When using the online PDF tool by FormsPal, you'll be able to complete or change northwestern mutual ownership change form here and now. In order to make our tool better and less complicated to utilize, we consistently develop new features, with our users' feedback in mind. If you are looking to get going, here's what it takes:

Step 1: First, open the editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This editor allows you to customize your PDF document in a variety of ways. Improve it by writing customized text, correct original content, and include a signature - all close at hand!

This PDF doc will involve specific details; in order to ensure accuracy and reliability, remember to bear in mind the subsequent tips:

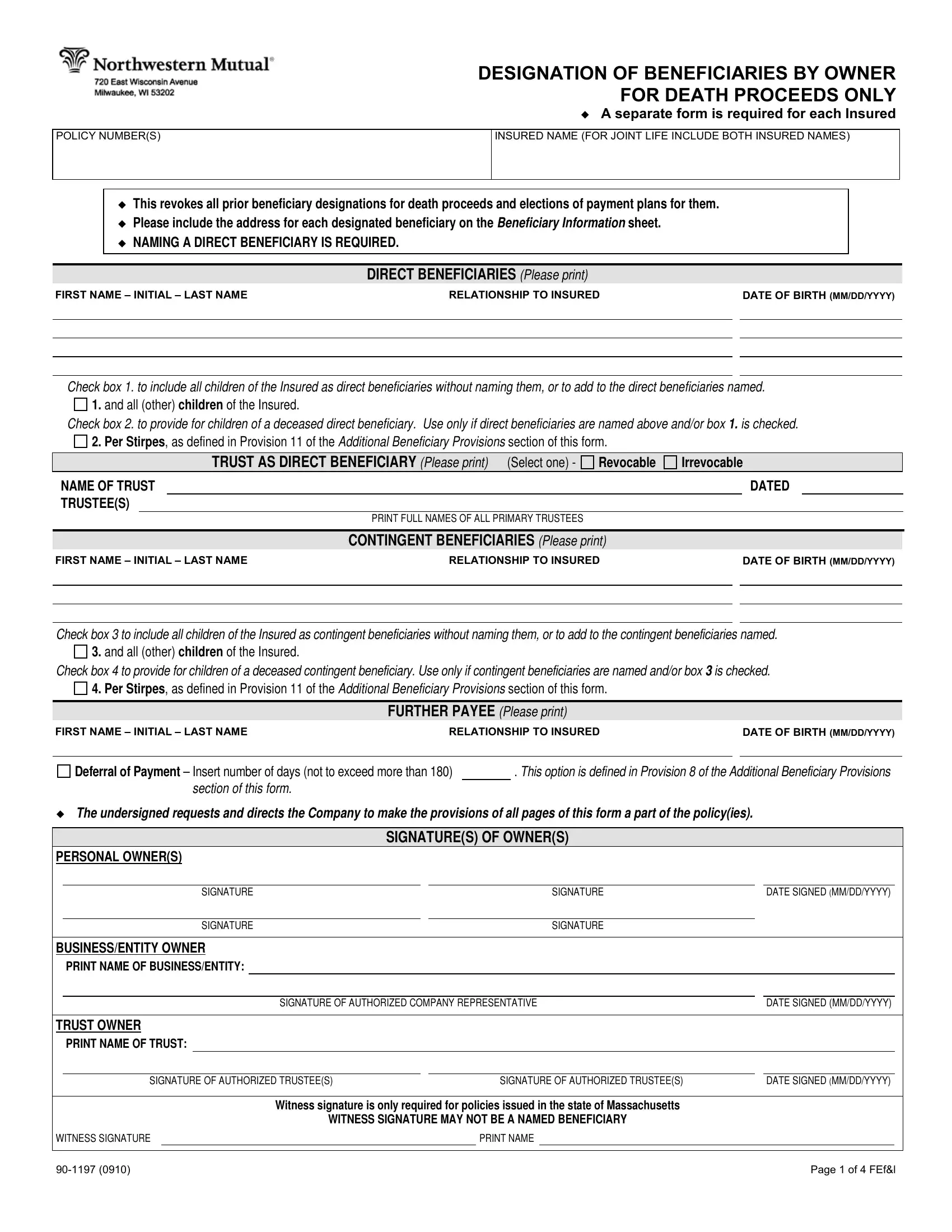

1. It is critical to fill out the northwestern mutual ownership change form correctly, thus take care while working with the areas that contain these blank fields:

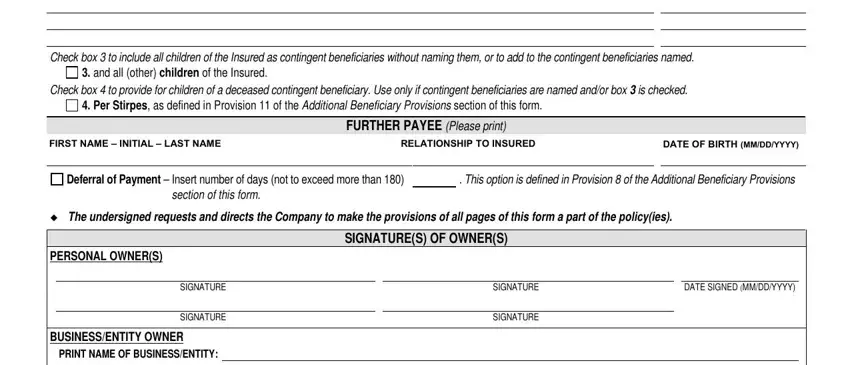

2. Now that the previous part is completed, you should include the essential specifics in DATE OF BIRTH MMDDYYYY FIRST NAME, and all other children of the, Check box to provide for children, Per Stirpes as defined in, FIRST NAME INITIAL LAST NAME, FURTHER PAYEE Please print, RELATIONSHIP TO INSURED, DATE OF BIRTH MMDDYYYY, Deferral of Payment Insert number, This option is defined in, section of this form, The undersigned requests and, PERSONAL OWNERS, SIGNATURE, and SIGNATURE so you can move on further.

