Our PDF editor allows you to manage the cac jury instructions fillable document. It will be easy to make the document right away by using these simple actions.

Step 1: The first step requires you to hit the orange "Get Form Now" button.

Step 2: Now you are on the form editing page. You may enhance and add text to the document, highlight words and phrases, cross or check specific words, add images, sign it, get rid of needless fields, or eliminate them entirely.

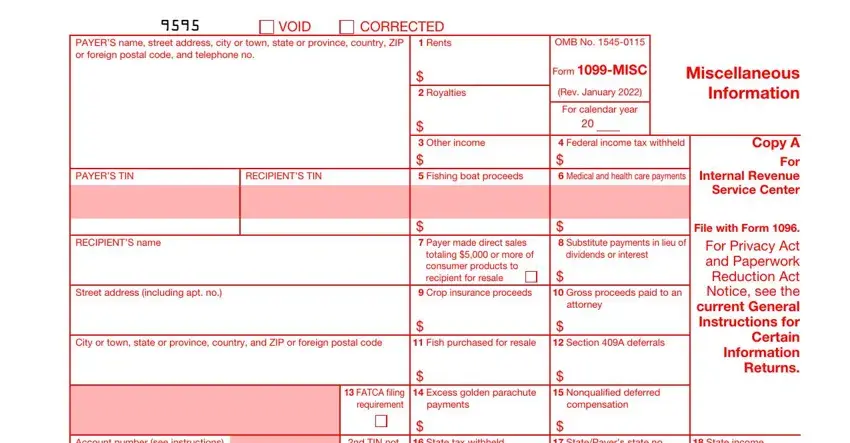

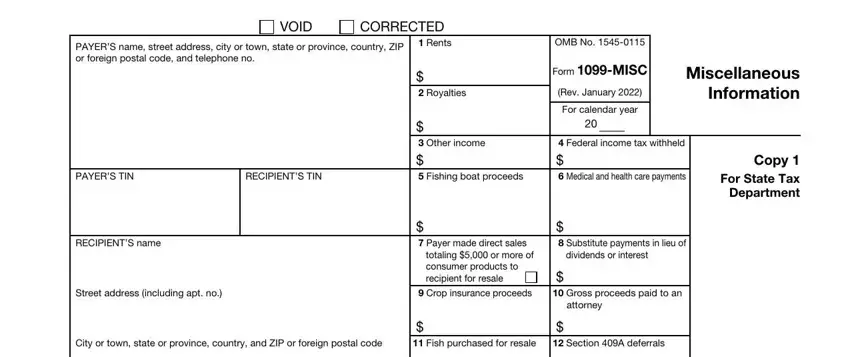

The PDF document you are going to prepare will include the following areas:

Add the requested particulars in the VOID, CORRECTED, PAYERS name street address city or, Rents, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Royalties, Other income Fishing boat, OMB No, Form MISC Rev January, For calendar year, and Miscellaneous Information section.

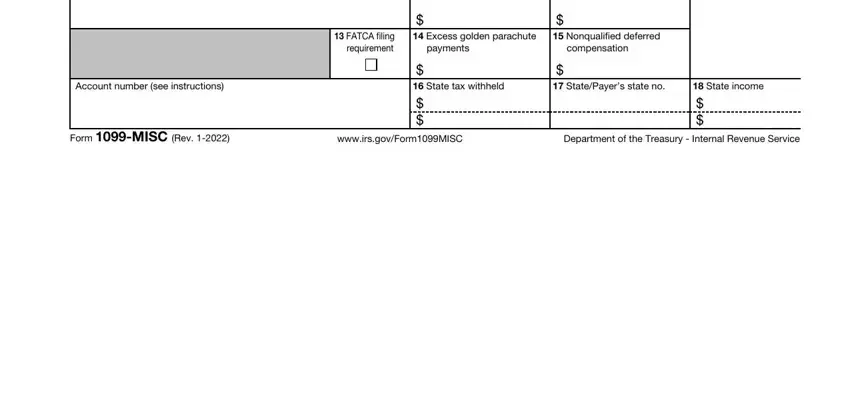

You need to write particular data in the area Account number see instructions, nd TIN not, State tax withheld, StatePayers state no, State income, Form MISC Rev Department of the, wwwirsgovFormMISC, and Cat No J.

The VOID, CORRECTED, PAYERS name street address city or, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Rents, OMB No, Royalties, Other income Fishing boat, Form MISC Rev January, For calendar year, and Miscellaneous Information section could be used to indicate the rights and obligations of each side.

Complete the document by taking a look at all of these areas: Account number see instructions, FATCA filing requirement, Excess golden parachute, Nonqualified deferred, payments, compensation, State tax withheld, StatePayers state no, State income, Form MISC Rev, wwwirsgovFormMISC, and Department of the Treasury.

Step 3: Select the "Done" button. At that moment, you can export your PDF file - upload it to your device or deliver it via electronic mail.

Step 4: It's going to be easier to prepare duplicates of the form. You can be sure that we will not display or view your information.

CORRECTED (if checked)

CORRECTED (if checked)

CORRECTED (if checked)

CORRECTED (if checked)