You can fill out California Form 3541 effortlessly by using our online editor for PDFs. Our development team is continuously endeavoring to develop the editor and insure that it is much easier for users with its many features. Enjoy an ever-evolving experience today! With just several easy steps, it is possible to begin your PDF editing:

Step 1: Hit the "Get Form" button above. It will open our pdf tool so you could begin filling out your form.

Step 2: The editor helps you change PDF forms in various ways. Enhance it by writing personalized text, adjust existing content, and include a signature - all within the reach of several mouse clicks!

With regards to the fields of this specific document, this is what you should do:

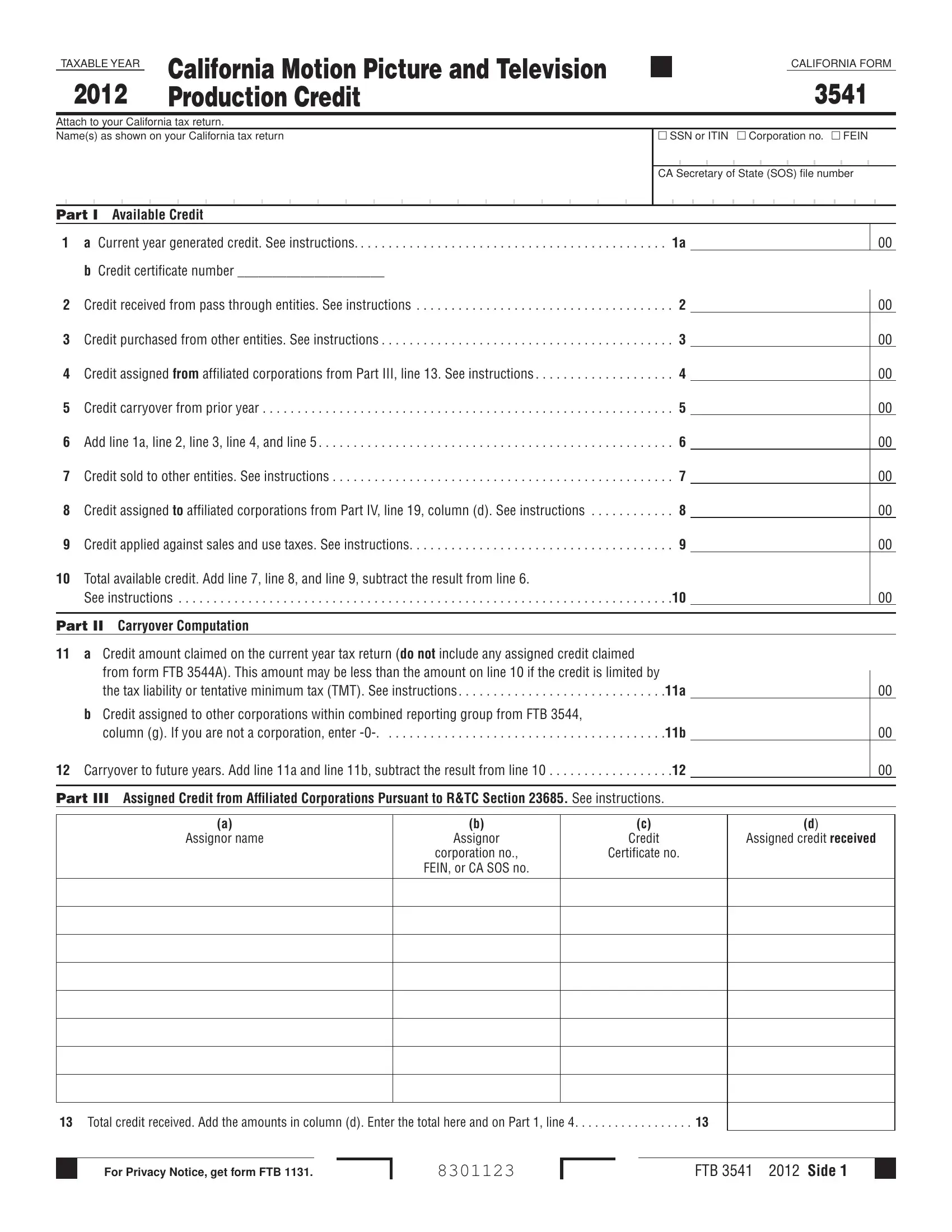

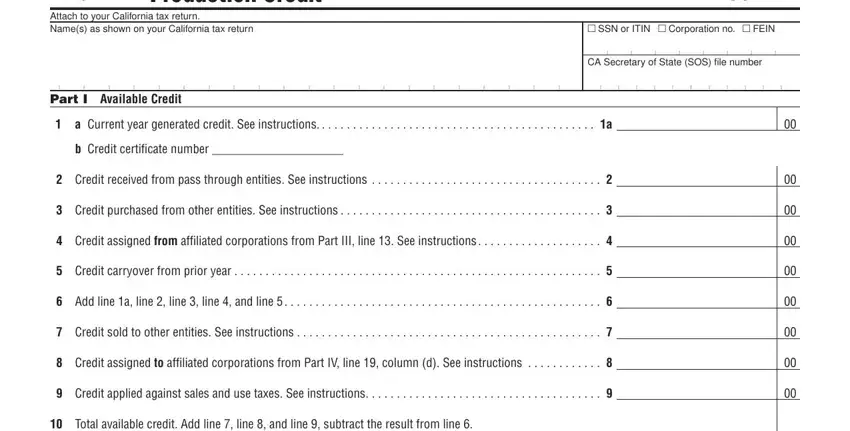

