You could complete cf2900 form effortlessly with the help of our online PDF editor. To make our editor better and more convenient to use, we consistently work on new features, bearing in mind feedback from our users. This is what you'd need to do to get started:

Step 1: Press the "Get Form" button above on this page to open our editor.

Step 2: As you start the tool, you'll see the form prepared to be filled in. Apart from filling in different blank fields, it's also possible to perform several other things with the file, specifically writing custom words, modifying the initial textual content, inserting graphics, placing your signature to the document, and more.

To be able to finalize this document, make sure that you type in the necessary details in every single field:

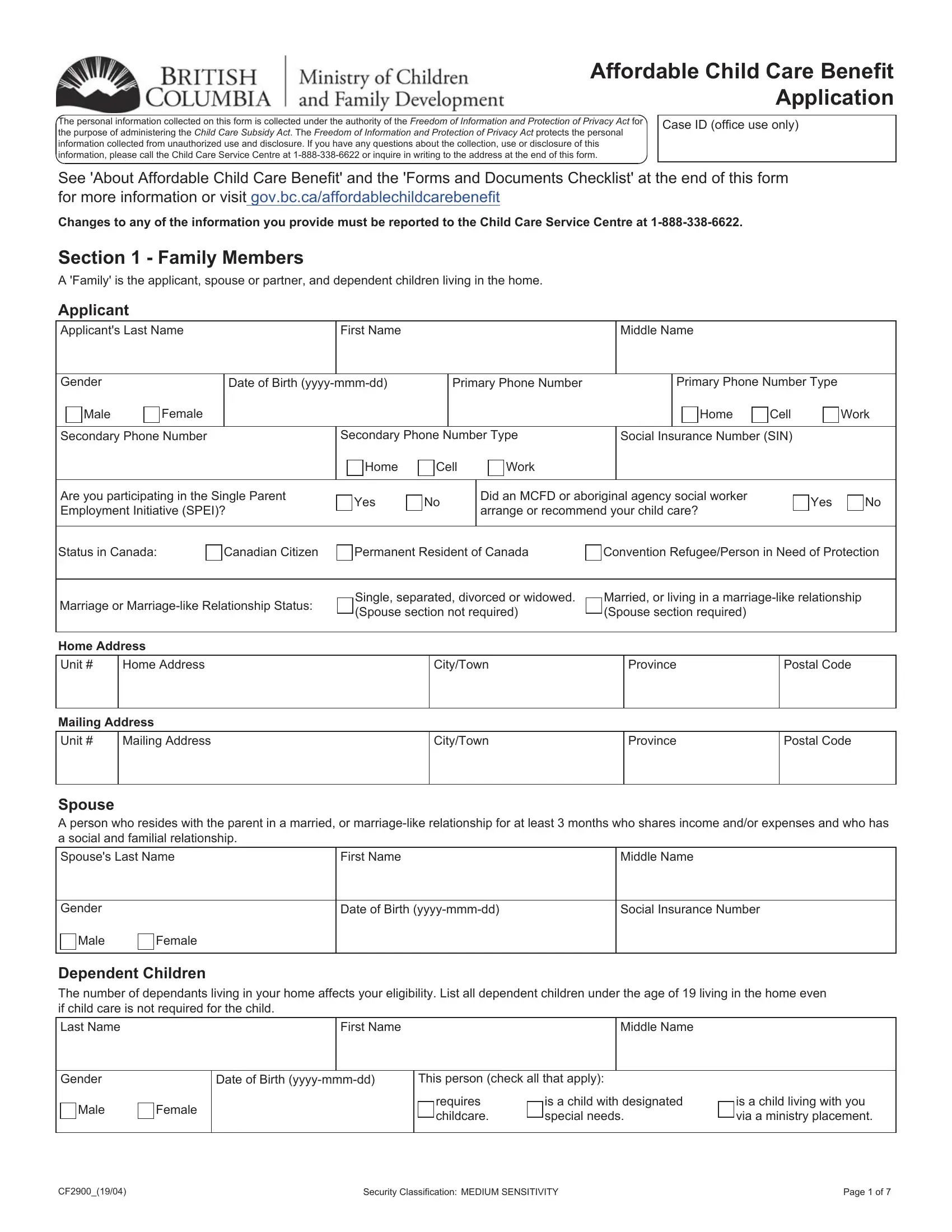

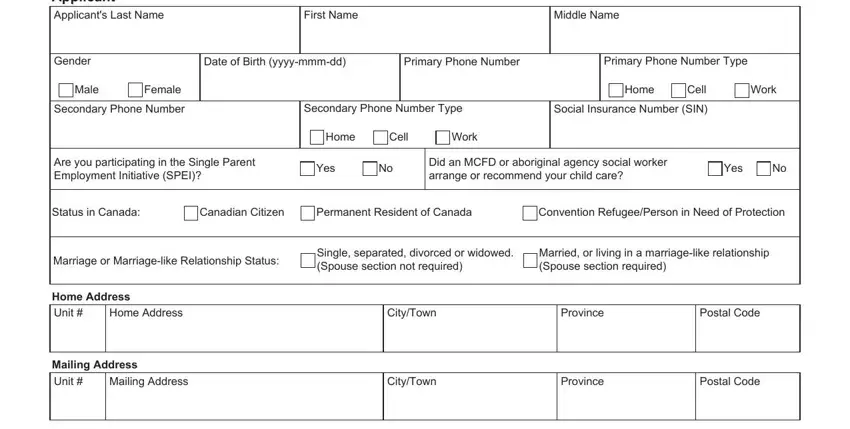

1. To get started, when filling out the cf2900 form, begin with the part that contains the following fields:

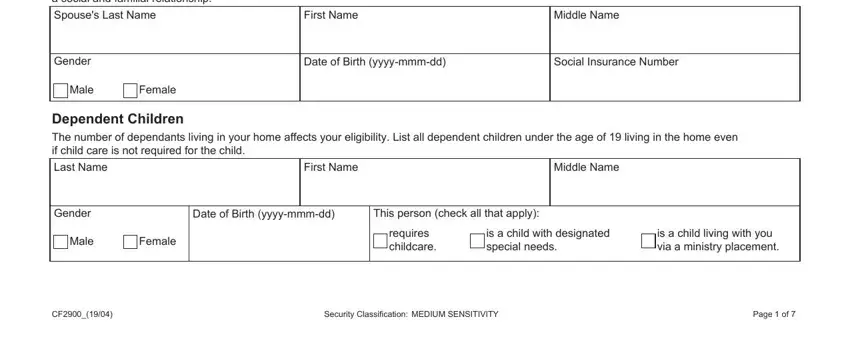

2. After this selection of blank fields is done, go to type in the relevant details in all these: Spouse A person who resides with, Spouses Last Name, First Name, Middle Name, Gender, Date of Birth yyyymmmdd, Social Insurance Number, Male, Female, Dependent Children The number of, Last Name, First Name, Middle Name, Gender, and Date of Birth yyyymmmdd.

Those who work with this document frequently make mistakes when completing Middle Name in this section. You need to reread everything you enter right here.

