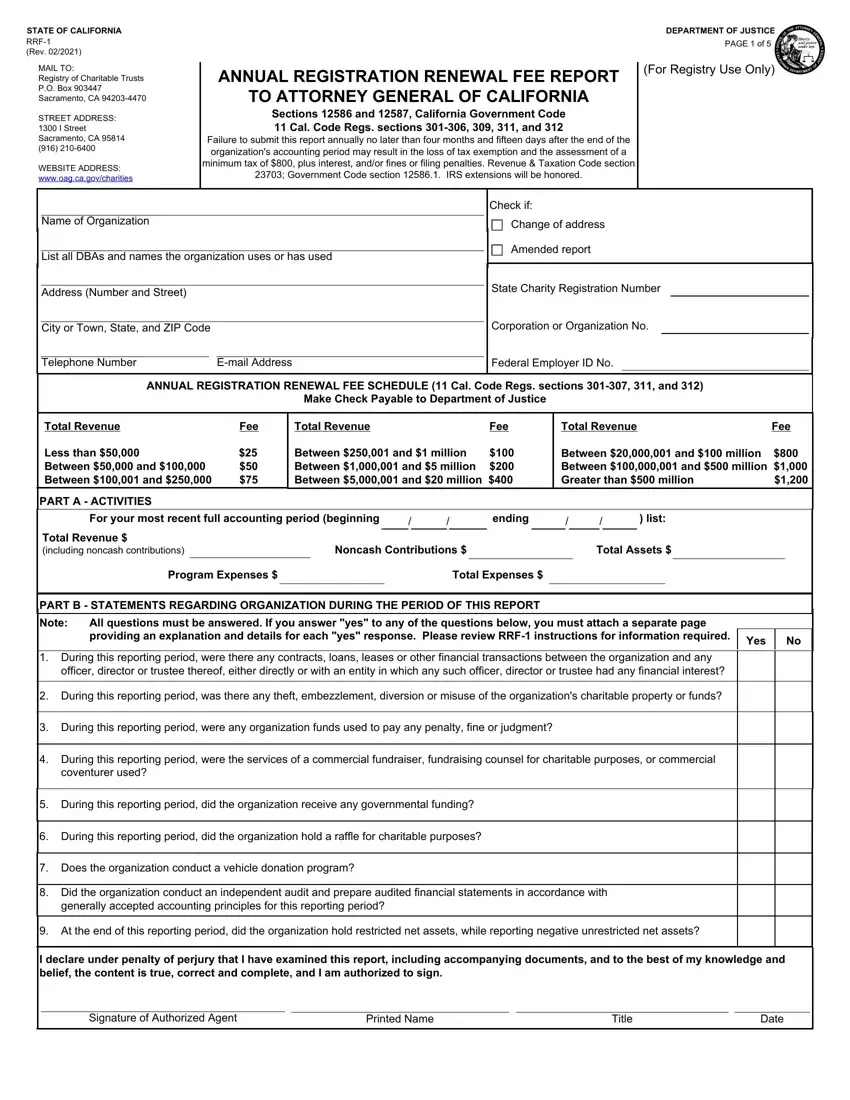

STATE OF CALIFORNIA

RRF-1

(Rev. 02/2021)

MAIL TO:

Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA 94203-4470

STREET ADDRESS: 1300 I Street Sacramento, CA 95814 (916) 210-6400

WEBSITE ADDRESS: www.oag.ca.gov/charities

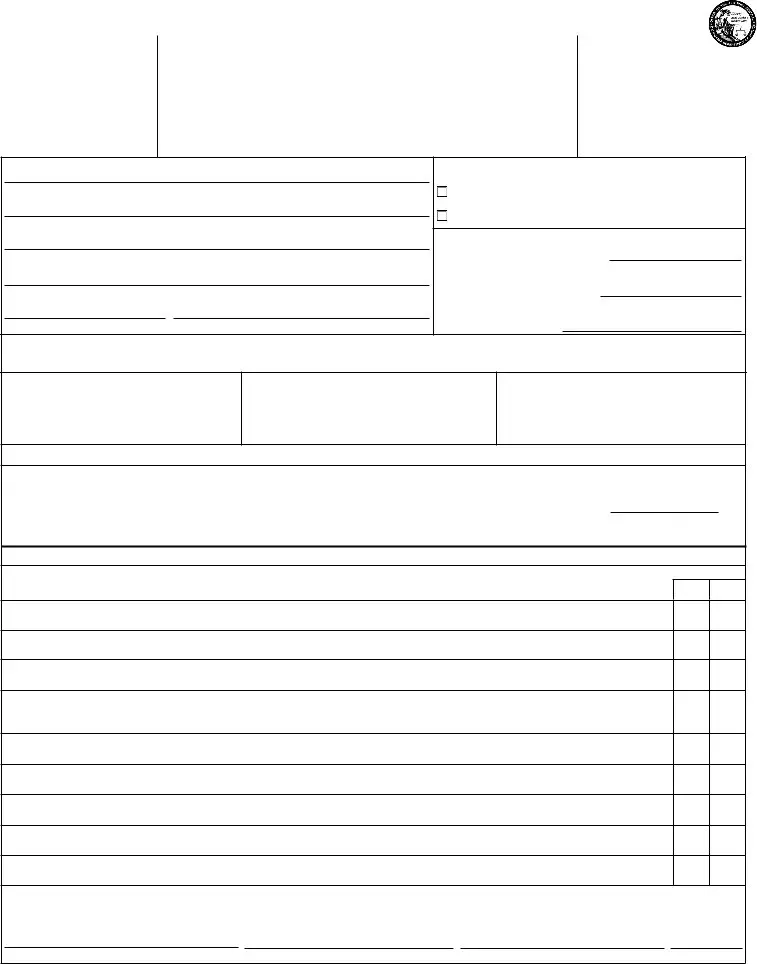

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code 11 Cal. Code Regs. sections 301-306, 309, 311, and 312

Failure to submit this report annually no later than four months and fifteen days after the end of the organization's accounting period may result in the loss of tax exemption and the assessment of a minimum tax of $800, plus interest, and/or fines or filing penalties. Revenue & Taxation Code section 23703; Government Code section 12586.1. IRS extensions will be honored.

DEPARTMENT OF JUSTICE

PAGE 1 of 5

(For Registry Use Only)

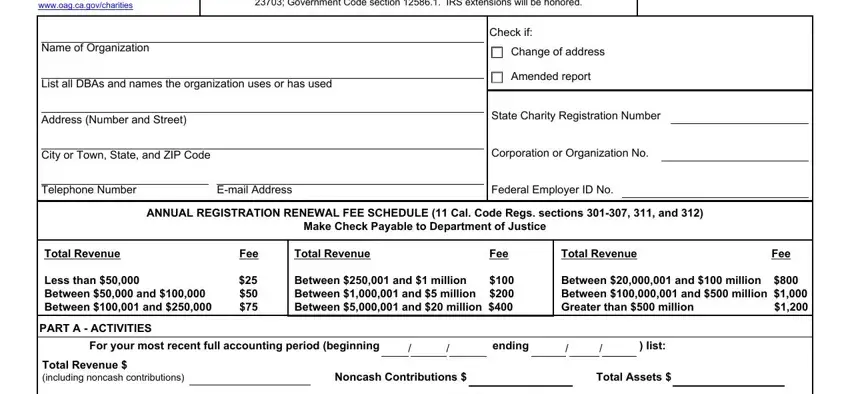

Name of Organization

List all DBAs and names the organization uses or has used

Address (Number and Street)

City or Town, State, and ZIP Code

Telephone Number |

E-mail Address |

Check if:

Change of address

Amended report

State Charity Registration Number

Corporation or Organization No.

Federal Employer ID No.

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections 301-307, 311, and 312)

Make Check Payable to Department of Justice

Total Revenue |

Fee |

Less than $50,000 |

$25 |

Between $50,000 and $100,000 |

$50 |

Between $100,001 and $250,000 |

$75 |

Total Revenue |

Fee |

Between $250,001 and $1 million |

$100 |

Between $1,000,001 and $5 million |

$200 |

Between $5,000,001 and $20 million $400

Total Revenue |

Fee |

Between $20,000,001 and $100 million |

$800 |

Between $100,000,001 and $500 million |

$1,000 |

Greater than $500 million |

$1,200 |

PART A - ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For your most recent full accounting period (beginning |

/ |

/ |

|

|

ending |

/ |

/ |

) list: |

Total Revenue $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncash Contributions $ |

