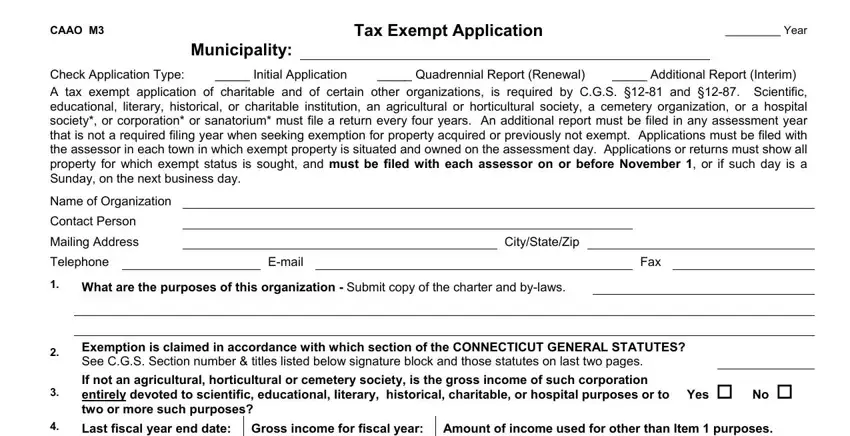

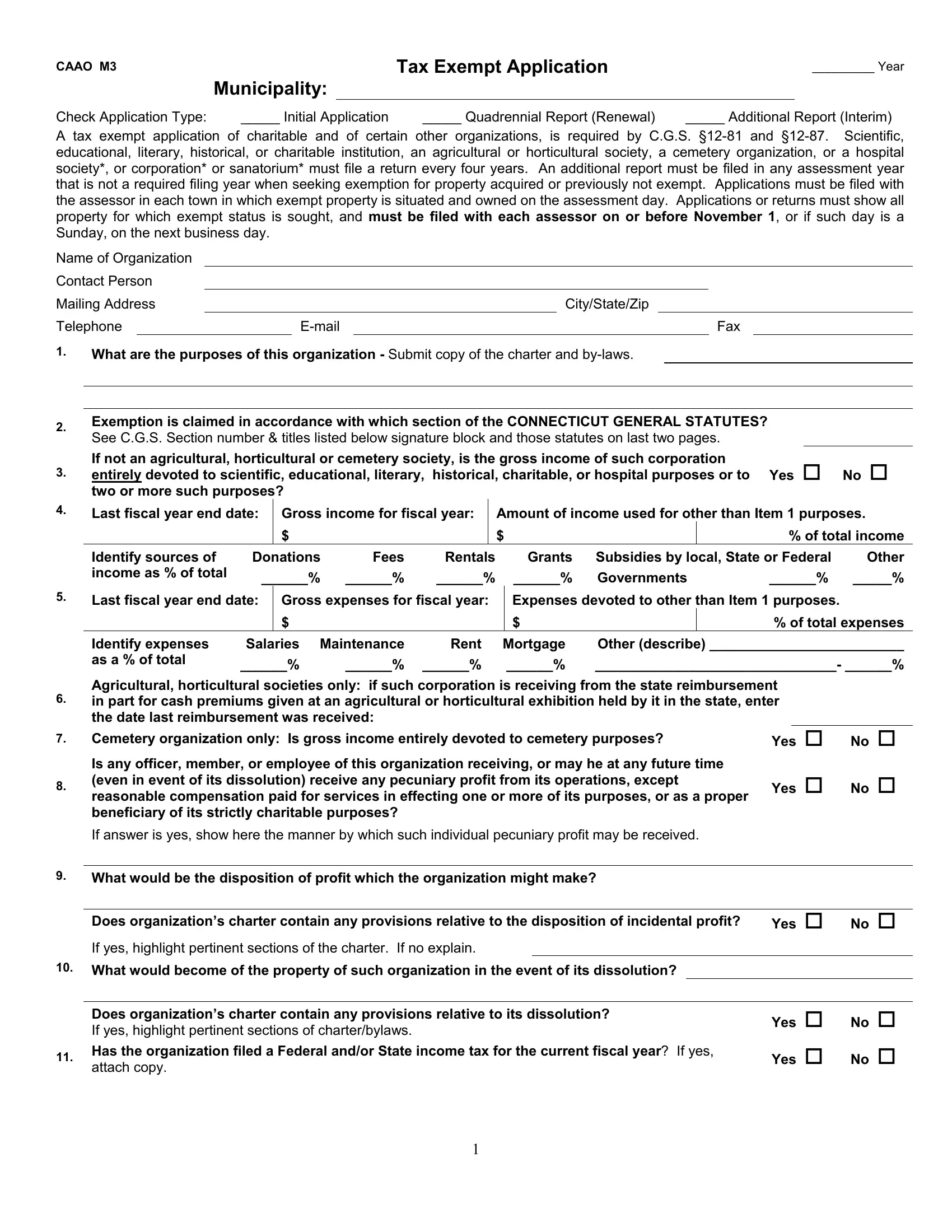

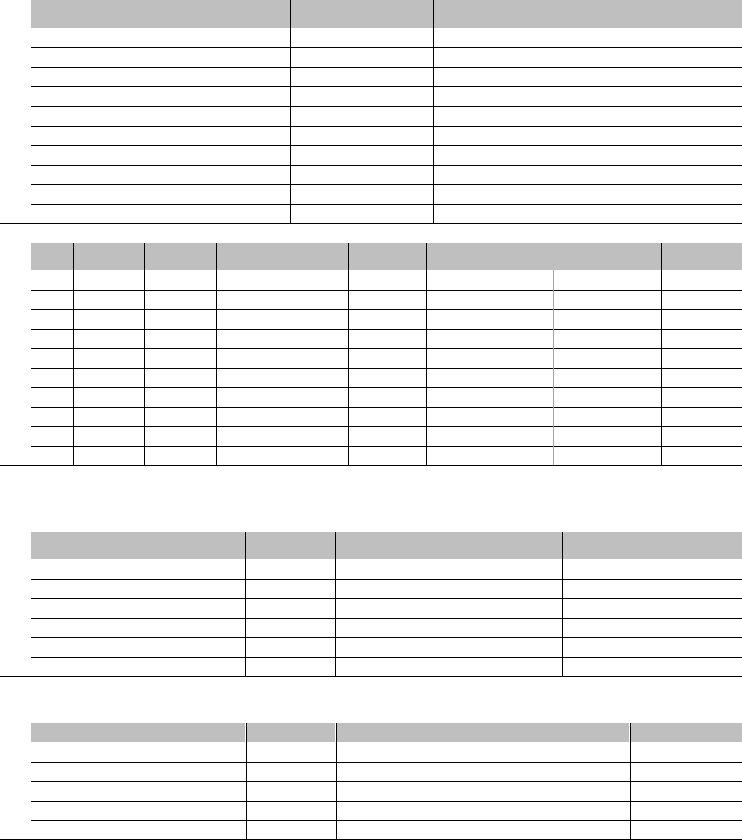

Tax Exempt Application

Municipality:

Check Application Type: |

_____ Initial Application |

_____ Quadrennial Report (Renewal) |

_____ Additional Report (Interim) |

A tax exempt application of charitable and of certain other organizations, is required by C.G.S. §12-81 and §12-87. Scientific, educational, literary, historical, or charitable institution, an agricultural or horticultural society, a cemetery organization, or a hospital society*, or corporation* or sanatorium* must file a return every four years. An additional report must be filed in any assessment year that is not a required filing year when seeking exemption for property acquired or previously not exempt. Applications must be filed with the assessor in each town in which exempt property is situated and owned on the assessment day. Applications or returns must show all property for which exempt status is sought, and must be filed with each assessor on or before November 1, or if such day is a Sunday, on the next business day.

Name of Organization |

|

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

|

Mailing Address |

|

|

|

City/State/Zip |

Telephone |

|

|

E-mail |

|

|

|

Fax |

|

1.What are the purposes of this organization - Submit copy of the charter and by-laws.

2.Exemption is claimed in accordance with which section of the CONNECTICUT GENERAL STATUTES? See C.G.S. Section number & titles listed below signature block and those statutes on last two pages.

|

If not an agricultural, horticultural or cemetery society, is the gross income of such corporation |

No |

|

3. |

entirely devoted to scientific, educational, literary, historical, charitable, or hospital purposes or to Yes |

two or more such purposes?

4.Last fiscal year end date:

Gross income for fiscal year:

$

Amount of income used for other than Item 1 purposes.

