State of California—Health and Human Services Agency |

Department of Health Care Services |

Every applicant or provider must complete and submit a current Medi-Cal Disclosure Statement (DHCS 6207) as part of a complete application package for enrollment, continued enrollment, or certification as a Medi-Cal provider.

Important:

•FOR NEW APPLICANTS: Failure to disclose complete and accurate information may result in a denial of enrollment and imposition of a three-year reapplication bar.

•FOR CURRENTLY ENROLLED APPLICANTS: Failure to disclose complete and accurate information may result in denial, deactivation of all business addresses and the imposition of a three-year reapplication bar.

The Department is required to report the termination of your participation in the Medi-Cal Program to the Centers for Medicare and Medicaid Services and to other States’ Medicaid and Children’s Health Insurance Programs pursuant to United States Code, Title 42, Sections 1396a(kk)(6) and 1902(kk)(6) and the Code of Federal Regulations, Title 42, Section 1002.3(b).

•Submitting a complete and accurate Medi-Cal Disclosure Statement is required.

•Read all instructions when completing the Medi-Cal Disclosure Statement.

•Type or print clearly in ink.

•DO NOT USE staples on this form or on any attachments.

•If applicant/provider must make corrections, please line through, date, and initial in ink. Do not use correction fluid.

•Return this completed statement with the complete application package to the address listed on the application form.

Overall Authority: Code of Federal Regulations, Title 42, Part 455; California Code of Regulations, Title 22, Sections 51000–51451; Welfare and Institutions Code, Sections 14043–14043.75

Section I: Applicant/Provider Information

1. All applicants and providers must complete this Section unless they are eligible to use the “Medi-Cal Rendering Provider Application/Disclosure Statement/Agreement for Physician/Allied/Dental Providers” (DHCS 6216) or the “Medi-Cal Ordering/Referring/Prescribing Provider Application/Agreement/Disclosure Statement for Physician and Non-Physician Practitioners” (DHCS 6219).

Do not leave any questions, boxes, lines, etc., blank. Check or write “N/A” if not applicable to you.

If you must correct an entry, the applicant or provider must initial and date the correction in ink.

Do not use a pencil, correction tape, correction fluid, highlighter pen, etc. on this form.

DO NOT USE staples on this form or on any attachments.

•

•

•

•

• To review the Title 22 provider enrollment regulations, please visit the Medi-Cal Website (www.medi-cal.ca.gov) and click the “Provider Enrollment” link. It is the responsibility of the applicant/provider to comply with all regulations pertaining to Medi- Cal.

GENERAL INSTRUCTIONS FOR COMPLETING THE MEDI-CAL DISCLOSURE STATEMENT

2.Rendering providers joining a group who are not eligible to use the “Medi-Cal Rendering Provider Application/Disclosure Statement/Agreement for Physician/Allied/Dental Providers” may leave parts E–H blank if part D is checked.

3.If applicant leases the location where services are being rendered or provided, please attach a copy of a current signed lease agreement.

4.In California, a domestic or foreign limited liability company is not permitted to render professional services, as defined in Corporations Code Sections 13401, subdivision (a) and 13401.3. See California Corporations Code Section 17375.

Section II: Unincorporated Sole-Proprietor or Individual Rendering Provider Adding to a Group Disclosure of social security number is mandatory. (See Privacy Statement at bottom of page 15)

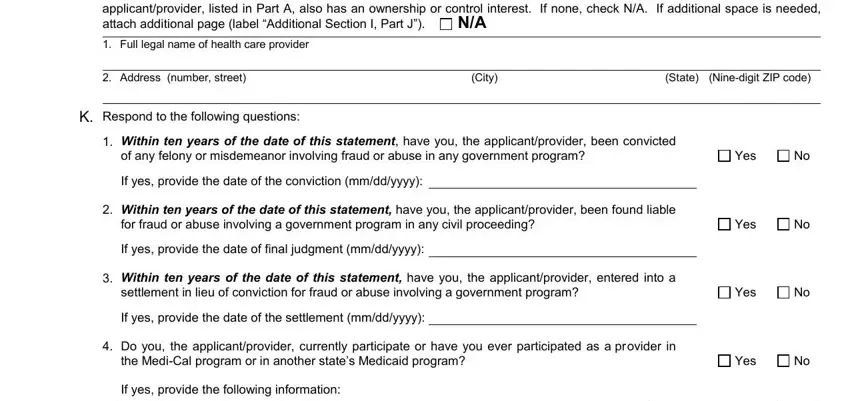

Section III: Ownership Interest and/or Managing Control Information (Entities)

