In the realm of construction and subcontracting, the CIS300 form embodies a crucial monthly ritual, ensuring contractors' compliance with the HM Revenue & Customs (HMRC) regulations. This comprehensive guide touches on all facets necessary for accurately completing the CIS300, along with its counterparts CIS300(CS), CIS300(Man), and CIS300(CS)(Man), catering to a variety of scenarios contractors might face. As HMRC dispatches the form at the cusp of a new tax month, it arrives partly filled with details regarding the contractor’s business and the subcontractors either previously verified or paid within the recent period. Contractors are then tasked with verifying this information, incorporating any new subcontractors not listed, documenting the payments made—including any deductions—and ultimately signing off with a declaration. An essential deadline is the 19th of the month, post which penalties are applicable. The form allows for both electronic and postal submissions, provided it arrives at the designated address by the due date. Additionally, the procedure includes considerations for nil returns, adjustments for any errors post-submission, and explicit directives for including payment details to subcontractors, ensuring a seamless reporting process. By observing these instructions, contractors uphold their compliance, contributing to the robust framework of the construction industry’s financial reporting.

| Question | Answer |

|---|---|

| Form Name | Cis300 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | form cis300, cis300 guide, cis300 online, cis 300 return |

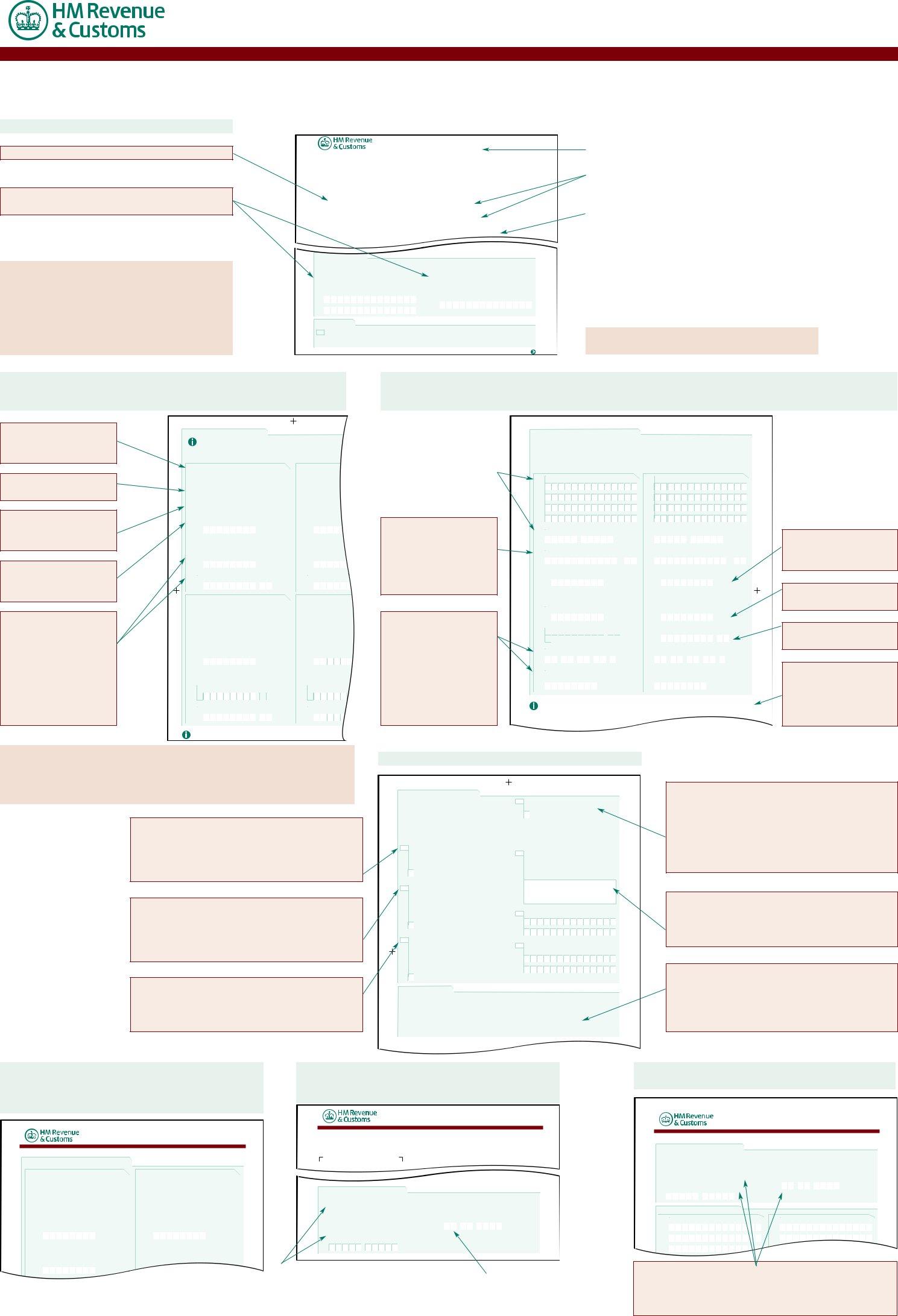

Guide to CIS Contractor’s monthly return

How to complete forms CIS300, CIS300(CS), CIS300(M an) and CIS300(CS)(M an)

We will send you a ret urn t owards t he end of each t ax mont h (a t ax mont h runs from t he 6t h of one mont h t o t he 5t h of t he next ). We will fill in t he ret urn wit h t he informat ion t hat we hold about your business and t he subcont ract ors t hat have been verified or you have paid recent ly. You must check informat ion on t he ret urn, add any new subcont ract ors not already shown, enter det ails of all payment s wit h det ails of deduct ions and consider and sign t he declarat ions. You must send the return to reach us by the 19th of the month, otherwise you will incur a penalty.

CIS300 Page 1

Your name and address det ails held on our file.

You only need t o fill in boxes 1 or 2 if your name or cont act telephone number changes.

If you have not paid any subcont ract ors during t he mont h, you must st ill make a nil ret urn.

If you tell us by phone, Internet or by EDI, you do not have t o send us your ret urn.

If you post your ret urn send it t o:

HMRC CIS, Comben House, Farriers Way, BOOTLE, L69 9ZX.

CIS300 Page 2

|

Contractor’s monthly return |

|

|

|

|

Month ending 05 06 2006 |

|

Mont h t o which t he ret urn relates. |

|

|

|

|

||

|

|

|||

|

|

|

|

|

1 2 3 PA1 2 3 4 5 6 7 8 0 6 0 6 |

|

|

|

|

|

|

|

Use t hese references when cont act ing us. |

|

|

|

|||

|

|

|

RECIPIENT NAME LINE 1 |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

RECIPIENT NAME LINE 2 |

|

X |

|

Contractor’s unique t ax reference (UTR) |

|

|||||||||||||||||||||||||

|

|

|

ADDRESS LINE 2 |

|

X |

|

Call t his number if you |

||||||||||||||||||||||||||

|

|

|

ADDRESS LINE 1 |

|

X |

12345 54321 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

ADDRESS LINE 3 |

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

ADDRESS LINE 4 |

|

X |

|

Accounts Office reference |

• need fur t her informat ion about filling in a ret urn |

|||||||||||||||||||||||||

|

|

|

ADDRESS LINE 5 |

|

X |

|

123PA12345678 |

||||||||||||||||||||||||||

|

|

|

POSTCODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIS Helpline 0845 366 7899 |

• have made a mist ake af ter you have sent a ret urn |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

envelope provided. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• need a replacement ret urn. |

|||||||||||||

Phot ocopies are not accept able. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

CONTACT DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Supplying t he following informat ion will help speed t hings up if we need t o t alk t o you about your ret urn. We will |

|

||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

|

|

Cont act name (if not shown or needs t o change) |

|

|

|

Cont act phone number/ mobile number (if not shown |

|

||||||||||||||||||||||||||

|

1 |

|

|

2 |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or needs t o change) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NIL RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

If you have not made any payment s t o subcont ract ors in t he const ruct ion indust r y for t he mont h shown above, you must |

|

|||||||||||||||||||||||||||||||

|

3 |

You can register t o fill in your mont hly ret urn |

|||||||||||||||||||||||||||||||

|

|

make a nil declarat ion. Do t his online at www.hmrc.gov.uk/ |

|||||||||||||||||||||||||||||||

‘DECLARATION AND CERTIFICATE’ at t he t op of page 4 and st ar t t o fill in t he ret urn from t here.

online at www.hmrc.gov.uk/

Please t urn over

CIS300 Page 3

Will cont ain det ails of subcont ract ors you have previously paid or verified. If you haven’t paid a subcont ract or leave t he box blank.