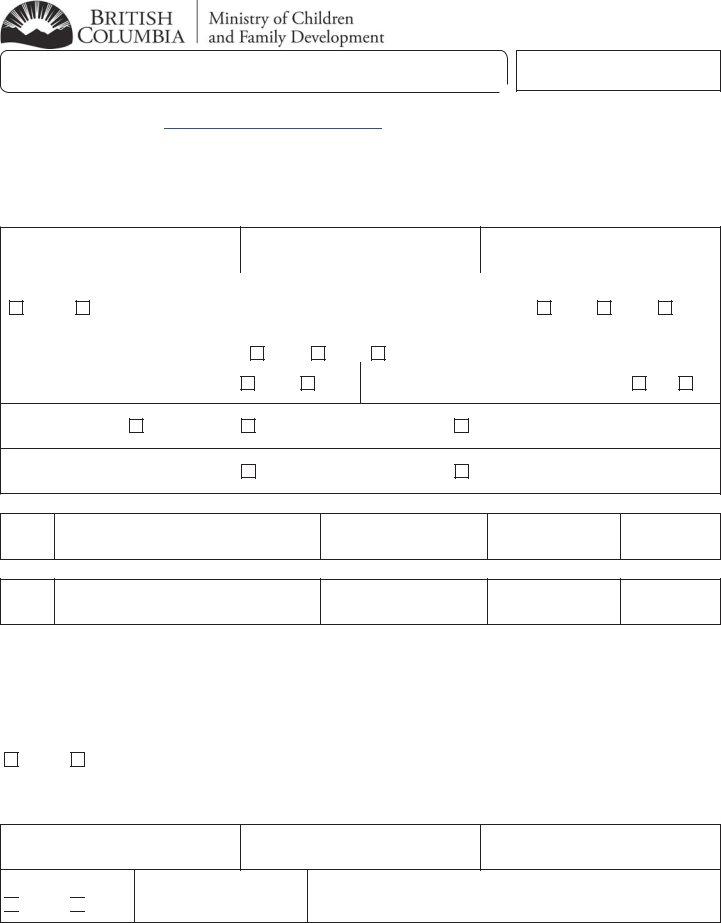

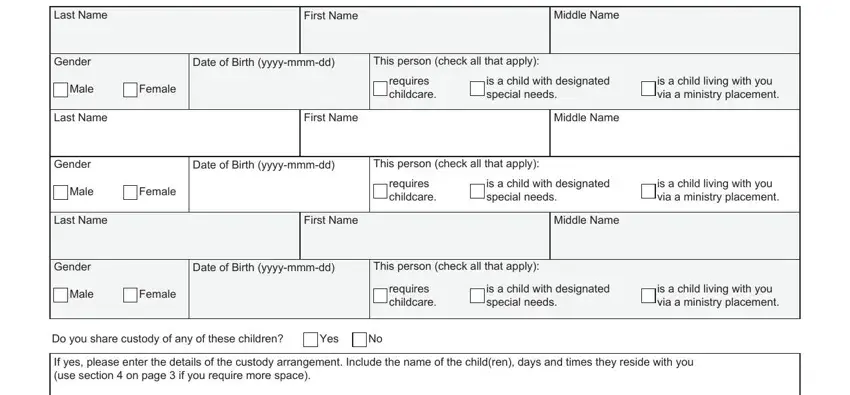

3. The next section is fairly easy, Last Name, First Name, Middle Name, Gender, Date of Birth yyyymmmdd, This person check all that apply, Male, Female, requires childcare, is a child with designated special, is a child living with you via a, Last Name, First Name, Middle Name, and Gender - each one of these form fields will need to be filled out here.

