Using PDF forms online is always simple using our PDF editor. Anyone can fill in 109 form here in a matter of minutes. Our editor is constantly evolving to provide the very best user experience possible, and that is thanks to our dedication to continuous improvement and listening closely to feedback from customers. In case you are looking to start, this is what it takes:

Step 1: Firstly, access the pdf tool by pressing the "Get Form Button" at the top of this site.

Step 2: This editor provides you with the ability to work with PDF documents in many different ways. Enhance it by writing your own text, adjust what is originally in the file, and put in a signature - all possible in minutes!

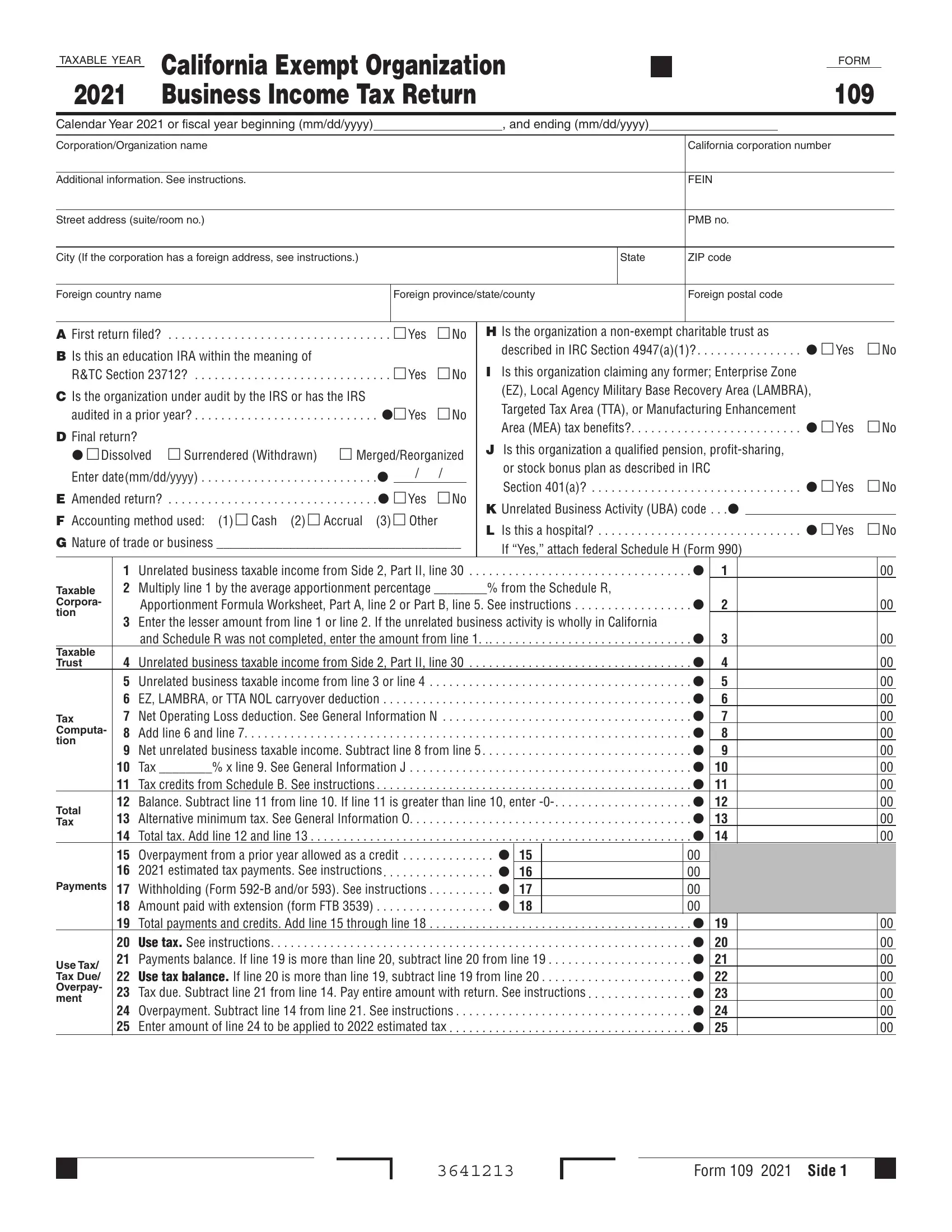

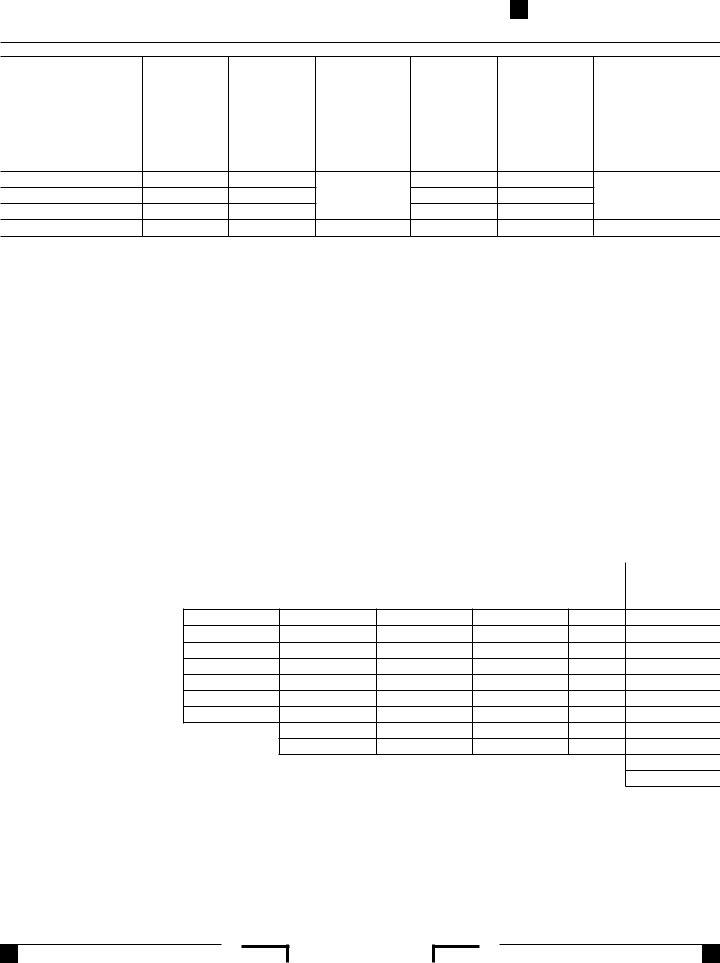