Fill in when you want t o tell us of payment s made t o subcont ract ors who do not appear on Page 2 or CIS300(CS) – Cont inuat ion Sheet

Name of subcont ract ors you have previously paid or verified.

Reference number as confirmed by HMRC.

1 2 3 P

PAYM ENTS TO SUBCONTRACTORS

Please do not change any of t he det ails we have printed. If any of t he det ails are wrong, pl CIS Helpline.

Use black ink t o fill in t he white boxes below. Only fill in t he det ails for t hose subcont ract o

If you haven’t paid the subcontractor, please leave the boxes blank.

4.1 |

Subcontractor’s name |

4.1 |

Subcontractor’s name |

||

|

BOB T HE BUI L DER |

|

MAST ER BUI L DERS |

||

|

Subcontractor’s unique t ax reference (UTR) |

|

Subcontractor’s unique t ax |

||

4.2 |

4.2 |

||||

|

5 4 3 2 1 |

1 2 3 4 5 |

|

9 8 7 6 5 |

5 6 7 8 9 |

|

Subcontractor’s verification number |

|

Subcontractor’s verification |

||

4.3 |

4.3 |

||||

|

V1 0 0 0 0 0 0 3 2 1 |

|

V1 0 0 0 0 0 0 6 2 8 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter t he subcont ract or ’s |

|

PAYM ENTS TO SUBCONTRACTORS CONTINUED |

|

|

|

|

1 2 3 PA1 2 3 4 5 6 7 8 0 6 0 6 |

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

name or business name |

|

If you made payment t o any subcont ract ors we have not listed on your mont hly ret urn, or on a cont inuat ion sheet , please |

|||||||

|

fill in t he white boxes below. Only fill in det ails for t hose subcont ract ors you have paid. |

||||||||

given during verificat ion |

|

If you have more t han t wo, you need t o fill in blank cont inuat ion sheet s, CIS300 (CS) (Man), and send t o us wit h your |

|||||||

|

|

mont hly ret urn. Supplies of t hese forms were enclosed wit h your Cont ract or Pack. You can get fur t her supplies from t he |

|||||||

in 4.1 and t he reference |

|

CIS Orderline on 0845 366 7899. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

number given by t he |

|

|

Subcontractor’s name or business name |

|

|

|

Subcontractor’s name or business name |

||

|

4.1 |

|

|

4.1 |

|||||

|

|

|

|

||||||

subcont ract or in 4.2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number supplied at verificat ion as confirmed by HMRC.

Enter t he t ot al amount paid t o t he subcont ract or in t he mont h in 4.4.

You only need t o fill in boxes 4.5 and 4.6 if you have made a

deduct ion on account of t ax. Enter t he t ot al cost of materials paid in t he mont h in 4.5 and t he

4.4 |

Tot al payments made. Do not include VAT. |

4.4 |

Tot al payments made. Do n |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only fill in boxes 4.5 and 4.6 if you have made a deduction |

Only fill in boxes 4.5 and 4.6 if yo |

||||||||||||||||||||

on account of t ax from what you paid t he subcont ract or. |

on account of t ax from what yo |

||||||||||||||||||||

|

Materials paid for by the subcontractor |

|

|

|

Materials paid for by the su |

||||||||||||||||

4.5 |

|

|

4.5 |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total amount deducted on account of tax £ and pence |

|

Total amount deducted on |

||||||||||||||||||

4.6 |

4.6 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subcontractor’s name |

|

|

|

Subcontractor’s name |

||||||||||||||||

4.1 |

|

|

4.1 |

||||||||||||||||||

|

CONST RUCT I ON & CO |

|

|

|

XXXXXXXXXXXXXXXXXXX |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XXXXXXXXXXXXXXXXXXX |

||||||

|

Subcontractor’s unique t ax reference (UTR) |

|

Subcontractor’s unique t ax |

||||||||||||||||||

4.2 |

4.2 |

||||||||||||||||||||

|

4 3 2 1 0 |

0 1 2 3 4 |

|

|

|

|

|

|

|

|

XXXXXXXXXXXXXXXXXXX |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Subcontractor’s verification number |

