With the help of the online tool for PDF editing by FormsPal, you're able to fill in or change form 1701 bir download right here and now. Our tool is consistently evolving to present the very best user experience possible, and that is due to our resolve for constant development and listening closely to comments from users. It just takes several basic steps:

Step 1: First of all, access the pdf tool by clicking the "Get Form Button" above on this page.

Step 2: With this state-of-the-art PDF editing tool, you may accomplish more than merely fill out blank form fields. Express yourself and make your forms seem great with custom textual content incorporated, or fine-tune the file's original input to excellence - all that backed up by the capability to insert any pictures and sign the PDF off.

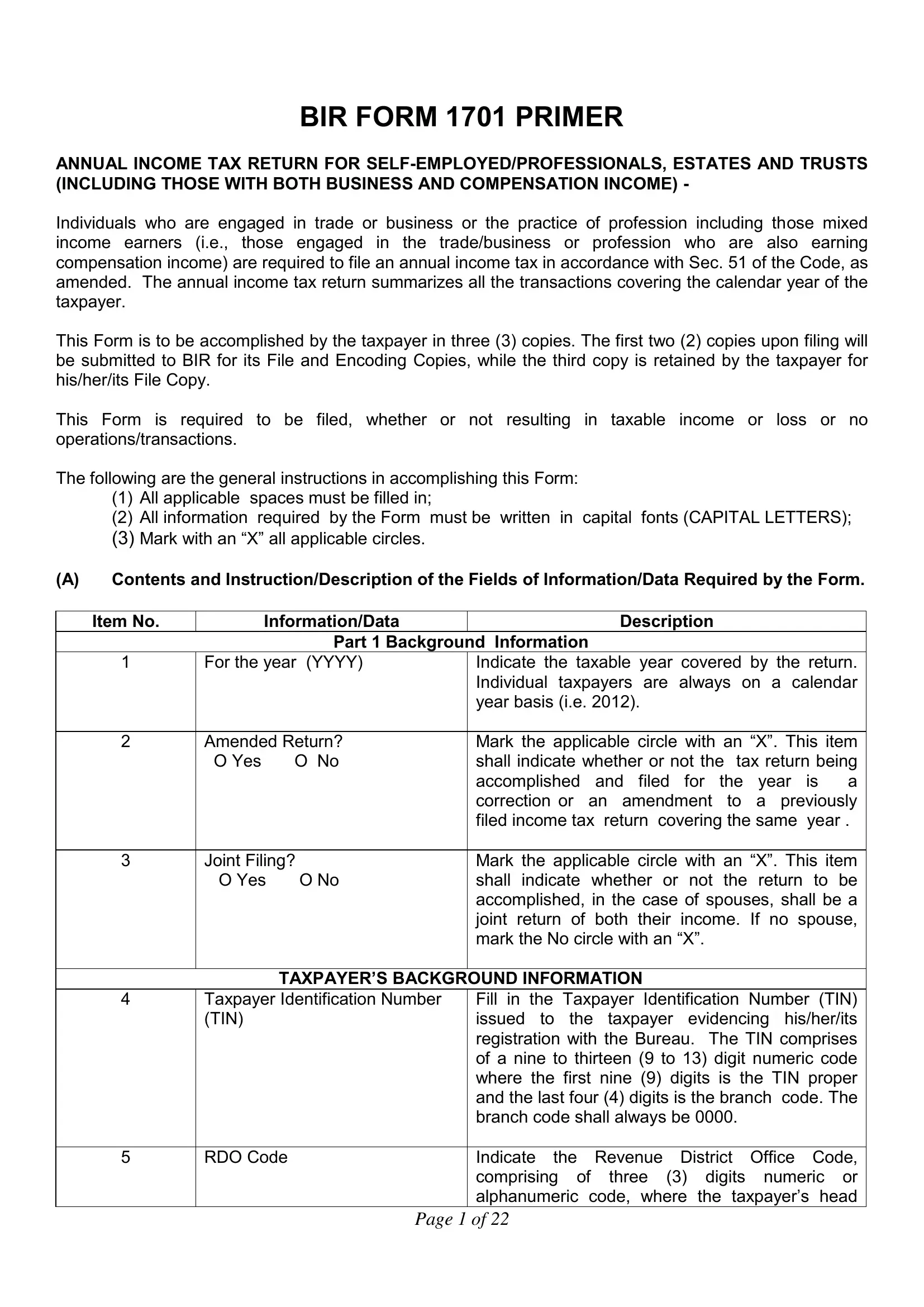

