Through the online PDF editor by FormsPal, it is easy to complete or change trinidad and tobago tax form here and now. To make our tool better and more convenient to use, we continuously come up with new features, taking into consideration feedback coming from our users. Should you be looking to start, here is what it will take:

Step 1: First of all, access the pdf editor by clicking the "Get Form Button" in the top section of this site.

Step 2: This tool offers you the ability to change nearly all PDF documents in a range of ways. Transform it with your own text, correct what's originally in the document, and put in a signature - all possible within minutes!

It's an easy task to finish the form with this detailed guide! This is what you have to do:

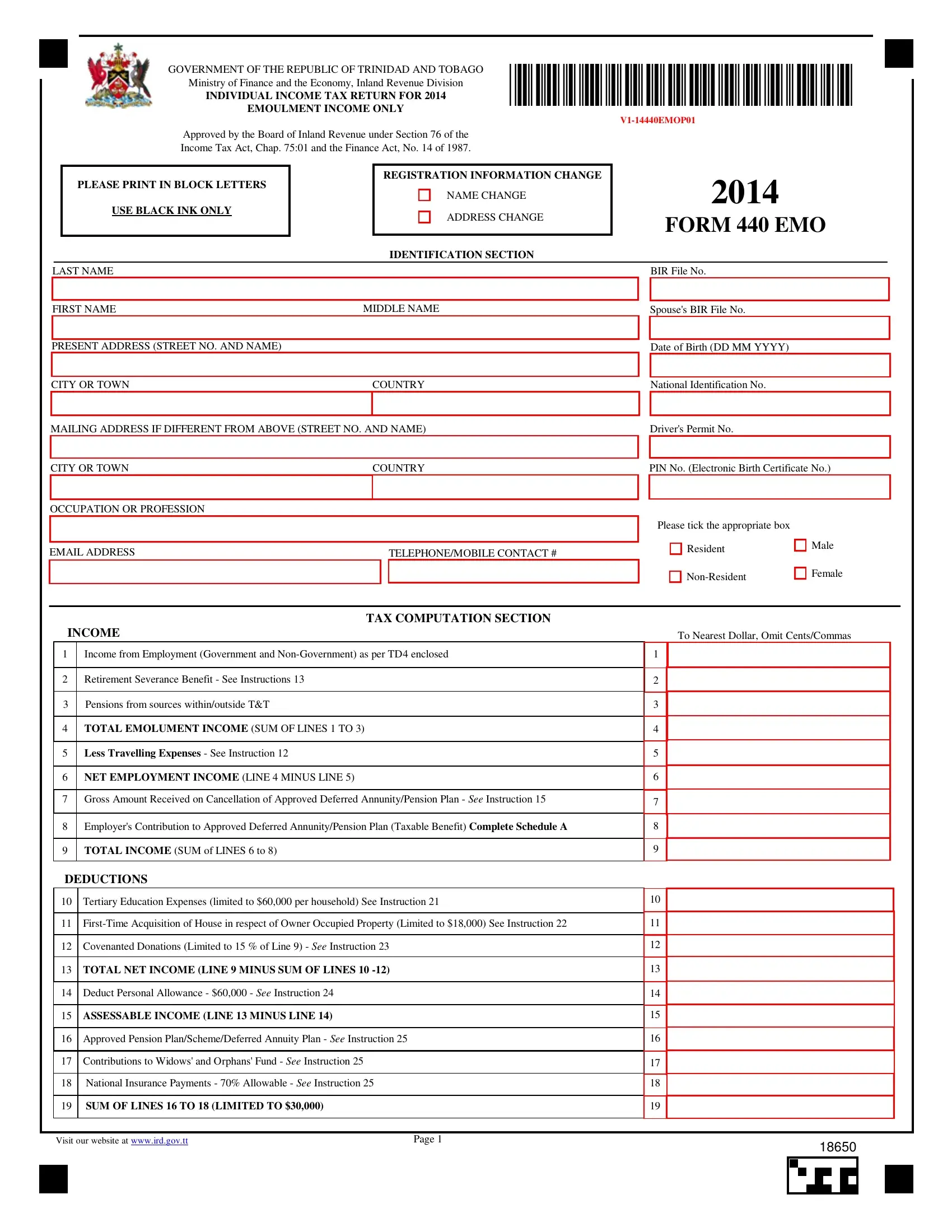

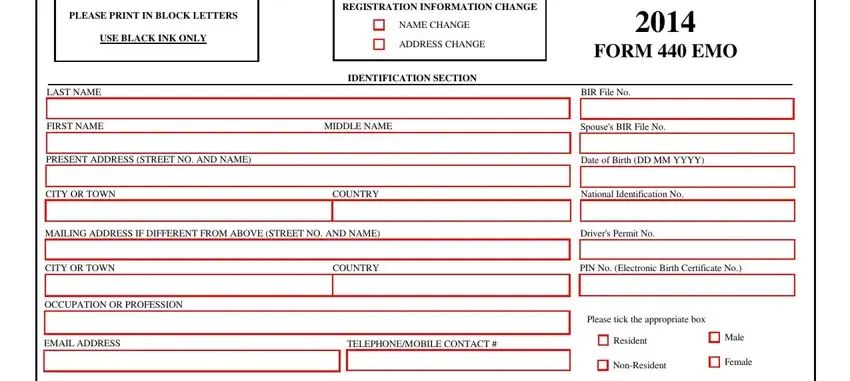

1. The trinidad and tobago tax form usually requires certain information to be entered. Be sure that the following fields are finalized:

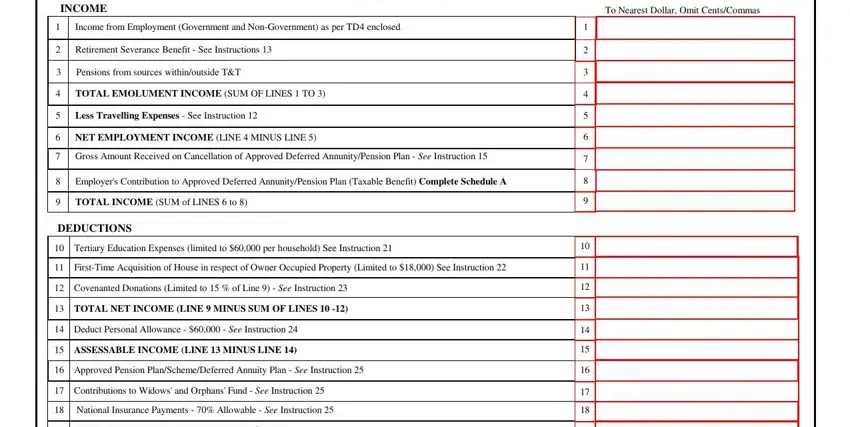

2. The subsequent stage is usually to fill in these blanks: INCOME, Income from Employment Government, TAX COMPUTATION SECTION, Retirement Severance Benefit See, Pensions from sources, TOTAL EMOLUMENT INCOME SUM OF, Less Travelling Expenses See, NET EMPLOYMENT INCOME LINE MINUS, Gross Amount Received on, Employers Contribution to, TOTAL INCOME SUM of LINES to , DEDUCTIONS, Tertiary Education Expenses, FirstTime Acquisition of House in, and Covenanted Donations Limited to .