1. First of all, while filling out the California Form 3541, begin with the page that contains the subsequent fields:

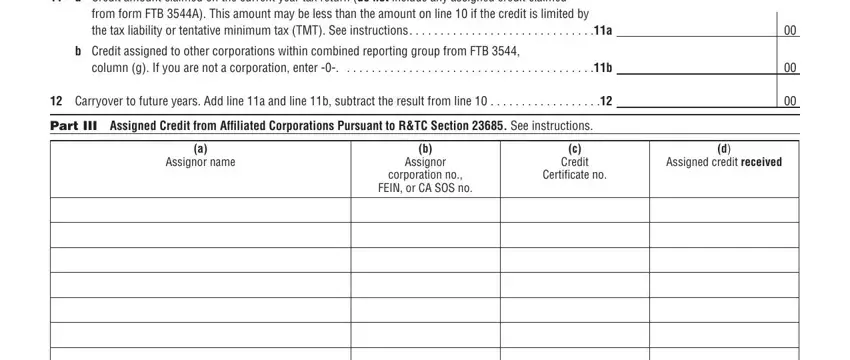

2. Right after filling out the previous section, go to the next step and fill out the essential particulars in these fields - Total available credit Add line , See instructions , Part II Carryover Computation, a Credit amount claimed on the, from form FTB A This amount may be, b Credit assigned to other, column g If you are not a, Carryover to future years Add, Part III Assigned Credit from, Assignor name, Assignor, corporation no FEIN or CA SOS no, Credit, Certificate no, and Assigned credit received.

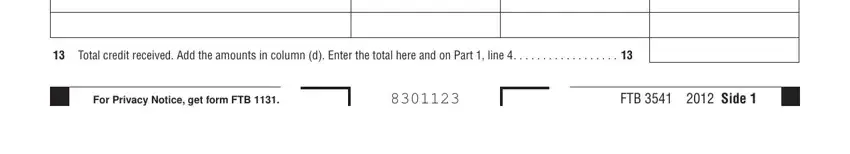

3. This next step is usually easy - complete all of the blanks in Total credit received Add the, For Privacy Notice get form FTB , and FTB Side in order to complete this segment.

