In the dynamic landscape of global trade, maintaining the accuracy of export data is crucial not only for compliance with legal obligations but also for ensuring the integrity of trade statistics. The C81 form plays a pivotal role in this context, serving as a tool to amend previously submitted export declarations, export statistical schedules, and data related to exports and re-exports. Tailored specifically for trade statistics purposes, it addresses corrections to a wide array of export data ranging from pre-shipment declarations to post-shipment supplementary declarations, including unique consignment references, economic operators' registration and identification numbers, and many more intricate details of the exporting process. The form's structure facilitates clear communication of original entries alongside the required amendments, underlining its importance in the ecosystem of customs and export control. Operated by HM Revenue & Customs, the C81 form stands as a testament to the need for precise and up-to-date trade data, embodying efforts to align with European Union legislation, and highlighting the necessity for businesses and trade operators to vigilantly update their records. Notably, the completion of the form underscores a commitment to adhere to the legal frameworks governing trade while providing a straightforward means of correcting inadvertent errors, rendering it an essential instrument in the realm of international trade compliance.

| Question | Answer |

|---|---|

| Form Name | C81 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | c81 hmrc, c81 to amend a customs export re export declaration 13 63, c81 form, c81 |

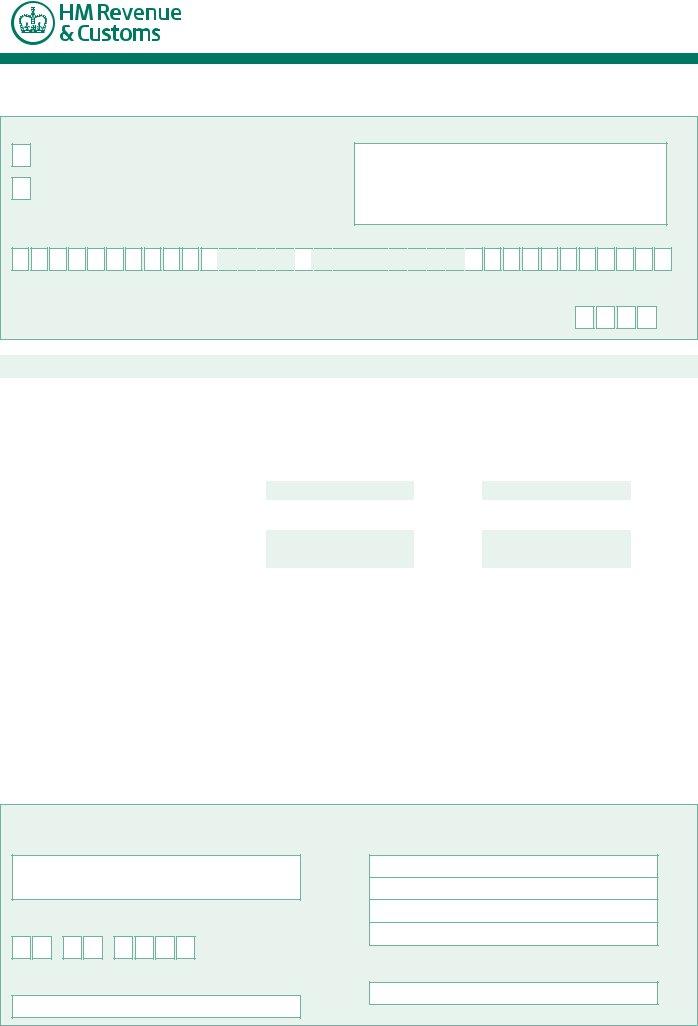

Notice of amendment to an

Use this form to make an amendment to export declarations, export statistical schedules, data presented by means of period entry or data presented via CHIEF. Before you complete this form, please read the notes on page 2.

I/we want to amend the following Tick one box |

HM Revenue & Customs use only |

Unique Consignment Reference (UCR)

—

EPU |

|

Entry number |

Date DD MM YYYY |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data field |

Particulars on original entry |

|

|

Corrected entries (amended details only) |

||||

|

|

|

|

|

|

|

|

|

Economic Operators Registration and Identification |

|

|

|

|

|

|

|

|

number (EORI) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exporter’s reference number (Box 7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of sailing or flight DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country of destination (Box 17) |

Country |

|

Code |

|

Country |

|

Code |

|

|

|

|

|

|

|

|

|

|

Container (Box 19) |

|

|

Code |

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

Identity and nationality of active means of transport |

|

|

Code |

|

|

|

Code |

|

crossing the border (Box 21) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mode of transport at border (Box 25) |

|

|

Code |

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

Mode of transport inland (Box 26) |

|

|

Code |

|

|

|

Code |

|

|

|

|

|

|

|

|

||

Place of loading (Box 27) |

Place |

|

Code |

|

Place |

|

Code |

|

|

|

|

|

|

|

|

|

|

Location of goods (Box 30) |

Place |

|

Code |

|

Place |

|

Code |

|

|

|

|

|

|

|

|

|

|

Commodity code (Box 33) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customs Procedure Code (Box 37) See note on page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of goods (Box 31) this is for information |

|

|

|

|

|

|

|

|

only, we are unable to amend for statistical purposes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Quantities as required for the appropriate |

Net mass (kg) (Box 38) |

|

|

Net mass (kg) (Box 38) |

|

|

||

Commodity Code in the tariff |

Supplementary units (Box 41) |

|

|

Supplementary units (Box 41) |

|

|

||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Statistical value to the nearest pound (Box 46) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration

I/we declare that all the information above is correct.

Signature of exporter/agent

Date DD MM YYYY

Company name

Company address

Postcode

Contact phone number

C81 |

Page 1 |

HMRC 11/12 |

About this form

1 Form C81 is used for statistical purposes only. Revisions to trade statistics are made in accordance with European Union (EU) legislation. You should enter the details from the original entry and the amended details.

2 It is essential that trade statistical staff can positively identify any given consignment.

3 Completion of this form should not be considered as automatically fulfilling your legal obligation to

For Customs Procedures with Economic Impact (CPEI) regimes such as:

•Customs warehousing (CW)

•Inward processing (IP)

•Outward processing relief (OPR)

•Processing under customs control (PCC)

•Temporary admission (TA)

you must also annotate your records if you are amending a Customs Procedure Code (CPC).

How to complete this form

4 All details of the originally declared particulars must be shown on this form and included in the second column, Particulars on original entry.

5 The actual amended details must be shown on the form and included in the third column, Corrected entries.

6 All quantities and values (in sterling) are to be entered to the nearest whole number. Please do not include decimals and fractions.

What to do if the original export declaration was incorrect

7 If, for example, goods of one tariff description were originally inserted in error on an export declaration when goods of two or more different tariff classifications were exported, you only need to complete the second column, Particulars on original entry.

If you need more space in order to supply all the relevant details, please use a plain sheet of paper.

By completing this form, you must not assume that your obligations are automatically met. Please ensure you do meet your obligations for

Where to send this form

Please ensure that all forms are signed before you send them to us.

It is not possible for HMRC to return stamped copies of form C81 to you, so please make that you keep a copy for your own records. Your copy may be required for audit purposes.

Please send the completed form to:

HM Revenue & Customs ECSM — Trade Statistics Unit 3rd Floor, Alexander House

SS99 1AA

If you need another form C81, go to www.hmrc.gov.uk and look for C81 within the Search facility.

Your rights and obligations

Your Charter explains what you can expect from us and what we expect from you. For more information go to

www.hmrc.gov.uk/charter

Need further guidance?

If you require further guidance on the completion of this form, please phone the VAT, Excise & Customs Helpline on 0845 010 9000.