If you wish to fill out customs form 258 form, you don't need to install any applications - simply use our PDF editor. To make our tool better and less complicated to use, we consistently design new features, taking into consideration suggestions from our users. With a few basic steps, you'll be able to start your PDF editing:

Step 1: Click the orange "Get Form" button above. It will open our tool so you can start filling out your form.

Step 2: With the help of our advanced PDF file editor, it is easy to do more than just complete blank form fields. Express yourself and make your docs look faultless with customized textual content incorporated, or tweak the file's original input to perfection - all comes along with the capability to incorporate stunning photos and sign the PDF off.

Pay close attention while filling in this form. Make sure that all necessary blanks are completed accurately.

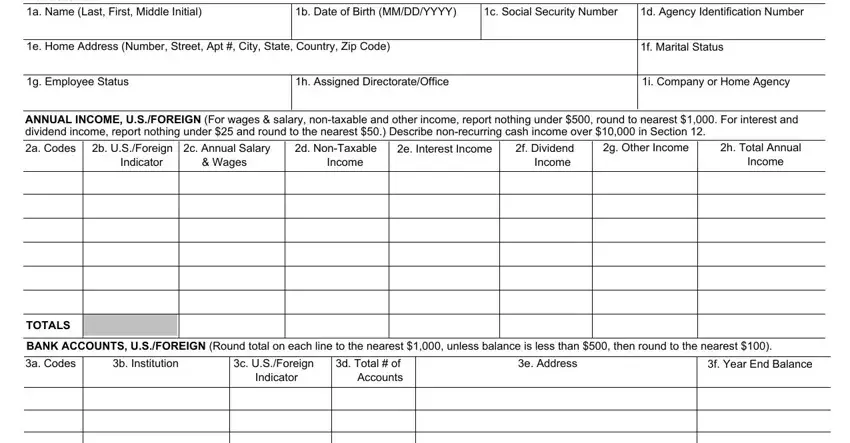

1. The customs form 258 form involves specific information to be typed in. Be sure that the following blanks are finalized:

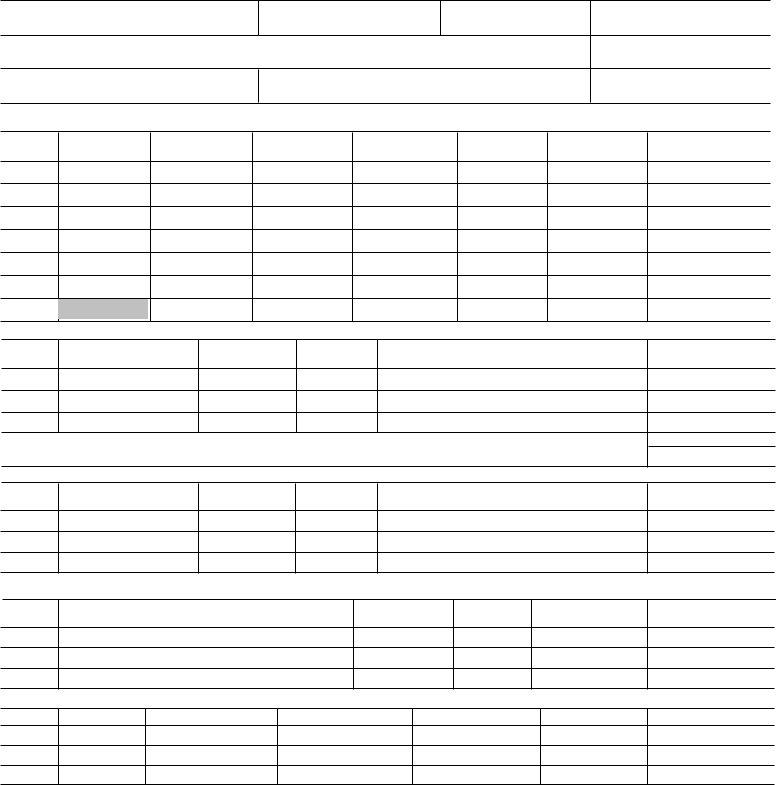

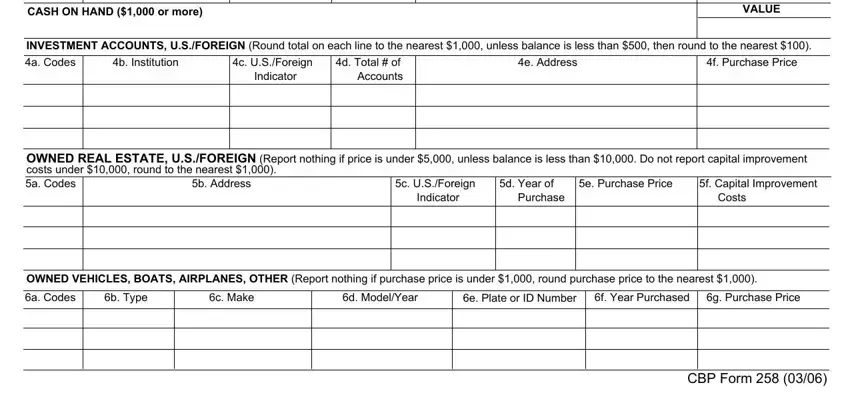

2. Right after finishing the previous part, head on to the next stage and enter the necessary particulars in these fields - CASH ON HAND or more, VALUE, INVESTMENT ACCOUNTS USFOREIGN, a Codes, b Institution, c USForeign Indicator, d Total of Accounts, e Address, f Purchase Price, OWNED REAL ESTATE USFOREIGN Report, e Purchase Price, b Address, f Capital Improvement Costs, c USForeign Indicator, and d Year of Purchase.

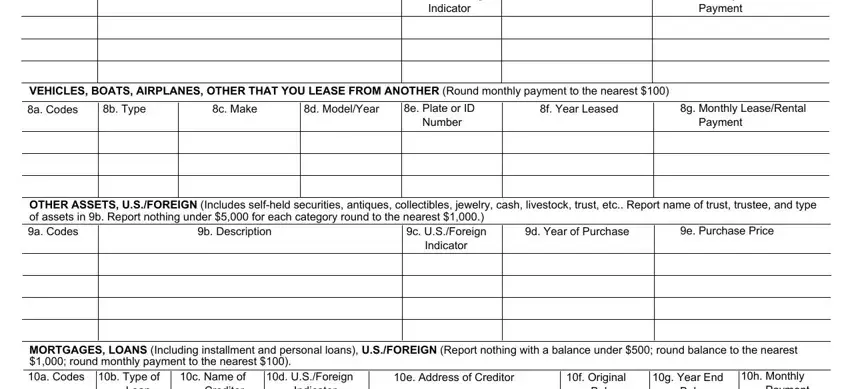

3. This next step will be focused on a Codes, b Address, c USForeign Indicator, d Year of LeaseRental, e Monthly LeaseRental Payment, VEHICLES BOATS AIRPLANES OTHER, a Codes, b Type, c Make, d ModelYear, e Plate or ID Number, f Year Leased, g Monthly LeaseRental Payment, OTHER ASSETS USFOREIGN Includes, and d Year of Purchase - complete each one of these blank fields.

