|

General Information |

The FTB may request documentation to |

residence is made, on a timely filed original |

|

A |

Purpose |

ensure the parties have complied with the |

return. If the available credit exceeds the |

|

requirements of the credit under Revenue and |

current year net tax, the unused credit may not |

|

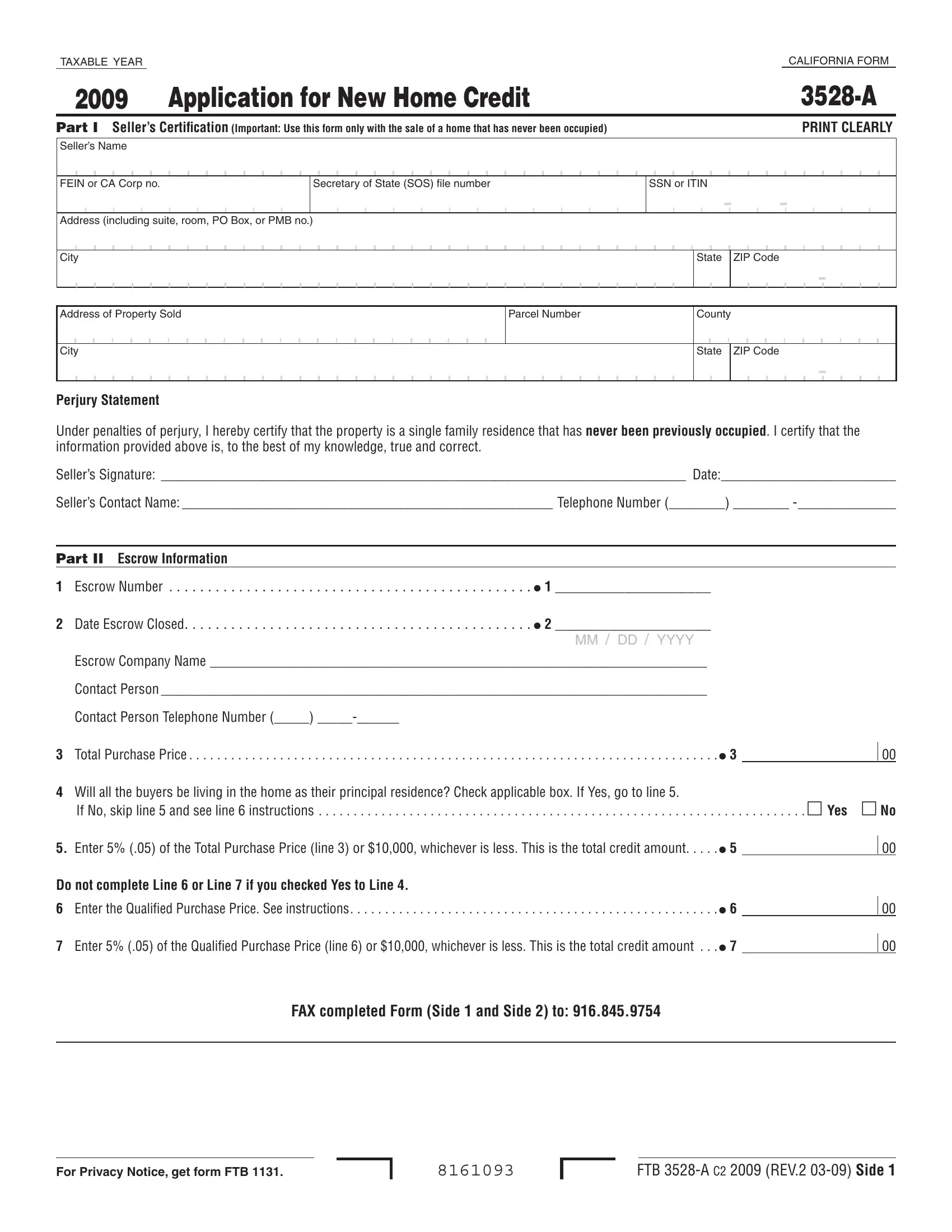

Use form FTB 3528-A, Application for New |

Taxation Code (R&TC) Section 17059. |

be carried over to the following year. |

|

Home Credit, if you are a seller of a new home |

The credit must be apportioned equally for |

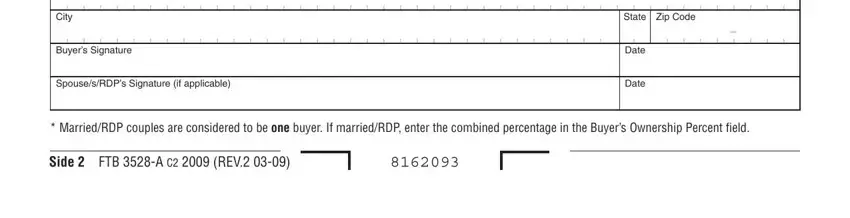

F Filing Form FTB 3528-A |

|

which has never been occupied and are selling |

|

two married taxpayers filing separate tax |

The escrow person will FAX a copy of the form |

|

to any individual who purchases the residence |

returns, even if their ownership percentage |

|

on or after March 1, 2009, and before March 1, |

is not equal. For two or more taxpayers who |

FTB 3528-A to the FTB and send one copy to |

|

2010. The seller must first complete Part I of |

are not married, the credit shall be allocated |

the buyer within one week after the close of |

|

form FTB 3528-A, certifying that the home |

among the taxpayers who will occupy the |

escrow. If a seller has several buyers, send |

|

has never been occupied, and provide a copy |

home as their principal residence using their |

only one application per FAX. |

|

to the buyer or escrow person. The buyer will |

percentage of ownership in the property. The |

Do not mail the form. |

|

complete the rest of form FTB 3528-A. The |

total amount of the credits allocated to all of |

FTB’s FAX Number is 916.845.9754 |

|

escrow person will FAX the completed form |

these taxpayers shall not exceed ten thousand |

The FAX number will be disconnected once the |

|

FTB 3528-A to the Franchise Tax Board (FTB) |

dollars ($10,000). |

|

$100,000,000 total allocation amount has been |

|

