Working with PDF forms online is definitely very simple with this PDF tool. You can fill in child tax credit worksheet here effortlessly. We are committed to providing you the absolute best experience with our tool by constantly introducing new features and enhancements. Our tool is now a lot more useful with the latest updates! At this point, editing documents is simpler and faster than ever before. To get the process started, consider these basic steps:

Step 1: Press the "Get Form" button above. It's going to open up our pdf editor so that you could begin filling out your form.

Step 2: Using our handy PDF tool, you'll be able to accomplish more than merely fill in blank fields. Express yourself and make your docs seem great with customized text incorporated, or optimize the file's original input to excellence - all comes with the capability to add just about any photos and sign the file off.

It is an easy task to complete the document adhering to this practical guide! This is what you should do:

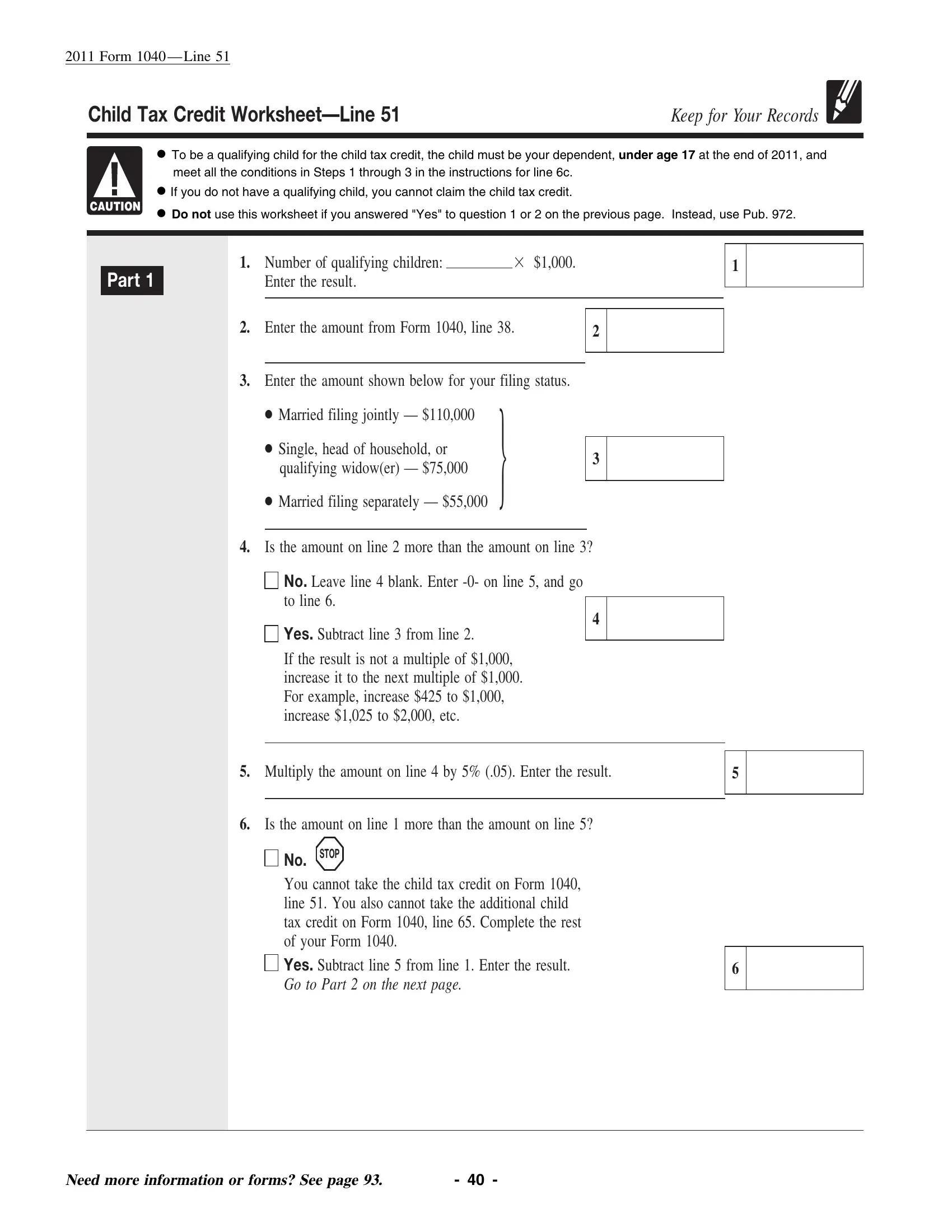

1. While filling in the child tax credit worksheet, be sure to complete all essential blanks within its corresponding form section. It will help to expedite the work, allowing for your information to be handled promptly and correctly.

