Form 1601F is an important document for Filipino taxpayers. This document is used to report your income and tax payments for the year. Here's what you need to know about Form 1601F. First, you should be aware of the different parts of Form 1601F. The first section is for your personal information, such as your name and address. The next section is for your annual income, including both taxable and nontaxable income. The final section lists your tax payments for the year. You will need to complete Form 1601F if you earn more than Php125,000 per year. You can file a copy online or through the mail. Be sure to submit your form on time so

| Question | Answer |

|---|---|

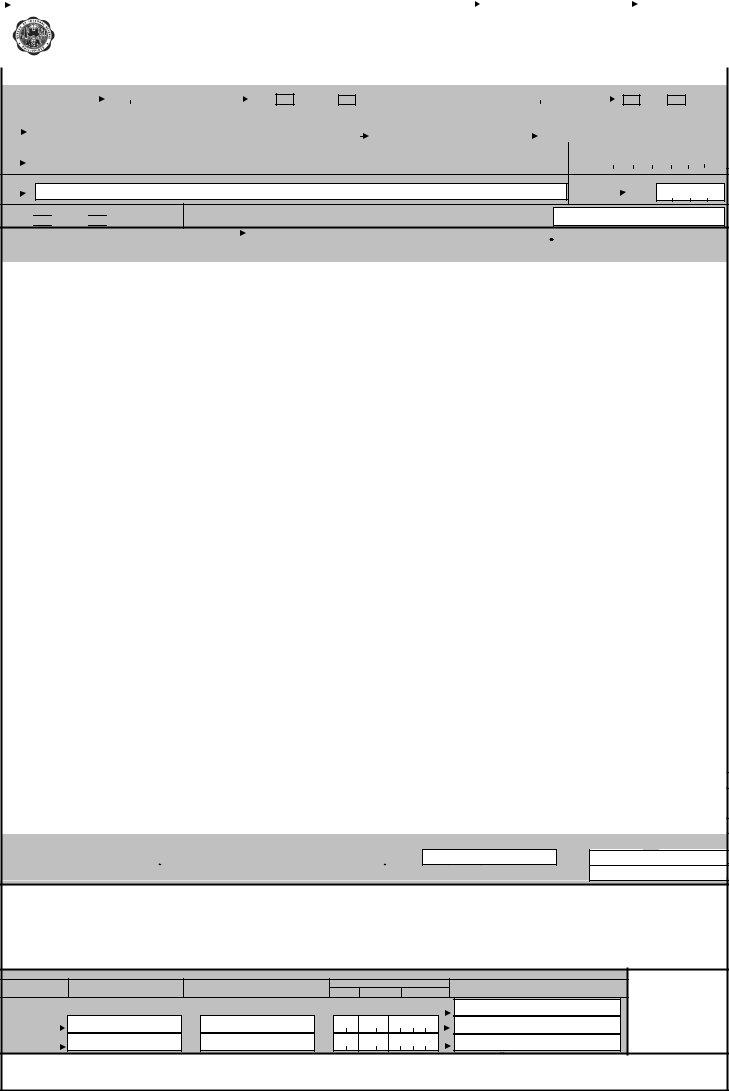

| Form Name | Bir Form 1601 F |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 1601f bir, bir form 1601 f, bir form 1601 e no download needed, 1601 f |

(To be filled up by the BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

DLN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PSOC: |

|

|

|

|

PSIC: |

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

Republika ng Pilipinas |

|

|

|

|

|

|

Monthly Remittance Return of |

|

|

BIR Form No. |

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

Kagawaran ng Pananalapi |

|

|

|

|

|

|

Final Income Taxes Withheld |

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Kawanihan ng Rentas Internas |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 2001 (ENCS) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in all applicable spaces. Mark all appropriate boxes with an “X”. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

1 |

For the Month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Amended Return? |

|

|

|

|

3 No. of Sheets Attached |

|

|

|

4 |

|

Any Taxes Withheld? |

|

|

|||||||||||||||||||||||||

|

(MM / YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I |

|

|

|

|

B a c k g r o u n d |

I n f o r m a t i o n |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

5 |

TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 RDO Code |

|

|

|

|

|

|

|

|

7 Line of Business/ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals)/(Registered Name for |

9 |

|

Telephone Number |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10Registered Address

