Any person required to withhold, account for, and pay/remit any tax imposed by the National Internal Revenue Code (NIRC), as amended, or who willfully fails to withhold such tax, or account for and pay/remit such tax, or aids or abets in any manner to evade any such tax or the payment/remittance thereof, shall, in addition to other penalties provided for under the Law, be liable upon conviction to a penalty equal to the total amount of the tax not withheld, or not accounted for and paid/remitted.

Any person required under the NIRC, as amended, or by rules and regulations promulgated thereunder to pay/remit any tax, make a return, keep any record, or supply correct and accurate information, who willfully fails to pay/remit such tax, make such return, keep such record, or supply such correct and accurate information, or withhold or pay/remit taxes withheld, or refund excess taxes withheld on compensation, at the time or times required by law or rules and regulations shall, in addition to the other penalties provided by law, upon conviction thereof, be punished by a fine of not less than ten thousand pesos (P= 10,000.00) and suffer imprisonment of not less than one (1) year but not more than ten (10) years.

Every officer or employee of the Government of the Republic of the Philippines or any of its agencies and instrumentalities, its political subdivisions, as well as government-owned or controlled corporations, including the Bangko Sentral ng Pilipinas, who, under the provisions of the NIRC, as amended, or regulations promulgated thereunder, is charged with the duty to deduct and withhold any internal revenue tax and to pay/remit the same in accordance with the provisions of the NIRC, as amended, and other laws and who is found guilty of any offense herein below specified shall, upon conviction of each act or omission, be fined in a sum not less than five thousand pesos (P= 5,000) but not more than fifty thousand pesos (P= 50,000) or imprisoned for a term of not less than six (6) months and one day but not more than two (2) years, or both:

a.Those who fail or cause the failure to deduct and withhold any internal revenue tax under any of the withholding tax laws and implementing regulations;

b.Those who fail or cause the failure to pay/remit taxes deducted and withheld within the time prescribed by law, and implementing regulations; and

c.Those who fail or cause the failure to file a return or statement within the time prescribed, or render or furnish a false or fraudulent return or statement required under the withholding tax laws and regulations.

If the withholding agent is the Government or any of its agencies, political subdivisions or instrumentalities, or a government-owned or controlled corporation, the employee thereof responsible for the withholding and payment/remittance of tax shall be personally liable for the additions to the tax prescribed by the NIRC, as amended.

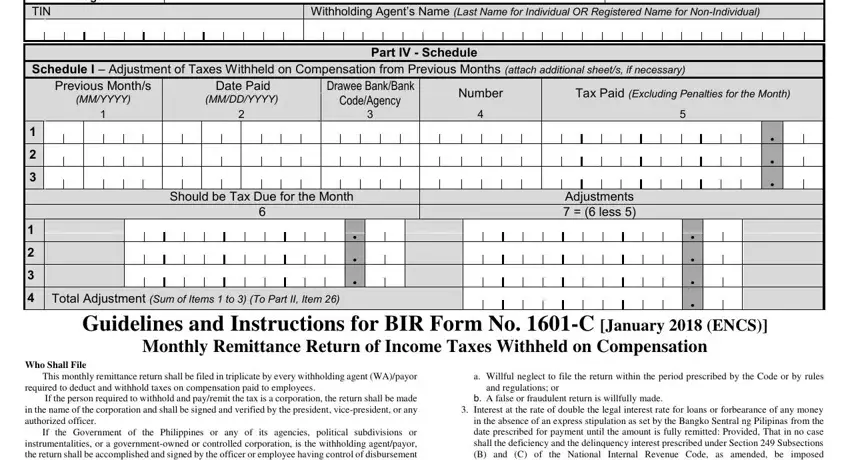

Required Attachments:

1.For Private Sector, copy of the list submitted to the DOLE Regional/Provincial Offices

– Operations Division/Unit.

2.For Public Sector, copy of Department of Budget and Management (DBM) circular/s or equivalent.

Note: All background information must be properly filled out.

The last 5 digits of the 14-digit TIN refers to the branch code

All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information:

A.For Individual (CPAs, members of GPPs, and others)

a.1 Taxpayer Identification Number (TIN); and

a.2 BIR Accreditation Number, Date of Issue, and Date of Expiry.

B.For members of the Philippine Bar (Lawyers)

b.1 Taxpayer Identification Number (TIN);

b.2 Attorney’s Roll Number;

b.3 Mandatory Continuing Legal Education (MCLE) Compliance Number; and b.4 BIR Accreditation Number, Date of Issue, and Date of Expiry.