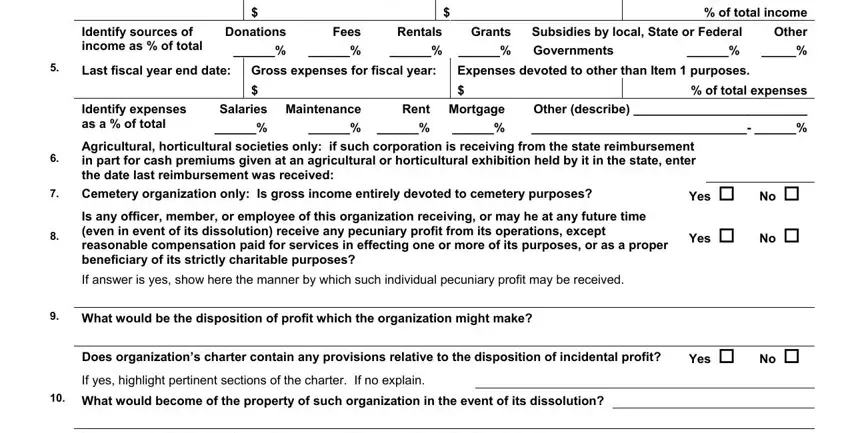

Identify sources of |

Donations |

Fees |

Rentals |

income as % of total |

______% |

______% |

______% |

|

5.Last fiscal year end date: Gross expenses for fiscal year:

$

Grants |

Subsidies by local, State or Federal |

Other |

______% |

Governments |

______% |

_____% |

Expenses devoted to other than Item 1 purposes.

Identify expenses |

Salaries |

Maintenance |

Rent |

Mortgage |

Other (describe) _________________________ |

as a % of total |

______% |

______% |

______% |

______% |

_______________________________- ______% |

|

Agricultural, horticultural societies only: if such corporation is receiving from the state reimbursement

6.in part for cash premiums given at an agricultural or horticultural exhibition held by it in the state, enter the date last reimbursement was received:

7.Cemetery organization only: Is gross income entirely devoted to cemetery purposes?

Is any officer, member, or employee of this organization receiving, or may he at any future time

8.(even in event of its dissolution) receive any pecuniary profit from its operations, except reasonable compensation paid for services in effecting one or more of its purposes, or as a proper beneficiary of its strictly charitable purposes?

If answer is yes, show here the manner by which such individual pecuniary profit may be received.

9.What would be the disposition of profit which the organization might make?

Does organization’s charter contain any provisions relative to the disposition of incidental profit? |

Yes No |

If yes, highlight pertinent sections of the charter. If no explain.

10.What would become of the property of such organization in the event of its dissolution?

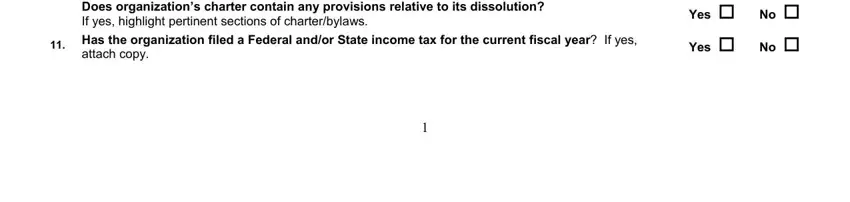

Does organization’s charter contain any provisions relative to its dissolution? If yes, highlight pertinent sections of charter/bylaws.

11.Has the organization filed a Federal and/or State income tax for the current fiscal year? If yes, attach copy.