|

|

|

Total Assets $ |

(including noncash contributions) |

|

|

|

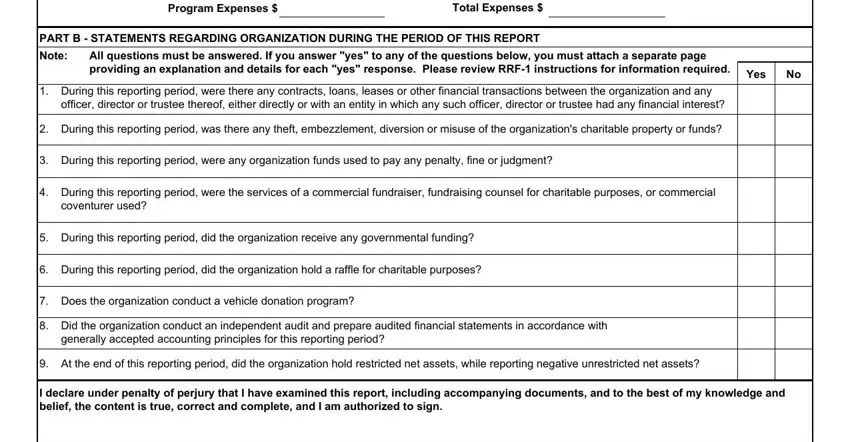

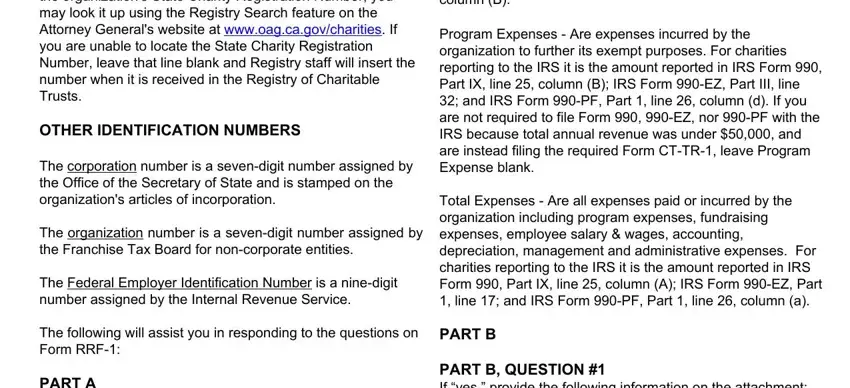

Program Expenses $ |

|

|

|

|

|

|

Total Expenses $ |

|

|

|

|

|

|

|

PART B - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note: |

All questions must be answered. If you answer "yes" to any of the questions below, you must attach a separate page |

|

providing an explanation and details for each "yes" response. Please review RRF-1 instructions for information required. |

1.During this reporting period, were there any contracts, loans, leases or other financial transactions between the organization and any officer, director or trustee thereof, either directly or with an entity in which any such officer, director or trustee had any financial interest?

2.During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable property or funds?

3.During this reporting period, were any organization funds used to pay any penalty, fine or judgment?

4.During this reporting period, were the services of a commercial fundraiser, fundraising counsel for charitable purposes, or commercial coventurer used?

5.During this reporting period, did the organization receive any governmental funding?

6.During this reporting period, did the organization hold a raffle for charitable purposes?

7.Does the organization conduct a vehicle donation program?

8.Did the organization conduct an independent audit and prepare audited financial statements in accordance with generally accepted accounting principles for this reporting period?

9.At the end of this reporting period, did the organization hold restricted net assets, while reporting negative unrestricted net assets?

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge and belief, the content is true, correct and complete, and I am authorized to sign.

Signature of Authorized Agent |

Printed Name |

Title |

Date |

STATE OF CALIFORNIA |

DEPARTMENT OF JUSTICE |

RRF-1 |

PAGE 2 of 5 |

(Rev. 02/2021) |

|

Office of the Attorney General

Registry of Charitable Trusts

Privacy Notice

As Required by Civil Code § 1798.17

Collection and Use of Personal Information. The Attorney General's Registry of Charitable Trusts (Registry), a part of the Public Rights Division, collects the information requested on this form as authorized by the Supervision of Trustees and Fundraisers for Charitable Purposes Act (Gov. Code § 12580 et seq.) and regulations adopted pursuant to the Act (Cal. Code Regs., tit. 11, §§ 300-316). The Registry uses the information in the administration and enforcement of the Act, including to register, renew, or update your organization's registration or to prepare reports pursuant to the Act. The Attorney General may also use the information for additional purposes, including in support of investigations and law enforcement actions, providing public access to information as required by the Act (Gov. Code §§ 12587, 12587.1, 12590), and making referrals to other law enforcement agencies. Any personal information collected by state agencies is subject to the limitations in the Information Practices Act and state policy. The Department of Justice's general privacy policy is available at www.oag.ca.gov/ privacy-policy.

Providing Personal Information. All the personal information requested in the form must be provided. An incomplete submission may result in the Registry not accepting the form, and cause your organization to be out of compliance with legal requirements to operate in California.

Access to Your Information. The completed form is a public filing that will be made available on the Attorney General's website at www.oag.ca.gov/charities pursuant to the public access requirements of the Act. You may review the records maintained by the Registry that contain your personal information, as permitted by the Information Practices Act. See below for contact information.

Possible Disclosure of Personal Information. In order to process the applicable registration, renewal, registration update, application, or report, we may need to share the information on this form with other government agencies. We may also share the information to further an investigation, including an investigation by other government or law enforcement agencies. In addition, the information is available and searchable on the Attorney General's website.