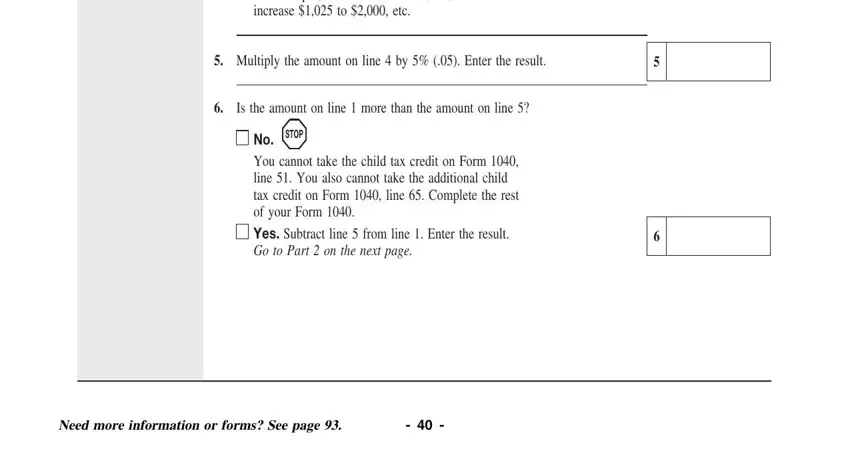

2. The next step is to submit the next few fields: Yes Subtract line from line If, Multiply the amount on line by, Is the amount on line more than, STOP, You cannot take the child tax, and Need more information or forms See.

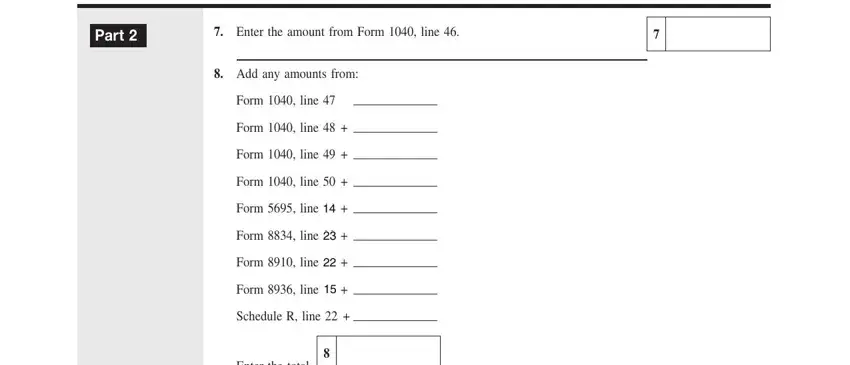

3. Completing Figure the amount of any credits, Part, Enter the amount from Form line, Add any amounts from, Form line, Form line, Form line, Form line, Form line, Form line, Form line, Form line, Schedule R line, and Enter the total is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

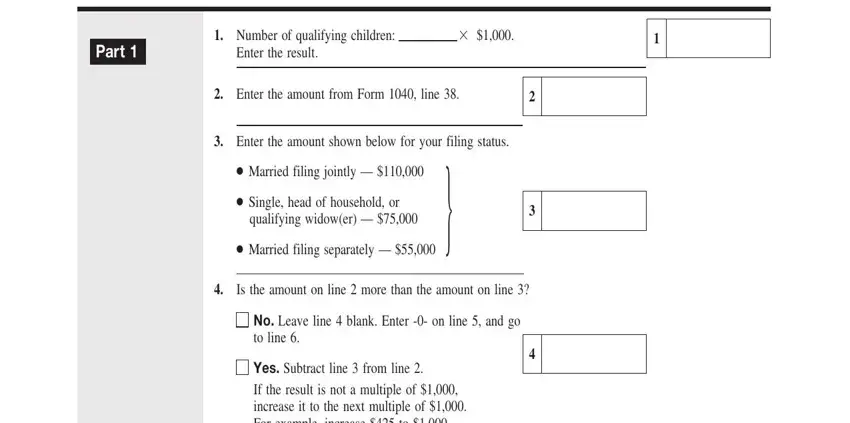

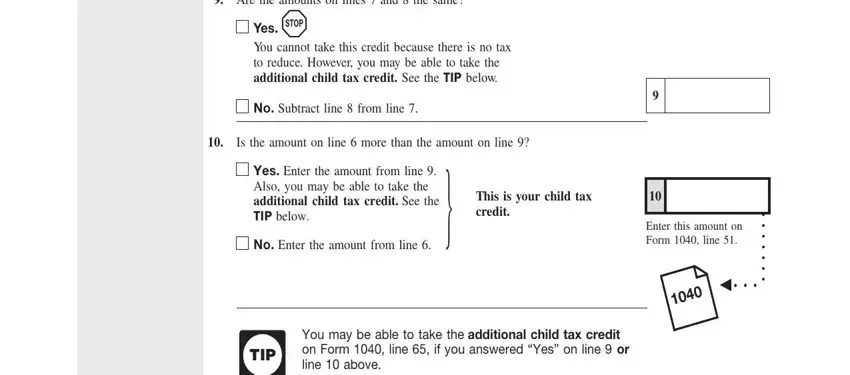

4. The form's fourth section comes with the next few blank fields to consider: Are the amounts on lines and the, Yes STOP, You cannot take this credit, TIP, No Subtract line from line, Is the amount on line more than, Yes Enter the amount from line, below, No Enter the amount from line, This is your child tax credit, Enter this amount on Form line, TIP, and You may be able to take the.

As for TIP and No Enter the amount from line, be certain that you review things in this current part. Those two are certainly the most significant fields in the PDF.

Step 3: Soon after looking through the fields you have filled out, hit "Done" and you are all set! Sign up with us right now and easily gain access to child tax credit worksheet, all set for downloading. All changes made by you are preserved , which means you can modify the pdf at a later time as needed. FormsPal guarantees secure document editing with no data record-keeping or any kind of sharing. Feel comfortable knowing that your information is safe here!