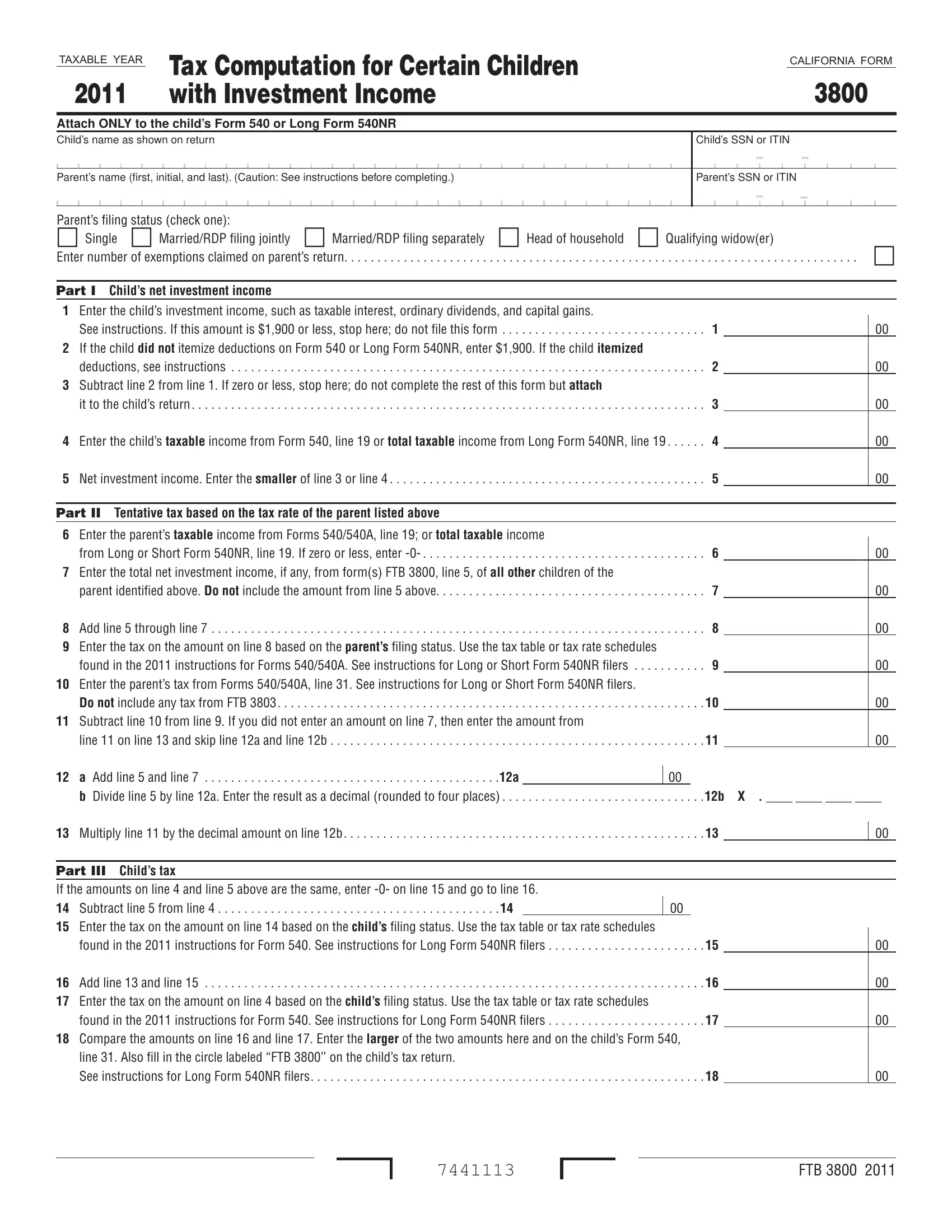

General Information

For taxable years beginning on or after January 1, 2010, California conforms to the provision of the Small Business and Work Opportunity Act of 2007 which increased the age of children to 18 and under or

a student under age 24 for elections made by parents reporting their child’s interest and dividends.

Registered Domestic Partners (RDP) – For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

Purpose

For certain children, investment income over $1,900 is taxed at the parent’s rate if the parent’s rate is higher. Use form FTB 3800, Tax Computation for Certain Children with Investment Income, to figure the child’s tax.