|

|

|

Subcontractor’s verification |

||||||||||||||||

4.3 |

|

|

4.3 |

||||||||||||||||||

|

V1 0 0 0 0 0 0 7 5 2 |

|

|

|

XXXXXXXXXXXXXXXXXXX |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Tot al payments made. Do not include VAT. |

|

Tot al payments made. Do n |

||||||||||||||||||

4.4 |

4.4 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

£ |

|

XXXXXXXXXXXXXXXXXXX |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Only fill in boxes 4.5 and 4.6 if you have made a deduction |

Only fill in boxes 4.5 and 4.6 if yo |

||||||||||||||||||||

on account of t ax from what you paid t he subcont ract or. |

on account of t ax from what yo |

||||||||||||||||||||

|

Materials paid for by the subcontractor |

|

|

|

Materials paid for by the su |

||||||||||||||||

4.5 |

|

|

4.5 |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• 0 |

0 |

|

|

£XXXXXXXXXXXXXXXXXXX |

|||||||

Enter t he verificat ion number given by HMRC but only for

subcont ract ors we could not mat ch t o our records.

If t he subcont ract or is an individual and gave t heir Nat ional Insurance number at verificat ion enter it . If t he subcont ract or is a company and gave you

4.2 |

Subcontractor’s unique t ax reference (UTR) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subcontractor’s verification number (higher rate only) |

||||||||||||||||||||

4.3 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Tot al payments made. Do not include VAT. |

||||||||||||||||||||

4.4 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only fill in boxes 4.5 and 4.6 if you have made a deduction on account of t ax from what you paid t he subcont ract or.

4.5 |

Materials paid for by the subcontractor |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total amount deducted on account of tax £ and pence |

||||||||||||

4.6 |

|||||||||||||

£ •

4.7 |

Subcontractor’s National Insurance number (if known) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subcontractor’s company registration number (CRN) |

||||||||||||||||

4.8 |

|||||||||||||||||

|

(if known) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.2 |

Subcontractor’s unique t ax reference (UTR) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subcontractor’s verification number (higher rate only) |

||||||||||||||||||||

4.3 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Tot al payments made. Do not include VAT. |

||||||||||||||||||||

4.4 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only fill in boxes 4.5 and 4.6 if you have made a deduction on account of t ax from what you paid t he subcont ract or.

4.5 |

Materials paid for by the subcontractor |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Total amount deducted on account of tax £ and pence |

|||||||||||||||||||

4.6 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Subcontractor’s National Insurance number (if known) |

|||||||||||||||||||

4.7 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subcontractor’s company registration number (CRN) |

|||||||||||||||||||

4.8 |

||||||||||||||||||||

|

(if known) |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter t he t ot al amount paid t o t he subcont ract or in t he mont h.

Enter t he t ot al cost of materials for t he mont h.

Enter t he t ot al amount deducted in t he mont h.

If you need t o tell us of payment s made t o ot her subcont ract ors please

t ot al amount deducted in t he mont h in 4.6.

4.6 |

Total amount deducted on account of tax £ and pence |

4.6 |

Total amount deducted on |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

|

|

|

|

£ |

|

XXXXXXXXXXXXXXXXXXX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We will send continuation sheets with your return if we hold det ails for five or more subcon or paid previously. If we have sent you any continuation sheets, please look at them before

t heir CRN at verificat ion enter t he number.

If you have paid more t han t wo subcont ract ors we have not listed, please fill in blank cont inuat ion sheet s CIS300 (CS) (Man) and send t o us wit h your mont hly ret urn. You can get supplies from your Cont ract or Pack or, if you have run out , from

t he CIS Orderline on 0845 366 7899.

Please t urn over

use t he CIS300(CS)(Man) cont inuat ion sheet .

If you make a mist ake cross out t he wrong informat ion and write t he correct informat ion underneat h. Page 2 only includes det ails for 4 subcont ract ors, if we hold det ails for more we will send you cont inuat ion sheet s CIS300(CS).