As for the blank fields of this precise form, here is what you should consider:

1. Fill out your 109 form with a group of major fields. Get all of the information you need and ensure there is nothing forgotten!

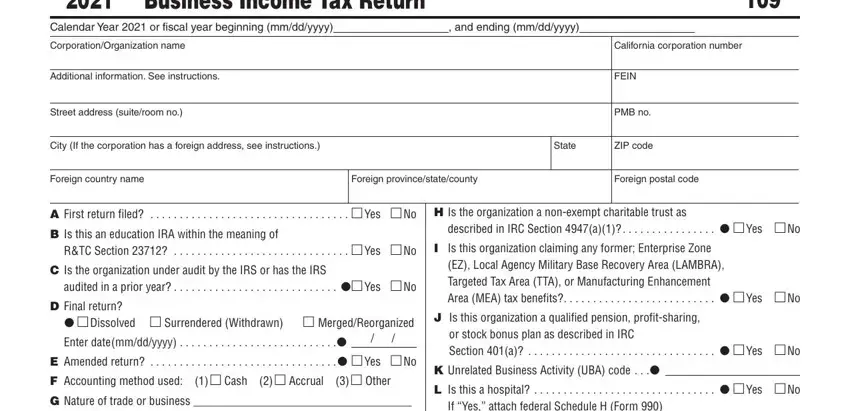

2. After this part is completed, you're ready to include the essential specifics in If Yes attach federal Schedule H, Taxable Corpora tion, Taxable Trust, Tax Computa tion, Total Tax, Payments, Use Tax Tax Due Overpay ment, Unrelated business taxable income, from the Schedule R, Apportionment Formula Worksheet, Enter the lesser amount from line, x line See General Information J, and Schedule R was not completed, Unrelated business taxable income, and Tax Tax credits from Schedule B allowing you to move forward further.

