Dealing with PDF files online is certainly quite easy with our PDF editor. Anyone can fill in usmca certification of origin form pdf here effortlessly. Our editor is consistently evolving to grant the best user experience possible, and that is due to our commitment to constant improvement and listening closely to user opinions. By taking some simple steps, you may begin your PDF journey:

Step 1: Press the orange "Get Form" button above. It is going to open up our editor so that you can begin filling out your form.

Step 2: The tool gives you the opportunity to change almost all PDF files in a range of ways. Transform it by adding your own text, correct what is already in the file, and add a signature - all manageable in minutes!

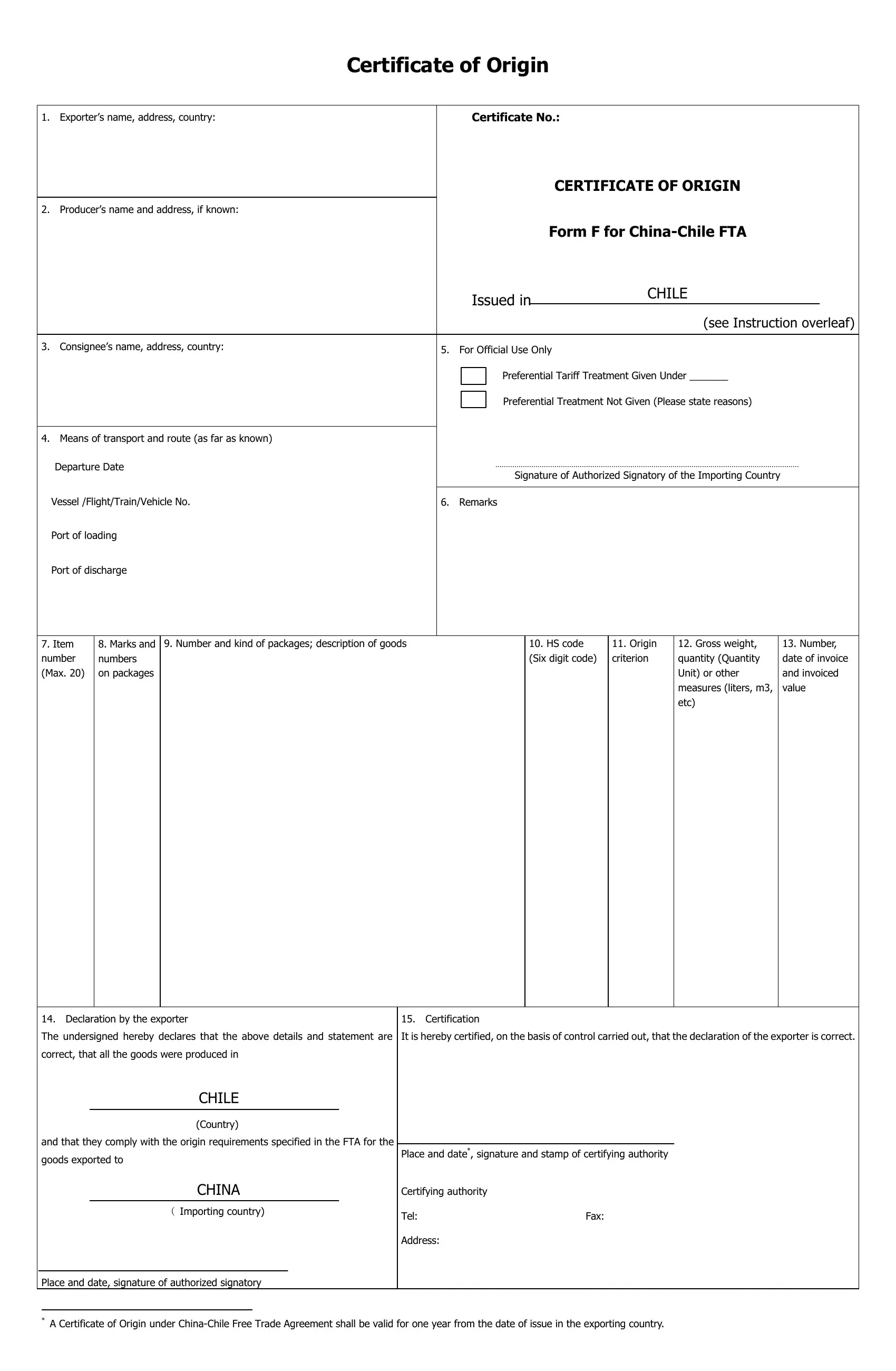

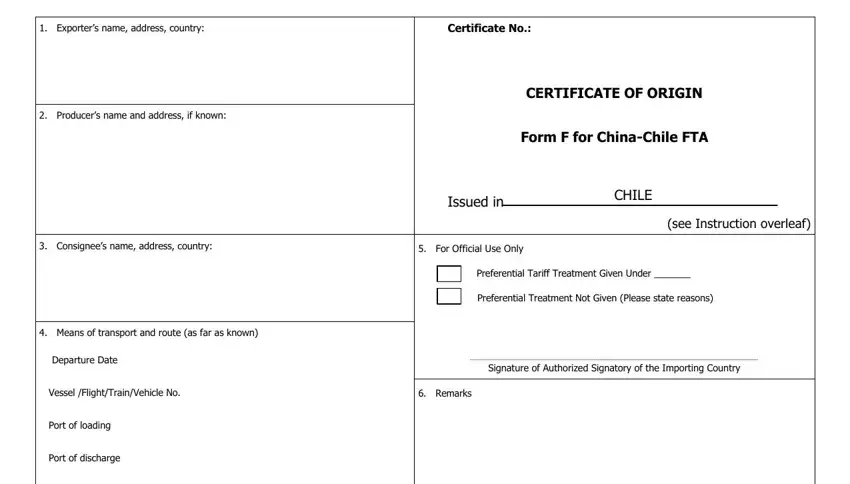

This document will require specific information to be entered, hence ensure you take some time to type in exactly what is requested:

1. Fill out your usmca certification of origin form pdf with a group of essential blank fields. Consider all the information you need and make certain not a single thing missed!

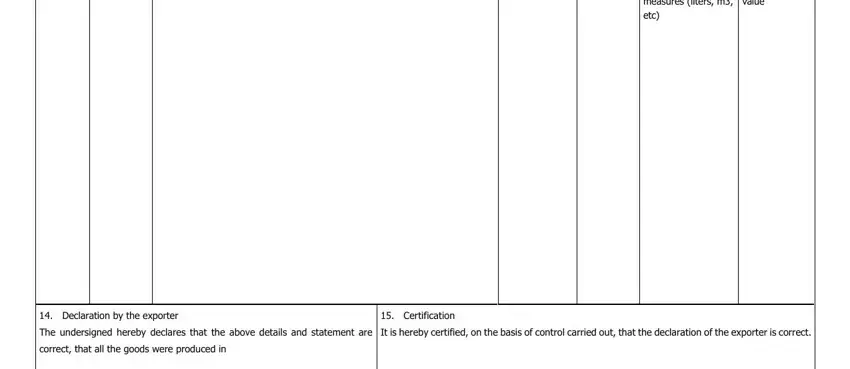