When it comes to blank fields of this particular PDF, here is what you want to do:

1. You have to complete the form 1701 bir download accurately, so pay close attention while filling in the areas including all these blanks:

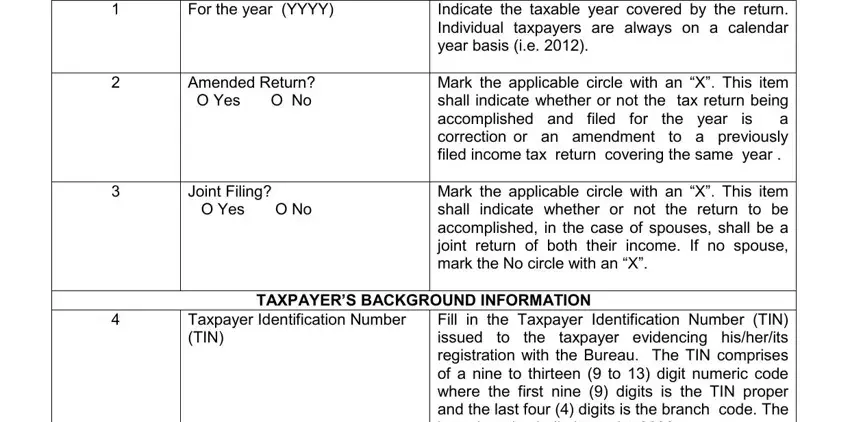

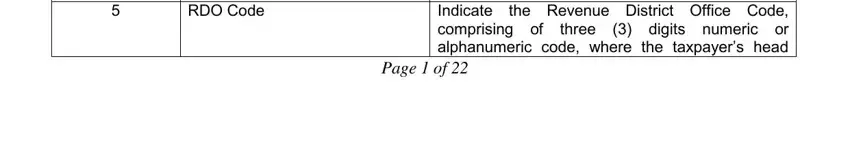

2. The subsequent step is to fill in all of the following fields: RDO Code, Fill in the Taxpayer, three, and Page of .

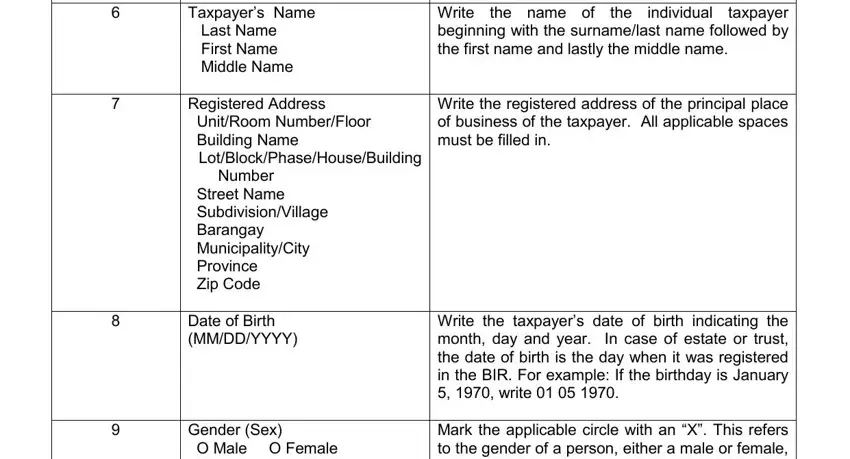

3. Completing Taxpayers Name Last Name First, LotBlockPhaseHouseBuilding, Number, Street Name SubdivisionVillage, Gender Sex O Male O Female, office is registered For example , the name of, individual, the, Write the registered address of, and Write the taxpayers date of birth is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