CIS300 Page 4

Please look at t hem before filling in page 3.

If you want t o tell us t hat you have not paid any cont ract ors in t he mont h using t he ret urn form, place an ‘X’ in t he box. If you tell us by phone, Internet or EDI, you do not have t o send us your ret urn.

You must consider t he employment st at us for each individual you have included on t he ret urn and place a ‘X’ in t he box t o confirm t hat payment s have not been made under cont ract s of employment .

DECLARATION AND CERTIFICATE

As t he cont ract or you may be liable for any deduct ions you should have made but have not declared on a mont hly ret urn t o HM Revenue & Cust oms (HMRC).

If you have not paid any subcont ract ors for t he mont h shown on t his ret urn, go t o box 5.

If you have paid subcont ract ors for t he mont h shown on t his ret urn, go t o box 6.

5Nil return

I confirm that no payments have been made to

subcont ract ors in t he const ruct ion indust r y in t his period.

Put ‘X’ in t he box below.

Now go st raight t o box 8.

6Employment st atus

The employment st atus of each individual included on t his ret urn, and any cont inuat ion sheet s, has been considered and payment s have not been made under contracts of employment.

Put ‘X’ in t he box below.

7Verified subcontractors

Ever y subcont ract or included on t his ret urn, and any cont inuat ion sheet s, has eit her been verified wit h

HM Revenue & Cust oms, or has been included in previous CIS ret urns in t his, or t he previous t wo t ax years.

Put ‘X’ in t he box below.

1 2 3 PA1 2 3 4 5 6 7 8 0 6 0 6

8If you do not ant icipate paying subcont ract ors in t he next six mont hs, put ‘X’ in t he box below.

This means we will not send you a mont hly ret urn unnecessarily. But , you must let us know when you st art to pay subcontractors again by phoning t he CIS Helpline or writ ing t o your HMRC of fice.

9Please sign below t o confirm t he declarat ion made at eit her box 5 or boxes 6 and 7. We may penalise or prosecute you if you make false st atement s.

The informat ion I have given on t his ret urn is correct and complete t o t he best of my knowledge and belief.

Signat ure

10Please print your name

11Capacity in which signed for example, cont ract or, payroll manager, wages clerk, agent .

If you do not plan t o pay subcont ract ors for a while place an ‘X’ in t he box and we can st op sending you ret urns for t he next six mont hs. IMPORTANT – You must tell us as soon as you st ar t paying subcont ract ors again as it is your responsibilit y t o ensure a mont hly ret urn is submit ted when one is due.

Unsigned ret urns will not be accepted and will be sent back t o you. If we receive your ret urn later

t han t he 19t h of t he mont h you will incur a penalt y.

Please send your ret urn t o t his address by t he 19t h

If you have verified ever y subcont ract or included on t his ret urn or have included t hem on a previous ret urn in t his t ax year or t he t wo previous t ax years you must place an ‘X’ in t he box.

WHAT TO DO NEXT

•If you fill in any cont inuat ion sheet s you must send t hem back at t he same t ime as your main mont hly ret urn ot herwise your mont hly ret urn is incomplete.

• Please do not fold or st aple any sheet s t oget her – keep t hem flat and use t he envelope provided.

•Please send your completed ret urn, including any cont inuat ion sheet s, t o:

HM Revenue & Cust oms, Const ruct ion Indust r y Scheme, Comben House, Farriers Way, BOOTLE, L69 9ZX.

•If a payment is due, send it t o your HMRC Account s Of fice and not wit h t his ret urn. See your P30BC – Payslip Booklet for notes on how to pay.

of t he mont h ot herwise you will incur a penalt y. You should get your ret urn back t o us by t his date regardless of whet her you are in discussion wit h us about any issues concerning t he ret urn.

CIS300(CS)

t han four subcont ract ors.