The information provided may also be disclosed in the following circumstances:

·With other persons or agencies where necessary to perform their legal duties, and their use of your information is compatible and complies with state law, such as for investigations or for licensing, certification, or regulatory purposes;

·To another government agency consistent with state or federal law.

Contact Information. For questions about this notice or access to your records, contact the Registrar of Charitable Trusts, 1300 I Street, Sacramento, CA 95814 at rct@doj.ca.gov or (916) 210-6400.

STATE OF CALIFORNIA RRF-1 Instructions (Rev. 02/2021)

MAIL TO:

Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA 94203-4470 (916) 210-6400

WEBSITE ADDRESS: www.oag.ca.gov/charities

DEPARTMENT OF JUSTICE

Page 3 of 5

INSTRUCTION FOR FILING

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Section 12586 and 12587, California Government Code 11 Cal. Code Regs. section 301-306, 309, 311 and 312

(FORM RRF-1)

The purpose of the Annual Registration Renewal Fee Report (Form RRF-1) is to assist the Attorney General's Office with early detection of charity fiscal mismanagement and unlawful diversion of charitable assets.

WHO MUST FILE A FORM RRF-1?

Every charitable nonprofit corporation, unincorporated association or trustee holding assets for charitable purposes that is required to register with the Attorney General's Office is also required to annually file Form RRF-1, even if the corporation does not file Form 990s annually or is on extended reporting with the Internal Revenue Service. Only those charitable entities and trustees required by law to register with the Attorney General are required to file Form RRF-1. Entities exempt from the filing requirement include:

(1)a government agency,

(2)a religious corporation sole,

(3)a cemetery corporation regulated under Chapter

12 of Division 3 of the Business and Professions Code,

(4)a political committee defined in Section 82013 of the California Government Code which is required to and which does file with the Secretary of State any statement pursuant to the provisions of Article 2 (commencing with Section 84200) of Chapter 4 of Title 9,

(5)a charitable corporation organized and operated primarily as a religious organization, educational institution or hospital,

(6)a health care service plan that is licensed pursuant to Section 1349 of the Health and Safety Code and reports annually to the Department of Managed Health Care,

(7)corporate trustees which are subject to the jurisdiction of the Commissioner of Financial Institutions of the State of California or to the Comptroller of Currency of the United States. However, for testamentary trusts, such trustees should file a copy of a complete annual financial summary which is prepared in the ordinary course of business. See Probate Code sections 16060-16063.

WHAT TO FILE

ALL REGISTRANTS, regardless of the amount of total revenue, must file Form RRF-1 with the Attorney General's Registry of Charitable Trusts no later than four months and fifteen days after the organization's accounting period ends (May 15 for calendar year filers).

A copy of IRS Form 990, 990-PF, 990-EZ, or 1120 as filed with IRS, together with all attachments and schedules, must be filed with the Attorney General's Registry of Charitable Trusts, together with Form RRF-1. Schedule B is not required. Organizations whose revenue falls below the threshold for filing IRS Form 990-EZ shall file Form RRF-1 with the Registry, together with a treasurer's report (CT-TR-1) sufficient to identify and account for revenue, assets and disbursements. [See instructions for Form CT-TR-1.]

EXTENSIONS FOR FILING

Extensions of time for filing Form RRF-1 will be allowed if an organization has received an extension from the Internal Revenue Service for filing the IRS Form 990, 990-PF, 990- EZ, or 1120. An organization shall file both forms (RRF-1 and IRS Form 990, 990-PF, 990-EZ, or 1120) with the Registry of Charitable Trusts at the same time, together with (1) the applicable renewal fee; and (2) a copy of all requests to IRS for an extension and, where approval of the extension is not automatic, a copy of each approved extension request. IT IS NOT NECESSARY TO SEND A COPY OF THE EXTENSION REQUEST PRIOR TO FILING THE REPORT.

ANNUAL REGISTRATION RENEWAL FEE

All registrants must include with Form RRF-1 the appropriate registration renewal fee based on the registrant's total revenue (the reported total revenue on Form 990, 990-PF,

990-EZ, or CT-TR-1) for the preceding fiscal year, as follows:

Total Revenue |

Fee |

Less than $50,000 |

$25 |

Between $50,000 and $100,000 |

$50 |

Between $100,001 and $250,000 |

$75 |

Between $250,001 and $1 million |

$100 |

Between $1,000,001 and $5 million |

$200 |

Between $5,000,001 and $20 million |

$400 |

Between $20,000,001 and $100 million |

$800 |

Between $100,000,001 and $500 million |

$1,000 |

Greater than $500 million |

$1,200 |

NOTE: A REGISTRATION FEE IS NOT DUE WITH AN AMENDED REPORT FOR ANY REPORT PERIOD IN WHICH A FEE HAS ALREADY BEEN PAID UNLESS AN AMENDED REPORT CHANGES THE AMOUNT OF THE FEE DUE.