11Zip Code

12Category of Withholding Agent

Private Government

13Are there payees availing of tax relief under Special Law

or International Tax Treaty? |

|

Yes |

|

No If yes, specify |

Part II |

C o m p u t a t i o n o f |

T a x |

|

|

|

|

|

|

|

|

||

|

NATURE OF INCOME PAYMENT |

ATC |

TAX BASE |

TAX RATE |

TAX REQUIRED |

|||||||

|

|

|

IND |

CORP |

|

|

|

IND |

CORP |

TO BE WITHHELD |

||

Interest on foreign loans payable to NRFCs |

|

|

WC 180 |

|

|

|

|

20% |

|

|

|

|

Interest and other income payments on foreign currency transactions/loans payable to OBUs |

|

WC 190 |

|

|

|

|

10% |

|

|

|

||

Interest and other income payments on foreign currency transactions/loans payable to FCDUs |

|

WC191 |

|

|

|

|

10% |

|

|

|

||

Cash dividend payment by domestic corporation to citizens and resident aliens/NRFCs |

WI 202 |

|

|

|

|

10% |

|

|

|

|

||

|

WC 212 |

|

|

|

|

32% |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Property dividend payment by domestic corporation to citizens and resident aliens/NRFCs |

WI 203 |

|

|

|

|

10% |

|

|

|

|

||

|

WC 213 |

|

|

|

|

32% |

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

Cash dividend payment by domestic corporation to NRFCs whose countries allowed tax |

|

WC 222 |

|

|

|

|

15% |

|

|

|

||

|

deemed paid credit (subject to tax sparing rule) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

Property dividend payment by domestic corporation to NRFCs whose countries allowed |

|

WC 223 |

|

|

|

|

15% |

|

|

|

||

|

tax deemed paid credit (subject to tax sparing rule) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

Cash dividend payment by domestic corporation to NRAETB |

WI 224 |

|

|

|

|

20% |

|

|

|

|

||

Property dividend payment by domestic corporation to NRAETB |

WI 225 |

|

|

|

|

20% |

|

|

|

|

||

Share of NRAETB in the distributable net income after tax of a partnership (except Genera |

|

|

|

|

|

|

|

|

|

|

||

|

Professional Partnership) of which he is a partner, or share in the net income after tax |

WI 226 |

|

|

|

20% |

|

|

|

|

||

|

of an association, joint account or a joint venture taxable as a corporation of which he |

|

|

|

|

|

|

|

|

|

|

|

|

is a member or a |

|

|

|

|

|

|

|

|

|

|

|

Distributive share of individual partners in a taxable partnership, association, joint |

WI 240 |

|

|

|

|

10% |

|

|

|

|

||

|

account or joint venture or consortium |

|

|

|

|

|

|

|

|

|||

All kinds of royalty payments to citizens, resident aliens and NRAETB (other than WI 380 |

WI 250 |

|

|

|

|

20% |

|

|

|

|

||

|

and WI 341), domestic and resident foreign corporations |

|

WC 250 |

|

|

|

|

20% |

|

|

|

|

On |

prizes exceeding P10,000 & other winnings paid to individuals |

WI 260 |

|

|

|

|

20% |

|

|

|

|

|

Branch profit remittances by all corporations except PEZA/SBMA/CDA registered |

|

WC 280 |

|

|

|

|

15% |

|

|

|

||

On the gross rentals, lease and charter fees derived by |

|

WC 290 |

|

|

|

|

4.5% |

|

|

|

||

|

of foreign vessels |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

On the gross rentals, charters and other fees |

derived by |

|

WC 300 |

|

|

|

|

7.5% |

|

|

|

|

|

aircraft, machineries and equipments |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

On payments to oil exploration service |

WI 310 |

|

|

|

|

8% |

|

|

|

|

||

|

WC 310 |

|

|

|

|

8% |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Payments to Filipinos or alien individuals employed by Foreign Petroleum Service Contractors |

|

|

|

|

|

|

|

|

|

|

||

|

WI 320 |

|

|

|

|

15% |

|

|

|

|

||

|

Regional Operating Headquarters of Multinational Companies occupying executive/ |

|

|

|

|

|

|

|

||||

|

managerial and technical positions. |

|

|

|

|

|

|

|

|

|

|

|

Payments to NRANETB except on sale of shares in domestic corp. and real property |

WI 330 |

|

|

|

|

25% |

|

|

|

|

||

On |

payments to |

corporate cinematographic film owners, |

WI 340 |

|

|

|

|

25% |

|

|

|

|

|

lessors or distributors |

|

|

WC 340 |

|

|

|

|

25% |

|

|

|

On other payments to NRFCs |

|

|

WC 230 |

|

|

|

|

32% |

|

|

|

|

Royalties paid to NRAETB on cinematographic films and similar works |

WI 341 |

|

|

|

|

25% |

|

|

|

|

||

Final tax on interest or other payments upon |

WI 350 |

|

|

|

|

30% |

|

|

|

|

||

|

trust or other obligations under Sec. 57C of the National Internal Revenue Code of 1997 |

|

|

|

|

|

|

|

|

|

|

|

Royalties paid to citizens, resident aliens and NRAETB on books, |

WI 380 |

|

|

|

|

10% |

|

|

|

|

||

|

other literary works and musical compositions |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

