Any time you intend to fill out form 3588 vs 3522, you won't need to download and install any kind of programs - just try our PDF editor. The editor is constantly maintained by our team, receiving cool features and becoming better. It just takes a couple of basic steps:

Step 1: Access the PDF form inside our editor by pressing the "Get Form Button" in the top part of this page.

Step 2: The editor will give you the ability to work with your PDF in a range of ways. Enhance it by adding personalized text, correct what is originally in the file, and include a signature - all possible in minutes!

It is actually an easy task to complete the form using out helpful guide! This is what you must do:

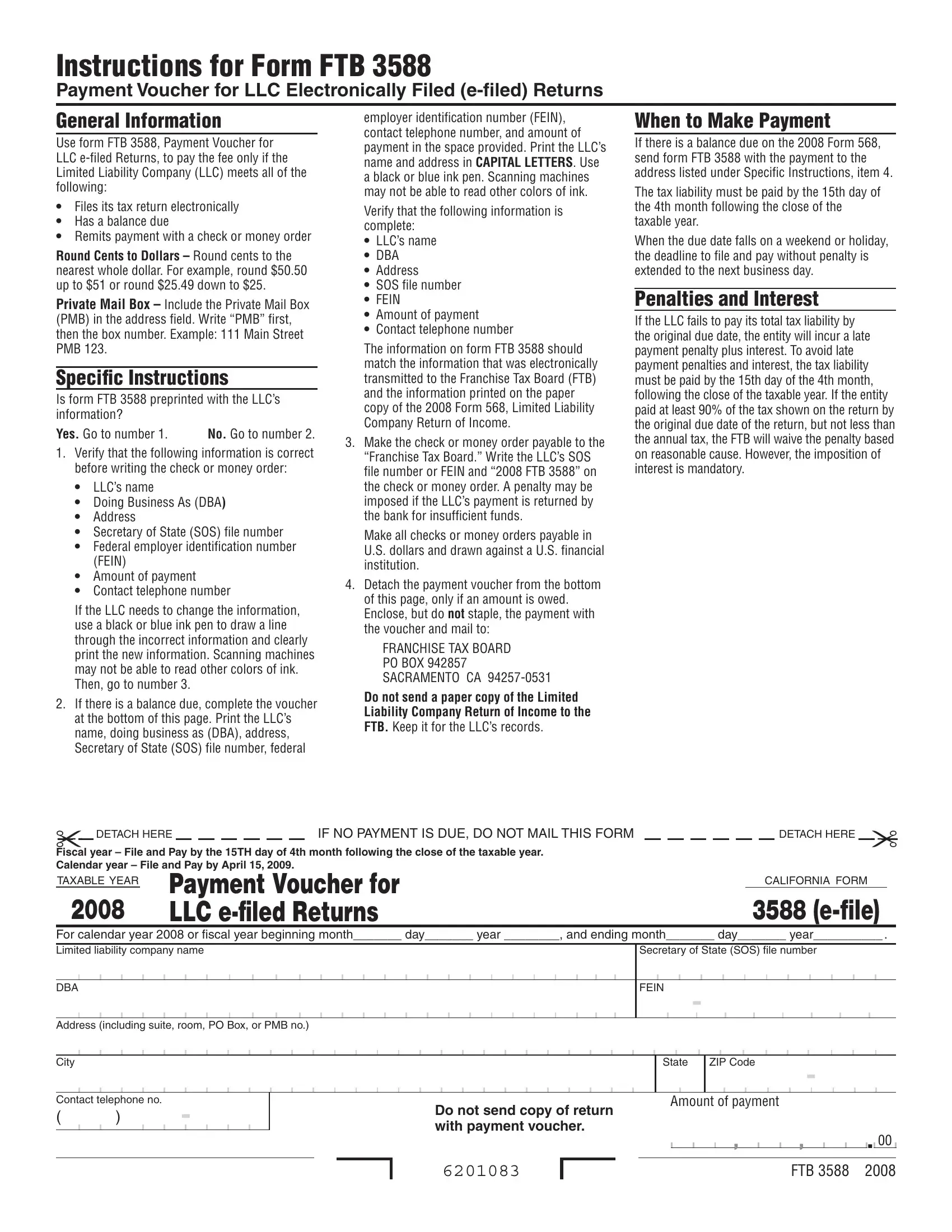

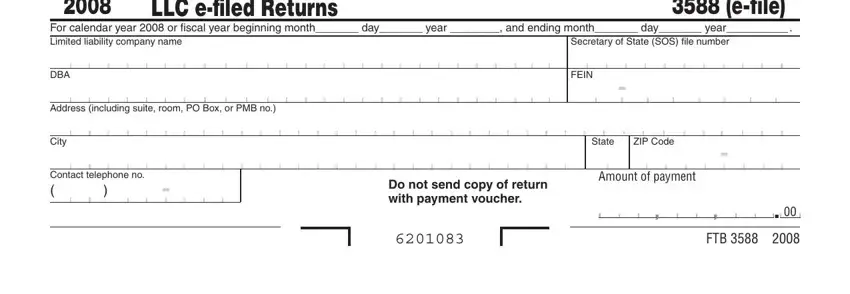

1. Complete your form 3588 vs 3522 with a selection of major fields. Collect all of the important information and make certain absolutely nothing is missed!

Step 3: Proofread all the details you have inserted in the form fields and click the "Done" button. After starting a7-day free trial account with us, it will be possible to download form 3588 vs 3522 or send it through email directly. The document will also be easily accessible in your personal account page with your every single edit. Here at FormsPal.com, we strive to ensure that all your details are kept protected.