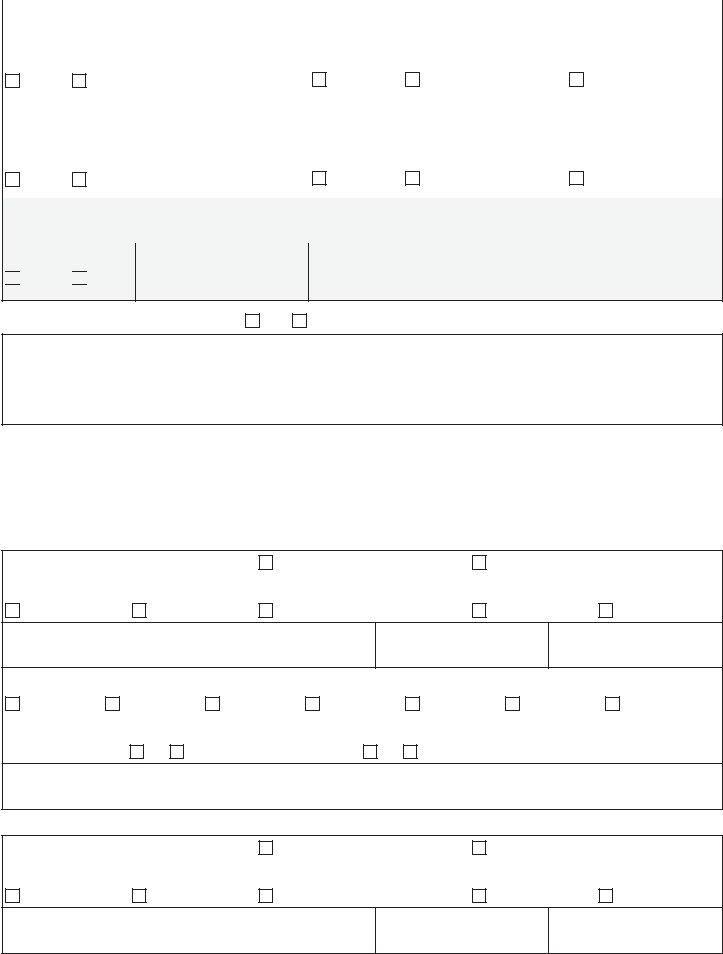

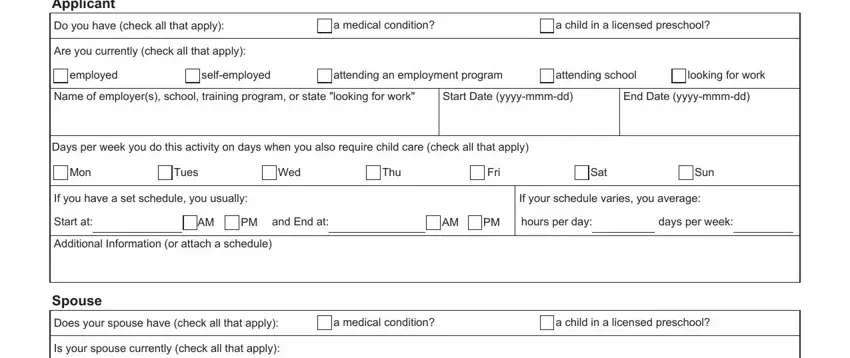

4. To go onward, this fourth part will require typing in a few blanks. These comprise of Applicant, Do you have check all that apply, a medical condition, a child in a licensed preschool, Are you currently check all that, employed, selfemployed, attending an employment program, attending school, looking for work, Name of employers school training, Start Date yyyymmmdd, End Date yyyymmmdd, Days per week you do this activity, and Mon, which you'll find integral to carrying on with this particular form.

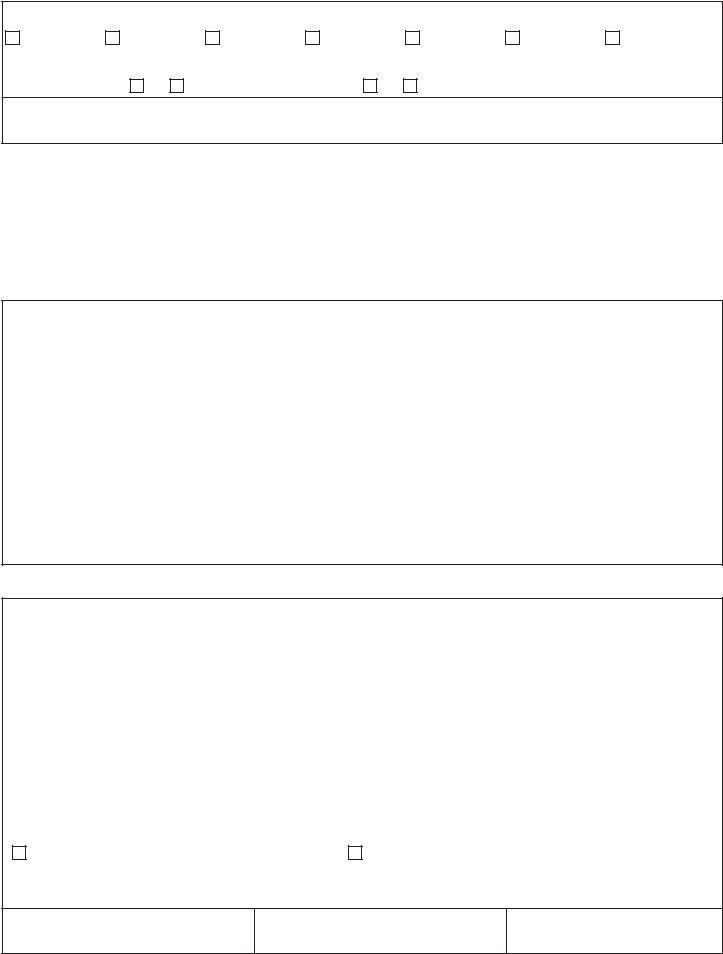

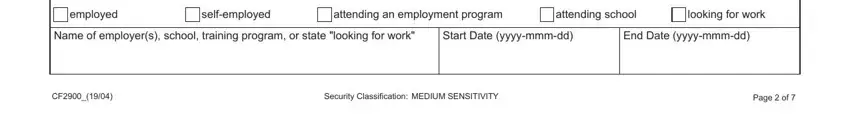

5. The document should be finished with this particular segment. Below there can be found a full list of form fields that require accurate information to allow your form usage to be complete: employed, selfemployed, attending an employment program, attending school, looking for work, Name of employers school training, Start Date yyyymmmdd, End Date yyyymmmdd, Security Classification MEDIUM, and Page of.

Step 3: Prior to finishing the file, check that blank fields were filled in the right way. The moment you are satisfied with it, press “Done." Get your cf2900 form as soon as you join for a free trial. Immediately use the pdf file inside your personal account page, with any modifications and adjustments being all synced! FormsPal guarantees your data privacy via a secure method that in no way saves or distributes any sort of private data provided. Rest assured knowing your docs are kept confidential any time you use our service!