You are able to prepare bir 1702 form effectively using our online editor for PDFs. In order to make our tool better and less complicated to utilize, we continuously work on new features, with our users' suggestions in mind. All it requires is a few easy steps:

Step 1: Access the PDF inside our tool by hitting the "Get Form Button" above on this webpage.

Step 2: As you start the PDF editor, you will get the document ready to be completed. Other than filling in different blank fields, you may also perform various other actions with the Document, that is adding custom textual content, changing the initial text, adding illustrations or photos, placing your signature to the form, and more.

This PDF form will involve specific information; in order to ensure consistency, be sure to heed the suggestions further down:

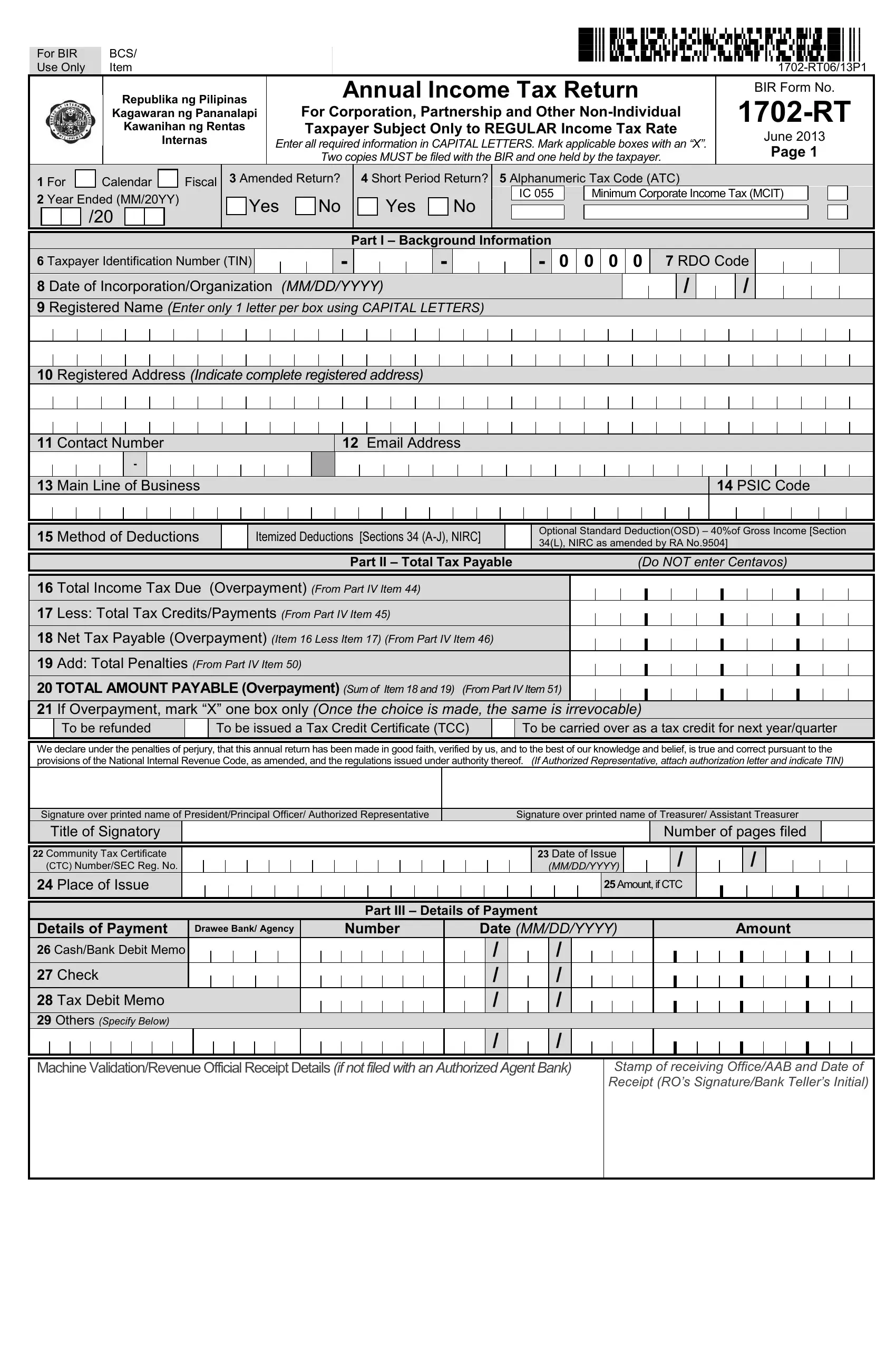

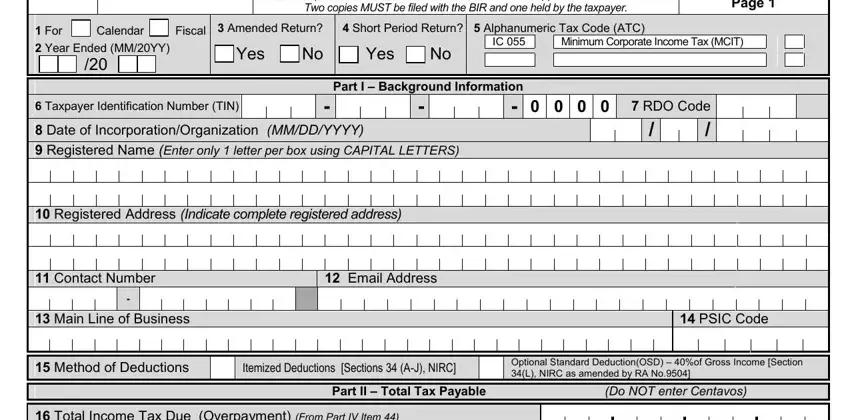