1.To determine percentage of ownership, mortgage, deed of trust, note or other obligation, the percentage of interest owned in the obligation is multiplied by the percentage of the disclosing entity’s assets used to secure the obligation. For example, if A owns 10 percent of a note secured by 60 percent of the applicant’s or provider’s assets, A’s interest in the provider’s assets equates to 6 percent and shall be reported pursuant to California Code of Regulations, Title 22, Section 51000.35. Conversely, if B owns 40 percent of a note secured by 10 percent of the applicant’s or provider’s assets, B’s interest in the provider’s assets equates to 4 percent and need not be reported.

2.“Indirect ownership interest” means an ownership interest in any entity that has an ownership interest in the applicant or provider. This term includes an ownership interest in any entity that has an indirect ownership interest in the applicant or provider. The amount of indirect ownership interest is determined by multiplying the percentages of ownership in each entity. For example, if A owns 10 percent of the stock in a corporation which owns 80 percent of the stock of the applicant or provider, A’s interest equates to an 8 percent indirect ownership interest in the applicant or provider and s hall be reported pursuant to California Code of Regulations, Title 22, Section 51000.35. Conversely, if B owns 80 percent of the stock of a corporation, which owns 5 percent of the stock of the applicant or provider, B’s interest equates to a 4 percent indirect ownership interest in the applicant or provider and need not be reported.

3.“Ownership interest” means the possession of equity in the capital, the stock, or the profits of the applicant or provider.

4.All entities with managing control of applicant/provider must be listed in this Section.

5.List the National Provider Identifier (NPI) of each listed corporation, unincorporated association, partnership, or similar entity having 5% or more (direct or indirect) ownership or control interest, or any partnership interest, in the applicant/provider identified in Section I.

6.Corporations with ownership or control interest in the applicant or provider must provide all corporate business addresses and the corporation Taxpayer Identification Number issued by the IRS. For verification, a legible copy of the IRS Form 941, Form 8109-C, Letter 147-C, or Form SS-4 (Confirmation Notification) must be included.

Section IV: Ownership Interest and/or Managing Control Information (Individuals)

1.Refer to Section III instructions and definitions.

2.“Person with an ownership or control interest” means a person that:

a.Has an ownership interest of 5 percent or more in an applicant or provider;

b.Has an indirect ownership interest equal to 5 percent;

c.Has a combination of direct and indirect ownership interest equal to 5 percent or more in an applicant or provider;

d.Owns an interest of 5 percent or more in any mortgage, deed of trust, note, or other obligation secured by the applicant or provider if that interest equals at least 5 percent of the value of the property or assets of the applicant or provider;

e.Is an officer or director of an applicant or provider that is organized as a corporation;

f.Is a partner in an applicant or provider that is organized as a partnership.

3. “Agent” means a person who has been delegated the authority to obligate or act on behalf of an applicant or provider.

4. “Managing employee” means a general manager, business manager, administrator, director, or other individual who exercises operational or managerial control over, or who directly or indirectly conducts the day-to-day operation of an applicant or provider. All managing employees must be included in this section.

5.List the National Provider Identifier (NPI) of each individual with ownership or control interest or any partnership interest, in the applicant/provider identified in Section I. In addition, all officers of the corporation, directors, agents and managing employees of the applicant/provider must be reported in this section.

6.Disclosure of social security number is mandatory. (See Privacy Statement at bottom of page 15)

Section V: Subcontractor and Significant Business Transactions

1.“Subcontractor” means an individual, agency, or organization:

a.To which an applicant or provider has contracted or delegated some of its management functions or responsibilities of providing healthcare services, equipment, or supplies to its patients.

b.With whom an applicant or provider has entered into a contract, agreement, purchase order, lease, or leases of real property, to obtain space, supplies, equipment, or services provided under the Medi-Cal Program.

2.“Significant business transaction” means any business transaction or series of transactions that involve health care services, goods, supplies, or merchandise related to the provision of services to Medi-Cal beneficiaries that, during any one fiscal year, exceed the lesser of $25,000 or 5 percent of an applicant’s or provider’s total operating expenses.