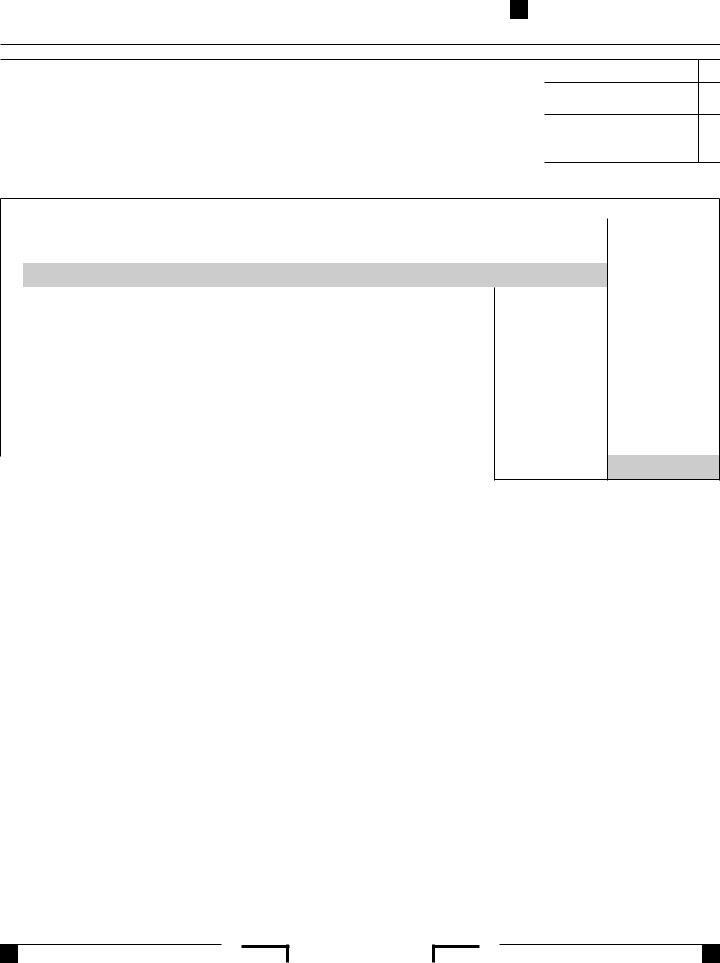

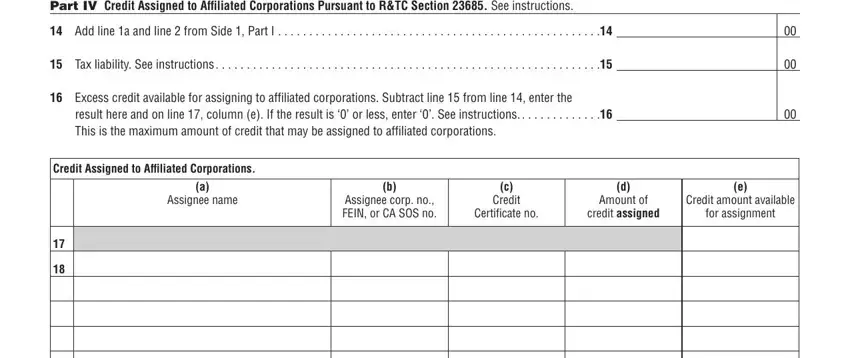

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part IV Credit Assigned to, Add line a and line from Side , Tax liability See instructions , Excess credit available for, result here and on line column e, Credit Assigned to Affiliated, Assignee name, Assignee corp no FEIN or CA SOS no, Credit, Certificate no, Amount of, credit assigned, Credit amount available, for assignment, and Add the amounts in column d Enter - to proceed further in your process!

Concerning Certificate no and Part IV Credit Assigned to, be certain that you get them right here. These two are thought to be the key fields in this form.

Step 3: Prior to moving forward, you should make sure that blanks are filled out the right way. When you are satisfied with it, click on “Done." Join FormsPal right now and easily access California Form 3541, ready for downloading. All adjustments made by you are saved , helping you to customize the form later on if required. FormsPal is devoted to the privacy of all our users; we ensure that all personal data put into our system continues to be secure.