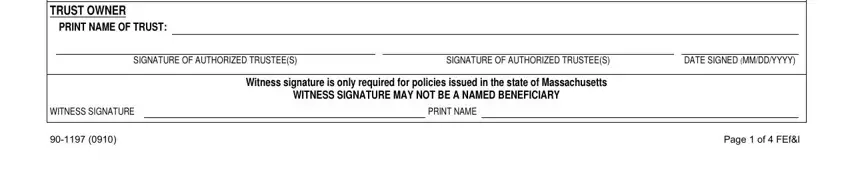

3. The next part is rather straightforward, TRUST OWNER PRINT NAME OF TRUST, SIGNATURE OF AUTHORIZED TRUSTEES, SIGNATURE OF AUTHORIZED TRUSTEES, DATE SIGNED MMDDYYYY, WITNESS SIGNATURE, Witness signature is only required, WITNESS SIGNATURE MAY NOT BE A, PRINT NAME, and Page of FEfl - these empty fields must be filled in here.

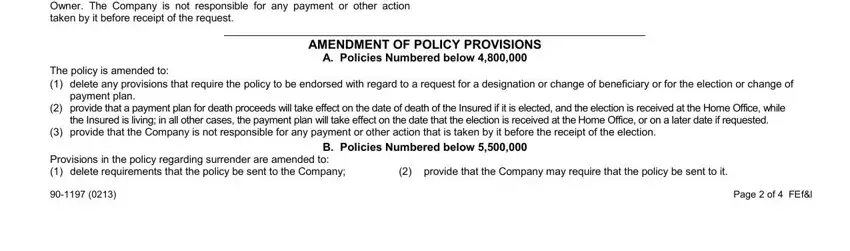

4. It is time to start working on this next segment! In this case you've got all these TRUSTEE AS BENEFICIARY If a, AMENDMENT OF POLICY PROVISIONS, A Policies Numbered below, The policy is amended to delete, payment plan, provide that a payment plan for, the Insured is living in all other, provide that the Company is not, Provisions in the policy regarding, provide that the Company may, B Policies Numbered below, and Page of FEfl blank fields to complete.

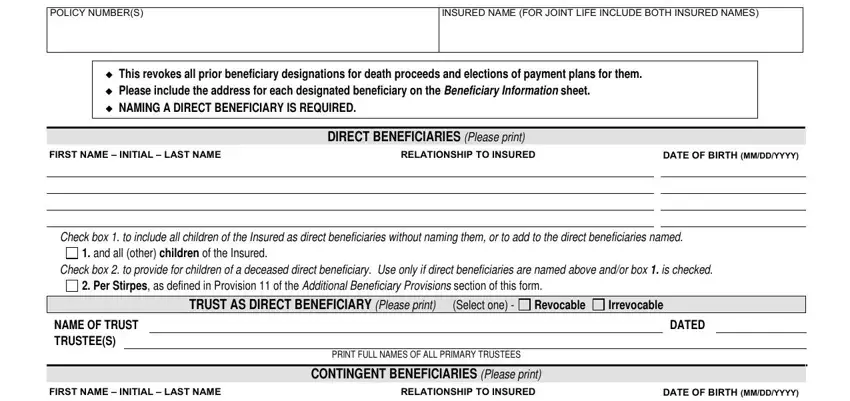

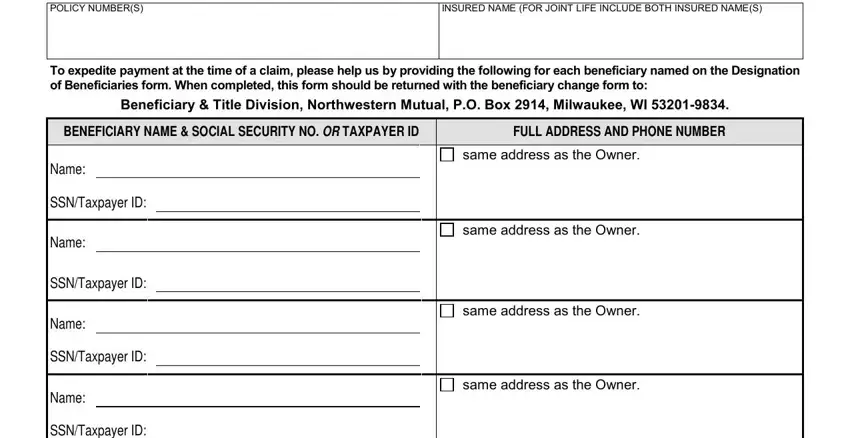

5. To finish your document, this particular subsection incorporates a couple of additional blanks. Entering POLICY NUMBERS, INSURED NAME FOR JOINT LIFE, To expedite payment at the time of, Beneficiary Title Division, BENEFICIARY NAME SOCIAL SECURITY, FULL ADDRESS AND PHONE NUMBER, Name, SSNTaxpayer ID, Name, SSNTaxpayer ID, Name, SSNTaxpayer ID, Name, SSNTaxpayer ID, and same address as the Owner should wrap up the process and you can be done in a snap!

A lot of people generally make some mistakes when filling out SSNTaxpayer ID in this part. Remember to read twice everything you enter right here.

Step 3: Right after rereading the fields, press "Done" and you are all set! Join FormsPal right now and easily use northwestern mutual ownership change form, available for downloading. Every modification made is conveniently kept , letting you modify the file later when required. We don't share or sell any information you enter when filling out forms at FormsPal.