It is easy to fill in the federal traumatic 1 spaces. Our software makes it nearly effortless to work with almost any PDF file. Below are the only four steps you need to take:

Step 1: On the page, press the orange "Get form now" button.

Step 2: Now, you are on the file editing page. You can add text, edit current information, highlight specific words or phrases, place crosses or checks, add images, sign the file, erase unwanted fields, etc.

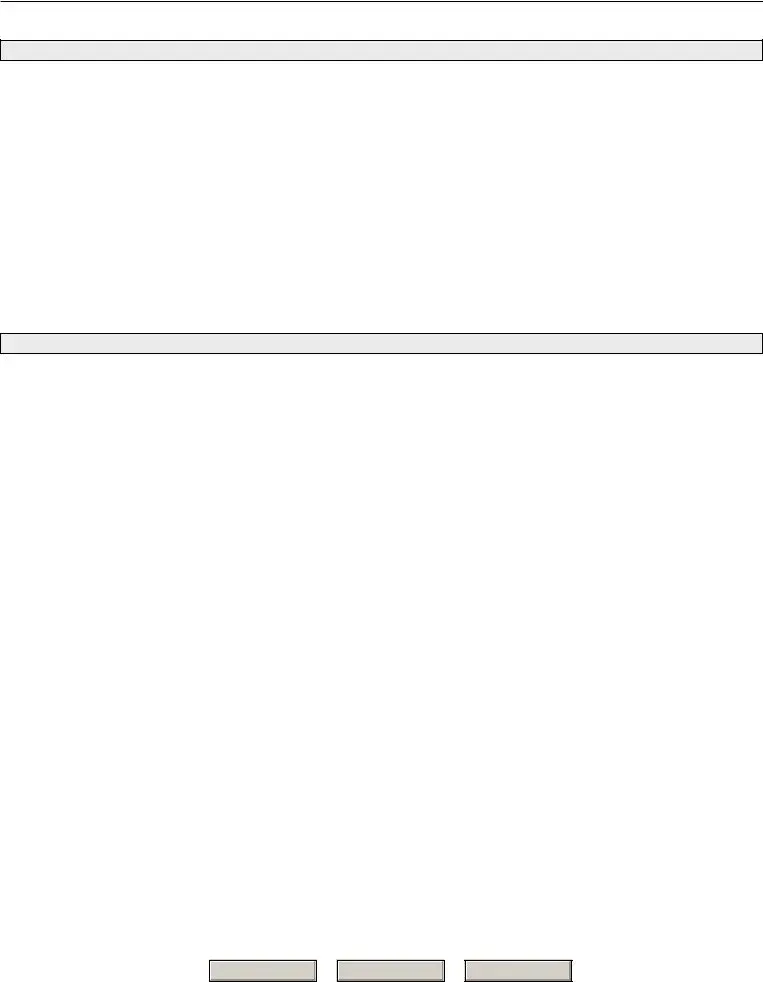

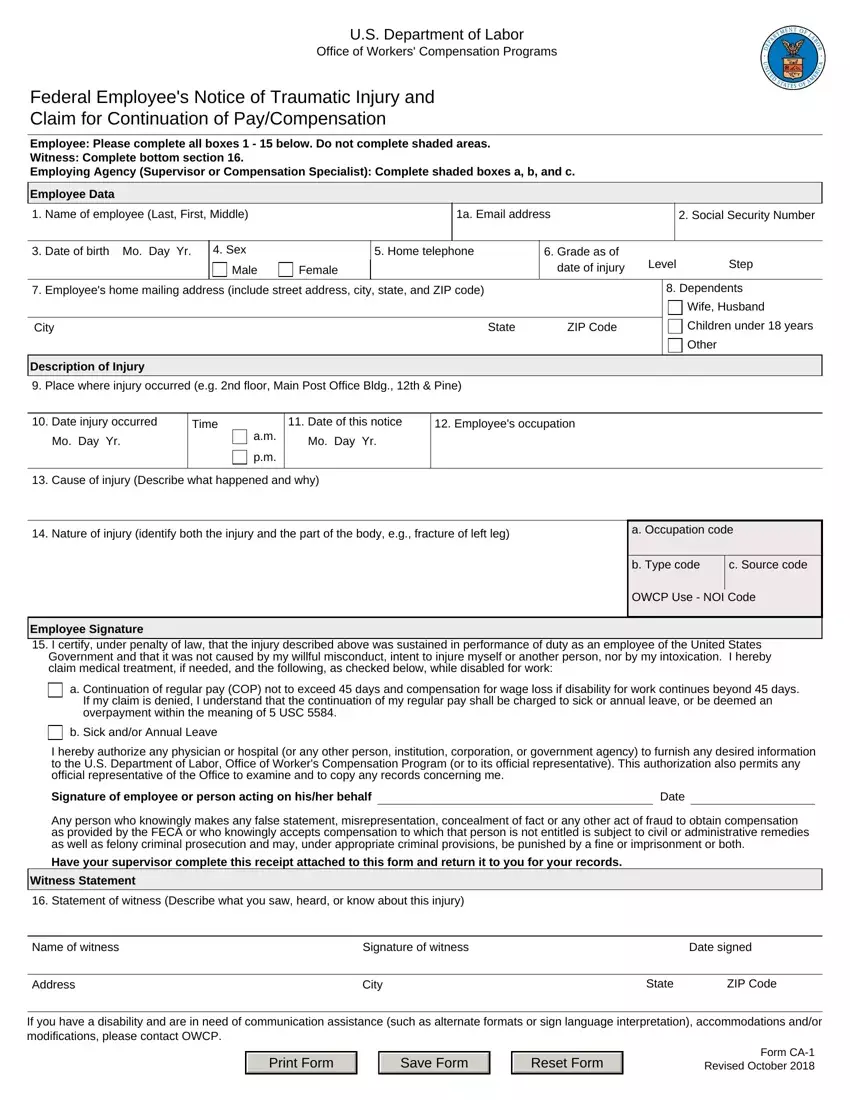

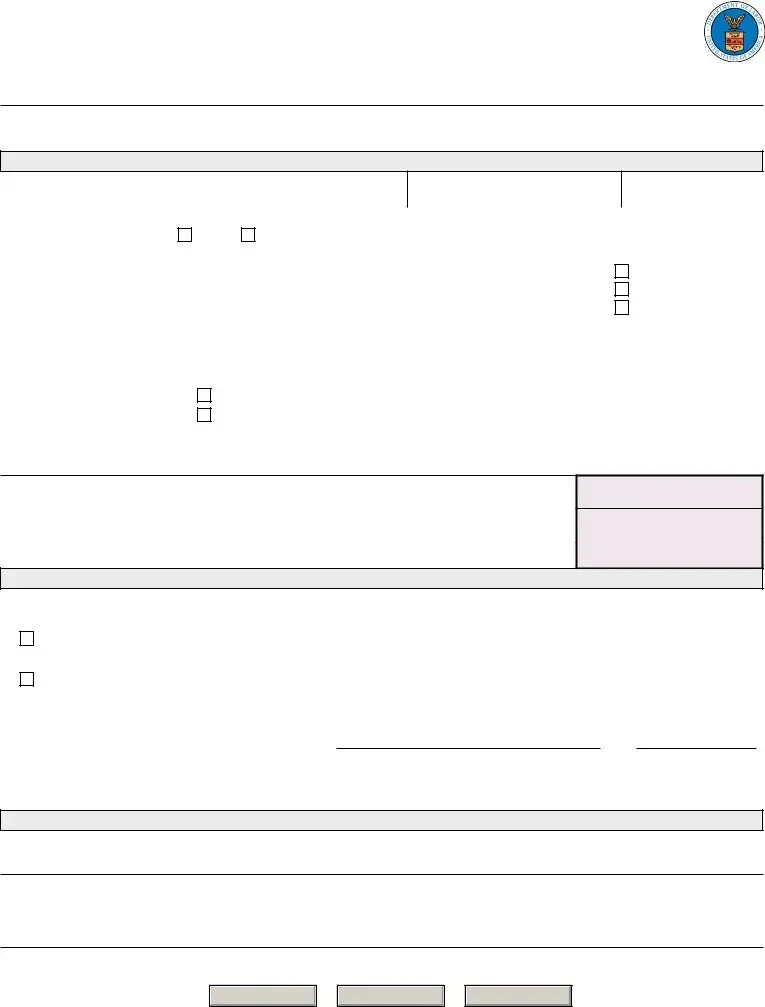

All of the following parts are what you will need to fill out to have the ready PDF form.