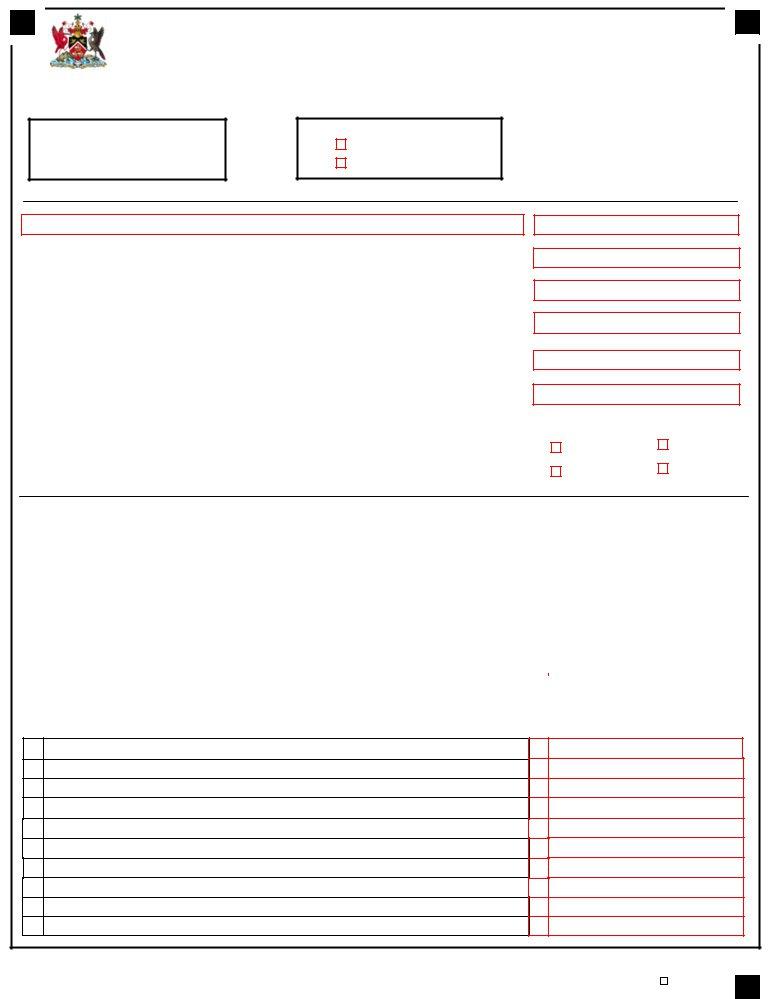

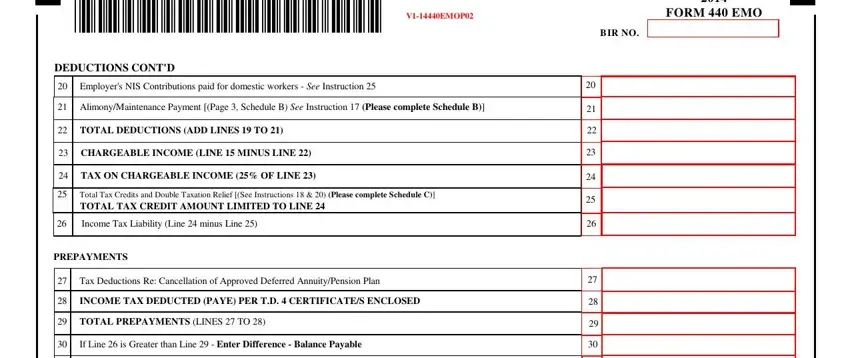

3. This third stage will be hassle-free - fill out all of the fields in VEMOP, VEMOP, FORM EMO, BIR NO, DEDUCTIONS CONTD, Employers NIS Contributions paid, AlimonyMaintenance Payment Page , TOTAL DEDUCTIONS ADD LINES TO , CHARGEABLE INCOME LINE MINUS, TAX ON CHARGEABLE INCOME OF LINE , Total Tax Credits and Double, Income Tax Liability Line minus, PREPAYMENTS, Tax Deductions Re Cancellation of, and INCOME TAX DEDUCTED PAYE PER TD in order to complete the current step.

Be very careful while filling out PREPAYMENTS and VEMOP, since this is the part where most people make errors.