Complete form FTB 3800 if all of the following apply:

•The child is 18 and under or a student under age 24 at the end of 2011. A child born on January 1, 1994, is considered to be age 18 at the end of 2011. A child born on January 1, 1988, is considered to be age 24 at the end of 2011.

•The child had investment income taxable by California of more than $1,900.

•At least one of the child’s parents was alive at the end of 2011.

If the child uses form FTB 3800, file Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return.

If the child does not file form FTB 3800, figure the tax in the normal manner on the child’s Forms 540/540A, or Long or Short Form 540NR.

Parents of children 18 and under or a student under age 24 at the end of 2011, may elect to include the child’s investment income on the parent’s tax return. To make this election, the child must have had income only from interest and dividends. The election is not available if estimated tax payments were made in the child’s name. Get form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends, for more information. If parents make this election, the child will not have to file a California tax return or form FTB 3800.

If you elect to report your child’s income on your federal income tax return, but not on your California income tax return, be sure to make an adjustment on your Schedule CA (540 or 540NR), line 21f.

Specific Line Instructions

Parent’s Name and Social Security Number (SSN) or Individual Taxpayer Identiication Number (ITIN)

If federal Form 8615, Tax for Certain Children Who Have Investment Income of More Than $1,900, was filed with the child’s federal tax return, enter the name and SSN or ITIN of the same parent who was identified at the top of federal Form 8615.

If the child’s parents were married to each other or in an RDP and filed a joint 2011 California tax return, enter the name and SSN or ITIN of the parent who is listed first on the joint return.

If the parents were married or in an RDP but filed separate California tax returns, enter the name and SSN or ITIN of the parent with the higher taxable income.

If the parents were unmarried, treated as unmarried for tax purposes, or separated either by a divorce or separate maintenance decree, enter the name and SSN or ITIN of the parent who had custody of the child for most of 2011.

Exception. If the custodial parent remarried or entered into an RDP and filed a joint return with the new spouse/RDP, enter the name and SSN or ITIN of the person listed first on the joint return, even if that person is not the child’s parent. If the custodial parent and the new spouse/RDP filed separate California tax returns, enter the name and SSN or ITIN of the person with the higher taxable income, even if that person is not the child’s parent.

If the child’s parents were unmarried but lived together during the year with the child, enter the name and SSN or ITIN of the parent who had the higher taxable income.

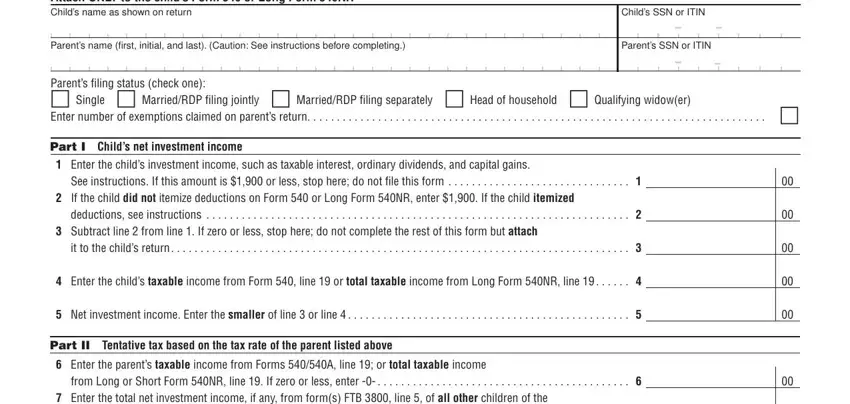

Part I Child’s Net Investment Income

Line 1 – Enter the child’s investment income. Include income such as taxable interest, dividends, capital gains, rents, annuities, and income received as a beneficiary. In most cases, this will be the same as the amount entered on federal Form 8615, include only income taxable by California. Also, include investment income that was not taxed on the child’s federal tax return but is taxable under California law. For more information, get the instructions for Schedule CA (540 or 540NR), line 8 and line 9.