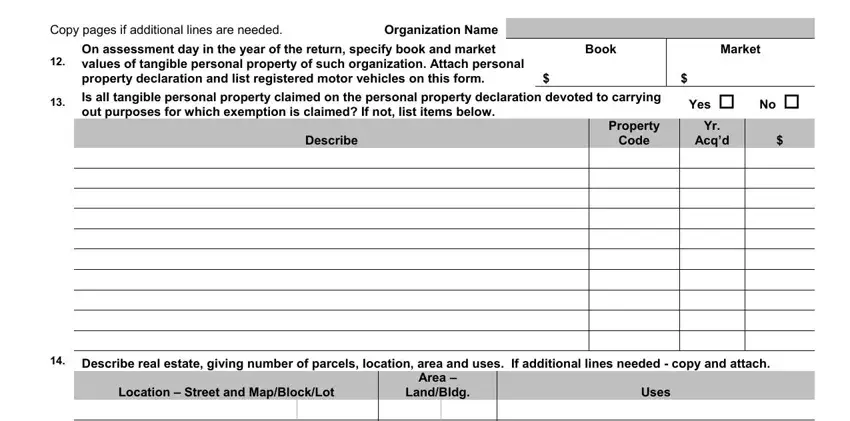

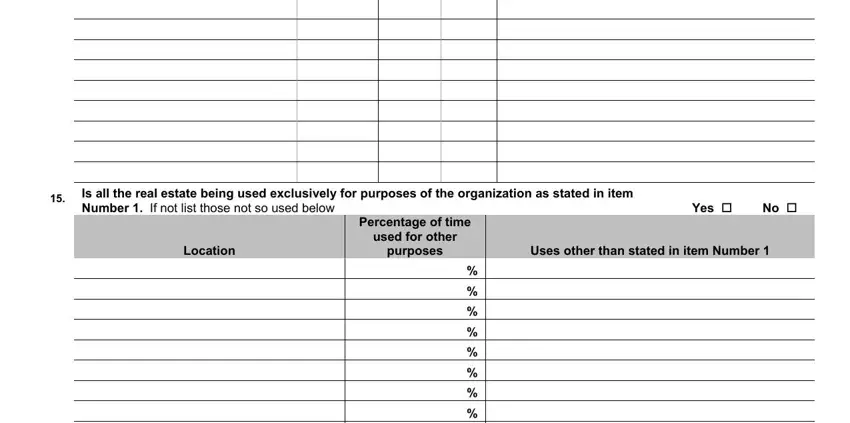

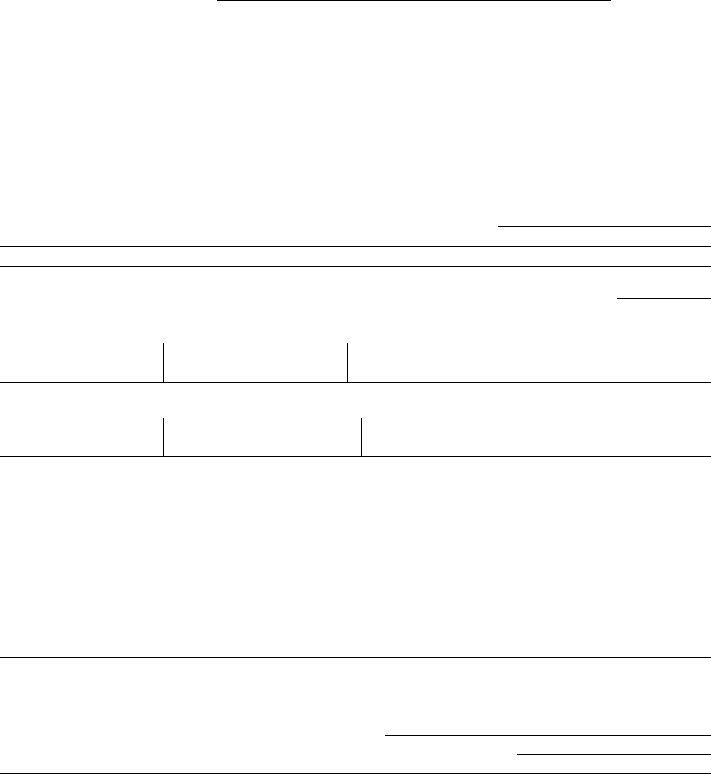

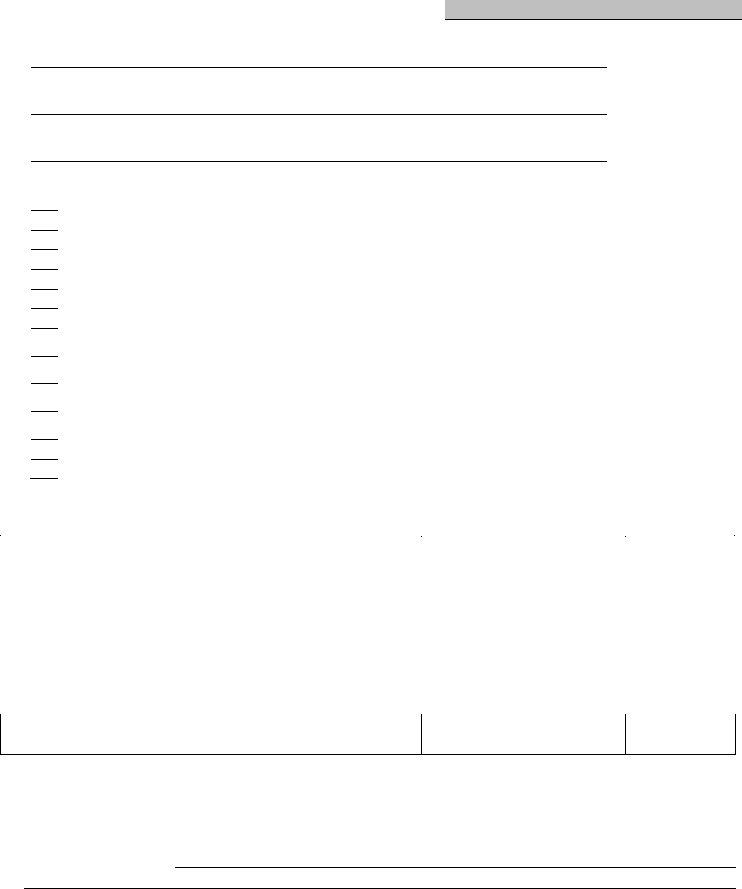

Copy pages if additional lines are needed.Organization Name

Has organization received a ‘Certificate of Need’ from the Connecticut Office of Health Care

21.Access? If yes, attach current copy (less than two years old). If no, explain.

Has organization received a State of Connecticut Sales Tax Exemption? If yes, attach a copy. If no,

22.explain.

Has organization received an exemption from the IRS in accordance with Section 501 (c) or 501

23.(d)? If yes, attach a copy. If no, explain.

Yes |

No |

Yes |

No |

Yes |

No |

24.Documents Provided: Put a check mark in front of each described document attached with this initial or quadrennial application.

Personal Property Declaration is the only item required for Additional Reports.

IRS document (most recent) recognizing the organization as tax exempt under 26 U.S.C. Sec. 501 (c) or 501 (d).

State of Connecticut Sales Tax Exemption.

Evidence that corporation has timely filed its biennial return naming officers & directors with the Secretary of State.

Certificate of Need from Connecticut Office of Health Care Access.

Certified copy by authorized officer of corporate charter and by-laws or good faith equivalent if applicant is not corporation.

Signed federal and/or state income tax returns, with all schedules attached for most current year.

Audited financial statements for the latest available year.

Description of each source of revenue, e.g. rents, fees, grants, charges, gifts, donation and the like, generated by or for each use of all real and/or personal property.

Description of all uses of real and/or personal property, owned or leased, of which an exempt activity is a part, whether or not exemption is requested for any such use or uses.

Personal property declaration for the current year REQUIRED ANNUALLY and complete listing of all Connecticut registered motor vehicles. .

Copies of funding requests made to public institutions or private parties in the current tax year and prior tax year of the applicant.

Evidence of compensation in money or in-kind paid to officers, directors and/or employee of the applicant.

Evidence that the property is used as claimed.

I do hereby declare under oath that, according to the best of my knowledge, remembrance and belief, this report is true.

|

Signed: Treasurer or other Chief Financial Officer of the Corporation |

Title |

|

Date |

|

|

|

X |

|

|

|

|

|

|

|

|

Signed: Justice of the Peace, Notary, Assessor, Town Clerk, Comm.-Superior Court |

