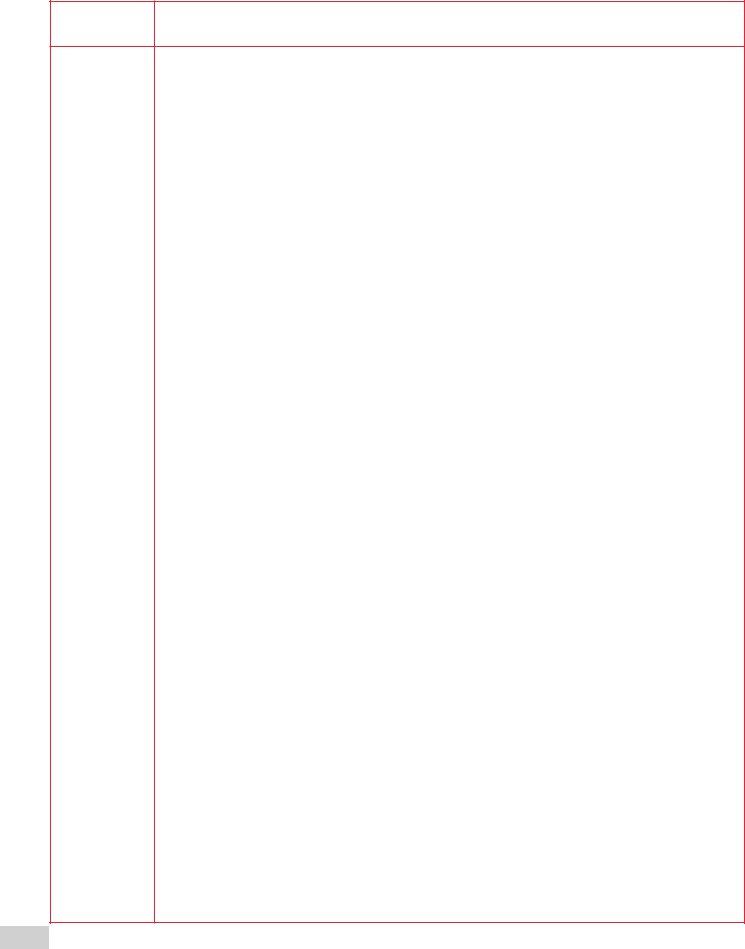

I/we acknowledge:

That where the application is for a Business Buy to Let mortgage

a)the mortgage will not be regulated by the Financial Conduct Authority (FCA) as the loan is wholly or predominantly for the purpose of me setting up or continuing with a buy to let business.

b)that I will not have the protection and remedies available to customers whose mortgages are regulated by the FCA which would be the case, if for example the property was my home or not wholly or predominantly for the purpose of me setting up or continuing with a buy to let business.

c)that I should seek independent legal advice if I have any doubt about the consequences of my mortgage not being regulated.

Birmingham Midshires reserves the right to reject my/our application, without giving any reason.

no person (other than an employee of Birmingham Midshires) is empowered to make any representations or give any undertaking, on behalf of Birmingham Midshires in relation to the mortgage applied for, and Birmingham Midshires shall not be found liable for such representation or undertaking.

that Birmingham Midshires and its Valuer accept no responsibility for the accuracy of the mortgage valuation report. Where a mortgage valuation is requested, this may be carried out by a Valuer employed by a member of the Lloyds Banking Group, or by an independent panel valuer who is not an employee of a member of the Lloyds Banking Group at my cost.

that the Mortgage Valuation Report is not a Building Survey or a Survey and Valuation. If advice about the structural condition of the property is required, a Building Survey or Survey and Valuation must be obtained.

that if the Automated Valuation Model (AVM) option is selected, I/we will not receive a valuation report.

that the valuation fee will not be refunded once the valuation has been carried out.

I/we agree:

that if a third party intermediary submitted this application on my/our behalf, Birmingham Midshires may liaise with them about any issues connected with my mortgage application and my mortgage, including any complaint about my mortgage application or mortgage unless otherwise instructed in writing.

that Birmingham Midshires may request additional information or confirmation of information provided in my/our application.

that Birmingham Midshires may, without notice, transfer or assign, either in whole or in part, any loan, mortgage or policies of life assurance or other security made in connection with this application to any company, person or body.

that if this application is for a Consumer Buy to Let that I/we have seen, read and understood a copy of the Illustration applicable to this mortgage application.

that if this application is for a joint mortgage and loan product, references in this document to “account” mean both the mortgage and loan accounts and the application is for both a mortgage and loan.