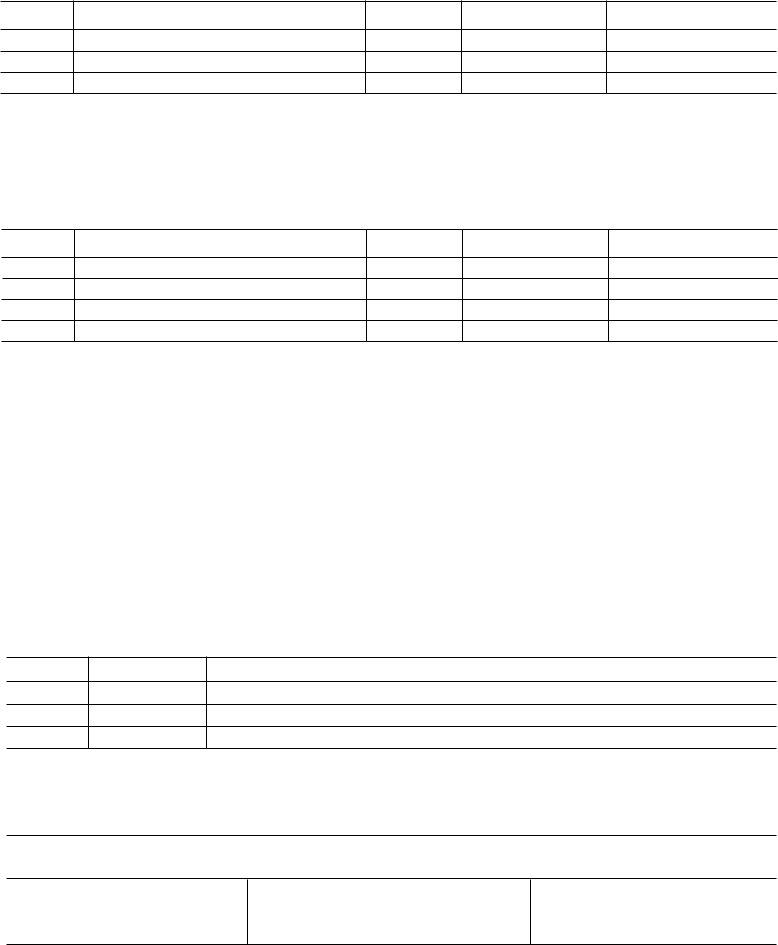

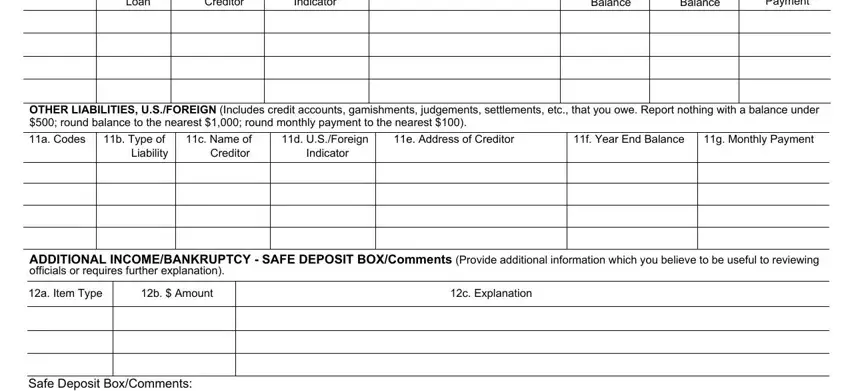

4. It is time to fill in this fourth section! In this case you've got all of these b Type of Loan, c Name of Creditor, d USForeign Indicator, f Original Balance, g Year End Balance, h Monthly Payment, OTHER LIABILITIES USFOREIGN, e Address of Creditor, f Year End Balance, g Monthly Payment, b Type of Liability, c Name of Creditor, d USForeign Indicator, ADDITIONAL INCOMEBANKRUPTCY SAFE, and a Item Type empty form fields to fill in.

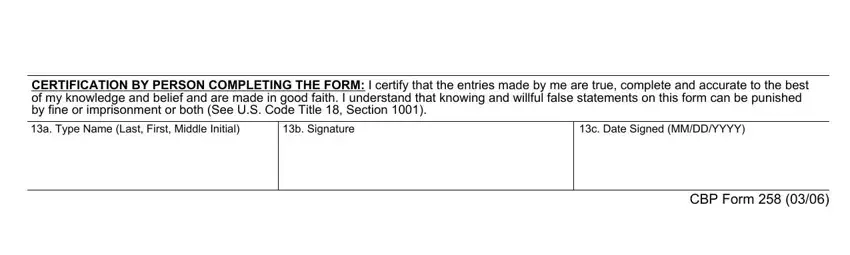

5. When you come near to the conclusion of this file, you'll find several more points to complete. Mainly, Safe Deposit BoxComments, CERTIFICATION BY PERSON COMPLETING, a Type Name Last First Middle, b Signature, c Date Signed MMDDYYYY, and CBP Form must all be filled out.

Be really mindful when completing b Signature and Safe Deposit BoxComments, as this is the section in which a lot of people make some mistakes.

Step 3: You should make sure the details are right and then simply click "Done" to continue further. Sign up with us right now and instantly get access to customs form 258 form, all set for download. Each and every modification you make is conveniently saved , meaning you can customize the form at a later time as needed. If you use FormsPal, it is simple to complete forms without worrying about personal information leaks or records being distributed. Our protected software ensures that your personal details are stored safely.