Contractor’s monthly return

Cont inuat ion sheet Month ending 05 JUN 2006

PAYM ENTS TO SUBCONTRACTORS CONTINUED |

|

|

|

|

|

1 2 3 PA1 2 3 4 5 6 7 8 0 6 0 6 |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Subcontractor’s name |

|

|

|

Subcontractor’s name |

|

|

|

||||||||||||||||||||

4.1 |

|

|

4.1 |

|

|

|

||||||||||||||||||||||

|

SCAF F OL DERS I NC |

|

|

|

J ACK EL EKT RI K |

|

|

|

||||||||||||||||||||

|

Subcontractor’s unique t ax reference (UTR) |

|

Subcontractor’s unique t ax reference (UTR) |

|||||||||||||||||||||||||

4.2 |

4.2 |

|||||||||||||||||||||||||||

|

9 6 3 8 5 |

5 2 3 6 9 |

|

|

|

|

|

|

|

|

1 2 3 3 2 |

1 2 3 4 5 |

|

|

|

|

|

|

|

|

||||||||

|

Subcontractor’s verification number |

|

|

|

Subcontractor’s verification number |

|

|

|

||||||||||||||||||||

4.3 |

|

|

4.3 |

|

|

|

||||||||||||||||||||||

|

V1 0 0 0 0 0 0 5 4 2 |

|

|

|

V1 0 0 0 0 0 0 8 9 5 |

|

|

|

||||||||||||||||||||

|

Tot al payments made. Do not include VAT. |

|

Tot al payments made. Do not include VAT. |

|||||||||||||||||||||||||

4.4 |

4.4 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only fill in boxes 4.5 and 4.6 if you have made a deduction |

Only fill in boxes 4.5 and 4.6 if you have made a deduction |

|||||||||||||||||||||||||||

on account of t ax from what you paid t he subcont ract or. |

on account of t ax from what you paid t he subcont ract or. |

|||||||||||||||||||||||||||

|

Materials paid for by the subcontractor |

|

|

|

Materials paid for by the subcontractor |

|

|

|

||||||||||||||||||||

4.5 |

|

|

4.5 |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

• |

0 |

0 |

|

|

£ |

|

|

|

|

|

|

|

|

• 0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIS300 Helpsheet v0.3 20 11 06

CIS300(M an)

Only use when you have lost your original

CIS300. Phone 0845 366 7899 t o get a manual ret urn.

Contractor’s monthly return

REFERENCES AND M ONTH ENDING

We need t hese det ails so we can be sure we have received your ret urn for t he correct mont h.

What is your Accounts Office reference number? |

What is the month ending for this return? |

|||||||||||||||||||||||

Take t his from t he front of your Payslip Booklet |

(The t ax mont h runs from t he 6t h of one mont h t o t he |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5t h of t he next .) |

|

|

|

|

|

|

||||

|

|

|

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

5 |

|

M |

M |

|

2 |

0 |

Y |

Y |

|

What is your Contractor’s unique t ax reference (UTR)?

This is t he

When filling in a CIS300(Man) |

|

|

you need t o tell us your |

|

You need t o tell us t he correct mont h so |

Account s Of fice reference |

|

t hat we can update your records. The mont h |

number and your UTR. |

|

should reflect when payment s were made. |

|

|

|

CIS300(CS)(M an)

Blank cont inuat ion sheet

Contractor’sr t or ’s monthlyont hly retreturnurn

Blank continuation sheetBlank cont inuat ion sheet

REFERENCES AND M ONTH ENDING

We need t hese det ails so we can ident if y you on our records. You can copy all t his informat ion from t he

front page of your Cont ract or ’s mont hly ret urn. Please fill in t hese boxes for each cont inuat ion sheet you use.

What is your Accounts Office reference number? |

What is the month ending for this return? |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(The t ax mont h runs from t he 6t h of one mont h t o t he |

||||||||||

|

|

|

P |

|

|

|

|

|

|

|

|

|

|

|

5t h of t he next .) |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What is your Contractor’s unique t ax reference (UTR)? |

0 |

5 |

|

M |

M |

|

2 |

0 |

Y |

Y |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYM ENTS TO SUBCONTRACTORS

4.1 |

Subcontractor’s name or business name |

|

4.1 |

Subcontractor’s name or business name |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each cont inuat ion sheet you use enter t he Account s Of fice reference shown on t he CIS300 or from t he front of your Payslip booklet along wit h your UTR. Don’t forget t o enter t he mont h t hat is shown on t he CIS300 as well .

HMRC 11/ 06