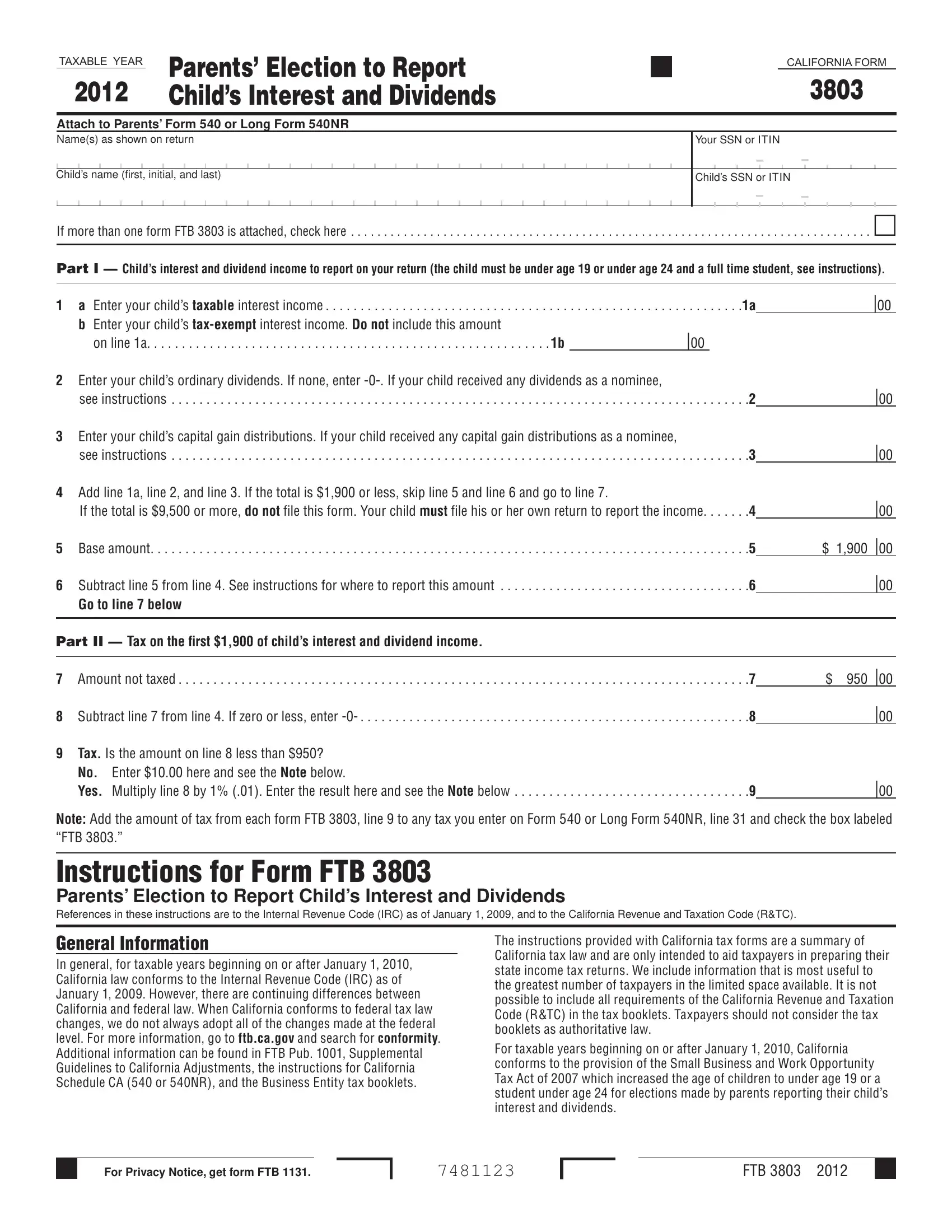

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified.