Subscribed and sworn to before me: |

Date |

|

|

|

X |

|

|

|

|

|

|

|

|

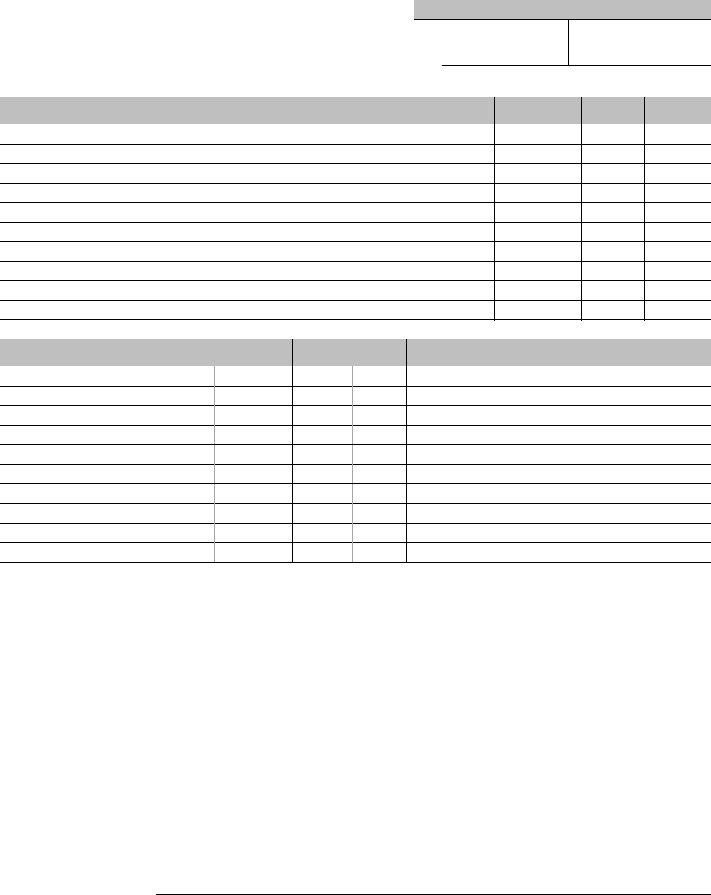

For additional information, please refer to the Section of the Connecticut General Statutes listed. |

|

|

|

|

Charitable Organizations |

12-81 (7) |

Agricultural Societies |

12-81(10) |

Determination of Exemption |

12-89 |

|

|

Educational Organizations |

12-81 (7) |

Horticultural Organization 12-81(10) |

Partially Exempt Property |

12-88 |

|

|

Historical Organizations |

12-81 (7) |

Hospitals |

12-81 (16) |

|

|

|

|

|

Literary Organizations |

12-81 (7) |

Sanatoriums |

12-81 (16) |

|

|

|

|

|

Scientific Organizations |

12-81 (7) |

Religious |

12-81 (12) (13) (14) (15) |

|

|

|

|

|

|

Cemetery Use |

12-81 (11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This Area for Office use only |

|

|

|

|

|

Signed: ASSESSOR |

|

|

Application Approved ____________ |

Date |

|

|

|

X |

|

|

Application Denied ______________ |

|

|

|

Denied as a copy of the Organization’s IRS tax exemption certificate or determination letter under Section 501 (c) or 501 (d) of the IRS Code was not filed.

Denied as a copy(s) of the Organization’s by-laws and/or Charter, was/were not filed.

Denied for failure to forward documentation that would support whether or not the property is held by a religious organization.

Denied as the property is not being used for statutory exempt purposes.

Denied for other reasons:

4

Sec. 12‐81. Exemptions. The following‐described property shall be exempt from taxation:

(7)Property used for scientific, educational, literary, historical, charitable or open space land preservation purposes. Exception. (A) Subject to the provisions of sections 12‐87 and 12‐88, the real property of, or held in trust for, a corporation organized exclusively for

scientific, educational, literary, historical or charitable purposes or for two or more such purposes and used exclusively for carrying out one or more of such purposes or for the purpose of preserving open space land, as defined in section 12‐107b, for any of the uses specified in

said section, that is owned by any such corporation, and the personal property of, or held in trust for, any such corporation, provided (i) any officer, member or employee thereof does not receive or at any future time shall not receive any pecuniary profit from the operations thereof, except reasonable compensation for services in effecting one or more of such purposes or as proper beneficiary of its strictly charitable purposes, and (ii) in 1965, and quadrennially thereafter, a statement shall be filed on or before the first day of November with the assessor or board of assessors of any town, consolidated town and city or consolidated town and borough, in which any of its property claimed to be exempt is situated. Such statement shall be filed on a form provided by such assessor or board of assessors. The real property shall be eligible for the exemption regardless of whether it is used by another corporation organized exclusively for scientific, educational,

literary, |

historical |

or |

charitable |

purposes |

or |

for |

two |

or |

more |

such |

purposes; |

(B)On and after July 1, 1967, housing subsidized, in whole or in part, by federal, state or local government and housing for persons or families of low and moderate income shall not constitute a charitable purpose under this section. As used in this subdivision, "housing" shall not include real property used for temporary housing belonging to, or held in trust for, any corporation organized exclusively for charitable purposes and exempt from taxation for federal income tax purposes, the primary use of which property is one or more of the

following: (i) An orphanage; (ii) a drug or alcohol treatment or rehabilitation facility; (iii) housing for homeless, retarded or mentally or physically handicapped individuals, or for battered or abused women and children; (iv) housing for ex‐offenders or for individuals participating in a program sponsored by the state Department of Correction or Judicial Branch; and (v) short‐term housing operated by a

charitable organization where the average length of stay is less than six months. The operation of such housing, including the receipt of any rental payments, by such charitable organization shall be deemed to be an exclusively charitable purpose;

