Using PDF forms online is definitely very easy with this PDF editor. You can fill out california llc 12 here without trouble. To retain our tool on the cutting edge of convenience, we work to integrate user-oriented features and enhancements on a regular basis. We are at all times glad to get suggestions - assist us with remolding the way you work with PDF forms. All it requires is several simple steps:

Step 1: First, access the editor by clicking the "Get Form Button" above on this site.

Step 2: With the help of this handy PDF editing tool, it is possible to do more than merely fill in blank fields. Express yourself and make your docs appear great with customized textual content added, or adjust the file's original input to perfection - all comes with the capability to incorporate your personal photos and sign the PDF off.

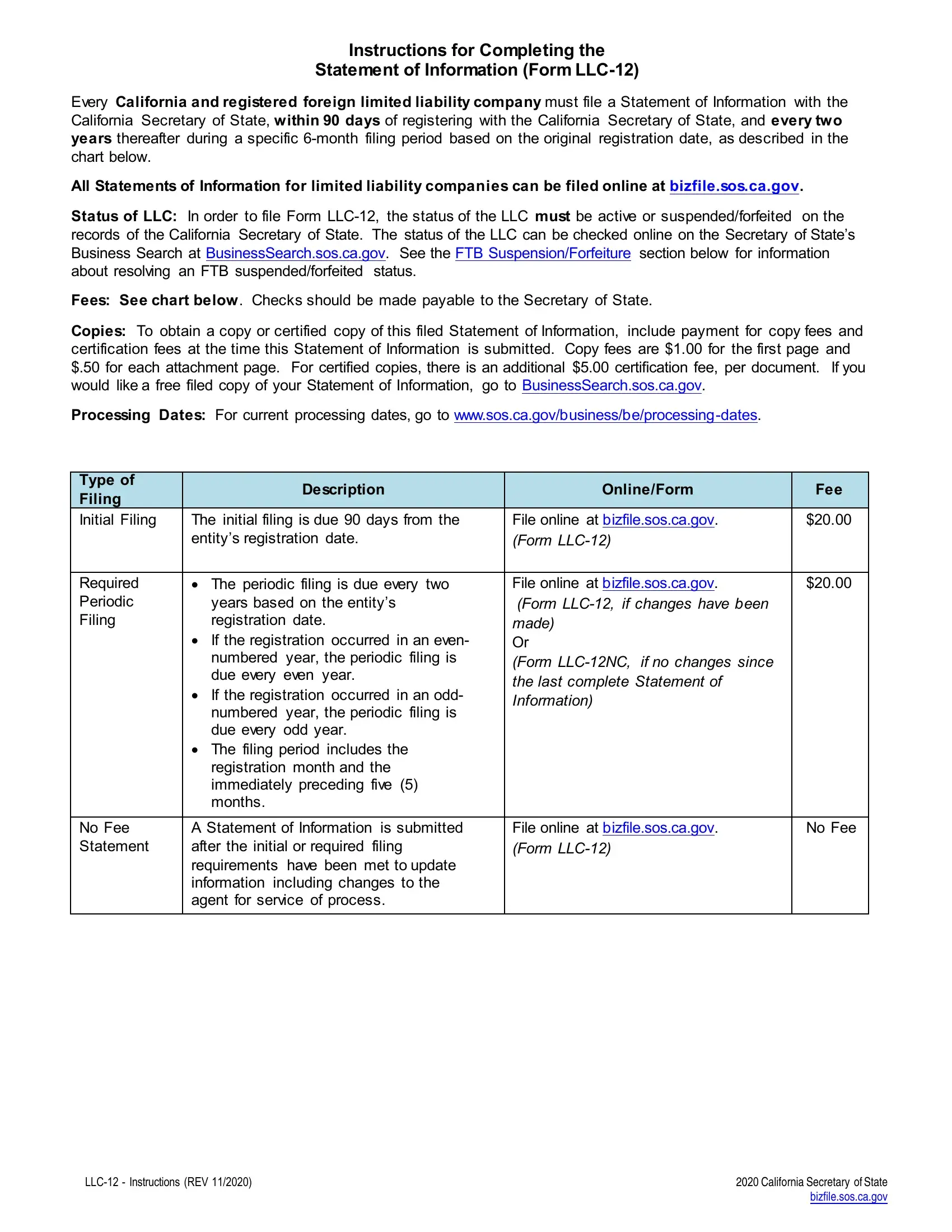

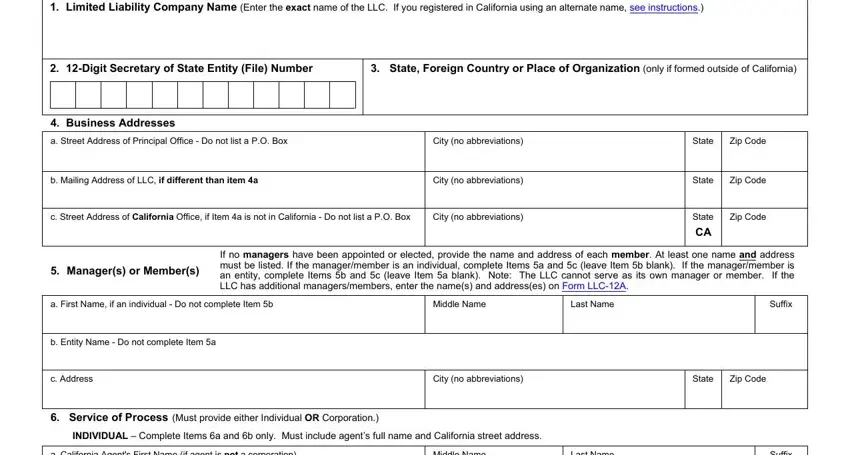

So as to fill out this PDF document, ensure you provide the right details in every area:

1. While submitting the california llc 12, be sure to include all necessary fields in its corresponding area. This will help to expedite the work, allowing your information to be processed quickly and accurately.

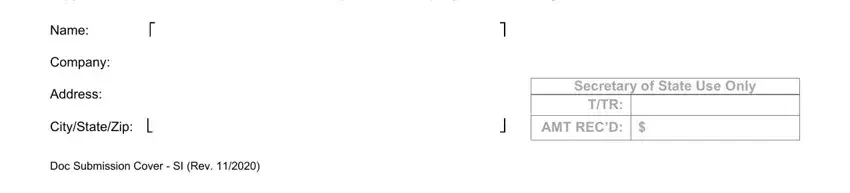

2. When the previous array of fields is done, it is time to put in the needed specifics in Return Address For written, Name, Company, Address, CityStateZip , Doc Submission Cover SI Rev , Secretary of State Use Only, TTR, and MT RECD so you can proceed further.