When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

A Purpose

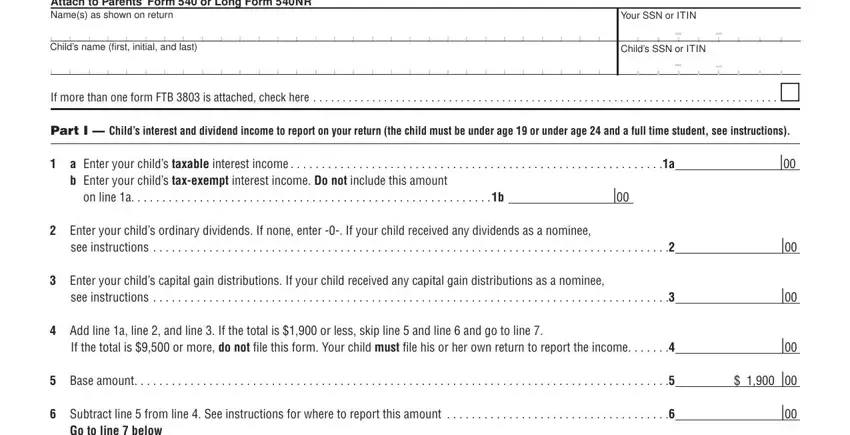

Parents may elect to report their child’s income on their California income tax return by completing form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends. If you make this election, the child will not have to file a return. You may report your child’s income on your California income tax return even if you do not do so on your federal income tax return. You may make this election if your child meets all of the following conditions:

•Was under age 19 or a student under age 24 at the end of 2012. A child born on January 1, 1994, is considered to be age 19 at the end of 2012. A child born on January 1, 1989, is considered to be age 24 at the end of 2012.

•Is required to file a 2012 income tax return.

•Had income only from interest and dividends.

•Had gross income for 2012 that was less than $9,500.

•Made no estimated tax payments for 2012.

•Did not have any overpayment of tax shown on his or her 2011 return applied to the 2012 estimated taxes.

•Had no state income tax withheld from his or her income (backup withholding).

As a parent, you must also qualify as explained in Section B.

B Parents Who Qualify to Make the Election

You qualify to make this election if you file Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part- Year Resident Income Tax Return, and if any of the following applies to you:

•You and the child’s other parent were married to each other or in a registered domestic partnership and you file a joint return for 2012.

•You and the child’s other parent were married to each other or in a registered domestic partnership but you file separate returns for 2012 AND you had the higher taxable income. If you do not know if you had the higher taxable income, get federal Publication 929, Tax Rules for Children and Dependents.

•You were unmarried, treated as unmarried for state income tax purposes, or separated from the child’s other parent by a divorce, separate maintenance decree, or termination of a domestic partnership and you had custody of your child for most of the year (you were the custodial parent). If you were the custodial parent and you remarried or entered into another registered domestic partnership, you may make the election on a joint return with your new spouse/RDP (your child’s stepparent). But if you and your new spouse/RDP do not file a joint return, you qualify to make the election only if you had higher taxable income than your new spouse/RDP.

If you and the child’s other parent were not married or in a registered domestic partnership but you lived together during the year with the child, you qualify to make the election only if you are the parent with the higher taxable income.

If you elect to report your child’s income on your return, you may not reduce that income by any deductions that your child would be entitled to claim on his or her own return, such as the penalty on early withdrawal of child’s savings or any itemized deductions. For more information, get the instructions for federal Form 8814, Parents’ Election to Report Child’s Interest and Dividends.

C How to Make the Election

To make the election, complete and attach form FTB 3803 to your Form 540 or Long Form 540NR and file your return by the due date (including extensions).

File a separate form FTB 3803 for each child whose income you choose to report.

Specific Line Instructions

Use Part I to figure the amount of the child’s income to report on your return. Use Part II to figure any additional tax that must be added to your tax.

Name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Enter your name as shown on your tax return. If filing a joint return, include your spouse’s/RDP’s name but enter the SSN or ITIN of the person whose name is shown first on the return.

For more information about interest, dividends, and capital gain distributions taxable by California, get the instructions for Schedule CA (540), California Adjustments — Residents, or Schedule CA (540NR), California Adjustments — Nonresidents or Part-Year Residents.