(10)Property belonging to agricultural or horticultural societies. Subject to the provisions of sections 12‐87 and 12‐88, property belonging to, or held in trust for, an agricultural or horticultural society incorporated by this state which is used in connection with an annual agricultural fair held by a nonprofit incorporated agricultural society of this state or any nonprofit incorporated society of this state carrying on or promoting any branch of agriculture, provided (A) said society shall pay cash premiums at such fair amounting to at least two hundred dollars, (B) said society shall file with the Commissioner of Agriculture on or before the thirtieth of December following said fair a report in such detail as the commissioner may require giving the names of all exhibitors and the amount of premiums, with the objects for which they have been paid, which statement shall be sworn to by the president, secretary or treasurer of the society, (C) any officer, member or employee thereof does not receive or at any future time shall not receive any pecuniary profit from the operations thereof except reasonable compensation for services in the conduct of its affairs, and (D) in 1965, and quadrennially thereafter, a statement shall be filed on or before the first day of November with the assessor or board of assessors of any town, consolidated town and city or consolidated town and borough in which any of its property claimed to be exempt is situated. Such statement shall be filed on a form provided by such assessor or board of assessors. For purposes of this subsection, "fair" means a bona fide agricultural exhibition designed, arranged and operated to promote, encourage and improve agriculture by offering premiums and awards for the best exhibits of two or more by the following branches of agriculture: Crops, livestock, poultry, dairy products and homemaking;

(11)Property held for cemetery use. Subject to the provisions of section 12‐88, tangible property owned by, or held in trust for, a religious organization, provided such tangible property is used exclusively for cemetery purposes; donations held in trust by a municipality, an

ecclesiastical society or a cemetery association, the income of which is to be used for the care or improvement of its cemetery, or of one or more private burial lots within such cemetery. Subject to the provisions of sections 12‐87 and 12‐88, any other tangible property used for

cemetery purposes shall not be exempt, unless (a) such tangible property is exclusively so used, and (b) no officer, member or employee of the organization owning such property receives or, at any future time, shall receive any pecuniary profit from the cemetery operations thereof except reasonable compensation for services in the conduct of its cemetery affairs, and (c) in 1965, and quadrennially thereafter, a statement on forms prepared by the assessor shall be filed on or before the last day required by law for the filing of assessment returns with the local board of assessors of any town, consolidated town and city or consolidated town and borough, in which any of its property claimed to be exempt is situated;

(12)Personal property of religious organizations devoted to religious or charitable use. Personal property within the state owned by, or held in trust for, a Connecticut religious organization, whether or not incorporated, if the principal or income is used or appropriated for religious or charitable purposes or both;

(13)Houses of religious worship. Subject to the provisions of section 12‐88, houses of religious worship, the land on which they stand, their pews, furniture and equipment owned by, or held in trust for the use of, any religious organization;

(14)Property of religious organizations used for certain purposes. Subject to the provisions of section 12‐88, real property and its equipment owned by, or held in trust for, any religious organization and exclusively used as a school, a daycare facility, a Connecticut nonprofit camp or recreational facility for religious purposes, a parish house, an orphan asylum, a home for children, a thrift shop, the proceeds of which are used for charitable purposes, a reformatory or an infirmary or for two or more of such purposes;

5

(15)Houses used by officiating clergymen as dwellings. Subject to the provisions of section 12‐88, dwelling houses and the land on which they stand owned by, or held in trust for, any religious organization and actually used by its officiating clergymen;

(16)Hospitals and sanatoriums. Subject to the provisions of section 12‐88, all property of, or held in trust for, any Connecticut hospital society or corporation or sanatorium, provided (A) no officer, member or employee thereof receives or, at any future time, shall receive any pecuniary profit from the operations thereof, except reasonable compensation for services in the conduct of its affairs, and (B) in 1967, and quadrennially thereafter, a statement shall be filed by such hospital society, corporation or sanatorium on or before the first day of November with the assessor or board of assessors of any town, consolidated town and city or consolidated town and borough, in which any of its property claimed to be exempt is situated. Such statement shall be filed on a form provided by such assessor or board of assessors;