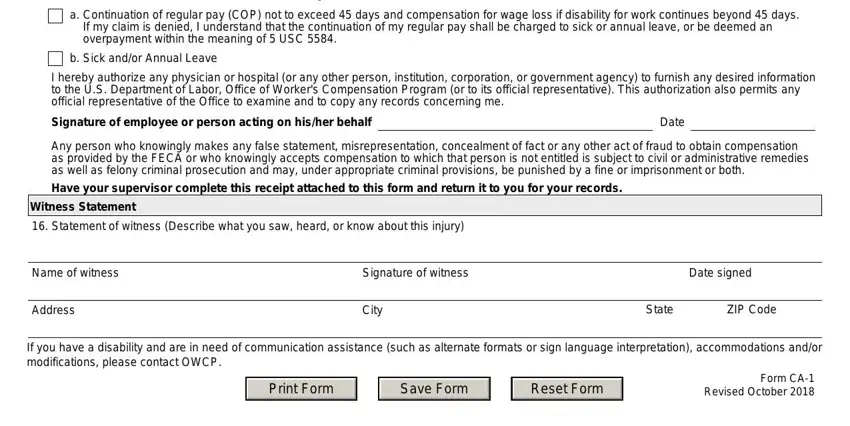

The application will require you to fill in the Employee Signature I certify, a Continuation of regular pay COP, b Sick andor Annual Leave, I hereby authorize any physician, Signature of employee or person, Date, Any person who knowingly makes any, Have your supervisor complete this, Witness Statement, Statement of witness Describe, Name of witness, Address, Signature of witness, Date signed, and City box.