Section VI: Incontinence Supplies

1.Applicant or provider must check “Yes” or “No.”

2.If “Yes,” complete A–C.

Section VII: Pharmacy Applicants or Providers

All pharmacy applicants or providers must complete this Section.

Section VIII: Declaration and Signature Page

1.All applicants or providers must complete this Section.

2.Legal name of applicant/provider must match name listed on associated application package.

3.The signature must be an individual who is the sole proprietor, partner, corporate officer, or an official representative of a governmental entity or nonprofit organization who has the authority to legally bind the applicant or provider. See Title 22, CCR Section 51000.30(a)(2)(B).

4.An original signature is required. Stamped, faxed, and/or photocopied signatures are not acceptable.

5.Disclosure Statement must be notarized by a Notary Public except for those applicants and providers licensed pursuant to Business and Professions Code, Division 2, beginning with Section 500. For example: Physicians, Pharmacy providers, Chiropractors, Osteopaths, Certified Nurse Midwives, Nurse Practitioners and Dentists do not need to notarize this form. Durable Medical Equipment (DME) providers, Prosthetics, Orthotics, Medical Transportation providers, etc., must notarize this form.

FOR MORE INFORMATION, PLEASE VISIT THE MEDI-CAL WEBSITE (WWW.MEDI-CAL.CA.GOV)

AND CLICK THE “PROVIDER ENROLLMENT” LINK.

DHCS 6207 (Rev. 7/14) |

iii |

State of California—Health and Human Services Agency |

Department of Health Care Services |

MEDI-CAL DISCLOSURE STATEMENT

Do not leave any questions, boxes, lines, etc., blank. Check or enter N/A if not applicable to you.

I.APPLICANT/PROVIDER INFORMATION

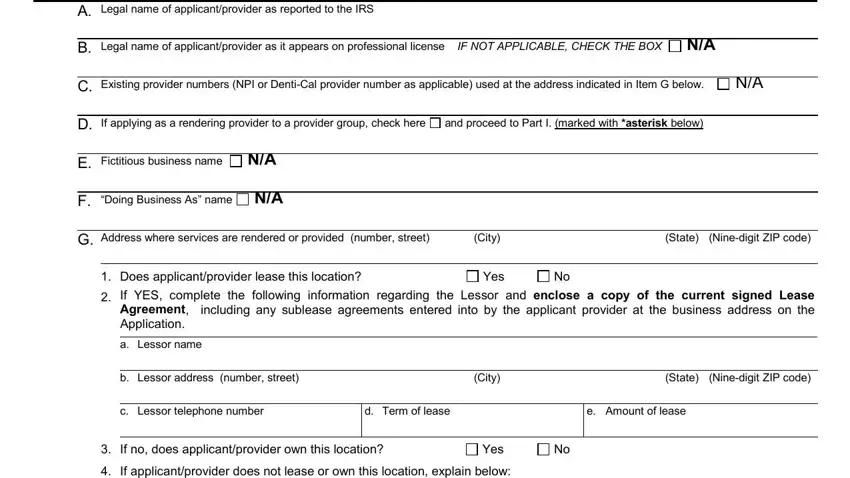

A. Legal name of applicant/provider as reported to the IRS

B. Legal name of applicant/provider as it appears on professional license |

IF NOT APPLICABLE, CHECK THE BOX |

N/A |

C. Existing provider numbers (NPI or Denti-Cal provider number as applicable) used at the address indicated in Item G below. |

N/A |

D. If applying as a rendering provider to a provider group, check here |

and proceed to Part I. (marked with *asterisk below) |

|

|

|

|

|

|

|

|

E. Fictitious business name |

N/A |

|

|

|

|

|

|

|

|

|

|

|

F. “Doing Business As” name |

N/A |

|

|

|

|

|

|

|

|

|

|

G. Address where services are rendered or provided (number, street) |

(City) |

|

(State) |

(Nine-digit ZIP code) |

|

|

|

|

|

|

|

1. Does applicant/provider lease this location? |

Yes |

No |

|

|

2.If YES, complete the following information regarding the Lessor and enclose a copy of the current signed Lease Agreement, including any sublease agreements entered into by the applicant provider at the business address on the Application.