(49)Nonprofit camps or recreational facilities for charitable purposes. Subject to the provisions of subdivision (7) of this section and section 12‐88, real property and its equipment owned by or held in trust for any charitable corporation exclusively used as a nonprofit camp or recreational facility for charitable purposes; provided at least seventy‐five per cent of the beneficiaries of its strictly charitable

purposes using such property and equipment in each taxable year were bona fide residents of the state at the time of such use. During the month preceding the assessment date of the town or towns where such camp or facilities are located, such charitable corporation shall submit to the assessors of such town or towns a statement under oath in respect to such residence of such beneficiaries using such facilities

during the taxable year ending with the month in which such statement is rendered, and, if the number of such beneficiaries so resident in Connecticut did not equal or exceed such seventy‐five per cent, such real property and equipment shall not be exempt during the next

ensuing taxable year. This subdivision shall not affect the exemption of any such real property or equipment of any such charitable corporation incorporated under the laws of this state granted prior to May 26, 1961, where such property and equipment was actually in use for such recreational purposes prior to said date;

Sec. 12‐87. Additional report. Property, when taxable. During any year for which a report is not required by subdivisions (7), (10) and (11) of section 12‐81, a report shall be filed during the time prescribed by law for the filing of assessment lists next succeeding the acquiring of property not theretofore made exempt by said subdivisions. Property otherwise exempt under any of said subdivisions and this section shall be subject to taxation until the requirements of said subdivisions and of this section have been complied with.

Sec. 12‐87a. Quadrennial property tax exemption statements; extension of time to file. Whenever any organization claiming exemption from property tax under the provisions of subdivision (7), (10), (11) or (16) of section 12‐81 has not filed within the time prescribed, a quadrennial statement concerning such claim for exemption as required in said subdivisions, the assessor or board of assessors of the municipality in which the property is situated, upon receipt of proof of substantial compliance by such organization with the requirements concerning submission of such statement, may allow an extension of time not exceeding sixty days within which such statement may be filed, provided whenever an extension of time is so allowed, such organization shall pay a fee of thirty‐five dollars for late‐filing to the municipality in which the property with respect to which such statement is submitted is situated.

Sec. 12‐88. When property otherwise taxable may be completely or partially exempted. Real property belonging to, or held in trust for, any organization mentioned in subdivision (7), (10), (11), (13), (14), (15), (16) or (18) of section 12‐81, which real property is so held for one or more of the purposes stated in the applicable subdivision, and from which real property no rents, profits or income are derived, shall be exempt from taxation though not in actual use therefor by reason of the absence of suitable buildings and improvements thereon, if the construction of such buildings or improvements is in progress. The real property belonging to, or held in trust for, any such organization, not used exclusively for carrying out one or more of such purposes but leased, rented or otherwise used for other purposes, shall not be exempt. If a portion only of any lot or building belonging to, or held in trust for, any such organization is used exclusively for carrying out one or more of such purposes, such lot or building shall be so exempt only to the extent of the portion so used and the remaining portion shall be subject to taxation.

Sec. 12‐89. Assessors to determine exemptions The board of assessors of each town, consolidated town and city or consolidated town and borough shall inspect the statements filed with it and required by sections 12‐81 and 12‐87 from scientific, educational, literary, historical, charitable, agricultural and cemetery organizations, shall determine what part, if any, of the property claimed to be exempt by the organization shall be in fact exempt and shall place a valuation upon all such property, if any, as is found to be taxable, provided any property acquired by any tax‐exempt organization after the first day of October shall first become exempt on the assessment date next succeeding the date of acquisition. Any organization filing a tax‐exempt statement, aggrieved at the action of the assessor or board of assessors, may appeal, within the time prescribed by law for such appeals, to the board of assessment appeals. Any such organization claiming to be aggrieved by the action of the board of assessment appeals may, within two months from the time of such action, make application in the nature of an appeal therefrom to the superior court for the judicial district in which such property is situated.

Sec. 12‐89a. Certain organizations may be required by assessor to submit evidence of exemption from federal income tax. Any organization claiming exemption from property tax in any municipality in which real or personal property belonging to such organization is situated, which exemption is claimed with respect to all or a portion of such property under the provisions of any of the subdivisions (7), (8), (10), (11), (12), (13), (14), (15), (16), (18), (27), (29), (49) or (58) of section 12‐81, may be required upon request, at any time, by the assessor or board of assessors in such municipality to submit evidence of certification from the Internal Revenue Service, effective at the time of such request and in whatever form s then in use under Internal Revenue Service procedure for purposes of such certification, that such organization has been approved for exemption from federal income tax as an exempt organization under Section 501(c) or 501(d) of the Internal Revenue Code.

6