within one week of the close of escrow, at |

C |

Definitions |

|

reached. Do not use any other FAX number. |

|

916.845.9754, and provide a copy to the buyer. |

|

The copy received from the seller or escrow |

A “qualified principal residence” means a |

Applications sent to any other FTB FAX number |

|

will not be be processed. |

|

person does not constitute an allocation of |

single-family residence, whether detached or |

|

We will post a notice on our website at |

|

the credit to the Buyer; instead the Buyer will |

attached, that has never been occupied and |

|

receive confirmation from the FTB certifying |

is purchased to be the principal residence of |

ftb.ca.gov when the credit has been fully |

|

the allocation of tax credit. The Buyer cannot |

the taxpayer for a minimum of two years and |

allocated. |

|

claim this credit unless they receive an |

is eligible for the property tax homeowner’s |

For more information, contact Withholding |

|

allocation of the credit from the FTB. |

exemption. |

Services and Compliance at: |

|

Upon receipt of form FTB 3528-A, the FTB will |

• Types of residence: Any of the following can |

888.792.4900 |

|

allocate the credit on a first-come first-served |

|

qualify if it is your principal residence and |

916.845.4900 (not toll-free) |

|

basis. The total amount of credit that may |

|

is subject to property tax, whether real or |

|

|

be allocated by the FTB must not exceed one |

|

personal property: a single family residence, |

Specific Instructions |

|

hundred million dollars ($100,000,000). |

|

a condominium, a unit in a cooperative |

|

|

|

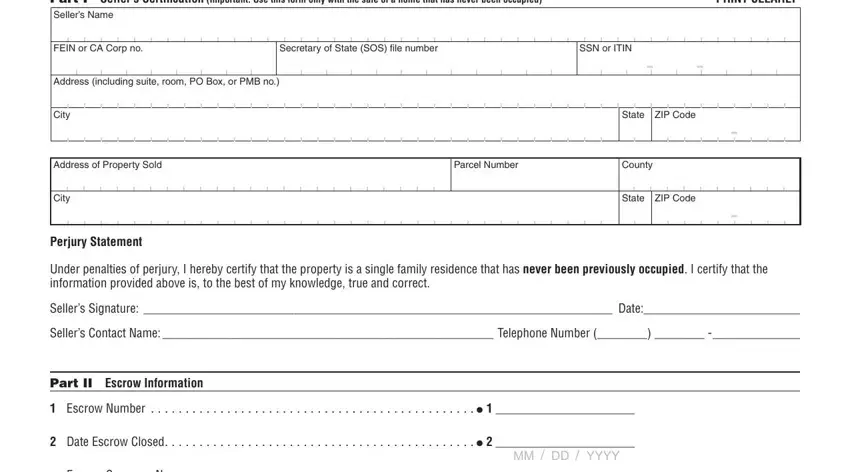

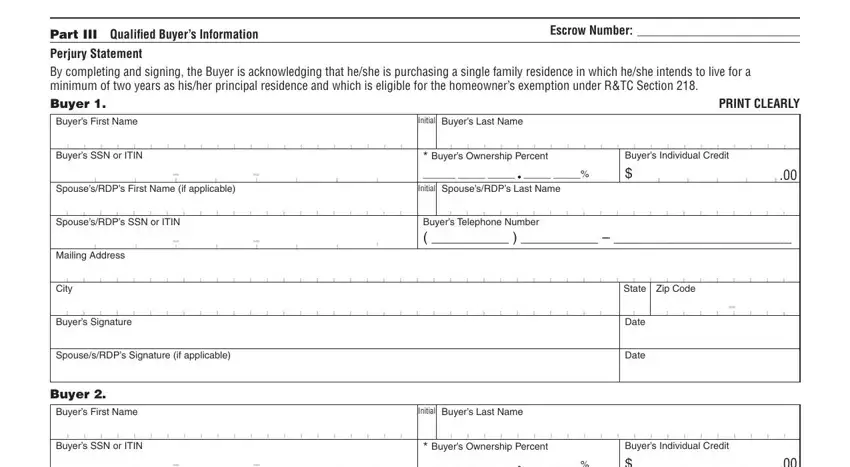

Part I – Seller’s Certification |

|

Registered Domestic Partner – For purposes |

|

project, a houseboat, a manufactured home, |

|

|

or a mobile home. |

Enter the name, address, and identification |

|

of California income tax, references to a |

|

|