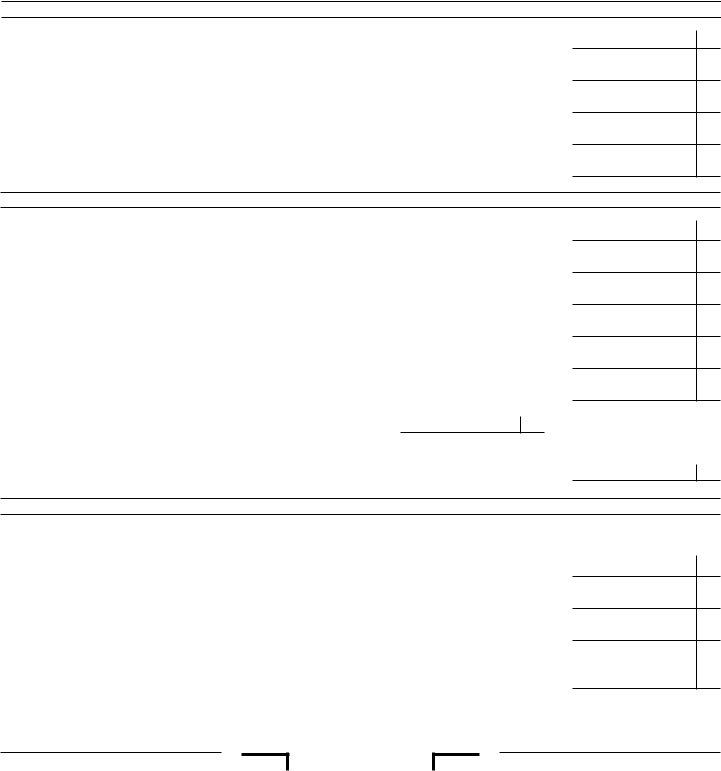

If the child had earned income (defined below), use the following worksheet to figure the amount to enter on form FTB 3800, line 1.

1.Enter the amount of the child’s adjusted gross income from Form 540, line 17 or

Long Form 540NR, line 17, whichever applies . . . . . . 1 __________

2.Enter the child’s earned income . . . . . . . . . . . . . . . . . . 2 __________

(wages, tips, and other payments received for personal services performed)

3.Subtract line 2 from line 1. Enter the result

here and on form FTB 3800, line 1 . . . . . . . . . . . . . . . 3 __________

Line 2 – If the child itemized deductions, enter the greater of:

$950 plus the portion of the amount on Form 540 or Long Form 540NR, line 18, that is directly connected with the production of the investment income shown on form FTB 3800, line 1 or $1,900.

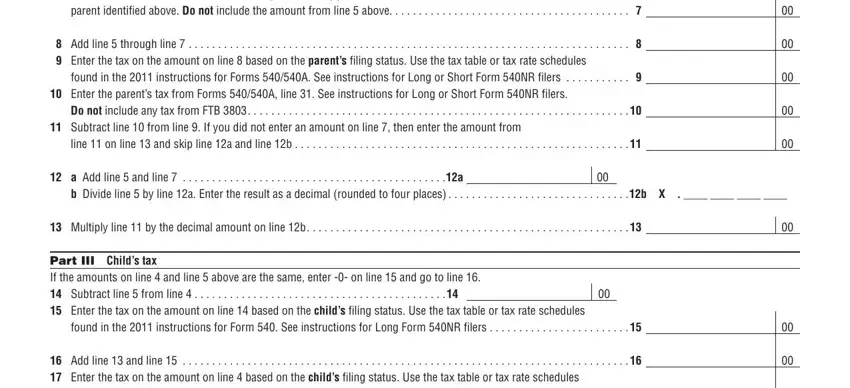

Part II Tentative Tax Based on Parent’s Tax Rate

If the parent used Form 540 2EZ, refigure your tax by referring to the tax table for Forms 540/540A in order to complete this part. Using Form 540 2EZ will not produce the correct result.

Line 6 – Enter the taxable income from Forms 540/540A, line 19; or total taxable income from Long or Short Form 540NR, line 19 of the parent whose name is shown at the top of form FTB 3800. If the parent’s taxable income is less than zero, enter -0- on line 6. If the parent filed a joint California tax return, enter the taxable income shown on that return even if the parent’s spouse/RDP is not the child’s parent.

Line 7 – If the individual identified as the parent on this form FTB 3800 is also identified as the parent on any other form FTB 3800, add the amounts, if any, from line 5 on each of the other forms FTB 3800 and enter the total on line 7.

Line 9 – Use the California tax table or tax rate schedules in the 2011 instructions for Forms 540/540A to find the tax for the amount on line 8, based on the parent’s filing status.