Informers Cash Reward to individuals/juridical persons |

WI 410 |

|

|

|

|

10% |

|

|

|

|

||

|

WC 410 |

|

|

|

|

10% |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

14 Total Tax Required to be Withheld Based on Regular Rates |

|

|

14 |

|

|

|

|

|||||

15 Total Tax Required to be Withheld Based on Tax Treaty Rates(from Schedule 1 at the back) |

|

15 |

|

|

|

|

||||||

16 Total (Sum of Items 14 and 15) |

|

|

|

16 |

|

|

|

|

||||

17 |

Less: Tax Remitted in Return Previously Filed, if this is an amended return |

|

|

17 |

|

|

|

|

||||

18 |

Tax Still Due (Overremittance) |

|

|

|

18 |

|

|

|

|

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

19 Add: Penalties |

Surcharge |

|

Interest |

19A |

|

19B |

|

20Total Amount Still Due/(Overremittance) (Sum of Items 18 and 19D)

19C

Compromise

19C

19D

20

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

21 |

|

|

22 |

|

|

|

|

Signature over Printed Name of Taxpayer/ |

|

|

|

Title/Position of Signatory |

|

|

Taxpayer Authorized Representative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIN of Tax Agent (if applicable) |

|

|

|

|

Tax AgentAcrreditation No. (if applicable) |

|

Part III |

|

D e t a i l s |

o f |

P a y m e n t |

|

|

Stamp of Receiving |

|

|

Drawee Bank/ |

|

|

|

DATE |

|

|

Office and Date |

Particulars |

Agency |

Number |

|

MM |

DD |

YYYY |

Amount |

Receipt |

23 Cash/Bank |

|

|

|

|

|

|

23 |

|

Debit Memo |

|

|

|

|

|

|

|

|

24 Check 24A |

24B |

24B |

24C |

|

|

|

24D |

|

25 Others 25A |

25B |

25B |

25C |

|

|

|

25D |

|

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIR Form |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 1 |

|

|

|

|

|

|

|

|

|

|

Details of Final Tax Based on Tax Treaty Rates |

|

|

|

|

|

|||||||

|

|

|

|

|

Nature of Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Treaty Code |

|

ATC |

|

|

Payment |

|

|

Amount of Income Payment |

|

|

|

Rate |

|

Tax Required To Be Withheld |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2 |

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE OF TAX TREATY CODE |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TREATY CODE |

COUNTRY |

|

|

TREATY CODE |

|

COUNTRY |

TREATY CODE |

|

COUNTRY |

|

|

TREATY CODE |

|

COUNTRY |

|||||||||

AU |

|

|

Australia |

|

FR |

|

France |

|

MY |

Malaysia |

|

SE |

|

|

Sweden |

||||||||

AT |

|

|

Austria |

|

DE |

|

Germany |

|

NL |

Netherlands |

|

CH |

|

|

Switzerland |

||||||||

BE |

|

|

Belgium |

|

HU |

|

Hungary |

|

NZ |

New Zealand |

|

TH |

|

|

Thailand |

||||||||

BR |

|

|

Brazil |

|

IN |

|

India |

|

PK |

Pakistan |

|

GB |

|

|

United Kingdom |

||||||||

CA |

|

|

Canada |

|

ID |

|

Indonesia |

|

RO |

Romania |

|

US |

|

|

USA |

||||||||

CN |

|

|

China |

|

IT |

|

Italy |

|

RU |

Russia |

|

|

|

|

|

||||||||

DK |

|

|

Denmark |

|

JP |

|

Japan |

|

SG |

Singapore |

|

|

|

|

|

||||||||

FI |

|

|

Finland |

|

KR |

|

Korea |

|

ES |

Spain |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

NRAETB |

- Non - resident alien engaged in trade or business within the Philippines |

* |

NR |

- Non - resident |

* NRANETB - Non - resident alien not engaged in trade or business within the Philippines |

* |

OBU |

- Offshore Banking Unit |

||

* |

NRFC |

- Non - resident Foreign |

* |

FCDU - Foreign Currency Deposit |

|

Corporations |

|

Unit |

|

|

|

BIR Form No.

