|

2020 INSTRUCTIONS FOR FORM FTB 3582 |

|

|

|

Amount You Owe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Voucher for Individual e-filed Returns |

|

(Form 540, Page 5, Line 111): |

|

|

|

|

|

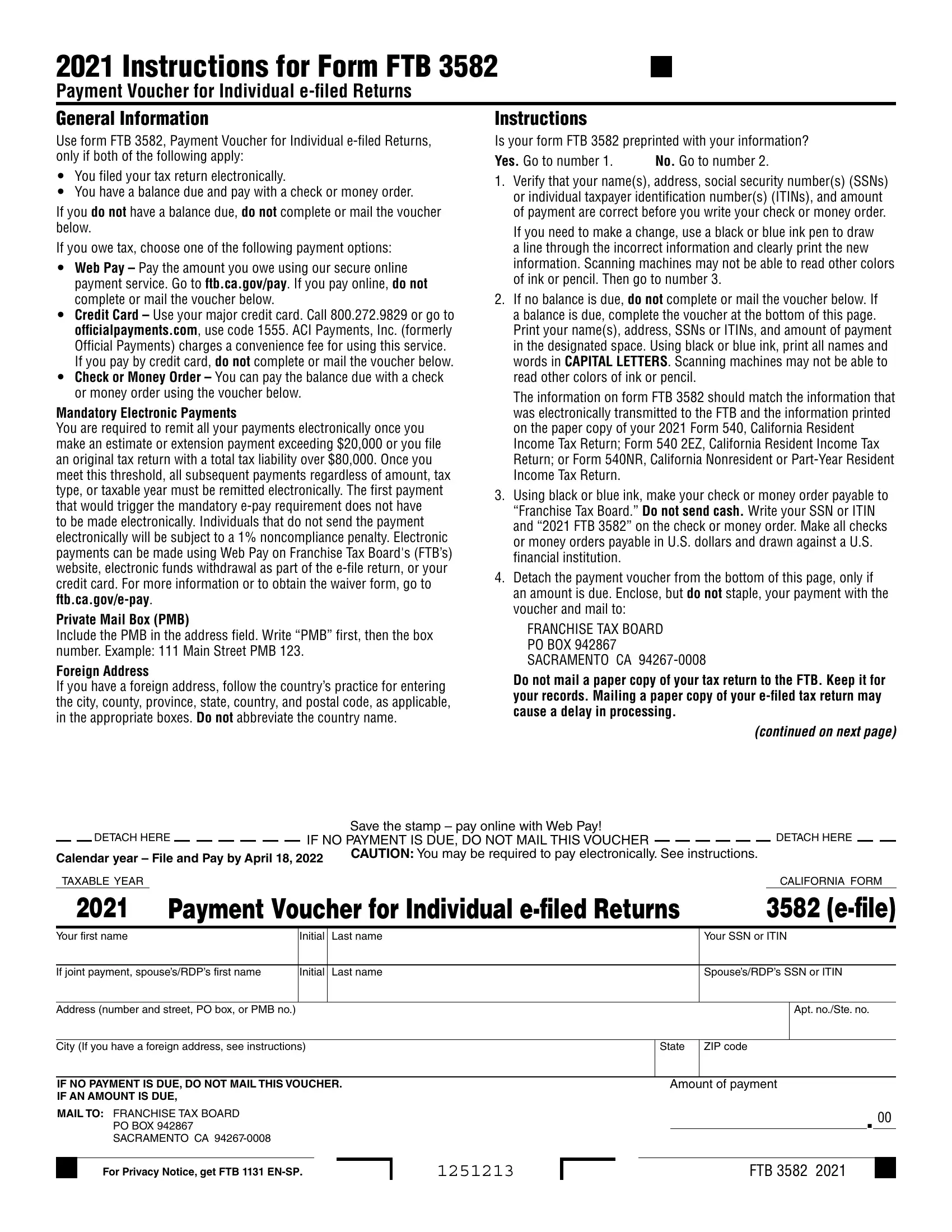

General Information |

2. If no balance is due, do not complete or mail the voucher below. If a |

|

Use form FTB 3582, Payment Voucher for Individual e-filed Returns, only if |

|

balance is due, complete the voucher at the bottom of this page. Print |

|

|

your name(s), address, SSNs or ITINs, and amount of payment in the |

|

both of the following apply: |

|

|

|

designated space. Using black or blue ink, print all names and words in |

|

|

|

|

You filed your tax return electronically. |

|

CAPITAL LETTERS. Scanning machines may not be able to read other |

|

You have a balance due and pay with a check or money order. |

|

colors of ink or pencil. |

|

If you do not have a balance due, do not complete or mail the voucher below. |

|

The information on form FTB 3582 should match the information that |

|

If you owe tax, choose one of the following payment options: |

|

was electronically transmitted to the FTB and the information printed |

|

|

on the paper copy of your 2020 Form 540, California Resident Income |

|

Web Pay – Pay the amount you owe using our secure online payment |

|

|

|

Tax Return; Form 540 2EZ, California Resident Income Tax Return; or |

|

service. Go to ftb.ca.gov/pay. If you pay online, do not complete or mail |

|

|

|

Form 540NR, California Nonresident or Part-Year Resident Income |

|

the voucher below. |

|

|

|

Tax Return. |

|

Credit Card – Use your major credit card. Call 800.272.9829 or go to |

|

|

3. Using black or blue ink, make your check or money order payable to |

|

officialpayments.com, use code 1555. Official Payments Corporation |

|

|

“Franchise Tax Board.” Do not send cash. Write your SSN or ITIN and |

|

charges a convenience fee for using this service. If you pay by credit |

|

|

|

“2020 FTB 3582” on the check or money order. Make all checks or |

|

card, do not complete or mail the voucher below. |

|

|

|

money orders payable in U.S. dollars and drawn against a U.S. financial |

|

Check or Money Order – You can pay the balance due with a check or |

|

|

|

institution. |

|

money order using the voucher below. |

