Every year, organizations seeking property tax exemptions in the State of New Hampshire must navigate the process outlined by the BTLA A-9 form. As specified by New Hampshire's RSA 72:23-c, this critical document serves as a detailed list of real estate and personal property for which exemption is being claimed. The stakes are high, as failure to submit this form by the April 15 deadline can lead to a denial of the exemption. Completing the form involves declaring the organization's purpose—be it religious, educational, or charitable—along with providing comprehensive details about the property in question, including its use and the public benefits it offers. A unique aspect of this process is the requirement to file the original document with the town or city assessors and to keep a duplicate for the organization's records. In diving into the form, one finds specific questions aimed at clarifying the organization's legal standing, its operational base in the state, and the underlying reasons for its tax exemption request. Additionally, it probes the nature of any public good provided, scrutinizes the beneficiaries of such services, and examines any income generated from the property, ensuring a thorough review process before any exemptions are granted.

| Question | Answer |

|---|---|

| Form Name | Btla A 9 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | btla form a 9, organization rsa form, how to fill out a btla a 9, nh btla forms hardship |

Form BTLA

Page 1

The State of New Hampshire

List of Real Estate and Personal Property on which Exemption is Claimed

Pursuant to RSA

This form must be filled in and filed annually before April 15. The ORIGINAL list must be filed with the selectmen (assessors) of the town (city) in which such property is located. A DUPLICATE copy should be retained by the applicant. Failure to file this list may result in denial of the exemption.

This is to certify that the answers to the following interrogatories are true and correct to the best of my knowledge and belief and that I am duly authorized to sign on behalf of the applicant organization.

Date: |

|

Signed by: |

NAME |

TITLE |

1.Name of applicant organization:

(OWNER OF PROPERTY OR PRINCIPAL OCCUPANT – CIRCLE ONE OR BOTH

2.Mailing address and telephone number:

3.In what municipality is this exemption claimed?

4.Under which section is applicant requesting exemption: (An organization may not claim multiple exemptions under separate provisions of RSA 72:23)

RSA 72:23 III (religious) |

|

RSA 72:23 IV (educational) |

|

RSA72:23 V (charitable) |

(Form

5.Is the applicant organization organized or incorporated in New Hampshire (Yes _____ No _____ ) Does it have a principal place of business in this state (Yes ____ No ____ ). If yes, where:

ADDRESS |

TELEPHONE NUMBER |

6.State general purpose for which applicant is organized or incorporated:

7.If applicant is requesting exemption as a charitable organization under RSA 72:23, V:

(a)What service of public good or welfare is provided?

(b)Who are the beneficiaries of this service?

(c)Is there a charge for this service? ________ If yes, explain

(d)For what purpose is any income used?

8.If the applicant is a religious organization, is it a regularly recognized and constituted denomination, creed or sect? If so, give its generally recognized name

Form BTLA

Page2

9.State whether the applicant has been granted exemption from taxation by special act of legislature since May 7, 1913. _________

If so, give date.

10.Did the municipality where the applicant claims exemption vote prior to April 1, 1958 to grant exemption on property not specifically exempted by Chapter 72 RSA as amended by Chapter 202 of the Laws of 1957? _________

If so, what is the total amount of the exemption voted?

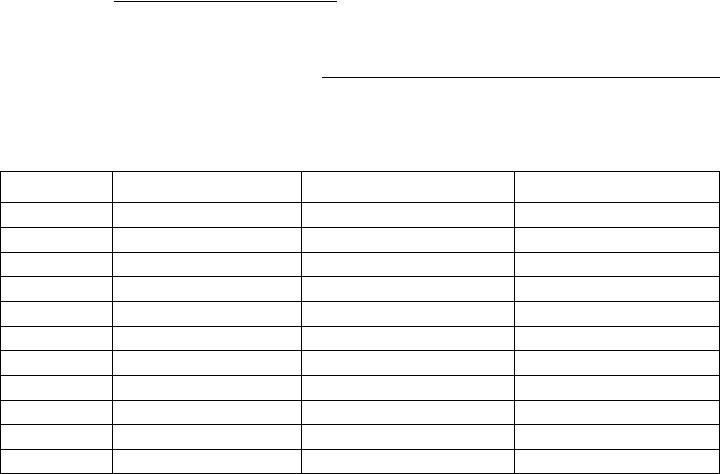

11.List real estate and personal property on which exemption is claimed for this town (city) and the purpose of which each item is used. Itemize each building or tract of land separately indicating the approximate area or percentage used for exempt purposes. (See example)

Tax Map & Lot No.

Property

Description

Primary Use and its extent

or duration

Other Use and its extent

or duration

EXAMPLE:

Tax Map |

Property |

Primary Use and its extent |

Other Use and its extent |

& Lot No. |

Description |

or duration |

or duration |

25/6 |

5 acres of land |

Continual support of |

|

|

|

|

|

|

|

Smith & Jones bldgs. |

|

|

|

|

|

25/6 |

Smith house |

25% science teacher’s apt |

|

|

|

|

|

|

|

75% dormitory (18 students) |

|

|

|

|

|

25/6 |

Jones Bldg. |

40% apt. rent to public |

|

|

|

|

|

|

|

50% student assemble room |

Rented to town |

|

|

|

|

|

|

10% school nurse’s office |

|

|

|

|

|

35/2 |

Brown |

Camping and hiking by scouts; |

|

|

|

|

|

|

|

150/yr. for 2 wk. period |

Logging |

|

|

|

|