Filling out printable original chase bank check is straightforward. Our team created our PDF tool to make it convenient to use and assist you to prepare any PDF online. Below are some steps you need to adhere to:

Step 1: Select the orange button "Get Form Here" on the following website page.

Step 2: Once you've accessed your printable original chase bank check edit page, you will notice all actions it is possible to use concerning your document in the top menu.

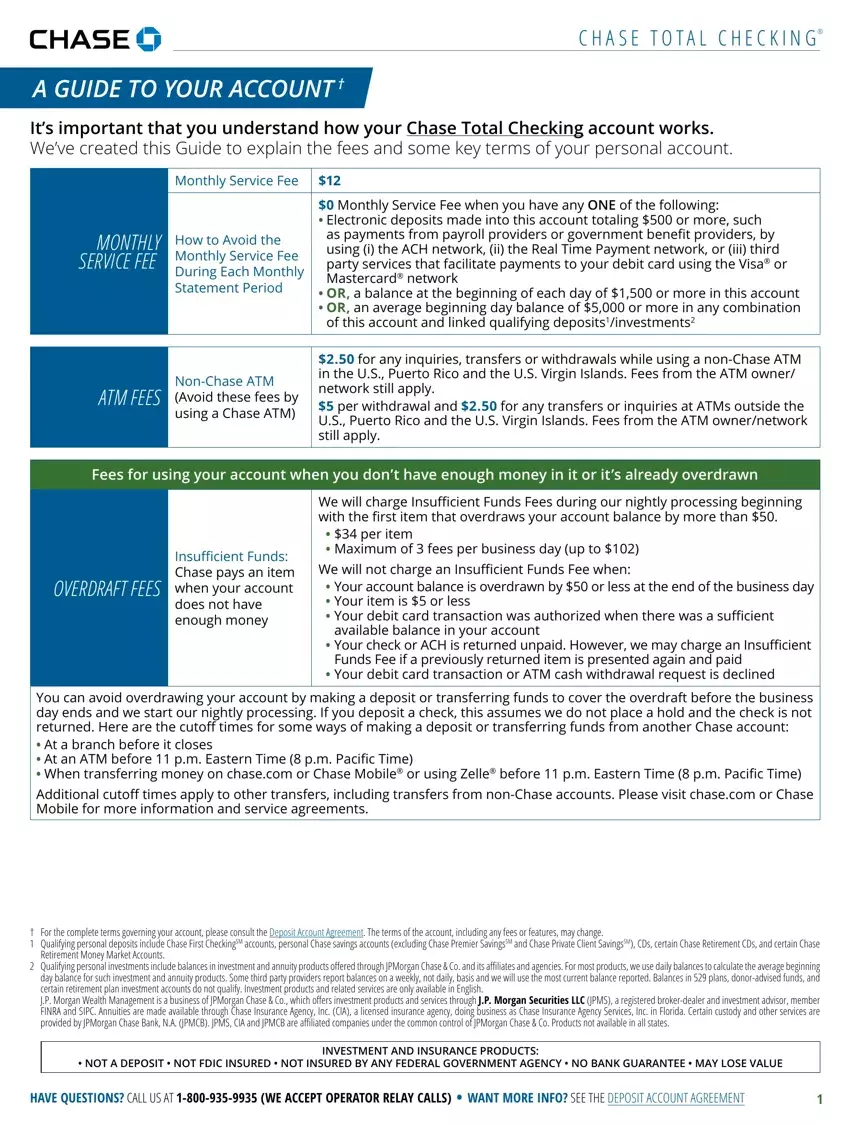

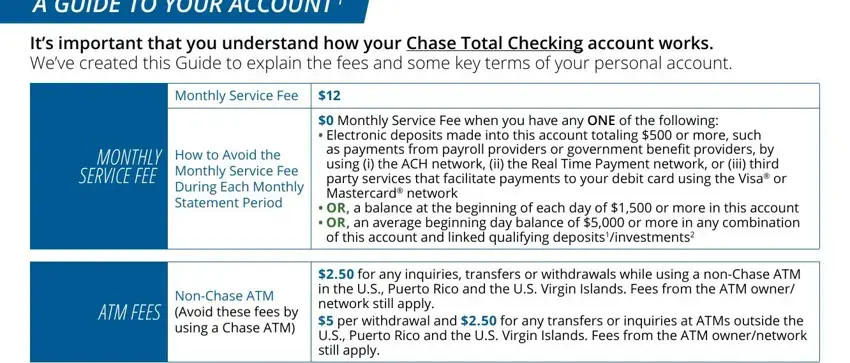

For you to fill in the template, provide the details the system will require you to for each of the next segments:

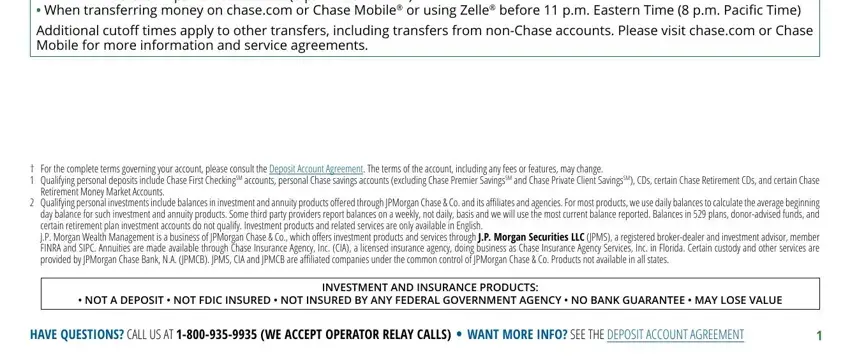

In the You can avoid overdrawing your, Additional cutoff times apply to, For the complete terms governing, Qualifying personal deposits, and INVESTMENT AND INSURANCE PRODUCTS field, put down your data.

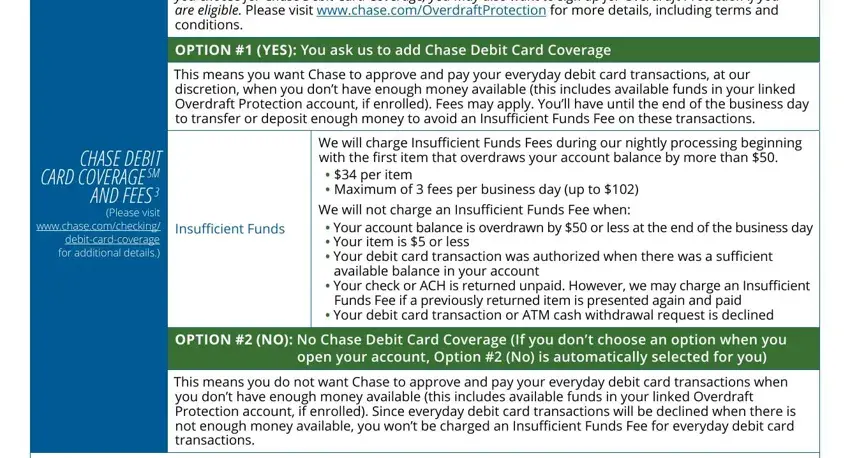

Describe the key details in the Chase Debit Card Coverage You can, OPTION YES You ask us to add, This means you want Chase to, CHASE DEBIT CARD COVERAGE SM AND, Please visit wwwchasecomchecking, Insufficient Funds, We will charge Insufficient Funds, We will not charge an Insufficient, Your account balance is overdrawn, available balance in your account, Your check or ACH is returned, Funds Fee if a previously returned, Your debit card transaction or, OPTION NO No Chase Debit Card, and open your account Option No is part.

You have to describe the rights and responsibilities of the parties in the You can avoid overdrawing your, Additional cutoff times apply to, and See the next page for other fees paragraph.

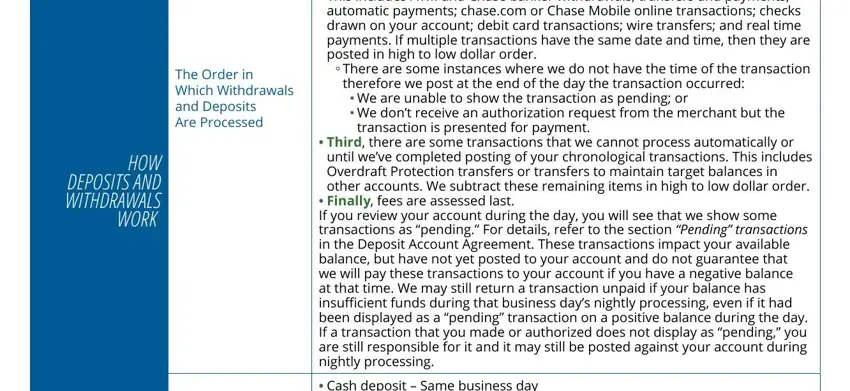

Finalize by reviewing all these areas and filling them out accordingly: Second we subtract transactions, There are some instances where we, We are unable to show the, transaction is presented for, Third there are some transactions, until weve completed posting of, Finally fees are assessed last If, Cash deposit Same business day, The Order in Which Withdrawals and, and HOW DEPOSITS AND WITHDRAWALS WORK.

Step 3: As soon as you've clicked the Done button, your form is going to be available for transfer to any kind of electronic device or email address you specify.

Step 4: In order to avoid possible forthcoming issues, it is important to hold no less than a few copies of each and every document.