When you need to fill out citibank authorization letter, there's no need to download and install any applications - simply try using our PDF editor. FormsPal is dedicated to providing you with the absolute best experience with our editor by constantly introducing new capabilities and improvements. With all of these improvements, working with our editor becomes better than ever! If you're seeking to begin, this is what it's going to take:

Step 1: Open the PDF in our tool by pressing the "Get Form Button" at the top of this page.

Step 2: When you access the PDF editor, you will get the document prepared to be completed. Besides filling in various fields, you might also perform several other actions with the PDF, such as putting on your own textual content, editing the initial textual content, adding graphics, affixing your signature to the document, and a lot more.

When it comes to blank fields of this precise document, here is what you need to know:

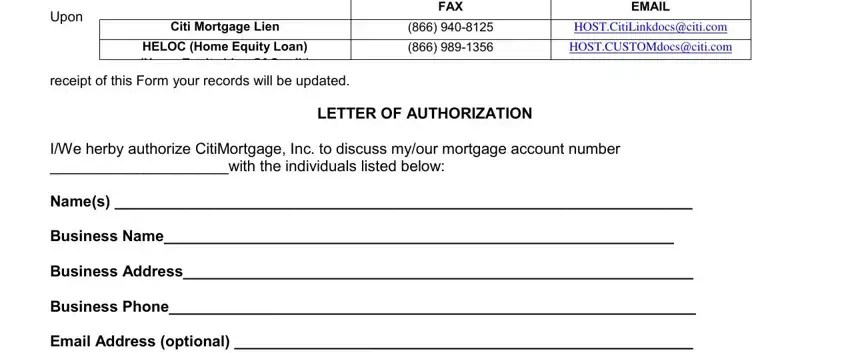

1. Firstly, once completing the citibank authorization letter, start in the area that has the next fields:

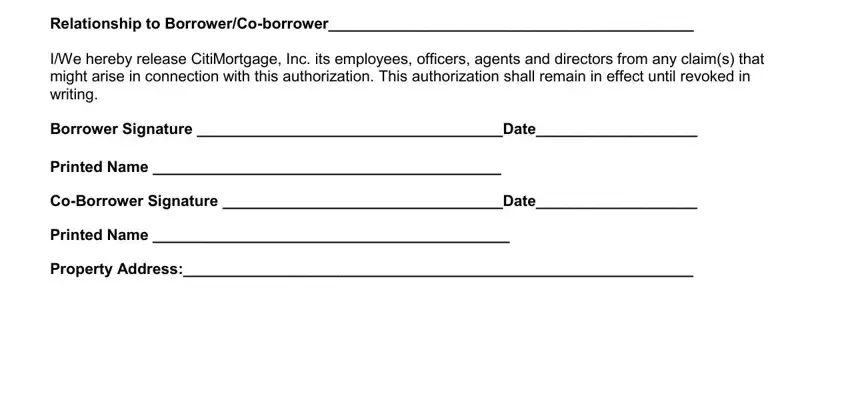

2. Once your current task is complete, take the next step – fill out all of these fields - IWe herby authorize CitiMortgage, CoBorrower Signature Date, Printed Name, and Property Address with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to get it wrong when filling in the CoBorrower Signature Date, thus make sure that you go through it again before you'll finalize the form.

Step 3: After rereading your fields and details, hit "Done" and you are all set! Make a 7-day free trial subscription at FormsPal and get instant access to citibank authorization letter - with all transformations preserved and available inside your personal account page. When using FormsPal, you're able to complete forms without worrying about information breaches or records being shared. Our secure platform ensures that your personal data is maintained safe.