a. Lessor name

b. Lessor address (number, street) |

(City) |

(State) (Nine-digit ZIP code) |

c. Lessor telephone number

3. If no, does applicant/provider own this location? |

Yes |

No |

4. If applicant/provider does not lease or own this location, explain below:

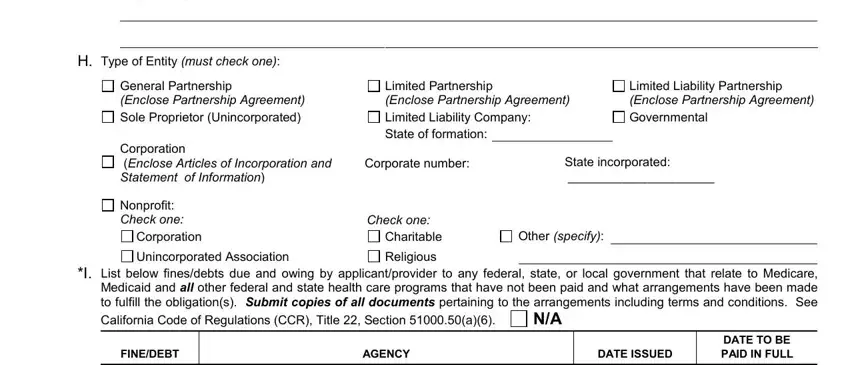

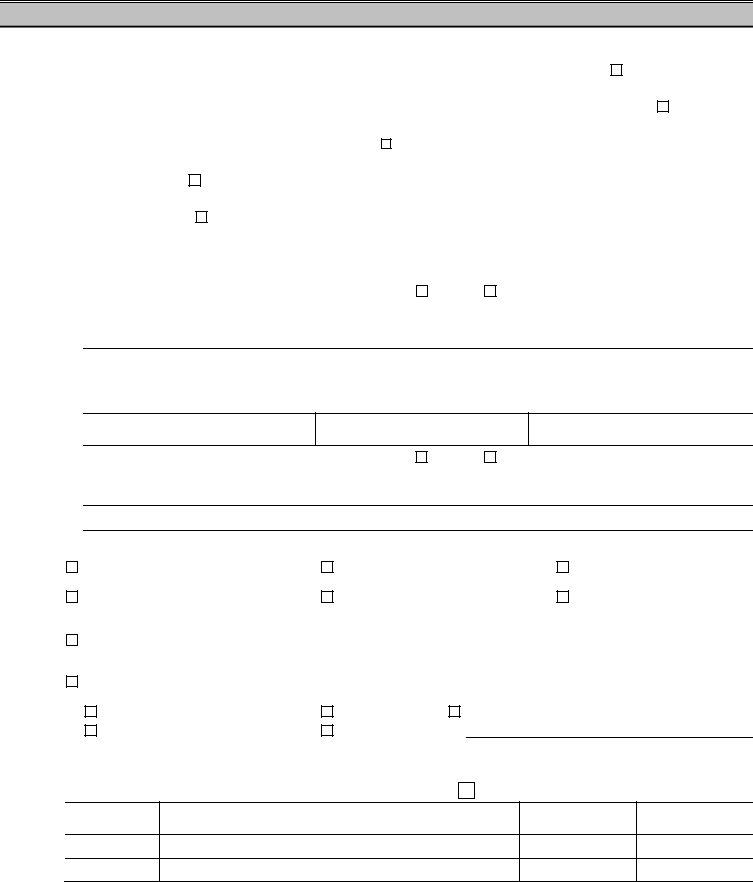

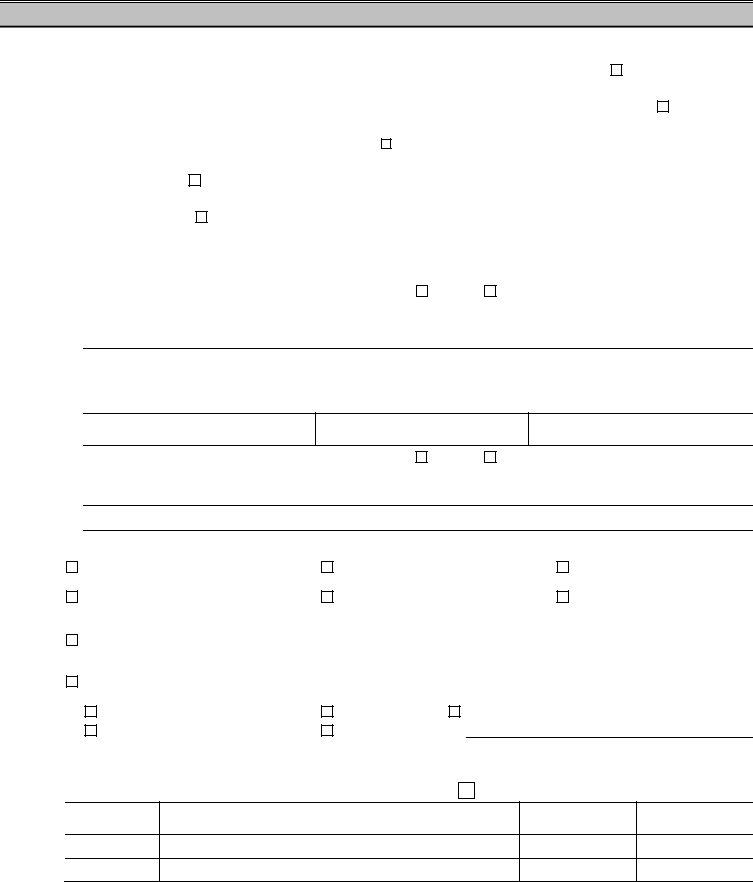

H.Type of Entity (must check one):

General Partnership |

Limited Partnership |

|

|

|

Limited Liability Partnership |

(Enclose Partnership Agreement) |

(Enclose Partnership Agreement) |

(Enclose Partnership Agreement) |

Sole Proprietor (Unincorporated) |

Limited Liability Company: |

|

|

Governmental |

Corporation |

State of formation: |

|

|

|

|

|

|

|

|

State incorporated: |

(Enclose Articles of Incorporation and |

Corporate number: |

|

