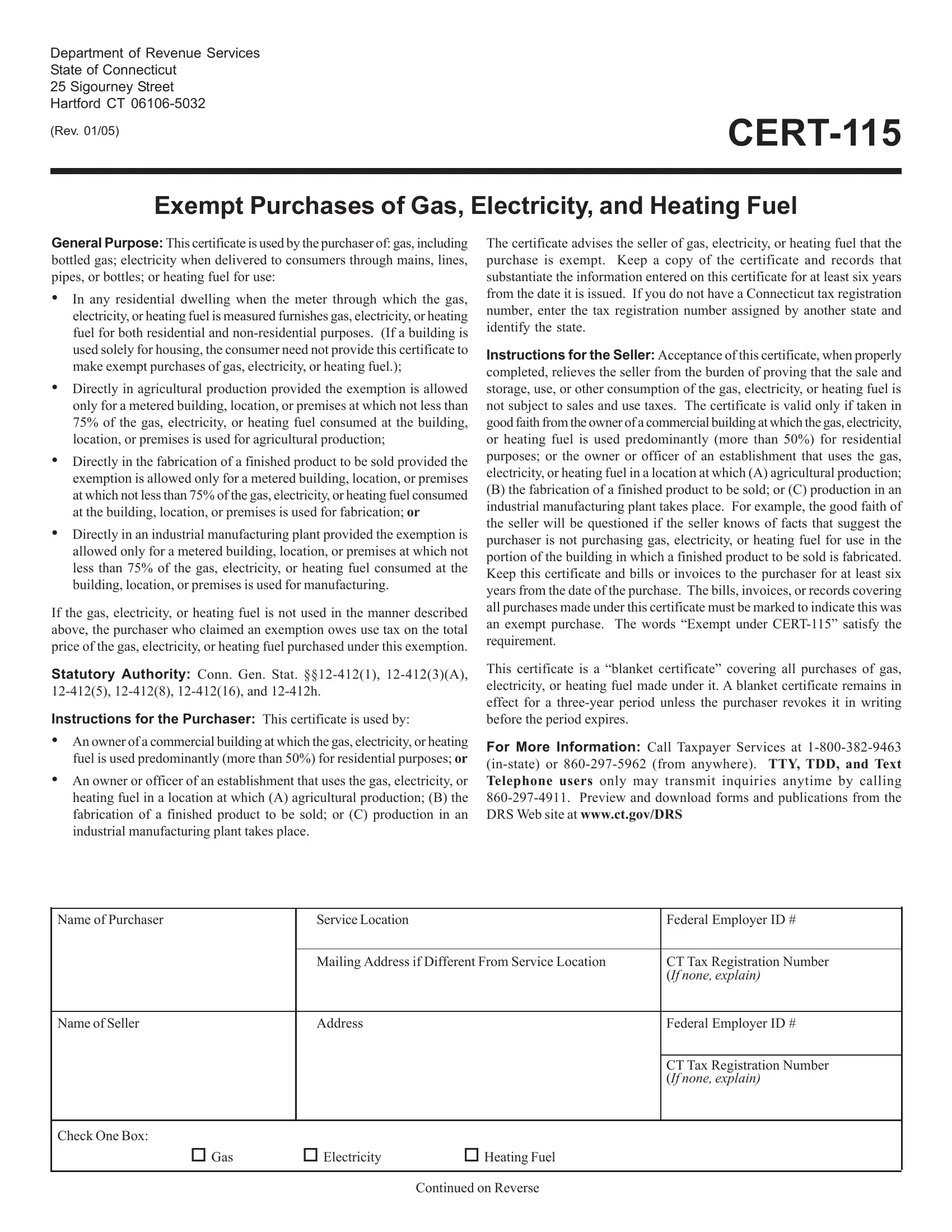

Working with PDF documents online is simple with our PDF editor. You can fill out cert 115 fillable here without trouble. The editor is continually upgraded by us, acquiring cool features and becoming much more versatile. For anyone who is seeking to get started, here's what it will require:

Step 1: First, access the pdf editor by pressing the "Get Form Button" in the top section of this site.

Step 2: With the help of this handy PDF tool, you'll be able to do more than merely complete blank fields. Try all of the features and make your forms seem great with custom text put in, or tweak the file's original input to perfection - all comes along with an ability to incorporate almost any images and sign the PDF off.