|

|

|

|

|

|

|

|

Mandatory Electronic Payments |

4. Detach the payment voucher from the bottom of this page, only if |

|

|

an amount is due. Enclose, but do not staple, your payment with the |

|

You are required to remit all your payments electronically once you make an |

|

|

|

voucher and mail to: |

|

estimate or extension payment exceeding $20,000 or you file an original tax |

|

|

|

|

|

|

|

|

return with a total tax liability over $80,000. Once you meet this threshold, |

|

FRANCHISE TAX BOARD |

|

all subsequent payments regardless of amount, tax type, or taxable year |

|

PO BOX 942867 |

|

must be remitted electronically. The first payment that would trigger the |

|

SACRAMENTO CA 94267-0008 |

|

mandatory e-pay requirement does not have to be made electronically. |

|

Do not mail a paper copy of your tax return to the FTB. Keep it for your |

|

Individuals that do not send the payment electronically will be subject to a |

|

|

|

records. Mailing a paper copy of your e-filed tax return may cause a |

|

1% noncompliance penalty. Electronic payments can be made using Web |

|

|

|

delay in processing. |

|

Pay on Franchise Tax Board's (FTB’s) website, electronic funds withdrawal |

|

|

When to Make Your Payment |

|

as part of the e-file return, or your credit card. For more information or to |

|

obtain the waiver form, go to ftb.ca.gov/e-pay. |

If you have a balance due on your 2020 tax return, mail form FTB 3582 to the |

|

Private Mail Box (PMB) |

|

FTB with your payment for the full amount by April 15, 2021. |

|

Include the PMB in the address field. Write “PMB” first, then the box |

If you cannot pay the full amount you owe by April 15, 2021, pay as much |

|

number. Example: 111 Main Street PMB 123. |

|

as you can when you mail in form FTB 3582 to minimize additional charges. |

|

Foreign Address |

|

To request monthly payments file form FTB 3567, Installment Agreement |

|

If you have a foreign address, follow the country’s practice for entering the |

Request. To get form FTB 3567, go to ftb.ca.gov and search for installment |

|

city, county, province, state, country, and postal code, as applicable, in the |

agreement or call 800.338.0505 and follow the recorded instructions. Enter |

|

appropriate boxes. Do not abbreviate the country name. |

code 949 when instructed. |