When you desire to fill out C 245 Carolina Form, you won't need to download and install any kind of applications - just try our online tool. We at FormsPal are focused on providing you with the absolute best experience with our editor by constantly presenting new features and improvements. With all of these improvements, using our tool gets easier than ever! Here is what you would have to do to get started:

Step 1: Click the "Get Form" button in the top part of this page to access our tool.

Step 2: With this online PDF file editor, you can actually do more than merely fill out blank form fields. Edit away and make your documents appear perfect with customized textual content added, or modify the original input to perfection - all backed up by the capability to add your own graphics and sign the file off.

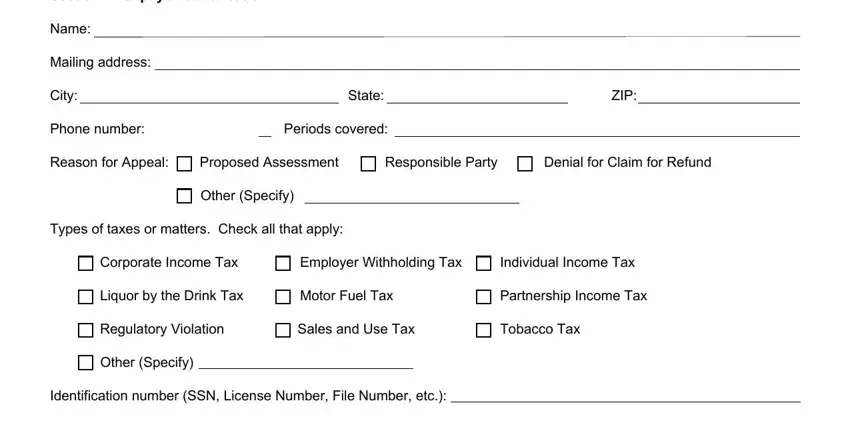

If you want to finalize this PDF document, ensure that you type in the necessary information in each blank field:

1. Begin completing the C 245 Carolina Form with a selection of essential blanks. Get all of the information you need and make sure nothing is missed!

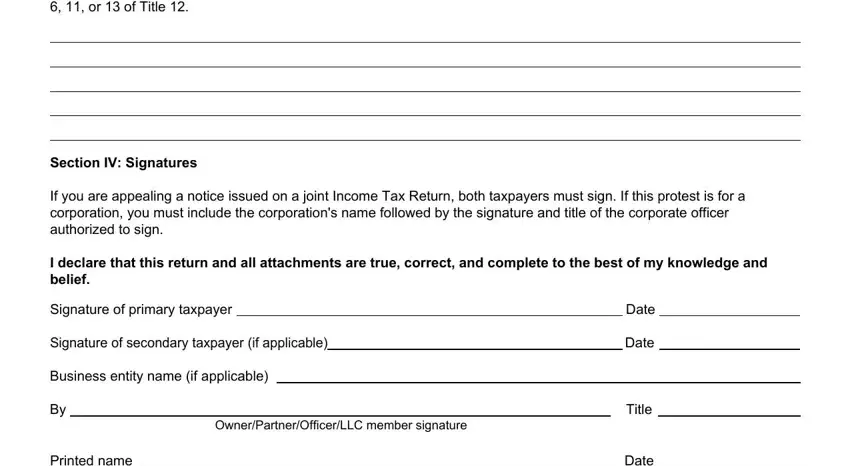

2. When the previous section is finished, you're ready to insert the required specifics in Indicate the reasons you disagree, Section IV Signatures If you are, Signature of primary taxpayer Date, OwnerPartnerOfficerLLC member, Printed name, and Date so you can move on to the 3rd stage.

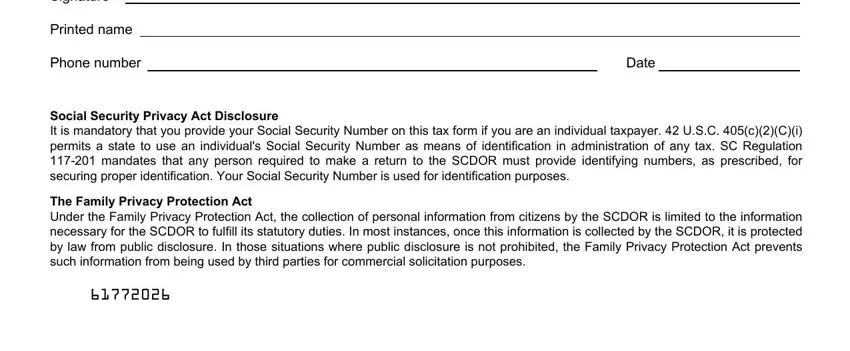

3. Completing Signature Printed name Phone number, Date, Social Security Privacy Act, and The Family Privacy Protection Act is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's easy to get it wrong when completing the Date, and so you'll want to reread it before you'll finalize the form.

Step 3: Prior to submitting this form, make certain that form fields have been filled in the proper way. As soon as you believe it is all fine, click “Done." Sign up with FormsPal today and instantly access C 245 Carolina Form, available for download. All adjustments you make are kept , making it possible to customize the pdf further when necessary. FormsPal offers secure document editing with no data record-keeping or sharing. Be assured that your details are safe here!