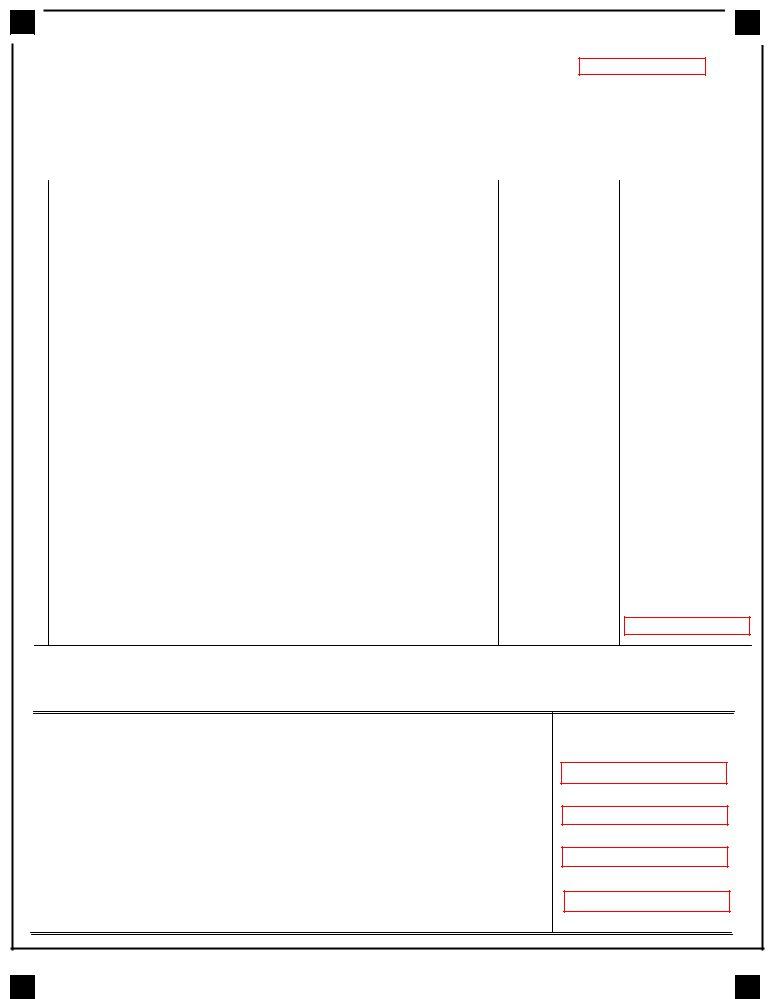

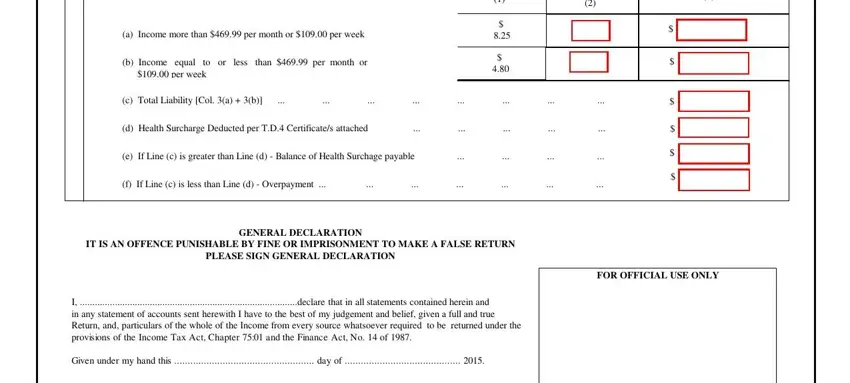

4. Filling out Rate per week , No of weeks , Liability , a Income more than per month or , b Income equal to or less than , c Total Liability Col a b , d Health Surcharge Deducted per TD, e If Line c is greater than Line d, IT IS AN OFFENCE PUNISHABLE BY, PLEASE SIGN GENERAL DECLARATION, GENERAL DECLARATION, I declare that in all statements, Given under my hand this day of , and FOR OFFICIAL USE ONLY is essential in the fourth section - make sure you devote some time and fill in every single field!

5. Last of all, the following last portion is what you'll want to finish prior to using the document. The fields here are the next: Signature of Taxpayer or, Place Date Received Stamp Here, and Page .

Step 3: Before getting to the next stage, check that all blank fields have been filled out the right way. Once you’re satisfied with it, press “Done." Make a free trial option with us and obtain direct access to trinidad and tobago tax form - accessible in your FormsPal cabinet. FormsPal is invested in the personal privacy of all our users; we always make sure that all information coming through our editor is kept secure.