It is possible to make errors while filling out your Use Tax Tax Due Overpay ment, and so you'll want to look again before you decide to finalize the form.

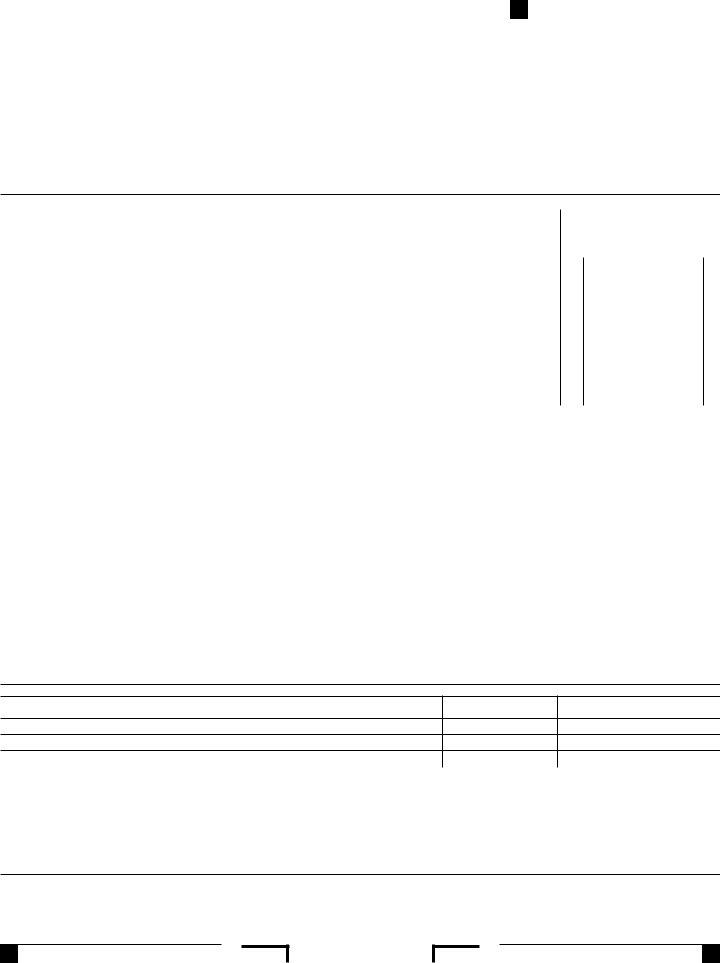

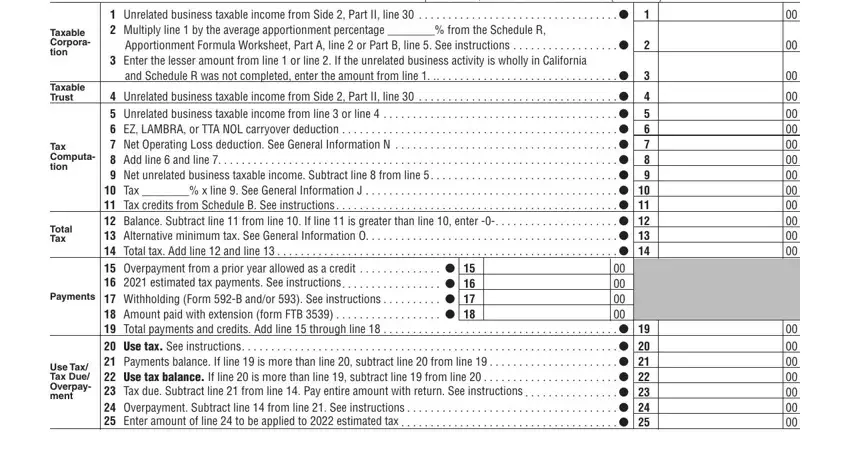

3. This third stage is going to be simple - fill out all the fields in Refund or Amount Due, Refund If line is less than line, a Fill in the account information, a , c Account Number, Savings, Penalties and interest See, Check if estimate penalty computed, Unrelated Business Taxable Income, a Gross receipts or gross sales , c , b Net gain loss from Part II, b Less returns and allowances, c Balance, and Income or loss from partnerships in order to complete this process.