3. Your next step is hassle-free - complete every one of the blanks in Limited Liability Company Name, Digit Secretary of State Entity, State Foreign Country or Place of, Business Addresses, a Street Address of Principal, City no abbreviations, State, Zip Code, b Mailing Address of LLC if, City no abbreviations, State, Zip Code, c Street Address of California, City no abbreviations, and State to conclude this process.

As for Zip Code and State Foreign Country or Place of, make sure you get them right in this section. These could be the key ones in the page.

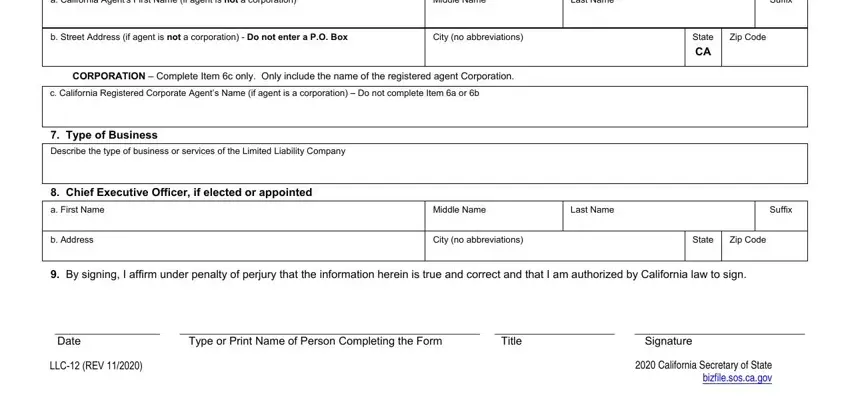

4. Now fill out this next section! Here you've got all of these a California Agents First Name if, Middle Name, Last Name, Suffix, b Street Address if agent is not a, City no abbreviations, Zip Code, State CA, CORPORATION Complete Item c only, c California Registered Corporate, Type of Business, Describe the type of business or, Chief Executive Officer if, a First Name, and b Address form blanks to fill in.

Step 3: Before finalizing this document, make certain that all blanks were filled out correctly. Once you’re satisfied with it, click “Done." Get your california llc 12 when you subscribe to a 7-day free trial. Conveniently get access to the form in your personal account, together with any modifications and adjustments all preserved! Here at FormsPal.com, we aim to ensure that your information is stored secure.