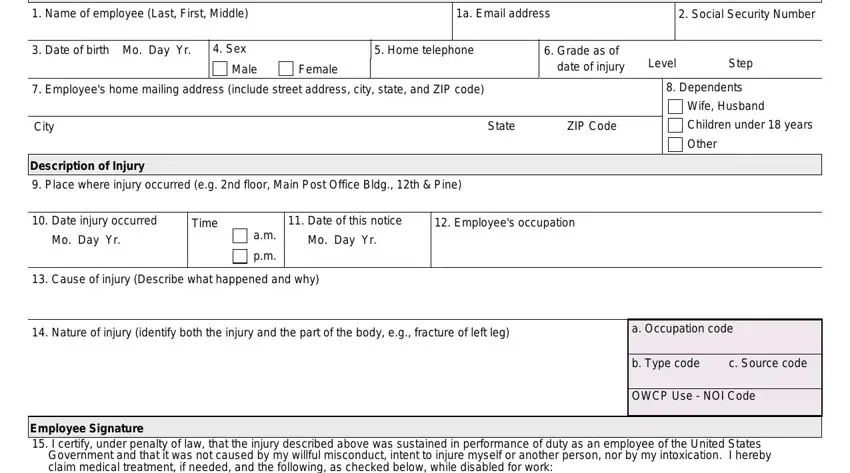

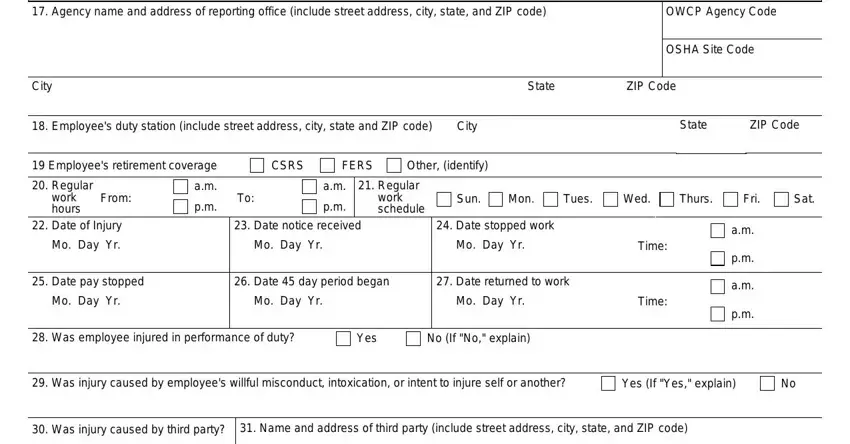

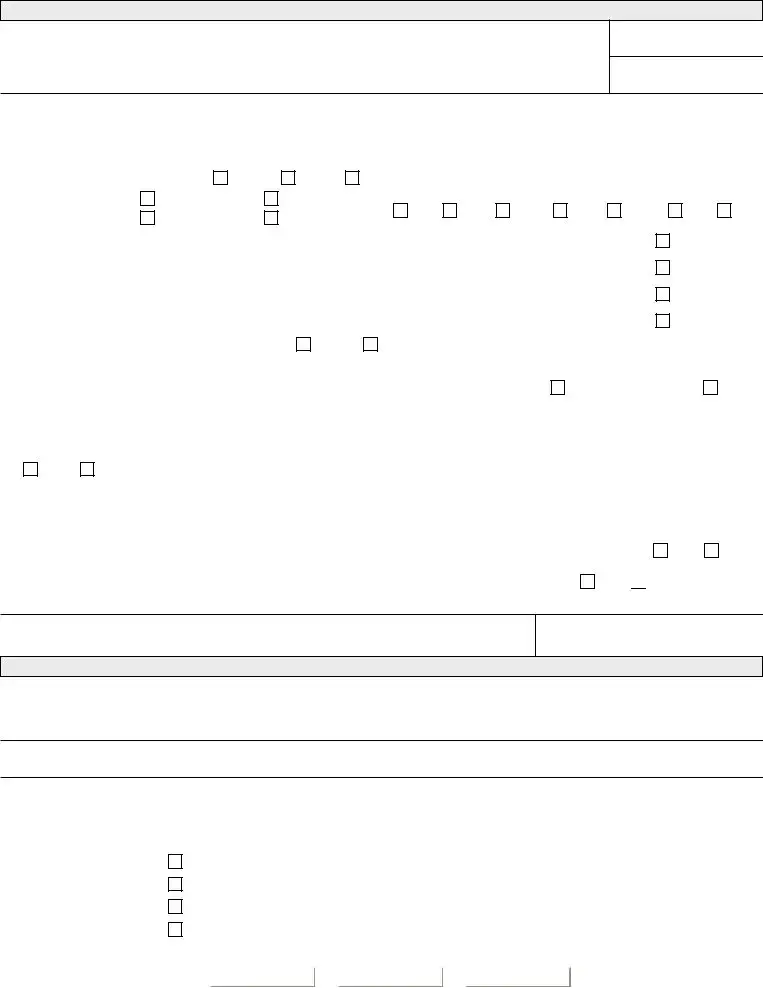

The program will ask you for data to conveniently fill in the box Supervisors Report, Agency name and address of, OWCP Agency Code, City, State, ZIP Code, Employees duty station include, City, State, ZIP Code, Employees retirement coverage, CSRS, FERS, Other identify, and OSHA Site Code.

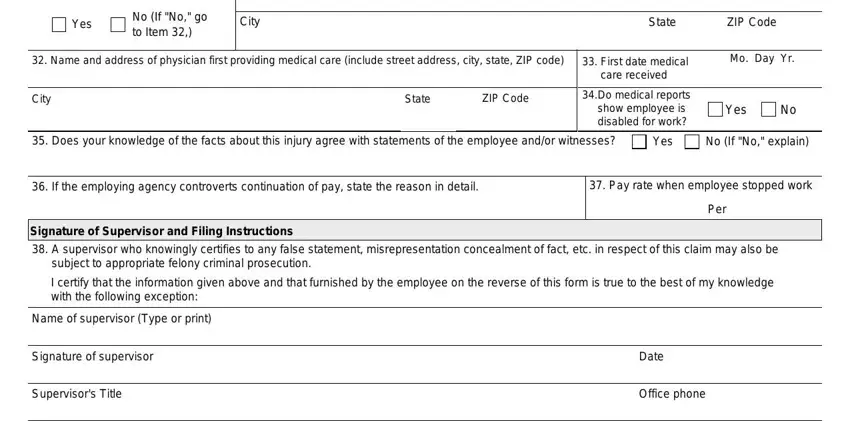

You need to specify the rights and obligations of the sides in the Yes, No If No go to Item, City, Name and address of physician, City, State, ZIP Code, State, ZIP Code, First date medical care received, Do medical reports show employee, Mo Day Yr, Yes, Does your knowledge of the facts, and Yes section.

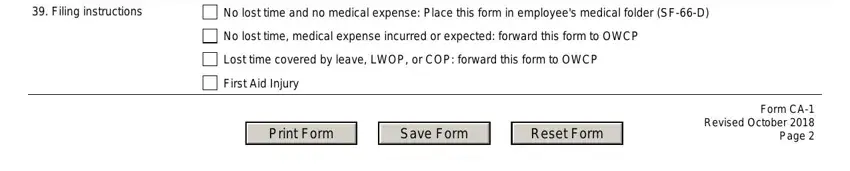

Finalize by looking at the following fields and filling them in as needed: Filing instructions, No lost time and no medical, No lost time medical expense, Lost time covered by leave LWOP or, First Aid Injury, and Form CA Revised October Page.

Step 3: Choose the Done button to ensure that your completed form is available to be transferred to every device you select or sent to an email you indicate.

Step 4: Create no less than two or three copies of your document to prevent any potential future challenges.

No (If "No," explain)

No (If "No," explain)