Guidelines and Instructions

Who Shall File

This return shall be filed in triplicate by every withholding agent (WA)/payor who is either an individual or

If the Government of the Philippines or any political subdivision agency or instrumentality thereof, as well as a

If the person required to withhold and pay the tax is a corporation, the return shall be made in the name of the corporation and shall be signed and verified by the president,

With respect to a fiduciary, the return shall be made in the name of the individual, estate or trust for which such fiduciary acts and shall be signed and verified by such fiduciary. In case of two or more joint fiduciaries, the return shall be signed and verified by one of such fiduciaries.

When and Where to File and Remit

The return shall be filed and the tax paid on or before the tenth (10th) day of the month following the month in which withholding was made except for taxes withheld for December which shall be filed/paid on or before January 15 of the succeeding year.

The return shall be filed and the tax paid with the Authorized Agent Bank (AAB) of the Revenue District Office (RDO) having jurisdiction over the withholding agent's place of business/office. In places where there are no Authorized Agent Banks, the return shall be filed and the tax paid with the Revenue Collection Officer or the duly Authorized City or Municipal Treasurer within the Revenue District where the withholding agent’s place of business/office is located, who will issue a Revenue Official Receipt (BIR Form No.2524) therefor.

Where the return is filed with an AAB, the lower portion of the return must be properly

A taxpayer may file a separate return for the head office and for each branch or place of business/office or a consolidated return for the head office and all the branches/offices except in the case of large taxpayers where only one consolidated return is required.

Penalties

There shall be imposed and collected as part of the tax:

1.A surcharge of twenty five percent (25%) for each of the following violations:

a.Failure to file any return and pay the amount of tax or installment due on or before the due date;

b.Unless otherwise authorized by the Commissioner, filing a return with a person or office other than those with whom it is required to be filed;

c.Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed on or before the due date;

d.Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment.

2.A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud, for each of the following violations:

a.Willful neglect to file the return within the period prescribed by the Code or by rules and regulations; or

b.In case a false or fraudulent return is willfully made.

3.Interest at the rate of twenty percent (20%) per annum, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until the amount is fully paid.

4.Compromise penalty.

Violation of Withholding Tax Provisions

Any person required to withhold, account for, and remit any tax imposed by the National Internal Revenue Code or who willfully fails to withhold such tax, or account for and remit such tax, or aids or abets in any manner to evade any such tax or the payment thereof, shall, in addition to other penalties provided for under this Law, be liable upon conviction to a penalty equal to the total amount of the tax not withheld, or not accounted for and remitted.

Any person required under the National Internal Revenue Code or by rules and regulations promulgated thereunder to pay any tax, make a return, keep any record, or supply correct and accurate information, who willfully fails to pay such tax, make such return, keep such record, or supply such correct and accurate information, or withhold or remit taxes withheld, or refund excess taxes withheld on compensation, at the time or times required by law or rules and regulations shall, in addition to the other penalties provided by law, upon conviction thereof, be punished by a fine of not less than ten thousand pesos (P= 10,000.00) and suffer imprisonment of not less than one (1) year but not more than ten (10) years.

Every officer or employee of the Government of the Republic of the Philippines or any of its agencies and instrumentalities, its political subdivisions, as well as

(P= 5,000) but not more than fifty thousand pesos (P= 50,000) or imprisoned for a term of not less than six (6) months and one day but not more than two

(2)years, or both:

a)Those who fail or cause the failure to deduct and withhold any internal revenue tax under any of the withholding tax laws and implementing regulations;

b)Those who fail or cause the failure to remit taxes deducted and withheld within the time prescribed by law, and implementing regulations; and

c)Those who fail or cause the failure to file a return or statement within the time prescribed, or render or furnish a false or fraudulent return or statement required under the withholding tax laws and regulations.

If the withholding agent is the Government or any of its agencies, political subdivisions or instrumentalities, or a

Note: All background information must be properly filled up.

!All returns filed by an accredited tax representative on behalf of a taxpayer shall bear the following information :

A.For CPAs and others (individual practitioners and members of GPPs);

a.1 Taxpayer Identification Number (TIN); and

a.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry.

B.For members of the Philippine Bar (individual practitioners, members of GPPs);

b.1 Taxpayer Identification Number (TIN); and

b.2 Attorney’s Roll number or Accreditation Number, if any.

!Box No. 1 refers to transaction period and not the date of filing this return.

!The last 3 digits of the

!TIN = Taxpayer Identification Number

!IND= Individual Payee

!CORP= Corporate Payee

!The ATC in the Details of Final Tax Based on Tax Treaty Rates

(Schedule 1) shall be taken from the List of ATCs in Part II of this form/return.

ENCS