Statement of Information) |

|

|

|

_____________________ |

Nonprofit: |

|

|

|

|

|

|

Check one: |

Check one: |

|

|

|

|

Corporation |

Charitable |

Other (specify): |

|

Unincorporated Association |

Religious |

|

|

|

|

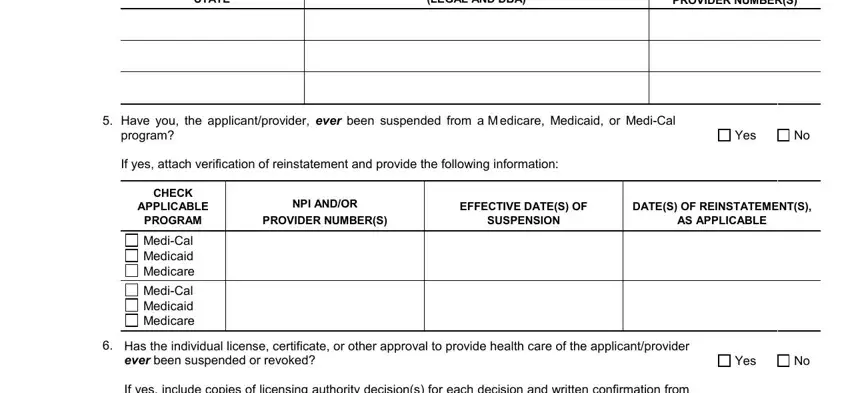

*I. List below fines/debts due and owing by applicant/provider to any federal, state, or local government that relate to Medicare, Medicaid and all other federal and state health care programs that have not been paid and what arrangements have been made to fulfill the obligation(s). Submit copies of all documents pertaining to the arrangements including terms and conditions. See

California Code of Regulations (CCR), Title 22, Section 51000.50(a)(6).

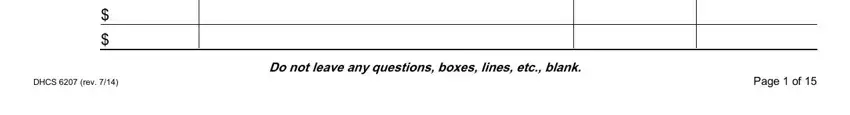

Do not leave any questions, boxes, lines, etc., blank.

DHCS 6207 (rev. 7/14) |

Page 1 of 15 |