• Owner-built property: A home constructed |

|

spouse, a husband, or a wife also refer to a |

number of the seller. If the seller is an |

|

California Registered Domestic Partner (RDP), |

|

by an owner-taxpayer is not eligible for the |

individual, enter the SSN or ITIN. If the seller |

|

unless otherwise specified. |

|

New Home Credit because the home has not |

is a corporation or partnership, enter the FEIN |

|

Round Cents to Dollars – Round cents to the |

|

been “purchased.” |

or CA Corporation number. If the seller is a |

|

“One week” means a 7 calendar day period. We |

Limited Liability Company (LLC), enter the |

|

nearest whole dollar. For example, round $50.50 |

|

Secretary of State (SOS) file number. Include |

|

up to $51 or round $25.49 down to $25. |

will count the day after escrow closes as the |

|

the Private Mail Box (PMB) in the address |

|

|

|

first full day. |

|

B |

Qualifications |

field. Write “PMB” first, then the box number. |

|

Example: Escrow closes March 1, 2009. We |

|

California allows a credit against net tax equal |

Example: 111 Main Street PMB 123. |

|

will accept an application filed March 1, 2009 |

|

Enter the address of the property sold, |

|

to the lesser of 5% (.05) of the purchase |

through March 8, 2009. |

|

price of the qualified principal residence or ten |

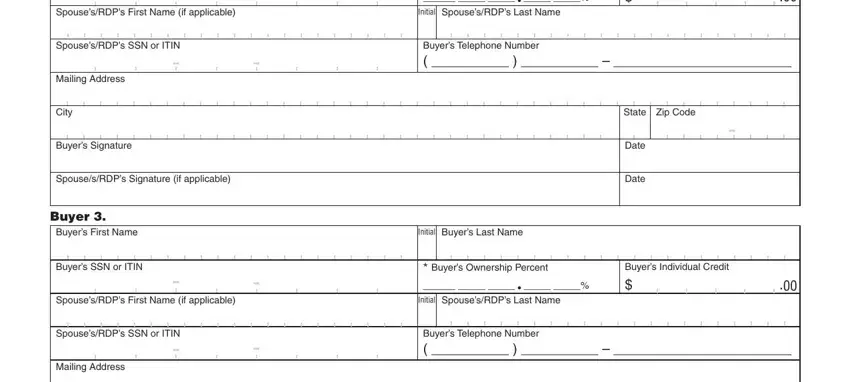

A “qualified buyer” is an individual who |

including parcel number and county. |

|

thousand dollars ($10,000). |

Complete the Seller’s Certification, sign and date. |

|

purchases a single-family residence, whether |

|

The credit shall be: |

|

|

detached or attached, and intends to live in the |

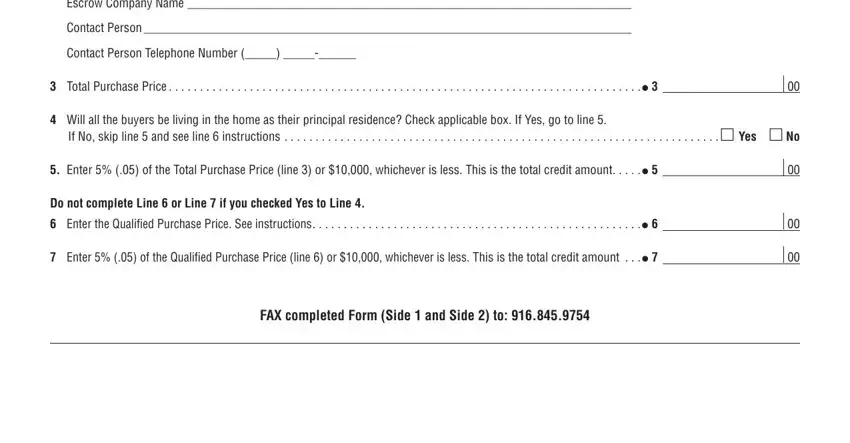

Part II – Escrow Information |

|

|

|

|

• |

Allocated for the purchase of only one |

qualified principal residence for a minimum of |

Line 1 – Escrow Number |

|

|

qualified principal residence with respect to |

two years. |

|

|

Enter the escrow number for the property |