1. Start filling out the bir 1702 form with a selection of necessary blanks. Collect all of the required information and be sure absolutely nothing is missed!

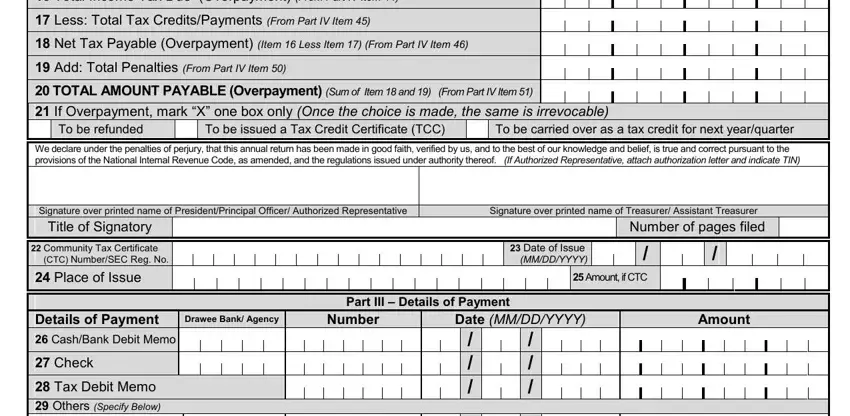

2. Once your current task is complete, take the next step – fill out all of these fields - Total Income Tax Due Overpayment, Less Total Tax CreditsPayments, Net Tax Payable Overpayment Item , Add Total Penalties From Part IV, TOTAL AMOUNT PAYABLE Overpayment, To be issued a Tax Credit, To be carried over as a tax credit, We declare under the penalties of, Signature over printed name of, Signature over printed name of, Date of Issue MMDDYYYY, Amount if CTC, Amount, Title of Signatory, and Community Tax Certificate CTC with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

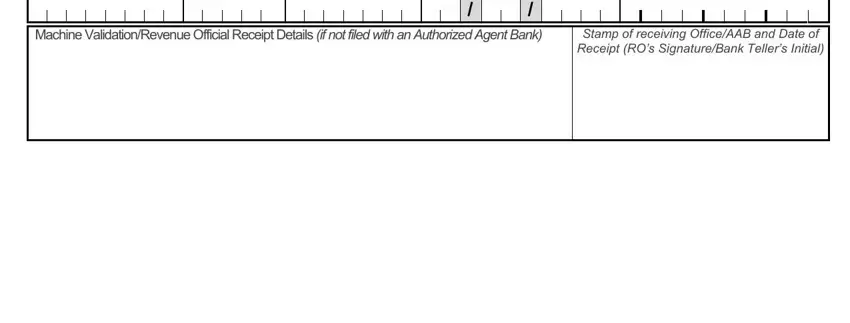

3. The next part is quite easy, Stamp of receiving OfficeAAB and, Others Specify Below, and Machine ValidationRevenue Official - each one of these form fields needs to be filled out here.

