Dealing with PDF forms online is actually quite easy using our PDF editor. Anyone can fill in LLPs here and try out various other options we provide. The editor is consistently updated by us, receiving new awesome functions and becoming better. With just several simple steps, you'll be able to start your PDF editing:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" at the top of this site.

Step 2: With the help of this advanced PDF editing tool, it is possible to do more than merely fill in blanks. Express yourself and make your docs appear sublime with customized text incorporated, or tweak the file's original content to perfection - all that backed up by an ability to insert your personal pictures and sign the PDF off.

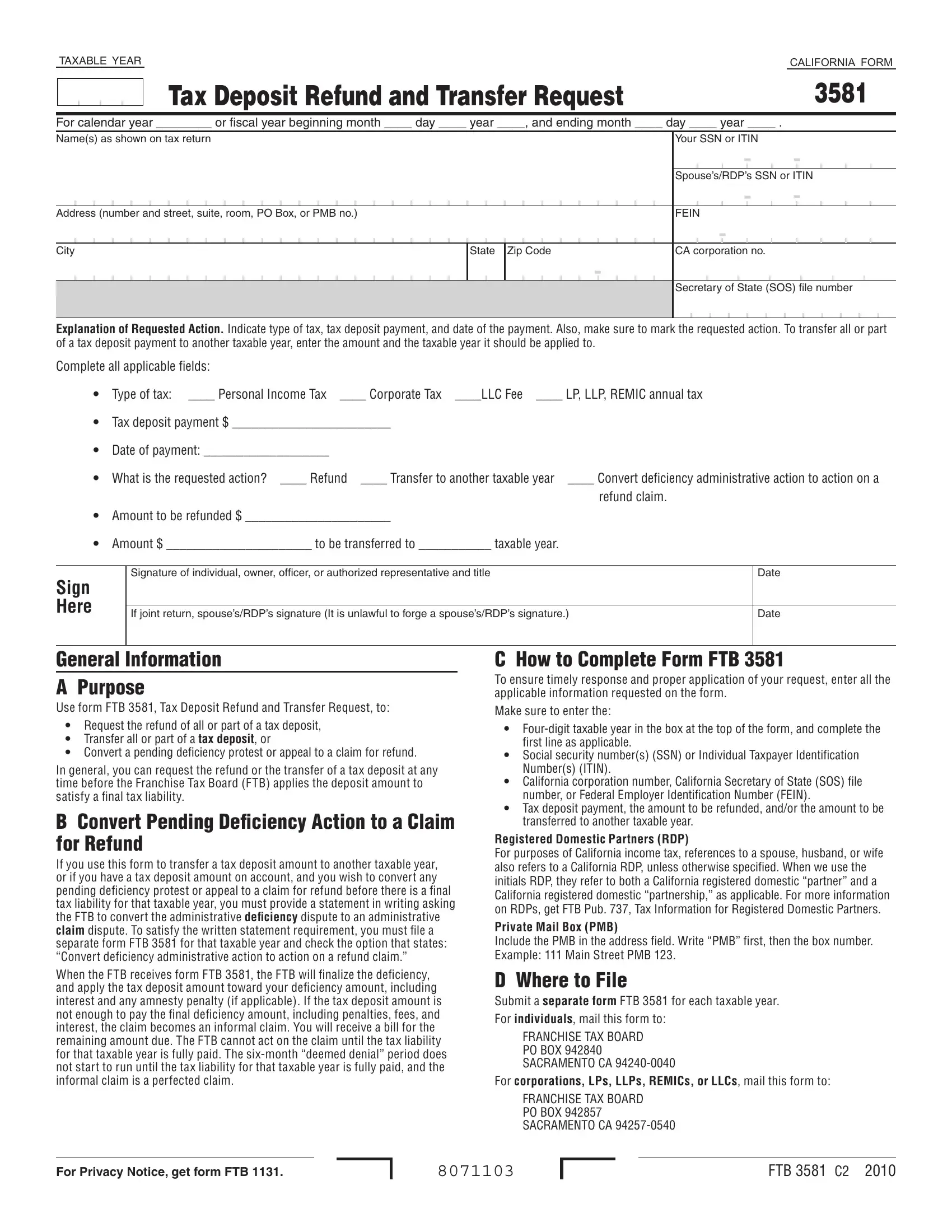

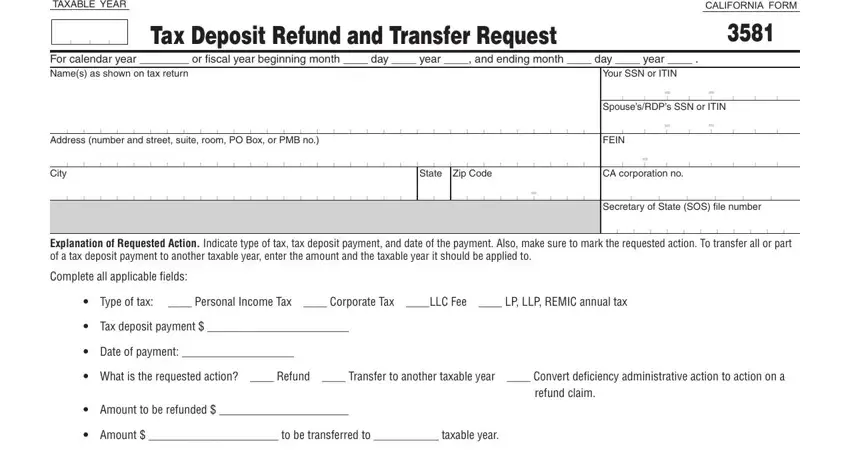

This form requires specific information to be filled out, hence ensure that you take your time to type in what is required:

1. You will want to fill out the LLPs correctly, hence be mindful when filling out the parts including these specific blank fields:

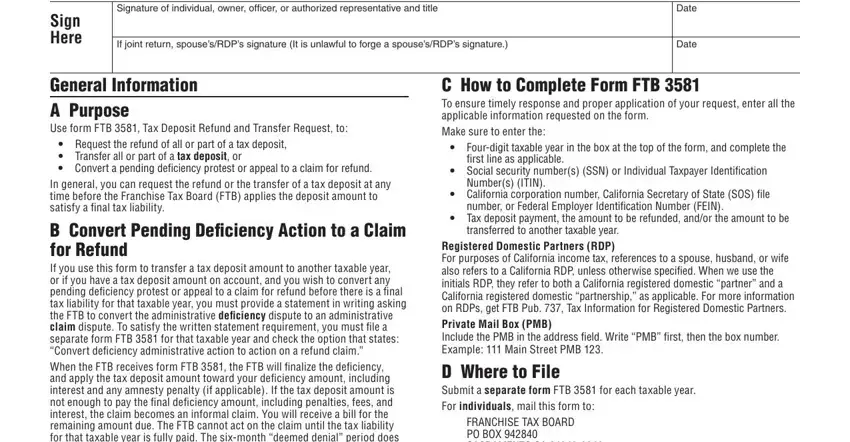

2. Soon after filling out the previous step, head on to the subsequent stage and fill in the essential particulars in these blank fields - Sign Here, Signature of individual owner, If joint return spousesRDPs, Date, Date, General Information A Purpose Use, Request the refund of all or part, In general you can request the, B Convert Pending Deficiency Action, C How to Complete Form FTB To, Fourdigit taxable year in the box, first line as applicable, Social security numbers SSN or, Numbers ITIN, and California corporation number.

As to General Information A Purpose Use and B Convert Pending Deficiency Action, be sure you double-check them in this current part. These two could be the most significant fields in the page.

Step 3: Proofread all the information you have entered into the blank fields and then click on the "Done" button. Try a 7-day free trial subscription at FormsPal and acquire immediate access to LLPs - accessible in your personal cabinet. We do not sell or share any details you type in when completing forms at FormsPal.