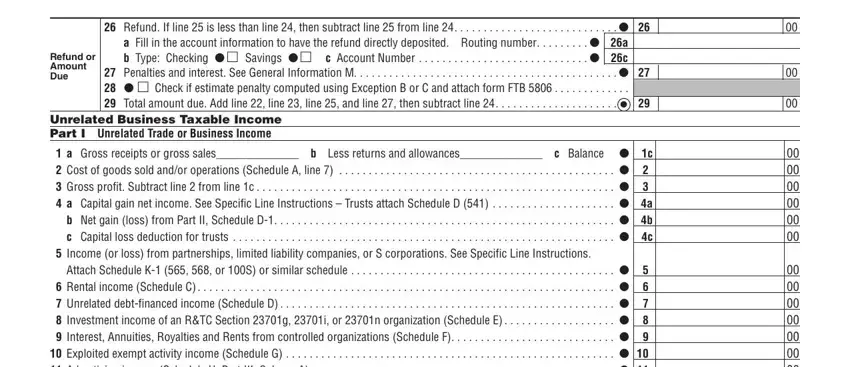

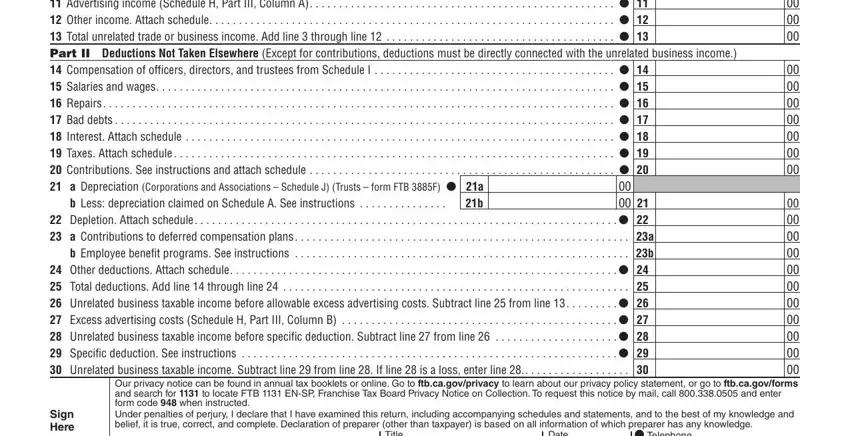

4. You're ready to start working on this fourth part! In this case you will get these Exploited exempt activity income, a b, b Less depreciation claimed on, Depletion Attach schedule a, , Our privacy notice can, Sign Here, Title, Date, and Telephone blank fields to complete.

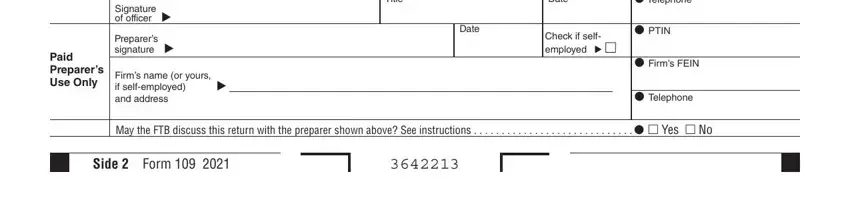

5. Because you come close to the conclusion of your form, you'll notice several more requirements that should be met. Mainly, Paid Preparers Use Only, Signature of officer, Preparers signature, Title, Date, Date, Check if self employed, Firms name or yours if, Telephone, PTIN, Firms FEIN, Telephone, May the FTB discuss this return, Yes, and Side Form must be done.

Step 3: Reread what you have inserted in the form fields and then hit the "Done" button. Get your 109 form as soon as you sign up for a 7-day free trial. Instantly access the pdf inside your personal cabinet, together with any modifications and adjustments being automatically preserved! At FormsPal.com, we do our utmost to be certain that your details are maintained secure.