Our PDF editor can make filling out documents simple and easy. It is quite an easy task to modify the [FORMNAME] file. Check out the next steps so that you can accomplish this:

Step 1: On the following web page, press the orange "Get form now" button.

Step 2: Now you can update the new jersey form 2553. Our multifunctional toolbar makes it possible to add, remove, adapt, and highlight content material or perhaps carry out other commands.

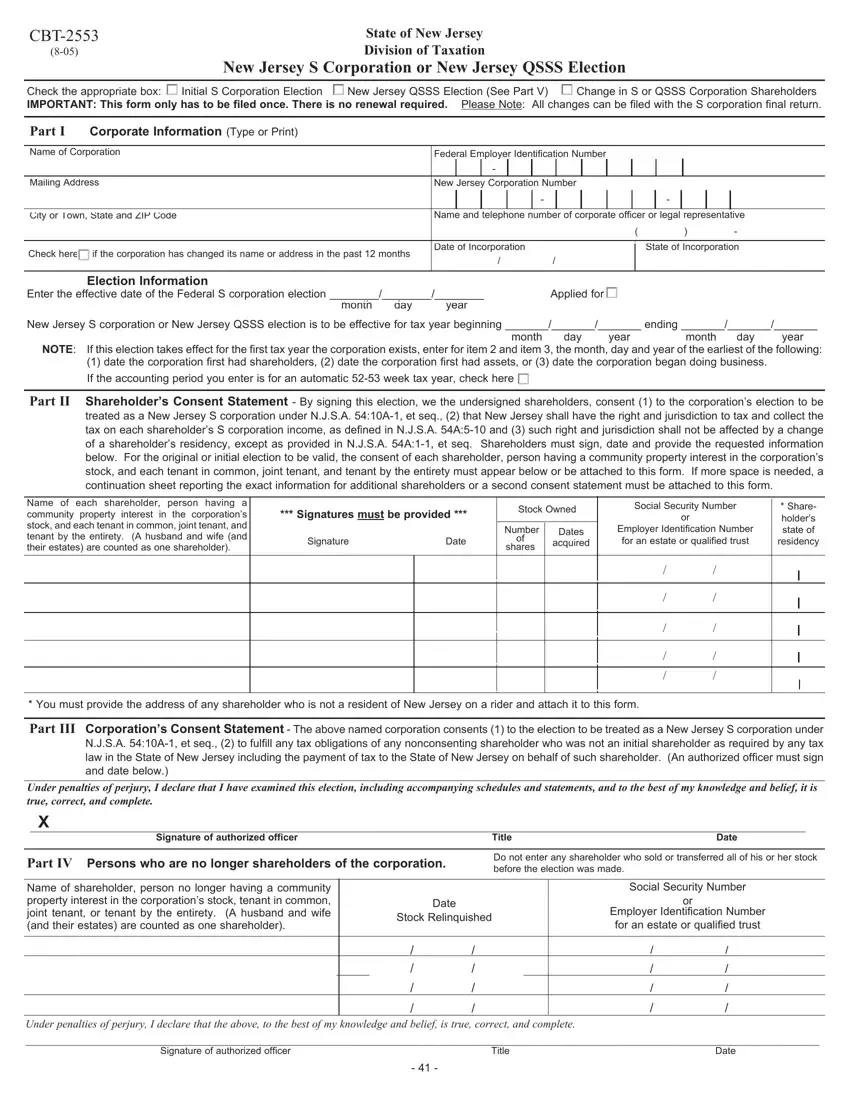

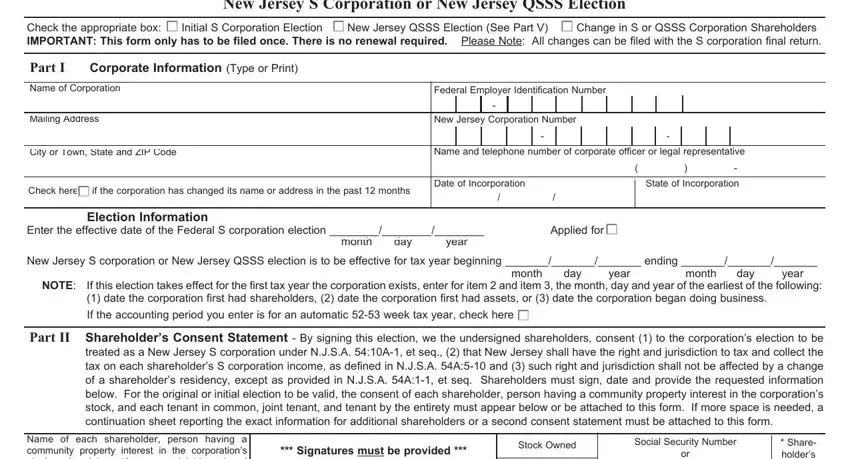

These particular sections will make up the PDF form:

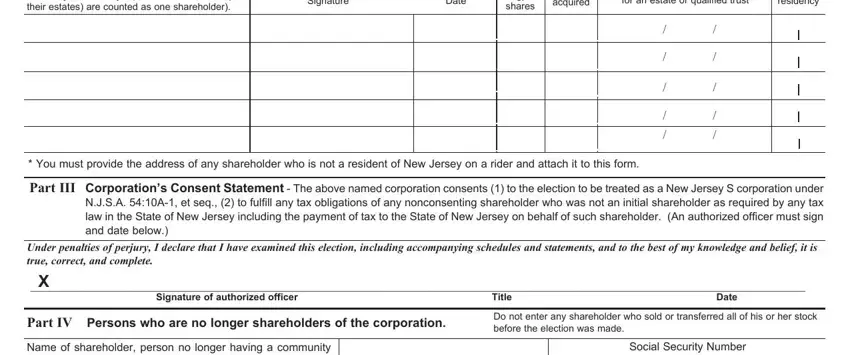

Make sure you write down the necessary data in the Name of each shareholder person, Signature, Date, Number of shares, Dates acquired, Social Security Number or Employer, Share holders state of residency, You must provide the address of, Part III Corporations Consent, Under penalties of perjury I, Signature of authorized officer, Title, Date, Part IV Persons who are no longer, and Do not enter any shareholder who space.

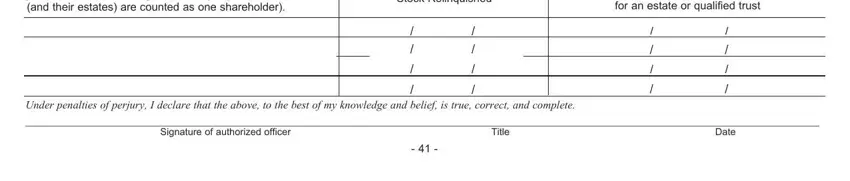

You can be required some essential particulars if you need to complete the Name of shareholder person no, Date Stock Relinquished, Social Security Number or Employer, Under penalties of perjury I, Signature of authorized officer, Title, and Date part.

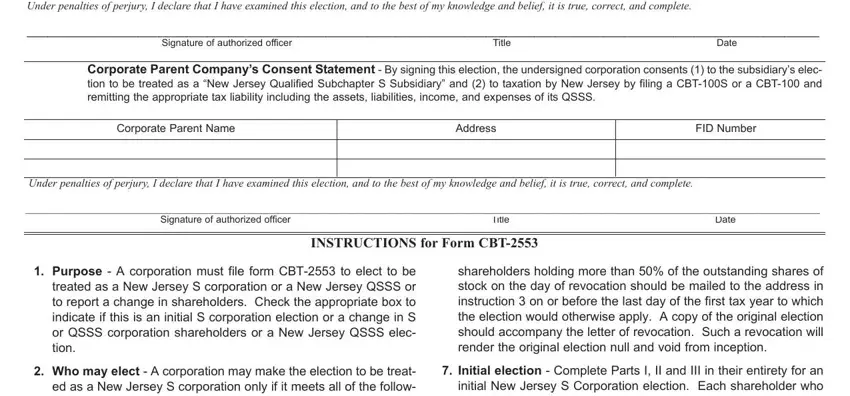

The Under penalties of perjury I, Signature of authorized officer, Title, Date, Corporate Parent Companys Consent, Corporate Parent Name, Address, FID Number, Under penalties of perjury I, Signature of authorized officer, Title, Date, INSTRUCTIONS for Form CBT, Purpose A corporation must file, and Who may elect A corporation may field will be the place to add the rights and obligations of both sides.

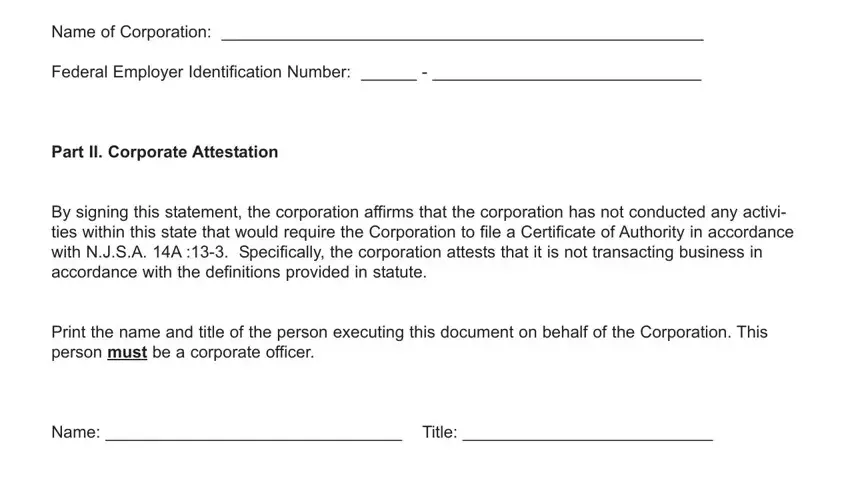

Prepare the form by taking a look at all of these fields: Name of Corporation, Federal Employer Identification, Part II Corporate Attestation, By signing this statement the, Print the name and title of the, and Name Title.

Step 3: Choose the button "Done". The PDF form may be transferred. You may upload it to your pc or email it.

Step 4: You will need to make as many copies of your file as you can to stay away from potential issues.