When it comes to blank fields of this particular PDF, here's what you should consider:

1. Complete the cert 115 fillable with a selection of necessary fields. Collect all the important information and make certain there's nothing overlooked!

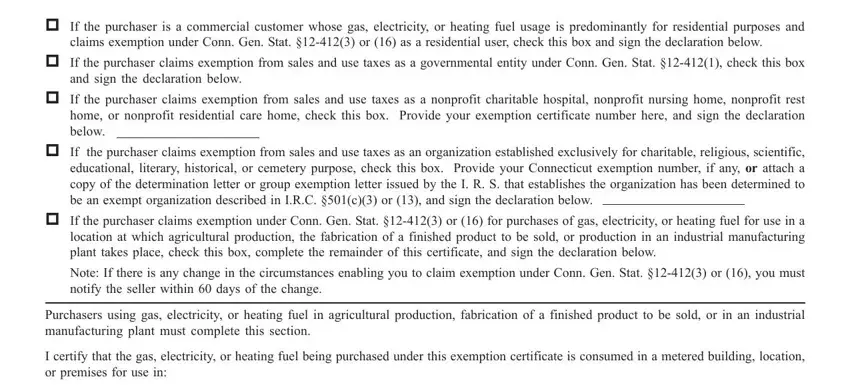

2. Right after this section is filled out, go to type in the suitable details in these - cid If the purchaser is a, claims exemption under Conn Gen, cid If the purchaser claims, and sign the declaration below, cid If the purchaser claims, cid If the purchaser claims, cid If the purchaser claims, Note If there is any change in the, Purchasers using gas electricity, and I certify that the gas electricity.

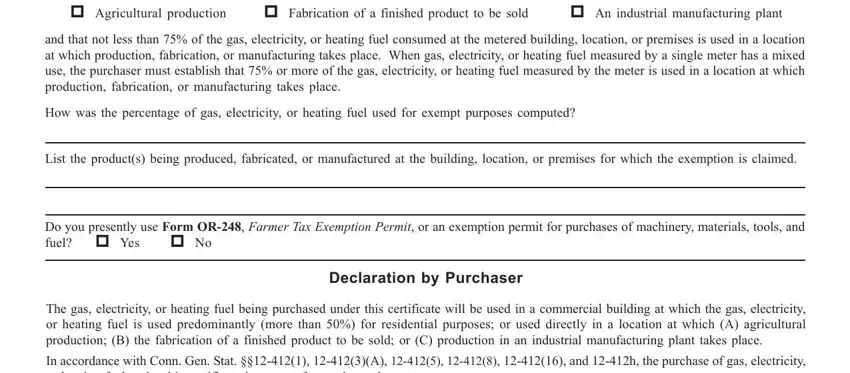

3. This third part is considered quite straightforward, cid Agricultural production, cid Fabrication of a finished, cid An industrial manufacturing, and that not less than of the gas, How was the percentage of gas, List the products being produced, Do you presently use Form OR, cid No, Declaration by Purchaser, The gas electricity or heating, and In accordance with Conn Gen Stat - all of these blanks is required to be completed here.

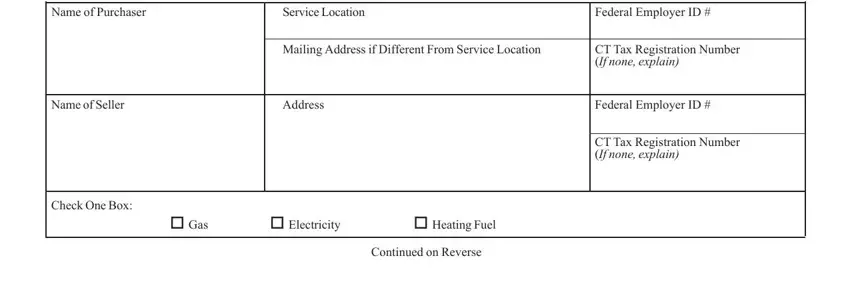

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name of Purchaser, Authorized Signature of Owner or, Title, Date, and CERT Back Rev - to proceed further in your process!

Always be really attentive while filling out CERT Back Rev and Name of Purchaser, as this is where many people make a few mistakes.

Step 3: Confirm that the details are accurate and then press "Done" to complete the process. Get the cert 115 fillable once you sign up for a free trial. Readily use the pdf from your personal cabinet, with any edits and changes conveniently kept! FormsPal is devoted to the confidentiality of our users; we make sure all personal information used in our editor is confidential.