I/we declare:

the property will be occupied as a home on the basis of a rental agreement and will not be occupied by me or a member of my family as far as I/we know, the information I/we have given in this application is true, and that if I/we provide any false, inaccurate or misleading information, it may constitute a criminal offence on my/our part which may lead to a criminal prosecution, and imprisonment and/or a fine; further that it may lead to a civil action against me/us for recovery of any losses that Birmingham Midshires incurs.

that when I give you information about another person, I am acting for them with their knowledge and approval. I also have their authority to agree to the processing of their personal details.

Birmingham Midshires is a division of Bank of Scotland plc.

Making a false, misleading or inaccurate declaration is a criminal offence, and may lead to prosecution of the applicant and/or the financial advisor, resulting in a fine and/or imprisonment. The applicant and/or financial advisor may also face civil action for recovery of any losses that Birmingham Midshires incurs.

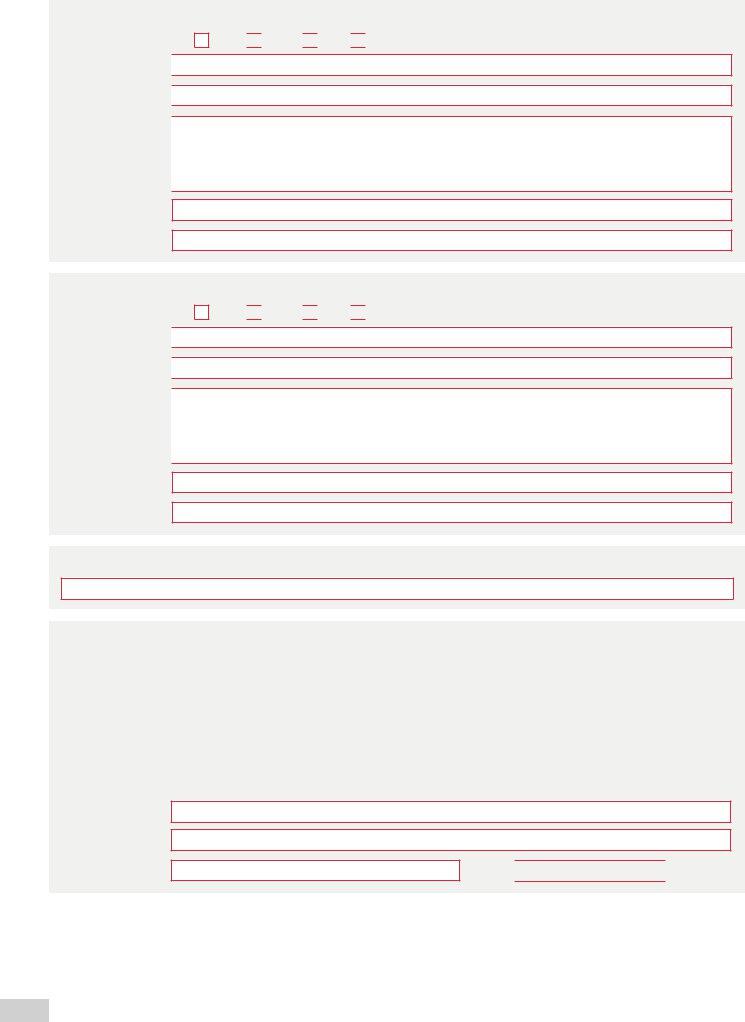

Privacy Notice

Who looks after your personal information

Your personal information will be held by Bank of Scotland plc which trades as Birmingham Midshires. BM Solutions is a brand of Birmingham Midshires. Bank of Scotland is part of the Lloyds Banking Group. More information on the Group can be found at www.lloydsbankinggroup.com

Our full privacy notice

This privacy notice contains key information about how we will use and share your personal information and the rights you have in relation to this. If you want to know more please access our full privacy notice at http://www.bmmortgages.co.uk/existing-customers/security-and- privacy/ or ask us for a copy.

How we use your personal information

We will use your personal information:

•to provide products and services, manage your relationship with us and comply with any laws or regulations we are subject to (for example the laws that prevent financial crime or the regulatory requirements governing the products we offer).

