When working in the online editor for PDFs by FormsPal, you can easily fill in or alter E-mail here. To maintain our tool on the forefront of efficiency, we strive to put into practice user-oriented capabilities and enhancements on a regular basis. We're routinely pleased to receive suggestions - play a vital part in reshaping PDF editing. Should you be seeking to get going, here is what you will need to do:

Step 1: Access the PDF file in our editor by pressing the "Get Form Button" above on this webpage.

Step 2: Using this state-of-the-art PDF file editor, it is easy to accomplish more than merely fill in blanks. Edit away and make your docs look professional with custom textual content put in, or tweak the file's original input to perfection - all that backed up by an ability to incorporate stunning graphics and sign the file off.

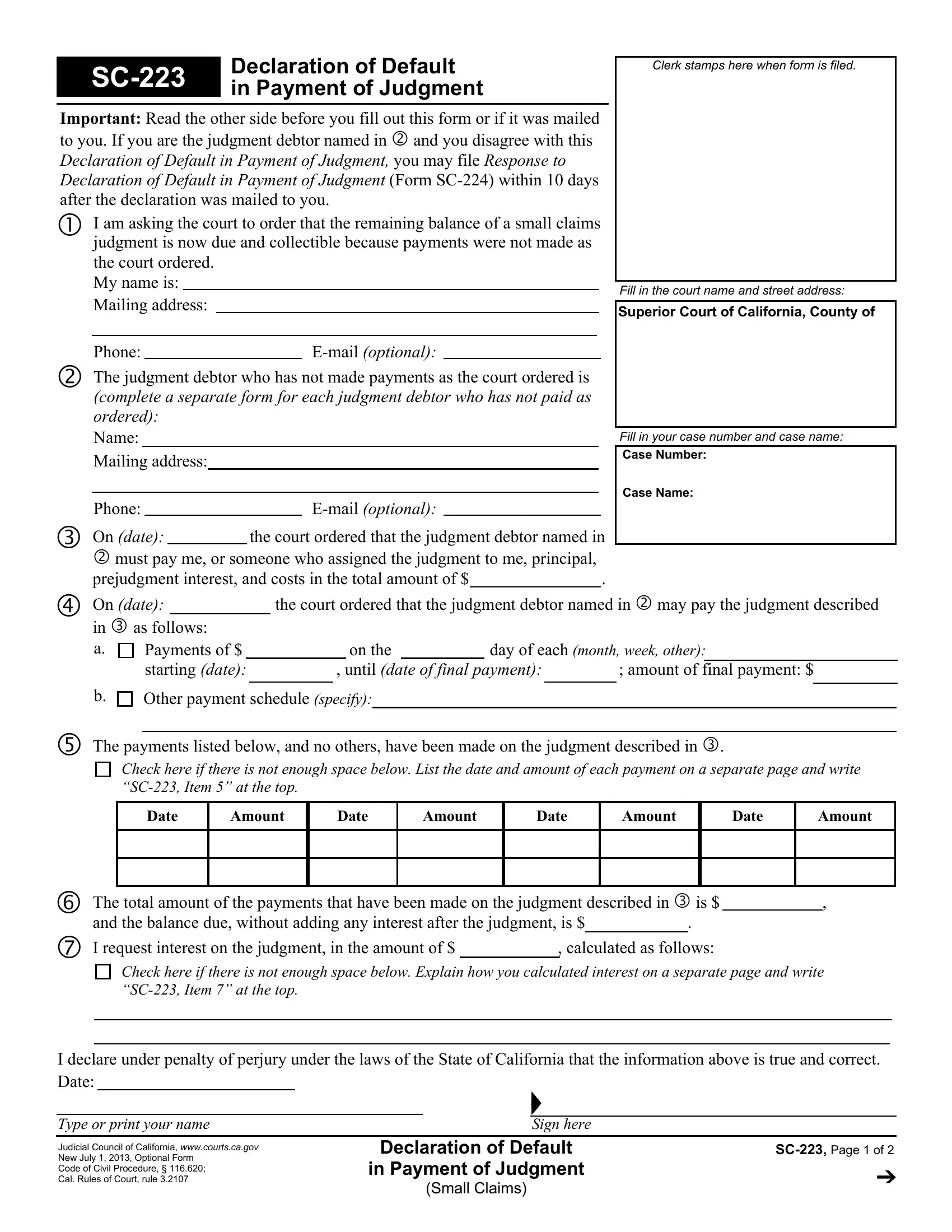

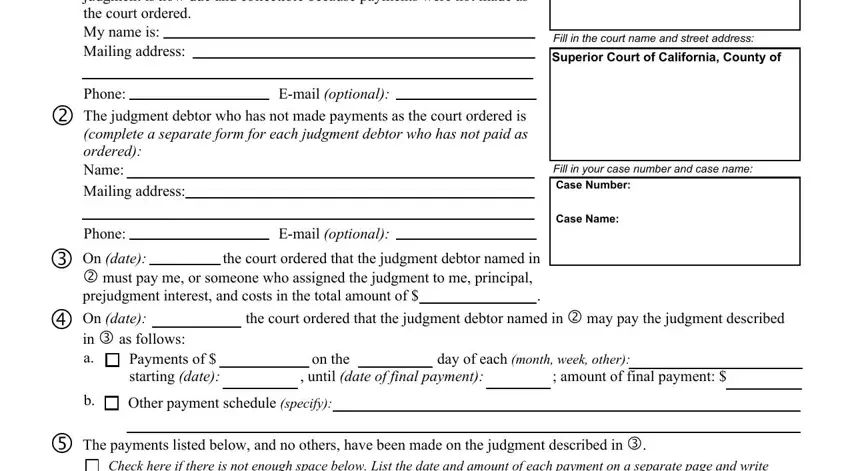

This PDF form will need you to enter some specific information; to ensure correctness, please adhere to the guidelines directly below:

1. To start off, once filling out the E-mail, start in the section that contains the subsequent fields:

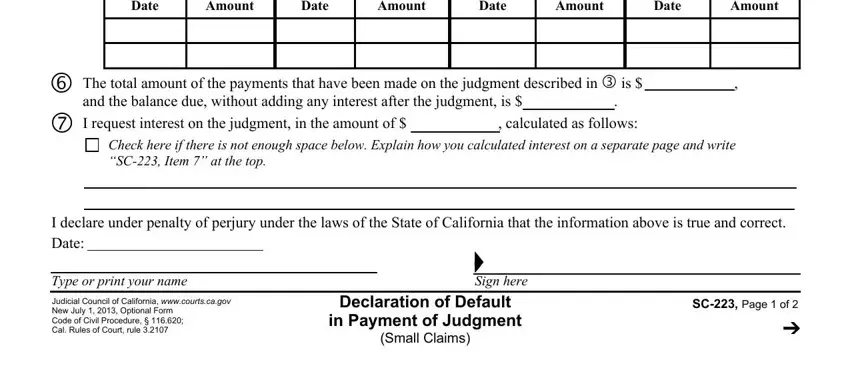

2. Just after this section is completed, proceed to type in the relevant details in these - Date, Amount, Date, Amount, Date, Amount, Date, Amount, The total amount of the payments, I request interest on the judgment, Check here if there is not enough, I declare under penalty of perjury, Type or print your name Sign here, Judicial Council of California, and Declaration of Default.

3. Through this step, review Need help For free help contact, Or go to, New July , Declaration of Default in Payment, SC Page of , and Small Claims. Each of these should be filled out with utmost accuracy.

It's simple to get it wrong while completing the Need help For free help contact, consequently you'll want to go through it again before you'll send it in.

Step 3: Glance through the information you've inserted in the blanks and press the "Done" button. Grab your E-mail when you register here for a 7-day free trial. Easily get access to the pdf file inside your FormsPal account, with any modifications and adjustments being conveniently preserved! Here at FormsPal, we endeavor to be sure that your details are maintained secure.