Making use of the online PDF editor by FormsPal, you're able to complete or change cigna beneficiary form right here and now. FormsPal team is always endeavoring to enhance the editor and insure that it is much better for people with its extensive functions. Take your experience to a higher level with continually growing and amazing options we provide! If you're seeking to get started, here's what it will require:

Step 1: Open the PDF in our tool by hitting the "Get Form Button" at the top of this webpage.

Step 2: With this advanced PDF editing tool, you are able to accomplish more than simply fill in blank form fields. Try all the functions and make your docs appear faultless with customized textual content added, or fine-tune the original content to perfection - all supported by the capability to incorporate your own images and sign the PDF off.

Be mindful while filling in this pdf. Ensure that each and every blank is completed accurately.

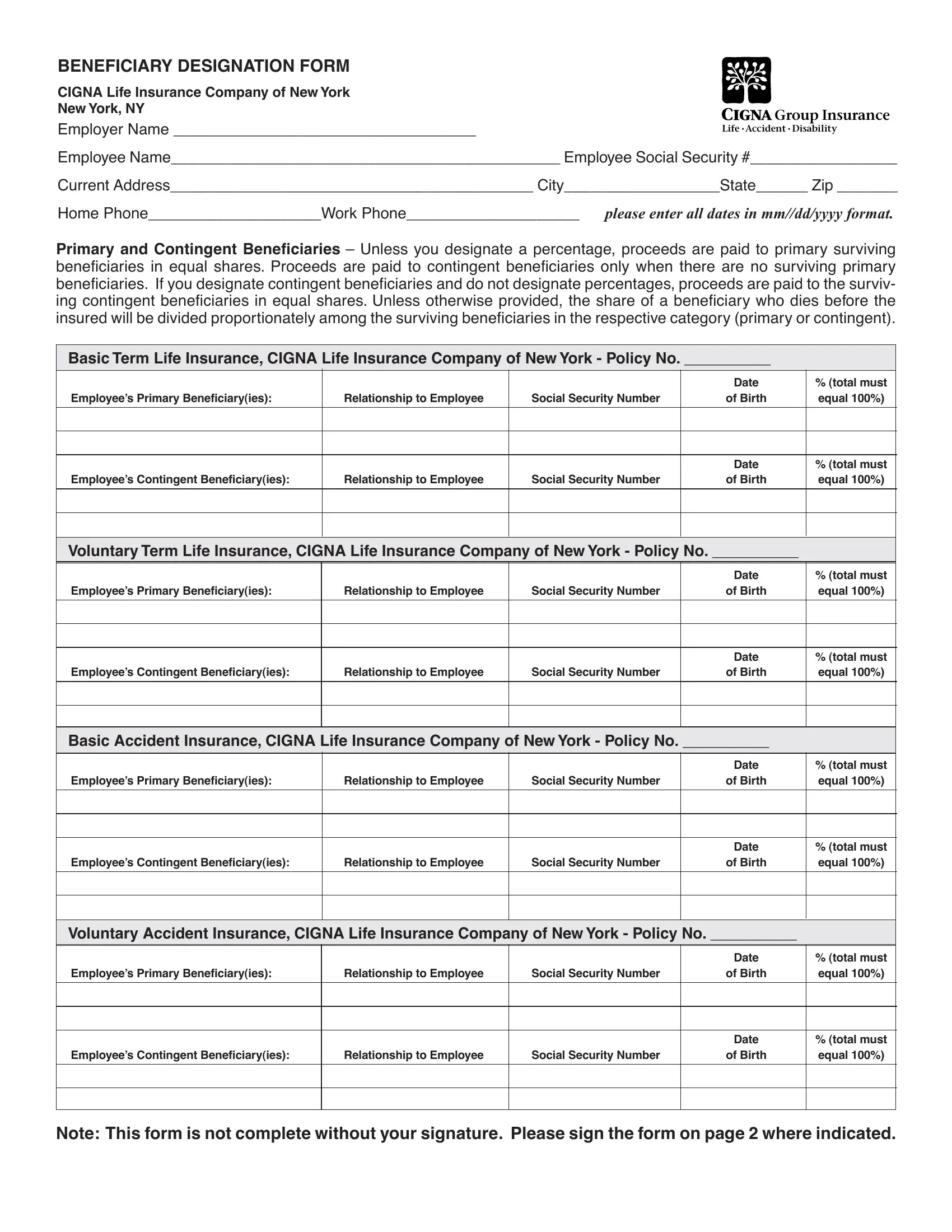

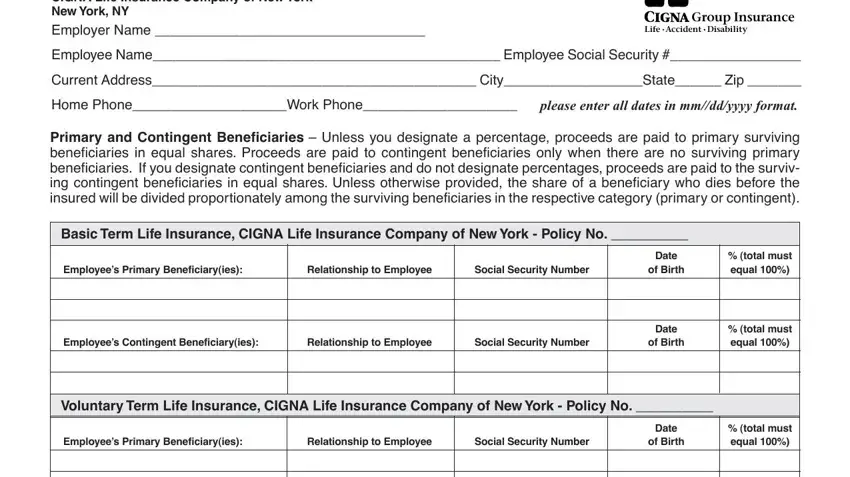

1. The cigna beneficiary form needs specific details to be typed in. Be sure that the next fields are finalized:

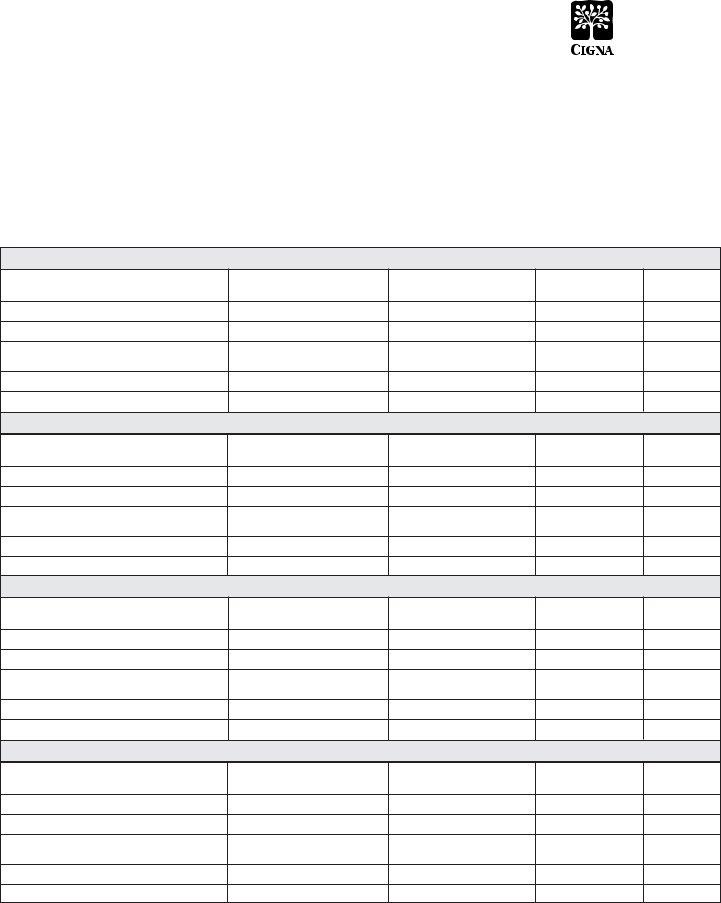

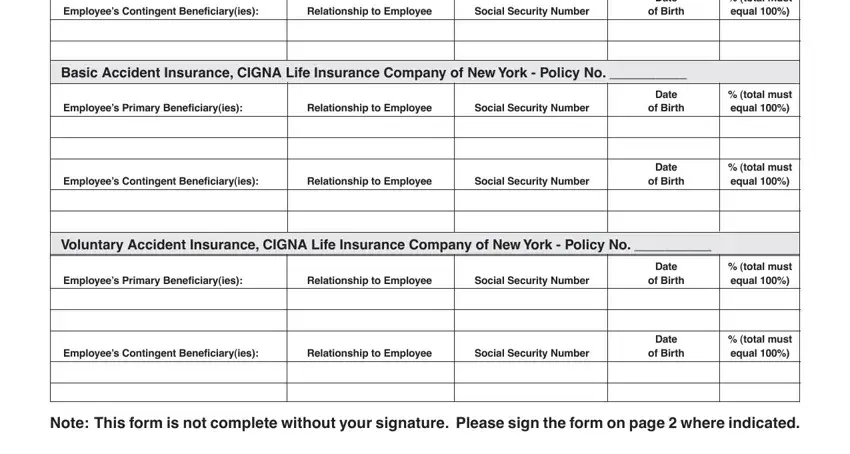

2. Once your current task is complete, take the next step – fill out all of these fields - Employees Contingent Beneficiaryies, Relationship to Employee, Social Security Number, Date, of Birth, total must equal, Basic Accident Insurance CIGNA, Employees Primary Beneficiaryies, Relationship to Employee, Social Security Number, Employees Contingent Beneficiaryies, Relationship to Employee, Social Security Number, Date, and of Birth with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

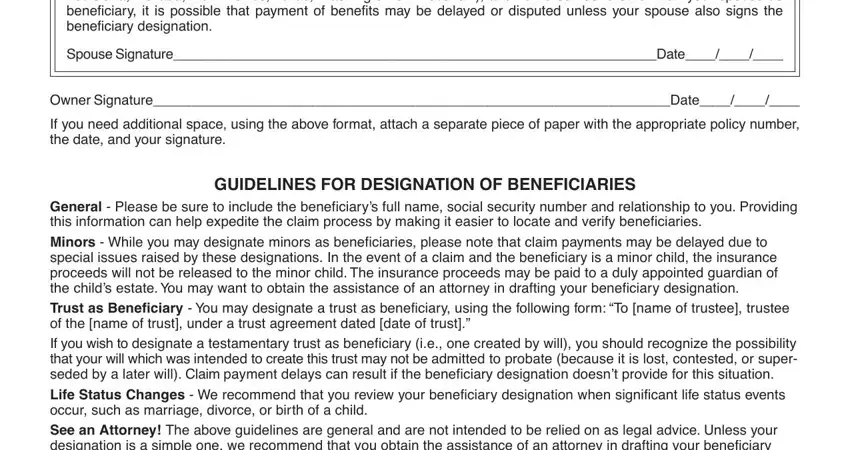

3. The following section is mostly about Community Property Laws If you, Spouse SignatureDate, Owner SignatureDate, If you need additional space using, GUIDELINES FOR DESIGNATION OF, General Please be sure to include, Minors While you may designate, Trust as Beneficiary You may, If you wish to designate a, Life Status Changes We recommend, and See an Attorney The above - complete each one of these blanks.

It is easy to make errors while filling out the Spouse SignatureDate, hence be sure to go through it again prior to deciding to submit it.

Step 3: Make certain your information is correct and just click "Done" to finish the task. Sign up with FormsPal now and instantly use cigna beneficiary form, available for download. All alterations you make are kept , allowing you to edit the document at a later point anytime. We don't share the information you enter whenever working with forms at our site.