Part I Child’s Interest and Dividend Income to Report on Your Return

Line 1a

Enter all interest income taxable by California and received by your child in 2012. If, as a nominee, your child received interest that actually belongs to another person, write the amount and the initials “ND” (for “nominee distribution”) on the dotted line to the left of line 1a. Do not include amounts received by your child as a nominee in the total entered on line 1a.

If your child received Form 1099-INT, Interest Income, showing California tax-exempt interest or Form 1099-OID, Original Issue Discount, get the instructions for federal Form 8814.

Line 1b

If your child received any interest income exempt from California tax, such as interest on United States savings bonds or California municipal bonds, enter the total tax-exempt interest on line 1b. Also include any exempt- interest dividends your child received as a shareholder in a mutual fund or other regulated investment company. Do not include this interest on line 1a. Get the instructions for Schedule CA (540 or 540NR), line 8, for more information.

Line 2

Enter ordinary dividends received by your child in 2012. Ordinary dividends should be shown on Form 1099-DIV, Dividends and Distributions, box 1. Also, include ordinary dividends your child received through a partnership, an S corporation, an estate, or trust.

If your child received, as a nominee, ordinary dividends that actually belong to another person, enter the amount and the initials “ND” on the dotted line to the left of line 2. Do not include amounts received as a nominee in the total for line 2.

Line 3

Enter the capital gain distributions taxable by California and received by your child in 2012. Capital gain distributions should be shown on Form 1099-DIV, box 2a. Also, see the instructions for line 6. If your child received, as a nominee, capital gain distributions that actually belong to another person, enter the amount and the initials “ND” on the dotted line to the left of line 3. Do not include amounts received as a nominee in the total for line 3.

Line 6

If the total amount on line 6 of all form(s) FTB 3803 is less than the total amount on line 6 of all your federal Form(s) 8814, enter the difference on Schedule CA (540 or 540NR), line 21f, column B and write “FTB 3803” on line 21f.

If the total amount on line 6 of all form(s) FTB 3803 is more than the total amount on line 6 of all your federal Form(s) 8814, enter the difference on Schedule CA (540 or 540NR), line 21f, column C and write “FTB 3803” on line 21f.

If you did not file federal Form 8814, enter the amount from form

FTB 3803, line 6, on Schedule CA (540 or 540NR), line 21f, column C and write “FTB 3803” on line 21f.

If your child received capital gain distributions (shown on Form 1099-DIV, box 2a and box 2b) and you have other gains or losses to report on your Schedule D, California Capital Gain or Loss Adjustment, you must report part or all of your child’s capital gain distributions on your Schedule D instead of on form FTB 3803, line 6. Get federal Publication 929 for more information on how to figure the amount to report on your Schedule D.

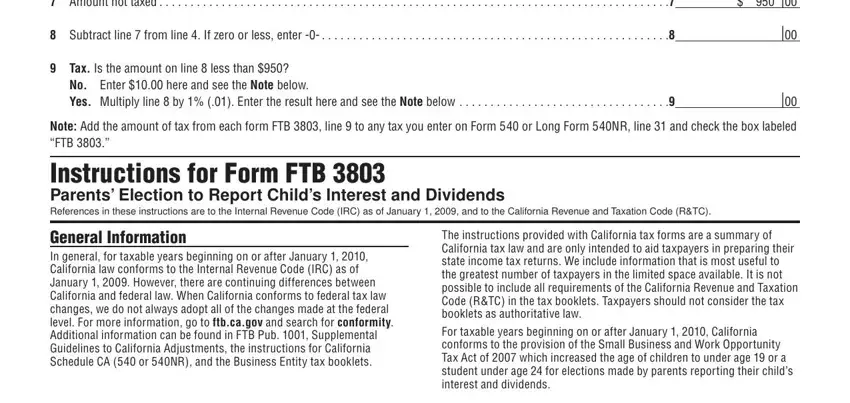

Part II Tax on the First $1,900 of Child’s Interest and Dividend Income

Line 9

Add the amount of tax from each form FTB 3803, line 9 to any tax you enter on Form 540 or Long Form 540NR, line 31 and check the box labeled “FTB 3803.”