•for other purposes including improving our services, exercising our rights in relation to agreements and contracts and identifying products and services that may be of interest.

To support us with the above we analyse information we know about you and how you use our products and services, including some automated decision making. You can find out more about how we do this, and in what circumstances you can ask us to stop, in our full privacy notice.

Who we share your personal information with

Your personal information will be shared within Lloyds Banking Group and other companies that provide services to you or us, so that we and any other companies in our Group can look after your relationship with us. By sharing this information it enables us to run accounts and policies, and provide products and services efficiently. This processing may include activities which take place outside of the European Economic Area. If this is the case we will ensure appropriate safeguards are in place to protect your personal information. You can find out more about how we share your personal information with credit reference agencies below and can access more information about how else we share your information in our full privacy notice.

Where we collect your personal information from

We will collect personal information about you from a number of sources including:

•information given to us on application forms, when you talk to us in branch, over the phone or through the device you use and when new services are requested.

•from analysis of how you operate our products and services, including the frequency, nature, location, origin and recipients of any payments.

•from or through other organisations (for example card associations, credit reference agencies, insurance companies, retailers, comparison websites, social media and fraud prevention agencies).

•in certain circumstances we may also use information about health or criminal convictions but we will only do this where allowed by law or if you give us your consent.

You can find out more about where we collect personal information about you from in our full privacy notice.

Do you have to give us your personal information

We may be required by law, or as a consequence of any contractual relationship we have, to collect certain personal information. Failure to provide this information may prevent or delay us fulfilling these obligations or performing services which may prevent us operating accounts or policies.

What rights you have over your personal information

The law gives you a number of rights in relation to your personal information including:

•the right to access the personal information we have about you. This includes information from application forms, statements, correspondence and call recordings.

•the right to get us to correct personal information that is wrong or incomplete.

•in certain circumstances, the right to ask us to stop using or delete your personal information.

•the right to receive any personal information we have collected from you in an easily re-usable format when it’s processed on certain grounds, such as consent or for contractual reasons. You can also ask us to pass this information on to another organisation.

You can find out more about these rights and how you can exercise them in our full privacy notice.

Other individuals you have financial links with

We may also collect personal information about other individuals who you have a financial link with. This may include people who you have joint accounts or policies with such as your partner/spouse, dependents, beneficiaries or people you have commercial links to, for example other directors or officers of your company.

We will collect this information to assess any applications, provide the services requested and to carry out credit reference and fraud prevention checks. You can find out more about how we process personal information about individuals with whom you have a financial link in our

full privacy notice.

How we use credit reference agencies

In order to process your application we may supply your personal information to credit reference agencies (CRAs) including how you use our products and services and they will give us information about you, such as about your financial history. We do this to assess creditworthiness and product suitability, check your identity, manage your account, trace and recover debts and prevent criminal activity.

We may also continue to exchange information about you with CRAs on an ongoing basis, including about your settled accounts and any debts not fully repaid on time, information on funds going into the account, the balance on the account and, if you borrow, details of your repayments or whether you repay in full and on time. CRAs will share your information with other organisations, for example other organisations you ask to provide you with products and services. Your data will also be linked to the data of any joint applicants or other financial associates as explained above.

You can find out more about the identities of the CRAs, and the ways in which they use and share personal information, in our full privacy notice.

How we use fraud prevention agencies

The personal information we have collected from you and anyone you have a financial link with may be shared with fraud prevention agencies who will use it to prevent fraud and money laundering and to verify your identity. If fraud is detected, you could be refused certain services, finance or employment. Further details of how your information will be used by us and these fraud prevention agencies, and your data protection rights, can be found in our full privacy notice.

Our full privacy notice

It is important that you understand how the personal information you give us will be used. Therefore, we strongly advise that you read our full privacy notice, which you can find at http://www.bmmortgages.co.uk/existing-customers/security-and-privacy/ or you can ask us for a copy.

How you can contact us

If you have any questions or require more information about how we use your personal information please contact us using http://www.bmmortgages.co.uk/contact-us/ You can also call us on 0345 300 2627.

If you feel we have not answered your question Lloyds Banking Group has a Group Data Privacy Officer, who you can contact on 0345 300 2627 and tell us you want to speak to our Data Privacy Officer.

Version control

This notice was last updated in December 2020.