2. Right after the first part is done, proceed to enter the relevant information in all these: Gross weight quantity Quantity, Number date of invoice and, Declaration by the exporter, Certification, The undersigned hereby declares, It is hereby certified on the, and correct that all the goods were.

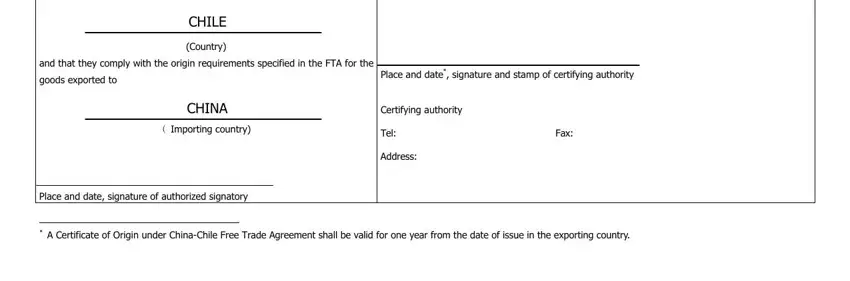

3. Completing CHILE, Country, and that they comply with the, goods exported to, Place and date signature and stamp, CHINA, Importing country, Certifying authority, Tel, Address, Fax, Place and date signature of, and A Certificate of Origin under is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be really careful when filling out goods exported to and CHILE, because this is where many people make mistakes.

Step 3: When you've looked over the details in the document, simply click "Done" to finalize your FormsPal process. After starting a7-day free trial account here, you will be able to download usmca certification of origin form pdf or send it through email right away. The PDF document will also be readily accessible via your personal account with your changes. We do not share or sell the details that you enter whenever completing forms at our website.