|

|

any taxpayer. |

“Total purchase price” is the price before |

|

|

purchased, if any. |

|

• Claimed only on a timely filed return, |

reduction of ownership percentage. |

|

Line 2 – Date Escrow Closed |

|

|

including returns filed on extension. |

“Qualified purchase price” is the price after |

|

• |

Applied in equal amounts over the three |

Enter the date escrow closed. Complete the |

|

reduction of the non-qualifed buyers ownership |

|

|

successive taxable years beginning with |

escrow information including the escrow |

|

|

percentage. |

|

|

the taxable year in which the purchase of |

company name, contact person, and telephone |

|

|

“Purchase date” is the date escrow closes. |

|

|

the qualified principal residence is made |

number. |

|

|

(maximum of $3,333 per year.) |

D |

Limitations |

Line 3 – Total Purchase Price |

|

The credit will not be allocated: |

The credit cannot reduce regular tax below |

Enter the total purchase price of the property. |

|

|

|

If there is more than one buyer, this amount is |

|

• |

If the residence has been previously |

the tentative minimum tax (TMT). This credit |

|

the total paid by all buyers. |

|

|

occupied. |

cannot be carried over. |

|

|

Line 4 |

|

• If the taxpayer does not intend to take |

This credit is nonrefundable. |

|

|

occupancy of the principal residence for at |

Check whether all of the buyers will be living |

|

|

|

|

|

|

least two years immediately following the |

E |

Claiming the Credit |

in the home as their principal residence. |

|

|

purchase. |

The credit is applied against the net tax in equal |

Disregard any buyers on title for incidental |

|

• If the application is not received within one |

purposes who do not have an ownership |

|

amounts (1/3 each year) over three successive |

|

|

week after the close of escrow. |

interest. Check the applicable box. If Yes, go to |

|

|

taxable years, beginning with the taxable year |