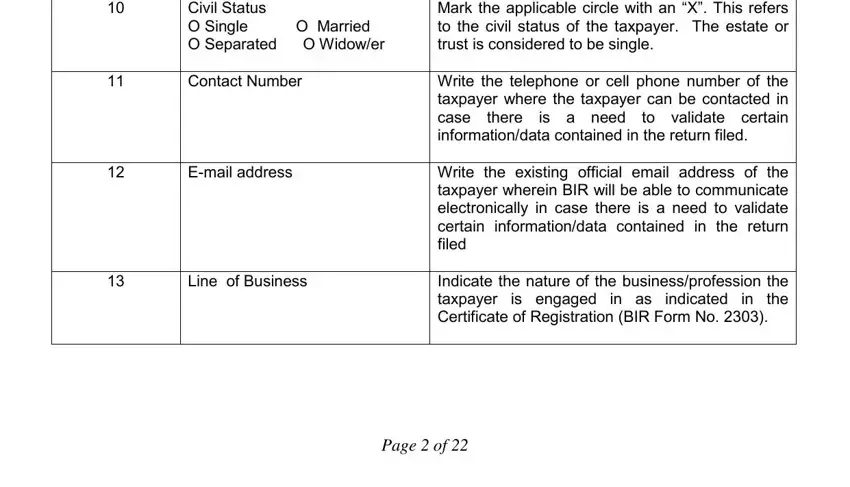

4. Filling out Civil Status O Single O Married O, Email address, Line of Business, Write the taxpayers date of birth, is a need, is engaged, there, in as, indicated, and Page of is key in this fourth part - you'll want to be patient and take a close look at each and every empty field!

It's very easy to make a mistake while filling out the there, for that reason ensure that you reread it before you'll send it in.

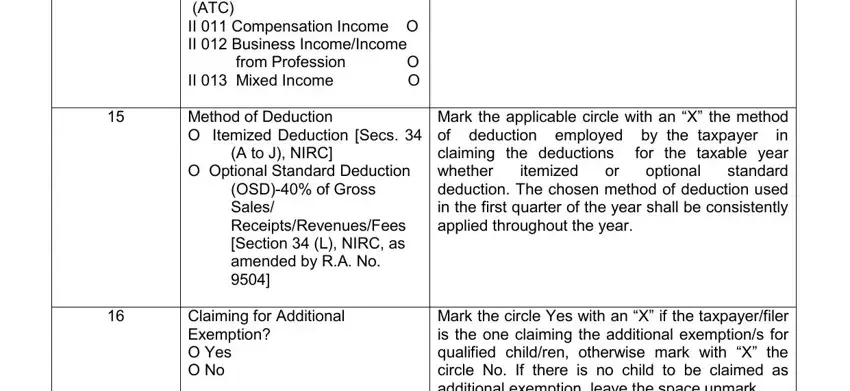

5. To wrap up your document, the last part involves several extra blanks. Entering Alphanumeric Numeric Code ATC II , A to J NIRC, O Optional Standard Deduction, OSD of Gross Sales, Claiming for Additional Exemption, Mark the applicable circle with an, Mark the applicable circle with an, optional, itemized, and Mark the circle Yes with an X if should wrap up the process and you're going to be done before you know it!

Step 3: When you've reread the details in the file's blanks, just click "Done" to finalize your form. Download the form 1701 bir download once you join for a 7-day free trial. Conveniently access the pdf document from your FormsPal cabinet, with any edits and changes being all saved! When using FormsPal, you can fill out forms without being concerned about database incidents or entries getting distributed. Our secure platform makes sure that your personal data is kept safe.