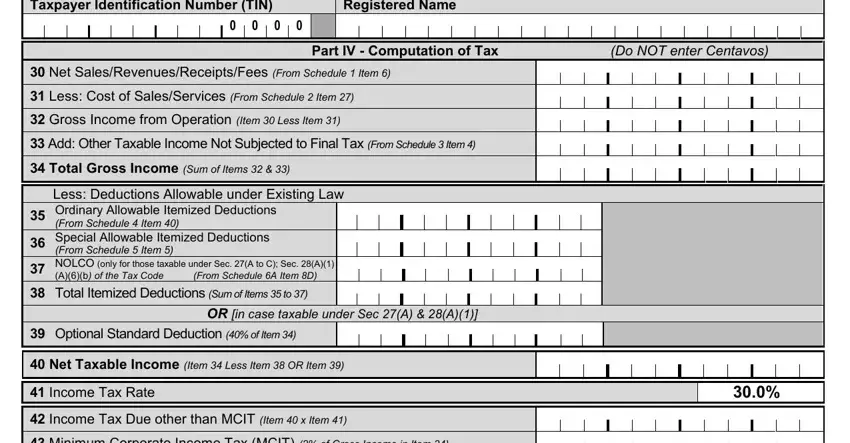

4. Your next paragraph needs your attention in the following places: Taxpayer Identification Number TIN, June Registered Name, Part IV Computation of Tax Do NOT, Net SalesRevenuesReceiptsFees, Less Cost of SalesServices From, Gross Income from Operation Item , Add Other Taxable Income Not, Total Gross Income Sum of Items , Less Deductions Allowable under, Total Itemized Deductions Sum of, OR in case taxable under Sec A A, Optional Standard Deduction of, Net Taxable Income Item Less, Income Tax Rate, and Income Tax Due other than MCIT. Remember to fill in all needed information to move further.

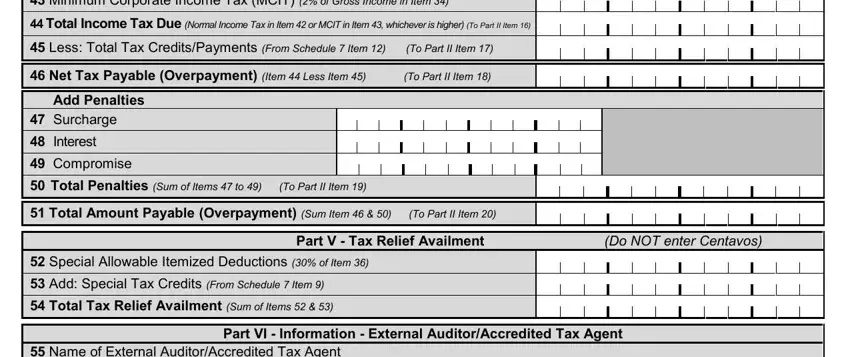

5. The document has to be wrapped up by going through this segment. Here you'll find a full set of fields that need to be filled out with accurate details in order for your form usage to be complete: Minimum Corporate Income Tax MCIT, Total Income Tax Due Normal, Less Total Tax CreditsPayments, Net Tax Payable Overpayment Item , Add Penalties, Surcharge, Interest, Compromise, Total Penalties Sum of Items to , Total Amount Payable Overpayment, Part V Tax Relief Availment Do, Special Allowable Itemized, Add Special Tax Credits From, Total Tax Relief Availment Sum of, and Part VI Information External.

Always be really mindful while filling out Add Penalties and Add Special Tax Credits From, since this is the part where a lot of people make mistakes.

Step 3: Before submitting your document, check that all blank fields were filled out the right way. As soon as you think it is all fine, click “Done." Acquire the bir 1702 form when you register at FormsPal for a free trial. Instantly get access to the form from your personal account page, along with any modifications and changes being all synced! FormsPal offers secure document completion without personal information record-keeping or sharing. Feel comfortable knowing that your data is in good hands here!